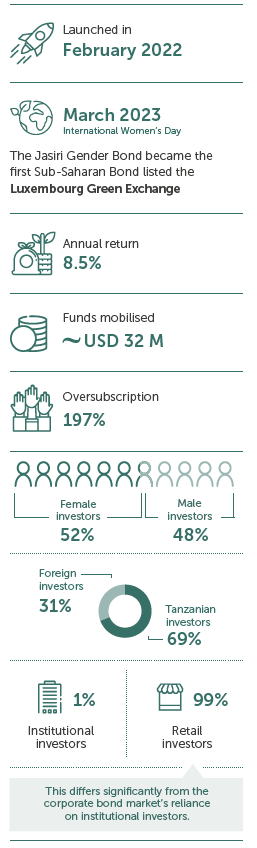

Jasiri Gender Bond

The Jasiri Gender Bond plays a crucial role in stimulating economic growth and empowering women in business.

Financing have played a key role in strengthening the agricultural sector, where women comprise over 65% of the workforce. The support has strengthened traditional female-led businesses in areas like retail and education and facilitated women’s entry and growth in male-dominated sectors like mining, energy, and spare parts. This has led to heightened employment, expanded inventory, and increased trade activities. By enabling women to grow their businesses, the bond contributes to improved livelihoods, education, and health outcomes for entire communities, thereby amplifying its impact.

The Jasiri Gender Bond plays a crucial role in stimulating economic growth and empowering women in business.

Naima Abdunur Athmani, an accountant who turned into an

entrepreneur, founded Mkajungu Hardware in Dar es Salaam in 2011. Starting with scrap metal, she soon shifted to construction supplies, growing her business over time. However, high credit interest rates from previous loans restricted her growth, leading her to NMB Bank for better rates. In a market where lending rates rise to up to 25%, the Jasiri loans, with no upfront deposit requirement and a low interest rate of 14%, significantly reduced her business costs, enabling expansion and increased stock.

Mkajungu Hardware is extending its reach to Kagera, planning several branches to cater to developing areas, with ambitions to cross into neighbouring countries. Athmani’s vision is fuelled by the favourable conditions of Jasiri financing, aiming to hit the ‘billion mark’ in revenues.

“With the support of the Jasiri gender bond, we can achieve significant growth,”

Athmani asserts, highlighting the bond’s role in her expansion strategy.

Athmani’s transition from accounting to entrepreneurship showcases her business journey, leveraging loans to facilitate business growth.

Smaller loans supported her initial ventures into the hardware sector, which gradually increased with the growth of her business. The shift to NMB was a strategic move to benefit from more favourable loan terms.

The introduction of the Jasiri Bond marked a pivotal moment for Athmani, offering lower interest rates and enabling significant business expansion. The financial support allowed her to diversify her product range and increase inventory, contributing to the business’s growth.

Athmani’s story underscores the impact of targeted financial products like the Jasiri Bond in empowering women entrepreneurs.

Athmani envisions further expansion, both within Tanzania and

internationally. She acknowledges the challenges women face in accessing loans and advocates for more supportive mechanisms to facilitate women’s entrepreneurial endeavours.

Athmani’s journey with Mkajungu Hardware, from its inception to its current expansion phase, exemplifies the power of strategic financial planning and the positive impact of tailored financial products like the Jasiri Bond. Her aspirations and achievements inspire women entrepreneurs aiming for growth and success in their businesses.