Persistent Energy Capital Fund

The fund accelerates access to equity and venture-building support for visionary and green innovators across Sub-Saharan Africa

Investment Criteria

Sustainability, potential positive impact on lives, job creation (particularly for youth), and the influence on women. The fund maintains a five to seven-year exit

horizon post-investment.

IMPACT TO DATE

In 2023, with FSD Africa Investments (FSDAi) support, Persistent Energy Capital kicked off fundraising for its US$100 million Africa Climate Venture Builder Fund. The fund will accelerate and amplify access to equity and venture-building support for visionary and green innovators across Sub-Saharan Africa.

With ‘catalytic’ support from FSDAi through a US$3 million investment, Persistent has expanded its network and amplified its impact by gaining exposure to diverse investors and platforms. In 2022, the company secured US$10 million in equity during its Series C round.

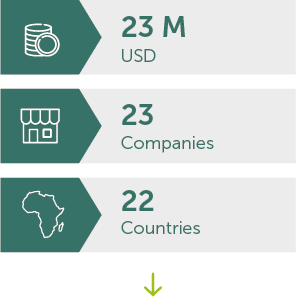

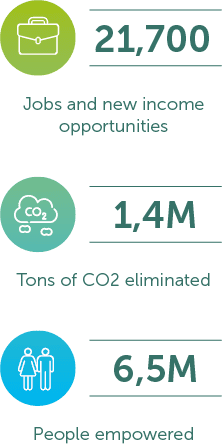

Persistent’s impact to date has been significant with US$23 million injected into 23 companies in 22 African countries dealing in e-mobility, solar home systems, commercial and industrial solar, energy efficiency and ecosystem enablers. Persistent has successfully demonstrated the ability to finance nascent businesses and was an early investor in pioneering solar home systems companies. The company has delivered solid financial returns, while contributing to the improvement of nearly 6.5 million lives. It has created more than 21,700 jobs and contributed to a reduction of over 1.4 million tons of CO2.

RAISING INVESTMENT CAPITAL FOR NEW GREEN TECHNOLOGIES

Climate change threatens Africa’s natural ecosystems, food, water security, and livelihoods. To address this, Persistent identifies innovative yet under-resourced smaller companies. Offering funding starting at $50,000, along with hands-on support in various aspects like financial management, capital raising, business analytics, technology, HR, legal & compliance, and strategic guidance, Persistent fosters their growth and facilitates subsequent funding rounds. Persistent’s approach helps new climate-friendly technologies get more funding, making it easier for them to grow. This way, it solves the problem of finding enough support to attract bigger investors in the later stages of development.

CASE: ALTECH

Persistent supported Altech in the DRC, providing financial support and guidance. Amidst turmoil and prolonged civil unrest, Altech successfully introduced life-changing pay-as-you-go solar solutions in 2018.

Persistent supported Altech in the DRC, providing financial support and guidance. Amidst turmoil and prolonged civil unrest, Altech successfully introduced life-changing pay-as-you-go solar solutions in 2018.

Within 3 years

Today, Altech is the premier distributor of clean energy products in the DRC, employing over 3,300 individuals.

Persistent operates in nine countries with offices in Nairobi, Lagos, Zurich, and New York. The workforce is over 65% African and 55% female. Persistent promotes gender equality by mandating investees to support it. The company actively seeks businesses founded by women, with a substantial female workforce, and offering products designed for women.

Persistent is committed to expanding funding to empower women founded companies while diversifying its sectoral reach. The company plans to invest in emerging climate sectors such as agritech, circular economy, waste management, and water & sanitation. Over the next years, FSDAi expects to be a cornerstone partner of Persistent as it raises its US$ 100 million fund to accelerate its impact.