Home 〉 Our Work 〉 Risk and Resilience 〉 Overview

Overview

About the Risk and Resilience team at FSD Africa

Established during FSD Africa’s recent strategy round in 2020, the Risk and Resilience team has grown quickly to a team of 9 implementing over 15 ambitious initiatives across Africa.

We believe that we have a series of relative strengths that allow us to bring together quite unique sets of partners. We are a systemic market-builder, taking approaches along a value chain end-to-end, and identifying where better risk management and transfer can unlock growth.

We bring a diverse instrument set and have a strong risk appetite that allows us to focus on solving the hard problems and experimenting with new approaches. Our experts bring decades in banking, innovation, strategy, programming and actuarial knowledge, which we complement through our networks of technical partners. We are regional and collaborative, encouraging cross-border knowledge transfer and codification of learnings; once we have done something well, we seek to crowd in and replicate that project across the continent.

Why is resilience key to a sustainable future for Africa?

Resilience must be mainstreamed into economic development, otherwise Africa’s future prosperity will be undermined by climate and other shocks, and inequalities will persist. Already, given the climate vulnerability of the continent, climate-related disasters alone are costing some African countries more than 10% of their GDP per year.

Financial markets, if operating correctly and functionally, have a vital role to play in reallocation of capital flows towards inclusive, green and resilient economic growth.

What are the main challenges in African risk markets?

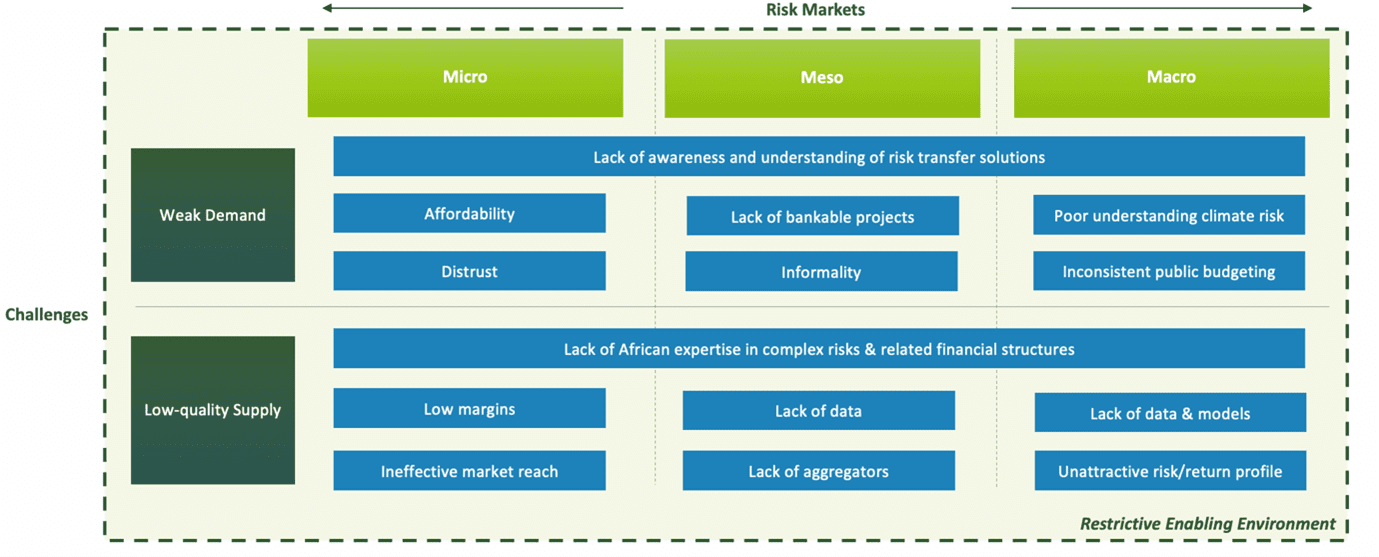

The low resilience of households, businesses and governments is exacerbated by weak demand for and low-quality supply of risk solutions, plus restrictive enabling environments that impact across financial markets.

How do we address these challenges? Our approach to market development:

Given the scope of the challenges, our strategy is to leverage our work for maximum impact through focusing on large partnerships, large transactions and catalysing innovative market solutions. The main sectors we will do this in are the ones with the most significant long-term risks and thus the greatest need for resilience. These are climate and nature, health and agriculture. Cross-cutting themes supporting the work in all these sectors are digital innovation, gender and regulatory reform.

In the key sectors in which we work, we take a targeted approach to achieve the dual objectives of:

- Incentivising sustainable investment through deploying financial instruments that transfer risk and create the right risk/return profile for private investors. Where necessary we assist to build the necessary market infrastructure to mobilise risk transfer capital.

- Reducing vulnerability through financial solutions. For example, disaster risk financing, facilitating resilient urban infrastructure projects and improving health financing for increased access and higher quality of care.

Where we work

Our priority markets are Nigeria, Ghana, Kenya and Ethiopia with the bulk of our programming focused on these 4 countries. We do, however, operate in many other African markets and have several large pan-African programmes.