For insurers to serve a new type of client at scale they must change their modus operandi. The high costs associated with conventional insurance cannot be absorbed by low premium products. This means that existing structures need to be adapted to serve the low to middle-income mass market.

One key to success lies in digitization, which can be used to automate existing (often paper-based) processes. Going digital has obvious benefits: minimising expenses, reducing the scope of human error, improving efficiency and achieving scale. But, how can insurers begin to make this shift?

Working with our partner Britam in Kenya, we have seen one route to becoming a digitally-driven insurer: start with strategic process mapping.

So what does a strategic approach to process mapping look like? Process mapping involves creating a flow chart to capture every step in a process. This is then analysed to see how the process could be redesigned. Process mapping can both reveal opportunities for automation and help manage the internal change required to put it into action.

The strategic element of process mapping lies in identifying how new processes can achieve greater efficiency and also help improve the client’s experience. The ILO’s Impact Insurance Facility advocates

To illustrate, let’s take a simple example. At Britam, one of the team’s many tasks was to redesign the member information gathering process at enrolment to cut data entry and courier costs. The team started by looking at the systems and resources in place to capture data, and the experience of internal and external stakeholders interacting with the system. Careful analysis from both “outside-in” and “inside-out” uncovered pitfalls and opportunities for automation of members’ enrolment data gathering, such as customers processing their own data through an automated platform.

However, there are limits to automation, including limited client access to internet and smart phones. This problem extends to partner organisations, who are in many for automated processes. For example, the mission hospitals who work with Britam prefer paper claims submission.

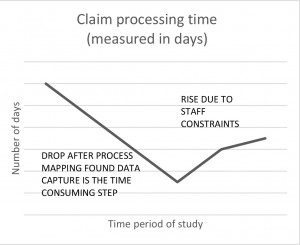

Furthermore, there may be initial teething problems with automation, especially when it is only partial and still relies on a degree of human intervention. For example and as illustrated by the graph, after making significant reductions in claims processing times through process automation, Britam found that the processing time started to increase again due to staff constraints. This highlighted the need to support process changes with training or new staffing structures.

Our change management projects have repeatedly shown that digitization success does not lie solely in introducing technology, but in how people are placed to handle this change. Understanding what it takes to encourage and sustain behavioural change, both internally and externally, is key to change management and to reaping the rewards of going digital.

This blog is part of a joint series between the ILO’s Impact Insurance Facility and FSD Africa. The series explores practical solutions to manage change within insurance providers.