A word from our Chairperson

As 2025 draws to a close, FSD Africa can look back on a year of profound disruption—and some remarkable achievements. The abrupt end of USAID and significant cuts across bilateral aid have focused a fundamental rethink on how the international community engages itself in Africa’s development. In parallel, African leaders have been clear; the continent must advance greater economic self-determination, mobilise more domestic resource, and accelerate private sector-led growth.

For this shift to take root, Africa’s domestic financial markets must rise to the challenge. Throughout 2025, a consensus has emerged that Africa’s commercial banks, pension funds and sovereign wealth funds must assume a much larger role in financing development. Doing so would reduce Africa’s reliance on external development finance—finance that is not always available when needed and often comes at a high cost.

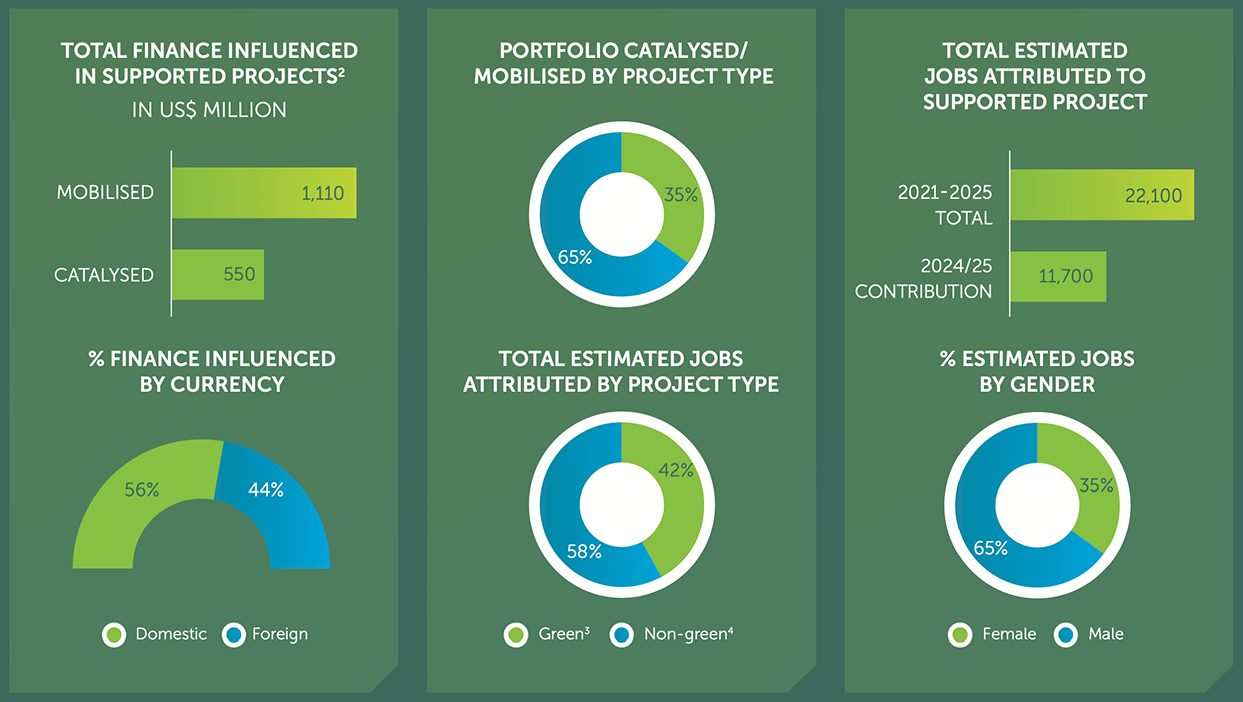

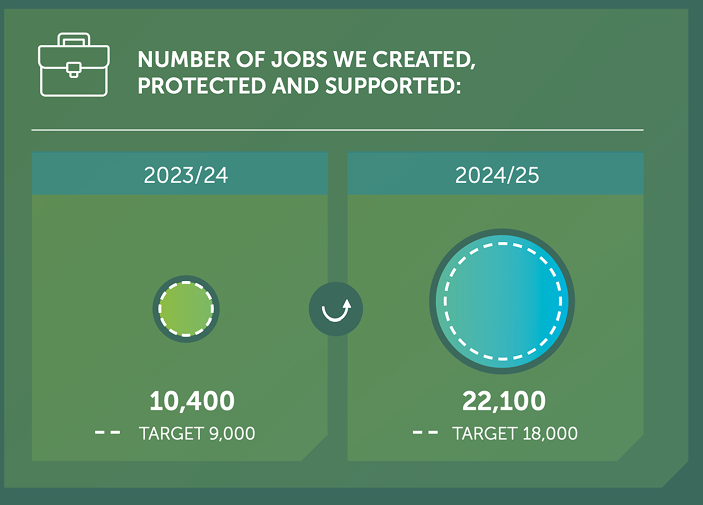

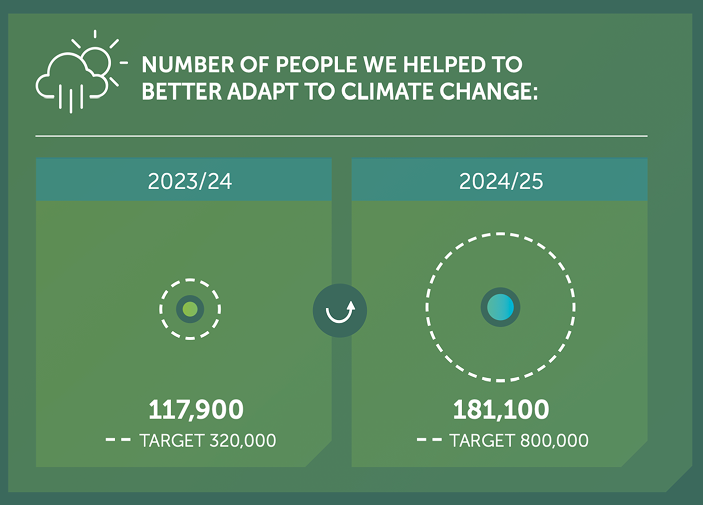

This conviction sits at the heart of FSD Africa’s strategy. Faced with serious economic, social and environmental problems, Africa needs a financial system that is fit-for- purpose - deeper financial markets that are supportive of investment and better able to address systemic risks, imbalances and inequities - such as those driven by high levels of debt, the changing climate and persistent social disparities that mean that men have better opportunities than women, and that younger people struggle to find jobs across a continent whose median age is 19.

The geopolitical realignments of 2025 have only made FSD Africa’s mission more urgent. I say that without any sense of complacency because there is so much hard work for us ahead. Yet I am confident that FSD Africa, with its unique approach to strengthening financial markets with grants and technical assistance and reinforcing this by actually investing directly in the financial system, can play an outsized, catalytic role in driving economic transformation in Africa. By bringing capital and know-how together in imaginative ways, we can unlock opportunities for entrepreneurs, investors and jobseekers, across the continent.

This Development Impact Report 2025 tells an important story. It reflects on our previous strategy which concluded last year. It shows how we will build on those lessons in our new 2025-2030 strategy. And it highlights the breadth and depth of our impact across the financial system. The diversity of the projects and transactions featured is a source of great pride to the Board. It demonstrates the effectiveness of our “whole of system” approach to financial market transformation.

The persistence and technical skill of the teams at FSD Africa and FSD Africa Investments shine through these stories: this is complex work that requires significant dedication.

I am especially proud that, in a year of shrinking Official Development Assistance, FSD Africa has successfully diversified its partnerships. Two years ago, we made a deliberate decision to broaden our funding base. This has paid off in 2025, with significant new grant agreements with the Gates Foundation, Quadrature Climate Foundation, the Children’s Investment Fund Foundation, Mastercard Foundation and Norad, the Norwegian development agency. We are thrilled to welcome these new partners to FSD Africa and thank them all for their generosity and confidence in us. These partnerships will allow us to keep driving forward our new strategy in critical areas such as sovereign debt advisory work, SME financing and resilient urban infrastructure.

The UK government remains our largest partner. We are deeply grateful for the support we receive from FCDO and DEFRA. It was particularly affirming that this year FCDO country posts accounted for almost a quarter of our total funding, a much higher figure than last year.

We are excited that FSD Africa will become increasingly multilateral in character. New funding partners can lean on us – we have strong governance and a hard-working, ethical and engaged corporate culture. But we also recognise it will take time for us to be able to replicate the scale and flexibility of FCDO’s funding. We are therefore greatly encouraged that FCDO continues to indicate its intention to maintain its support for FSD Africa.

Looking ahead to 2026, we do so with confidence and renewed ambition. I extend my deepest thanks to my colleagues on the Board for their dedication and commitment, and to the entire FSD Africa team for another year of excellent achievement.