African Leadership University’s School Of Wildlife Conservation (ALU’s SOWC), Dalberg, and FSD Africa Investments bring together their in-depth expertise in biodiversity conservation and restoration, finance, and impact investments to form a partnership that will help investors measure and track the impact of their biodiversity-related investments over time.

NAIROBI, KIGALI, DAR ES SALAAM – A pioneering initiative aimed to boost biodiversity investments by helping investors measure, rate, and track their impact on biodiversity conservation and restoration – the Biodiversity Investment Rating Agency (BIRA) – was launched today by the African Leadership University’s School of Wildlife Conservation, Dalberg, and FSD Africa Investments.

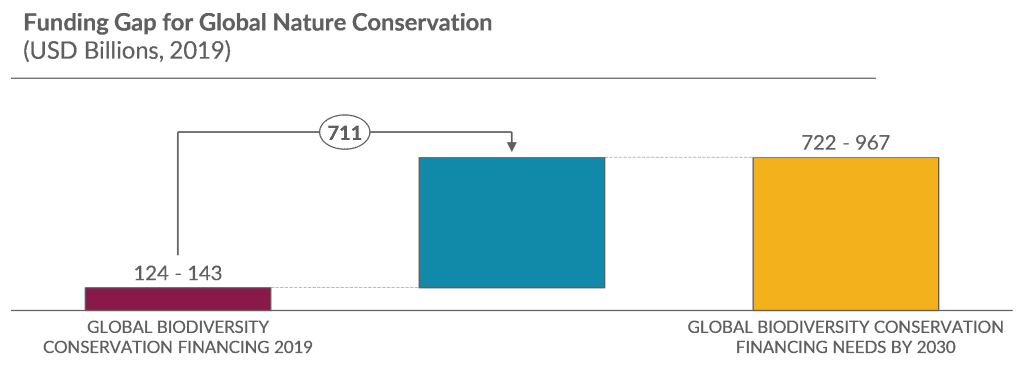

Biodiversity is ranked as the third most significant threat to humanity, after carbon emissions and nuclear war. Yet, less than 16% of the required funding is currently available for biodiversity, leaving a US$ 700 billion funding gap for biodiversity conservation and restoration. Private capital can play a critical role in closing this funding gap while tapping into an attractive asset class that is poised to grow. However, investments are currently limited because there is no standard way to measure, rate, track, and communicate biodiversity impacts. Investors are looking for simple, credible tools based on biodiversity science.

Figure 1: Illustration of the biodiversity conservation funding gap

To address these challenges, BIRA will advise investors on identifying the opportunities for impact investing in the biodiversity sector, spotlighting relevant frameworks to measure biodiversity investment impacts, and provide existing aligned frameworks with guidance on how to make their tools investor friendly. BIRA aspires to see measurement frameworks that can provide simple answers to investors’ questions about the potential outcomes of biodiversity investments. BIRA will work in collaboration with existing frameworks that meet certain design criteria to develop modules that match measurement frameworks with investor needs.

FSD Africa Investments and Dalberg are excited to welcome ALU’s SOWC as the science and training partner for the initiative. ALU SOWC will bring its expertise in scientific inquiry, research, and training to ensure that the modules developed are credible and usable. BIRA will also lean on SOWC’s expertise to develop and launch training programs that will help bridge the existing knowledge gap in the market.

By bridging the gap between investors and the existing biodiversity measurement frameworks, BIRA will support informed decision-making by investors. Ultimately, this will increase investments in conservation and restoration, leading to positive biodiversity outcomes.

Mike Musgrave, Conservation Leadership Faculty, School of Wildlife Conservation, said:

“Institutional investment in biodiversity as an asset class will be the key to unlocking the billions of private capital we need to address climate change and promote the business of conservation.”

Devang Vussonji, Partner, Dalberg Advisors, said: “We have lost 68% of monitored animal populations between 1970 and 2016. We face a USD 700 billion funding gap in reversing this effect, and private capital will be essential in filling this gap. BIRA aims to attract private capital to the sector by making it easier for private investors to measure, communicate, and track biodiversity outcomes.”

Anne-Marie Chidzero, CIO, FSD Africa Investments, said: “FSD Africa Investments is proud to partner with Dalberg and the African Leadership University’s School of Wildlife Conservation to create the Biodiversity Investment Rating Agency. This innovative initiative to help investors measure and track the impact of their capital on biodiversity conservation and restoration will play a central role in increasing investment in the sector.”

BIRA invites technical partners and investors to join the founding partners in developing the initiative. Interested parties should contact Devang Vussonji at devang.vussonji@dalberg.com.