18 Nov 2020

18 Nov 2020

FSD Africa was created in 2012 by the UK government’s Foreign, Commonwealth & Development Office with a mission to reduce poverty by strengthening Africa’s financial markets. This Impact Report, our first, charts our progress in fulfilling that mission.

It explains what we do, and how we do it. It highlights some of our most important work, demonstrating the impact we’ve had on the lives of millions of Africans. And it also outlines our plan for the future, as we look to new challenges.

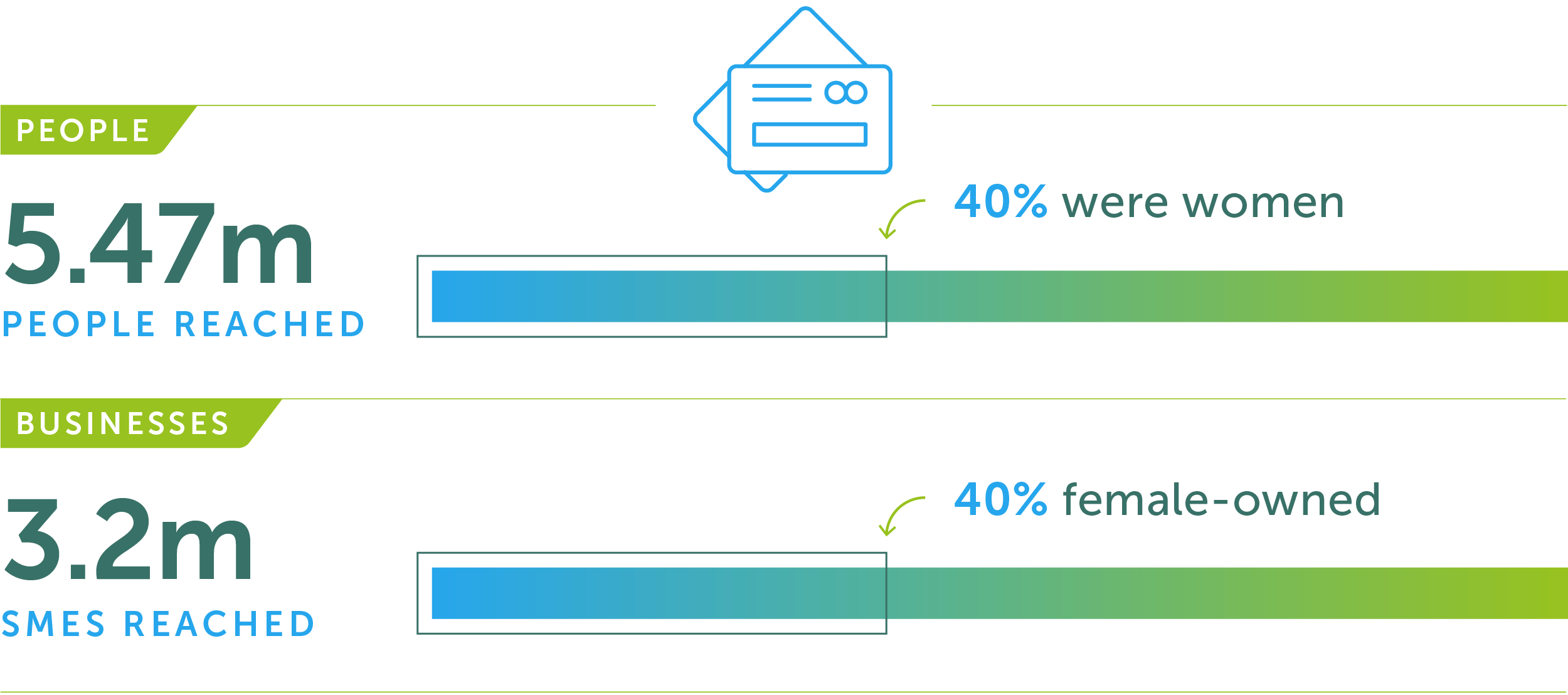

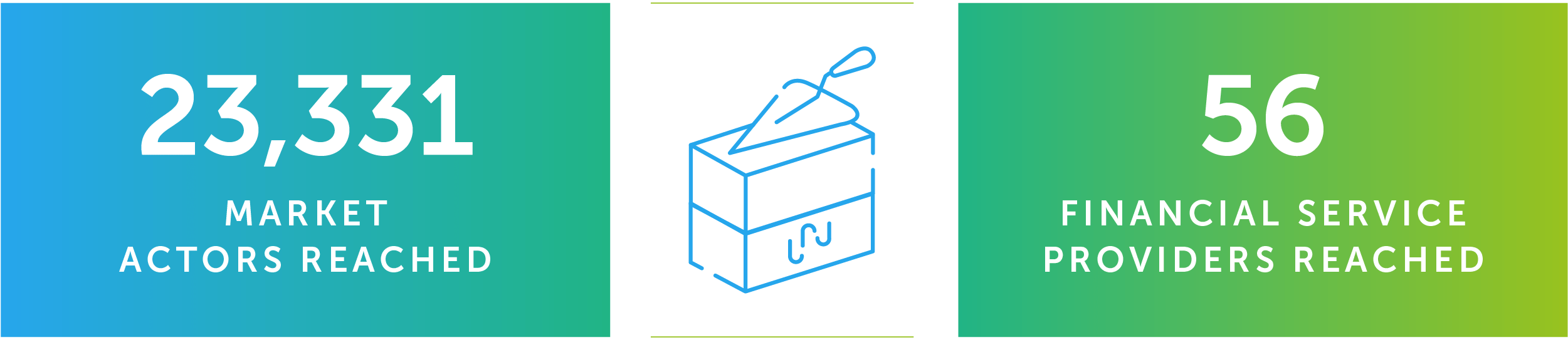

Between 2012 and early 2020, we reached millions of people and small businesses with financial services and products.

As of March 2020, we’ve helped to raise over £1 billion in capital to aid the growth of businesses and infrastructure.

Since 2012, we’ve supported training for thousands of market actors, building the capacity of more than 50 companies providing vital financial services.

Across sub-Saharan Africa, there’s an urgent need for affordable housing – not only to provide shelter and security, but to boost economic development.

To help tackle the issue, we invested in Sofala Capital, a housing finance business that provides funding and services for building projects, as well as mortgages.

Thanks to our help, Sofala has been able to attract new investors, increase its loan portfolios and extend its work in some of South Africa’s poorest neighbourhoods. And encouragingly, 48% of new borrowers with Sofala have been women.

To read more, and to take a look at other case studies, download our Impact Report.

So far, we’ve focused on ‘finance for the poor’ – improving underlying market fundamentals in Africa to allow financial services to reach the people who need them most.

Now, as Covid-19 has demonstrated, we face new challenges. We need to redouble our efforts to ensure financial inclusion delivers tangible benefits – jobs, basic goods, green futures – with a direct impact on people’s day-to-day lives.

That’s why a £320 million package of UK aid has been announced, to support the next phase of financial sector development in Africa: FSD 2.0.