The refugee and internally displaced people (IDP) crisis in the DRC is long and complex. Continued fighting in the East and recent Ebola outbreaks have done little to assuage the conflict. For countries that have long been embroiled in civil war, humanitarian actors are overwhelmed in their efforts to find sustainable solutions to improve livelihoods. They cannot do it alone. To find integrated solutions, the private sector, government agencies and alternative finance providers must come together to figure out new solutions that can improve the lives of this vulnerable segment.

We partnered with UKAID-funded ELAN RDC to develop market-based solutions to the financial needs of forcibly displaced people and the communities they live in. In the DRC, just like in Rwanda and Uganda, we have used market intelligence to build the business case and get the private sector involved.

Financial service providers are profit-driven and risk-averse, especially with a segment of the population that remains largely misunderstood. We gather this intelligence to debunk the myths surrounding refugees and IDPs: that they are transient, financially illiterate and have no other means to sustain themselves beyond humanitarian aid. Evidence from Uganda, Rwanda and Kenya shows that refugee communities that integrate into the broader economy contribute positively to the economy. On top of this, financial services play an important role in helping refugees integrate and contribute to the broader community.

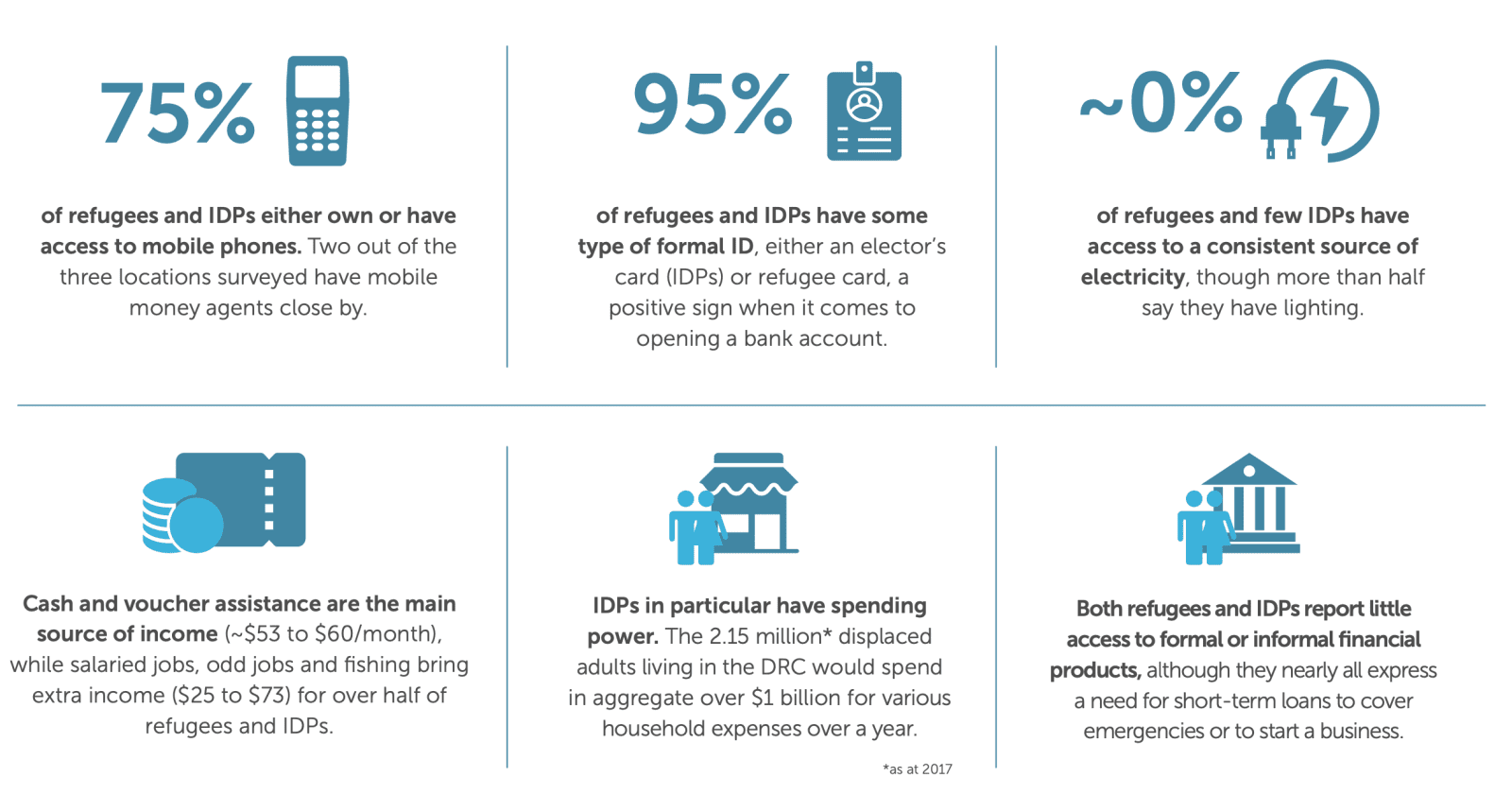

Digital Disruptions, a global consulting and training firm in digital financial services, conducted a market assessment of the demand for goods and services by refugees and IDPs. The findings show:

From these findings, we ran a 3-day Design Sprint to brainstorm emerging solutions. The high rate of mobile phone ownership coupled with an acute lack of electricity could see the emergence of pay as you go (PAYGo) solar solutions repaid through mobile money. The existence of cash transfers and income from odd-end jobs means there could be a little income to save, especially digitally, hence creating a credit history and enhancing the possibility of micro-credit.

Our Design Sprint included four local service providers: Rawbank, one of the country’s largest banks, Orange, a leading mobile operator, CFC, a financial institution focused on money transfers and Altech, a fintech startup in the PAYGo solar energy sector. We brainstormed ideas, built prototypes and then tested them out with the refugees and IDPs to gauge their initial reactions and feedback.

From the Design Sprint we realized two things: that there is no shortage of good ideas when it comes to finding innovative solutions to improve and incase access to and usage of financial services for refugees and that financial incentives can go a long way to moving from ideas to concrete solutions that are adopted on the ground. Subsequently, FSD Africa launched an FDP Innovation Competition as part of the Fintech Challenge in DRC. Round One will provide up to 5 awards of £10,000, while Round Two will provide up to 3 awards of up to £150,000.

Reaching refugees and IDPs in a commercially viable way is difficult, especially those in very remote areas of DRC and those who have minimal economic activities. We believe with the right rules and incentives the market could deliver to certain segments within the FDP population efficiently, at scale and on a lasting basis. Partnerships with the humanitarian sector must continue as we try to establish the rails on which financial solutions will eventually run to improve the livelihoods of this vulnerable segment in the long run. In countries like DRC, where programming, in general, can be difficult not just for refugees and IDPs, the incentive for the private sector is to view this segment as an extreme use case: if they are able to adapt and offer services to this group commercially then the scale up to the rest of the Colese market, whose low-income population is similar to the refugee and IDP population, will be easier.,