Do what is right, not what is easy nor what is popular.

Roy T. Bennett, The Light in the Heart

FinTech has a key role to play in enabling and promoting financial sector development, inclusive finance and much more. The regulatory environment in a market is central to both enabling the FinTech opportunity and reducing the potential downsides. While it is positive that financial regulators have embraced FinTech with proactive optimism, we are sounding a note of caution on focusing on one approach only – the regulatory sandbox. Momentum seems to be gathering behind the sandbox approach, but it is not a panacea to all challenges – financial regulators have a wide range of tools at their disposal in their pioneering work on FinTech.

Good vibrations

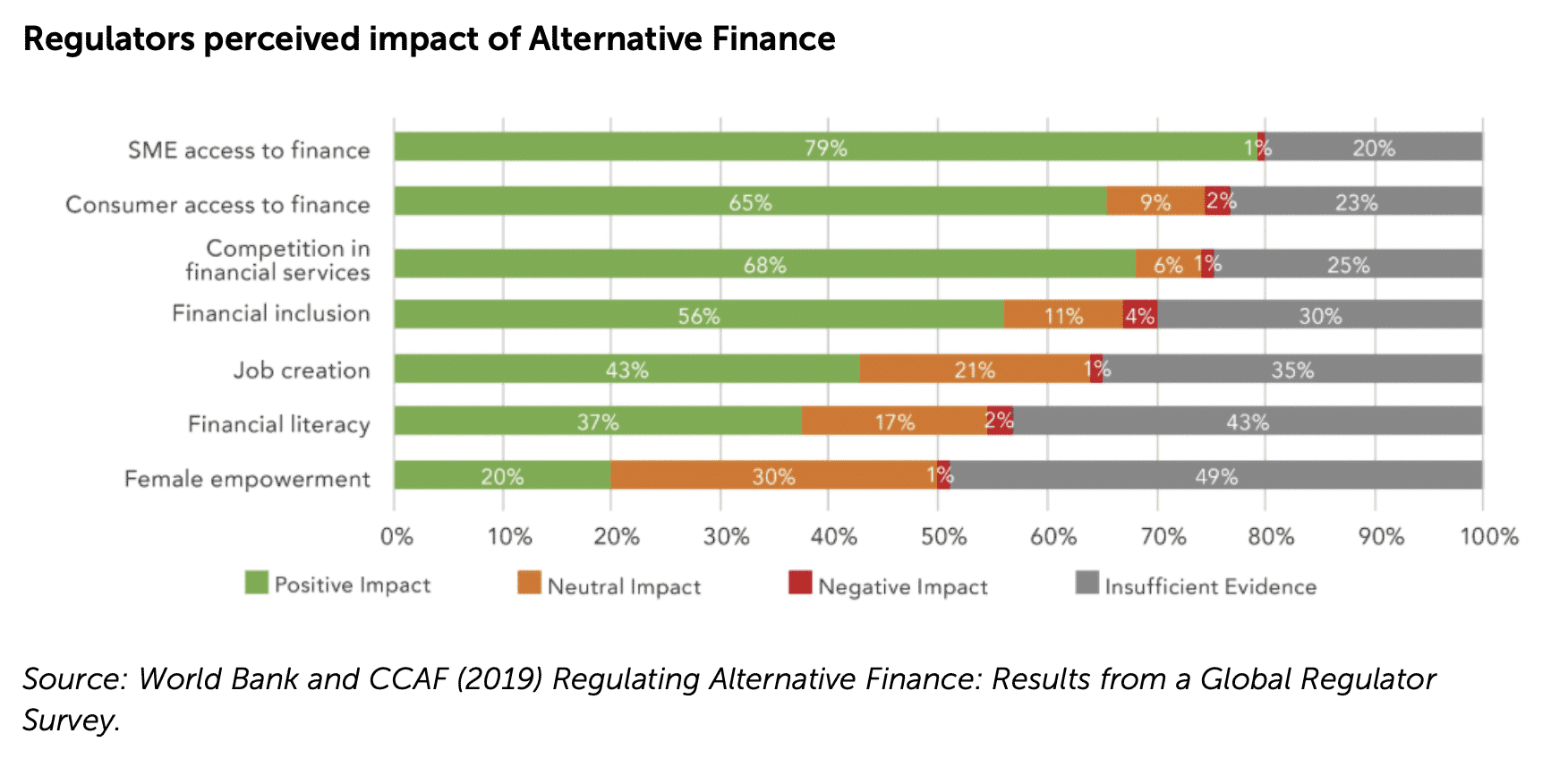

Financial regulators around the world are seeking to create an enabling regulatory framework for FinTech to promote SME and consumer access to finance, financial inclusion, financial sector development and competition in financial services. A recent survey in more than 110 jurisdictions, including 24 in Africa, underlines this sentiment, with 79% of regulators expecting a positive impact on SME financing, 65% expecting a positive imon consumer finance, and 56% responding positively to a more general question on the impact on “financial inclusion” (World Bank and CCAF 2019).

The rise – and limits- of sandboxes

The perceived positive impact of FinTech among regulators in sub-Saharan Africa has been reflected in markets across the continent, with one of the most prominent support initiatives being the set-up of formal regulatory programmes. A regulatory sandbox is a formal regulatory program that allows market participants to test new financial services or business models with live customers, subject to certain safeguards and oversight. There are now regulatory sandboxes either launched or in the design phase in Kenya, Sierra Leone, Mauritius, Mozambique, Uganda and Nigeria. Three of these are a direct output of FSD Network support.

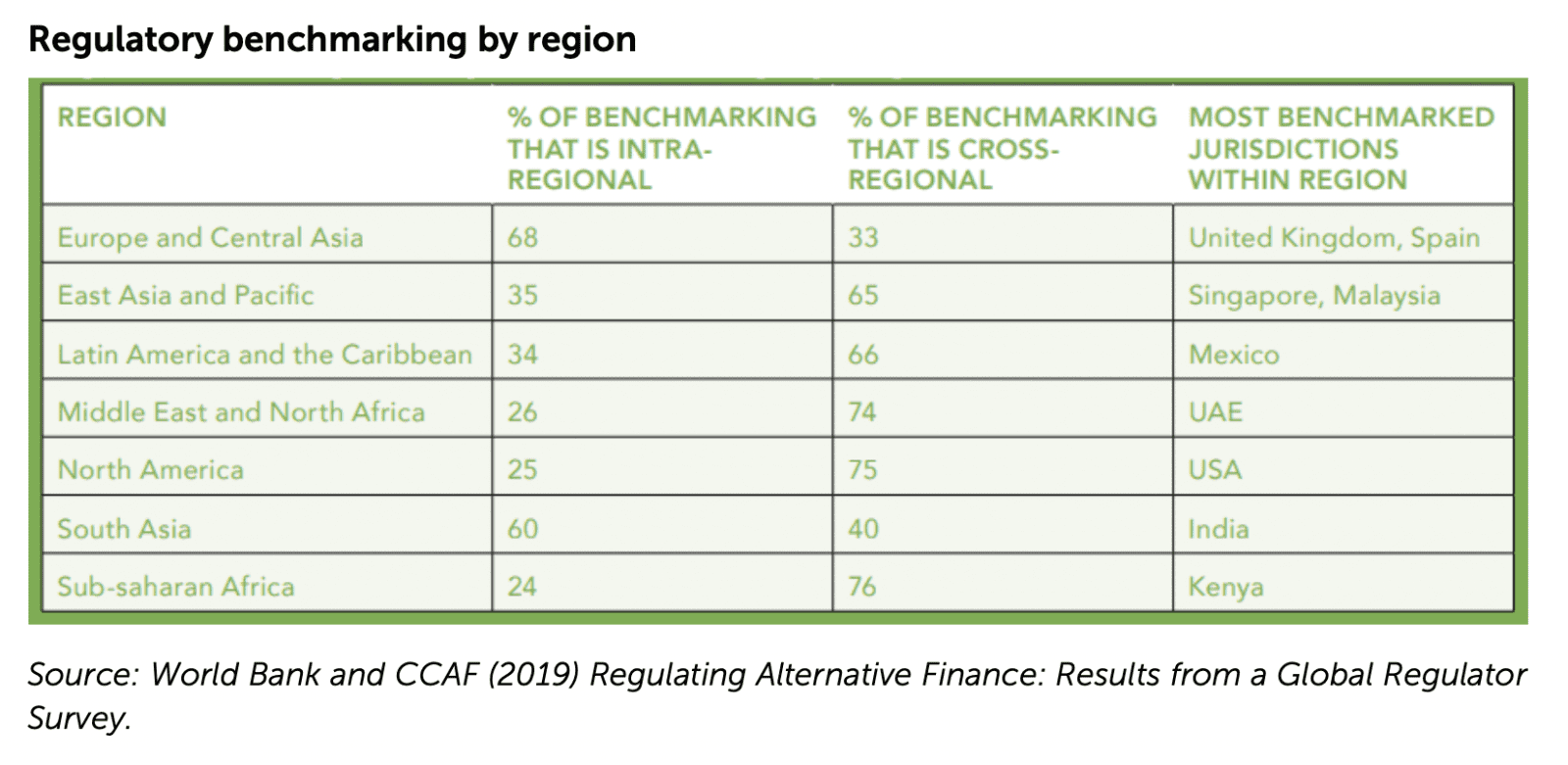

At least part of the inspiration for regulatory sandboxes appears to be peer effects. The aforementioned World Bank – CCAF survey found that over 90% of jurisdictions conducted analysis of the regulatory frameworks of other jurisdictions in designing their own regulatory change. Kenya is the most benchmarked jurisdiction in sub-Saharan Africa, while regulators in the continent also cast the net wide beyond the region in the search for inspiration and new ideas.

For capacity-constrained regulators, regulatory benchmarking can reduce the considerable resources that go into economic analyses, policy development, and public consultation. However, it is equally important that financial regulators carefully consider the unique circumstances and conditions of their market, together with the potential benefits and costs of any initiative to promote or support FinTech.

Sandboxes may have several benefits, such as reducing the time and cost of bringing innovative ideas to market (see FCA 2017), facilitating access to finance for innovators, and supporting the development of regulatory enablers of inclusive finance (see UNSGSA FinTech Working Group and CCAF 2019). However, they may not be the most efficient or impactful means of creating an enabling regulatory environment for FinTech.

Recent research (CGAP 2019) highlights the potentially high costs of operating a regulatory sandbox. The range of committed human resources can be up to 25 full-time employees. It was also found that the dedicated financial resources can range from $25,000 to over $1 million.

Logistical challenges are also present. For example, it might also be hard to ensure that particular firms or sectors do not receive (un)favourable access to a regulatory sandbox, perhaps due to strict eligibility criteria (such as restricting access only to start-ups or incumbents). Managing or containing the outcomes of any failed sandbox tests can also be testing. In short, then, regulatory sandboxes can’t solve all problems.

Alternative initiatives to address regulatory barriers to innovation

A key barrier identified by FSD Africa is the uncertainty and lack of clarity which innovators, and investors, experience concerning the regulatory approach in their market. This can result in delayed entry to, or limited expansn in, a market, or an innovator choosing not to enter at all.

An example of initiatives working to reduce such uncertainty is an Innovation Office – a dedicated team set up within a regulator to provide regulatory clarification to financial services providers seeking to offer innovative products and services. Innovation Offices are a compelling option for capacity-constrained regulators in emerging and developing economies. They are often easier to establish than other regulatory initiatives since they require no protracted legislative or regulatory change. Regulators can start small and simply educate innovators on the regulatory environment in which they operate—for example, by explaining relevant regulations for a planned new service or providing licensing guidance.

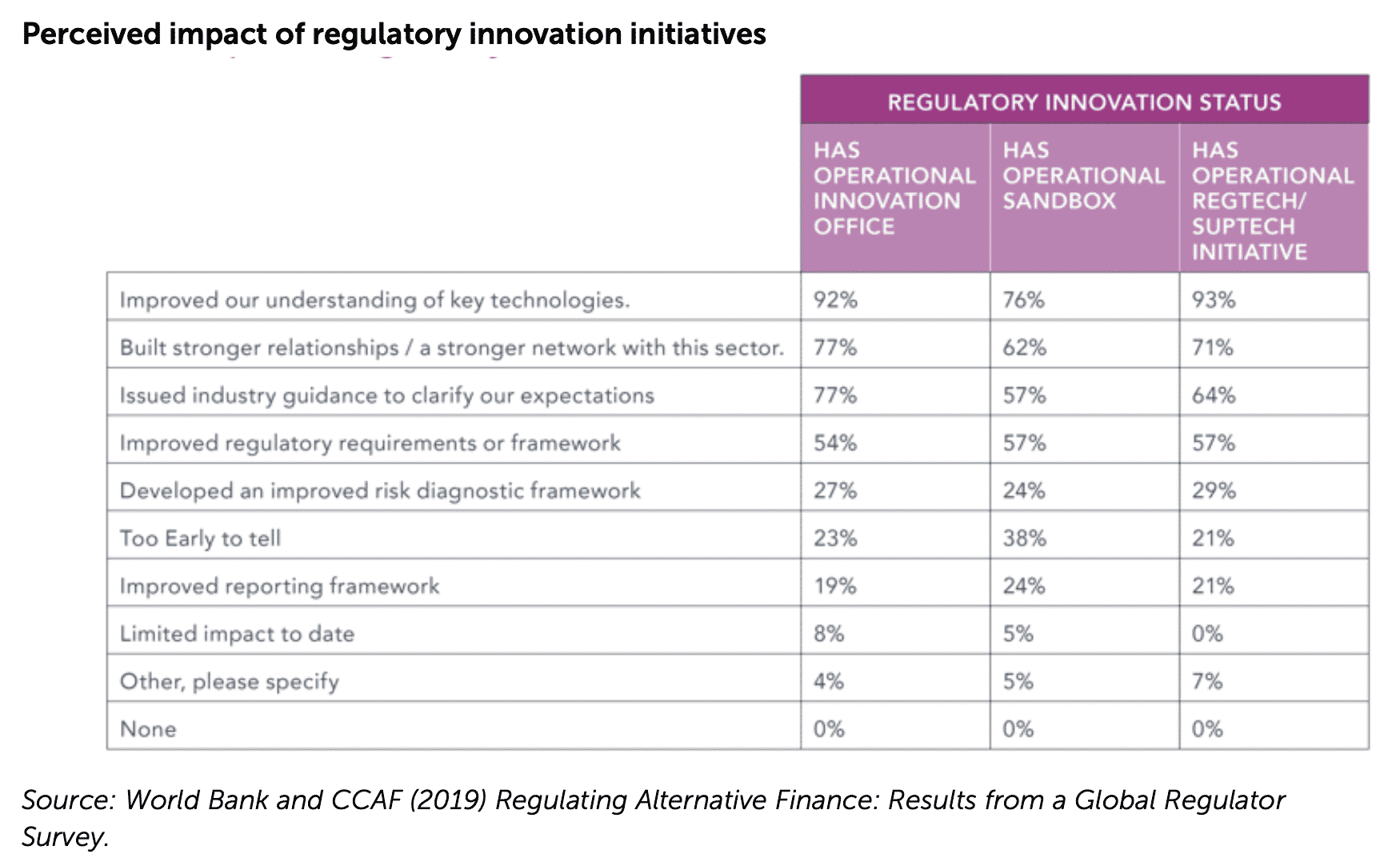

Early insights from Innovation Offices also compare favorably with regulatory sandboxes. For example, 76% of jurisdictions with a regulatory sandbox surveyed in the World Bank-CCAF report highlighted that it had improved their understanding of key technologies. However, this was higher still for jurisdictions with an operational Innovation Office (92%). InnovatioOffices also appear to be more conducive to building stronger relationships or networks with the FinTech sector, with 77% of jurisdictions with an operational Innovation Office citing this, compared to 62% for those with a regulatory sandbox.

Other approaches might include creating new regulatory frameworks (such as through licensing or changing the regulations themselves), or the deployment of RegTech.

Recommendations

FinTech is broadly a force for good in supporting financial sector deepening, and it is encouraging to see the positive reaction to it from financial regulators. Regulators are encouraged to consider the full range of options and responses at their disposal and seek to support FinTech in the most efficient and impactful way. Whilst momentum appears to be behind the establishment of regulatory sandboxes, regulators are encouraged to examine several implementation considerations, including:

- Conducting a feasibility assessment focused on capacity and objectives

- Engaging with a wide range of relevant stakeholders and consulting with them to identify challenges and crowdsource solutions

- Sequencing and combining a variety of approaches to regulatory innovation

FSD Africa and the FSD Network have been working closely with partners and financial authorities in a number of markets to support evidence-based and informed decisions. These can create an enabling regulatory environment for FinTech and support the long-term conditions needed for innovation and investment to thrive.

The Network has delivered technical assistance to regulators in sub-Saharan Africa to help them research, identify and implement regulatory frameworks that support and facilitate innovation in their respective countries. These have included:

- FSD Africa working alongside UNCDF, supported the Bank of Sierra Leone in establishing a regulatory sandbox in 2018.

- FSD Kenya supported the Capital Markets Authority in Kenya to put in place a regulatory sandbox.

- The Bank of Mozambique with the support of FSD Mozambique also launched a similar framework.

FSD Africa is also currently engaging with regulators in Zimbabwe, Tanzania, Nigeria, DRC, Ghana, and Ethiopia to support the development of mechanisms for regulating innovation, both regulatory sandboxes and more widely.

Other FSD Africa initiatives focused on building the capacity of regulators include:

- The publication of reports such as Regulating for Innovation and Crowdfunding in East Africa: Regulation and Policy for Market Development to provide relevant stakeholders with vital market insights and information to support informed decision-making.

- The hosting of the inaugural innovation conference “Regulation and Innovation in the Age of Fintech” in London in 2018. This was:

- Attended by over 100 participants from 19 countries, 40% of whom were regulators from Central Banks, Ministries of Finance and Capital Market Authorities.

- Instrumental in facilitating the sharing of insights on regulatory approaches to FinTech around the world, providing capacity building and training to regulatory authorities, and providing a forum for the sharing of lessons learned and good practices.

—

About the authors:

- Philip Rowan is the Regulatory Innovation Lead at the Cambridge Centre for Alternative Finance.

- Brian Yalla is an Analyst for FSD Africa.

,