I often find it difficult for most people to relate to refugees. We seem to forget that we can be in the same situation depending on the circumstances around us. The happenings in Ukraine have shown just how delicate our stability status is, and that we can quickly be turned into forcibly displaced people overnight!

While conflict, war or persecution have been traditionally viewed as the main forces giving rise to refugees, natural disasters triggered by climate change among others are fast becoming a force to reckon with. The number of forcibly displaced people has now surpassed 100 million for the first time, fueled by the war in Ukraine and other ongoing conflicts around the globe.

This takes me back to a scenario in June 2018 when FSD Africa, FSD Uganda and BFA Global were conducting a design sprint with 6 Ugandan financial service providers (FSPs), to develop new ideas for financial products and services for refugees in the country. The 4-day event reached a phenomenal breakthrough when one of the participants posed: “What if something happened and we found ourselves in another country as refugees? What financial services would we need?” Those two questions opened the minds of the participants and ideas started flooding in. The design sprint was one of the 4 steps that FSD Africa has been following to develop financial inclusion for refugees (FI4R) projects. The other 3 are:

- Market assessments that capture the financial lives of refugees and show the potential of serving these populations.

- Innovation competitions where FSPs are invited to pitch ideas of how they would address refugee financial needs

- Financial support and technical assistance to FSPs to develop, pilot and roll-out financial solutions.

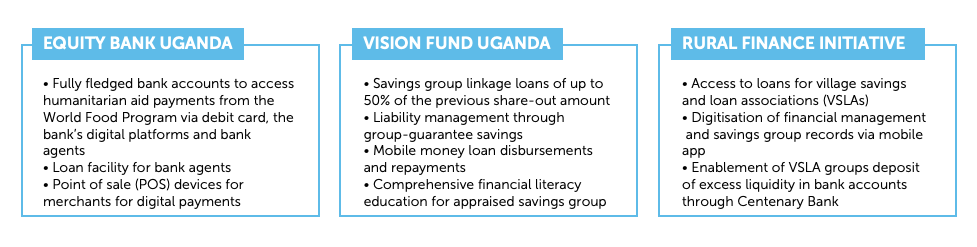

In Uganda, working with FSD Uganda, we identified Equity Bank Uganda Limited, VisionFund Uganda and Rural Finance Initiative to offer financial services in various refugee settlements from October 2019. While the project concluded in March 2022, these FSPs have continued operations as this turned out to be a viable business for them. The project engaged BFA Global as the learning and research partner. They undertook a baseline study in January 2020 and a series of 4 financial diaries (linked below) – capturing the financial needs and uses of refugee households.

The 4 financial diaries:

- Financial Inclusion for Refugees (FI4R) – Results of round 1 diaries

- Financial Inclusion for Refugees (FI4R) – Results of round 2 diaries

- Financial Inclusion for Refugees (FI4R) – Results of round 3 diaries

- Financial Inclusion for Refugees (FI4R) – Results of round 4 diaries

They then carried out an endline study in November 2021. The partners achieved the following results:

- Over 26,300 customers accessed loans, with 73% being female

- Cumulative loans amounted to £9 million ($2.7million)

- 262 bank agents were recruited across the settlements, 15% of which were women

- Over 93,300 households registered on Equity Bank Uganda’s digital platform

- 65,484 households receiving digital payments as of March 2022.

- The bank made payments worth UGX 10.8 Bn (£2.2m) during the first quarter of 2022

- 8 humanitarian agencies used the Equity Bank Uganda platform for disbursements

Below is a summary of some of the different financial services offered by the FSPs:

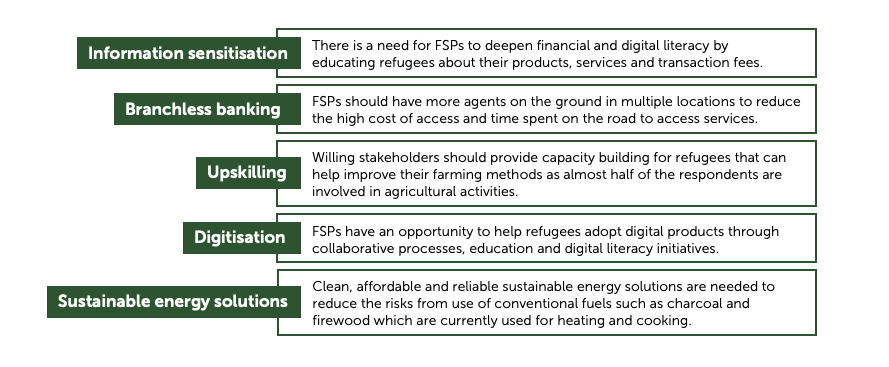

Based on the end-line study findings, there is still work to be done to improve financial services for refugees in the following areas: