The Green Bond Development Programme in Nigeria

aims to accelerate the development of Green Bonds as a tool for Nigeria to broaden investment in green projects and assets.

Early progress

The programme has made considerable strides towards developing the market and

supporting green bond issuances at both sovereign and corporate levels in Nigeria.

“The Green Bond Programme empowered us to implement around 4.5 megawatts of power infrastructure. A significant number of our clients have leveraged our

blockchain platform to purchase energy, ensuring precise payments for their usage. The capacity building initiatives by FMDQ and the resilience of their ecosystem were pivotal factors in our decision to collaborate with them. FMDQ has proven to be a catalytic partner, facilitating a swift market entry and interaction with a diverse range of stakeholders.”

Femi Oye

Co-founder of OneWattSolar and clean-tech entrepreneur

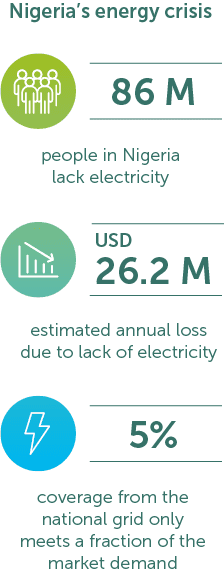

In 2023, the International Energy Agency (IEA) ranked Nigeria as the country with the highest population lacking electricity access—a staggering 86 million people. Power connectivity adds an extra financial burden for businesses. The World Bank estimates Nigeria’s annual economic loss at USD 26.2 billion (NGN 10.1 trillion), approximately 2% of its GDP. The 2020 World Bank Doing Business Report ranks Nigeria 171 out of 190 countries. The situation is worsened by the small amount of power availed by the national grid, which only delivers about 5% of the national market energy demand. Climate change is seen as a major contributor to the unreliability of energy globally, hence the need to seek critical climate financing and investment.

The Climate Policy Initiative highlights that to achieve the global climate objectives by 2030, there must be a substantial increase of at least 550% in annual climate finance, reaching USD 4.35 trillion. This investment is crucial for various sectors such as energy systems, agriculture, buildings, industry, transport, and other essential mitigation and adaptation solutions.

FSD Africa collaborated with key stakeholders to launch a green bond initiative to tackle the country’s power challenges. The partners included FMDQ Group, Africa’s first vertically integrated financial market infrastructure group, and the Climate Bonds Initiative, a nonprofit international organisation focused on investors. They solidified their collaboration through a three-year Cooperation Agreement to facilitate the establishment of the Nigerian Green Bond Market Development Programme.

In December 2017, Nigeria marked a significant milestone by issuing its inaugural sovereign green bond. This move underscored the government’s commitment to advancing environmental goals and fulfilling its National Determined Contributions (NDCs) in alignment with the Paris Agreement’s targets. Notably, this issuance was groundbreaking as it became the first Corporate Green Sukuk in Africa and the first Corporate Green Bond for an off-grid renewable energy project certified under the Climate Bonds Standards and Certification Scheme—a labelling system akin to Fair Trade for Green Bonds.

Case: OneWattSolar

OneWattSolar is a start-up using digital solutions built on a blockchain platform to provide off-grid renewable energy. Like many other private energy providers, the company faces the challenge of raising investment capital for reliable energy provision.

The capital is earmarked to finance the deployment of 750 standalone off-grid solar systems across diverse outlets. The estimated cost of the OneWattSolar project is NGN 6 billion, with the company committing 20% in equity (NGN 1 billion) and seeking to raise an additional NGN 5 billion from the debt capital market.

The proceeds from the five-year, NGN 10.69 billion demonstration green bond, issued with international support from the World Bank, UNEP and Climate Bonds Initiative in collaboration with the Federal Ministry of Finance, the Federal Ministry of Environment, and leading financial advisors from the Nigerian Capital Market, was used to finance renewable energy and afforestation projects.

Nigeria has raised its commitment to emission reduction with its enhanced Nationally Determined Contributions (NDC), proposing a 20% decrease below business as usual. Additionally, it aims for a further 47% reduction, contingent on securing financial support, capacity building, and technology transfer. Realising the conditional target is projected to necessitate an estimated investment of USD 177.00 billion.