The Green Bonds Listing Rules and Guidelines for Kenya were issued last week. These make it clear to issuers of Green Bonds in Kenya what the regulators expect of them by way of disclosure. Regulatory certainty is the bedrock of well-functioning financial markets and so the launch is an important milestone in the development of this fast-growing market.

The Kenya Green Bond Programme, co-funded by FSD Africa, has already identified KSh90bn of investment opportunity in Green Bonds in the manufacturing, transport and agriculture sectors in Kenya, a small but significant contribution to a global market that is already worth almost $400bn. The Kenyan government itself is planning to issue its first Green Sovereign Bond, perhaps in the next six months.

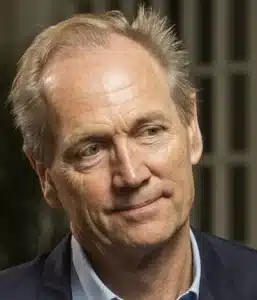

The Patron of the Kenya Green Bond Programme, Central Bank Governor Patrick Njoroge, a passionate environmentalist, spoke eloquently at the launch about the societal value of investing through Green Bonds.

The elephant in the room was the interest rate cap in nya. While caps remain in place, the pricing for Green Bonds, as for other non-sovereign bonds, will almost certainly be prohibitively expensive compared to long-term bank finance. We run the risk that the momentum that now exists in Kenya for Green Bonds will stall because of this almost existential problem. The Governor urged us to take a long view – implying the caps will one day be lifted. We live in hope but it is a pity that priority sectors for Kenya’s economic development, such as affordable housing and manufacturing, cannot at the moment easily benefit from investor interest in this asset class.

Already Nigeria, which issued a Green Sovereign in December 2017, is pulling ahead of Kenya and the Nigerian corporate sector seems to be gripping the Green Bond opportunity more vigorously than Kenya with several issues at an advanced stage, including in the commercial banking sector. FSD Africa has an active Green Bond programme in Nigeria too.

Another problem is easy access to competitively-t from Development Finance Institutions. On the one hand, DFIs push environmental priorities through ESG frameworks. On the other, they offer credit lines to potential issuers on significantly more attractive terms than bond pricing. Does that matter – if green projects get funded anyway? Well, yes it does, if it means we keep not seeing demonstration transactions for Green Bonds. The potential supply of finance for Green Bonds from local pension funds and other institutions is so much greater than what DFIs will ever be able to make available – we should take what opportunities there are to get local institutional capital into this market and DFIs should step back.

A big part of the attraction with Green Bonds is the extra corporate disclosure that is required. Companies are required to lay out their environmental strategy for the Green Bond they want to issue and what systems they will put in place to make sure the bonds proceeds are allocated for the stated environmental purpose. This createunity for a different kind of conversation between investors and issuers, forging a connection that is values-based as well as purely economic.

In the same way, according to Suzanne Buchta of Bank of America, a big issuer of Green Bonds, Green Bonds create opportunities for new kinds of “corporate conversation” within companies – how green is this initiative, how green are we as a company? Buchta suggests that the ESG disclosures from Green Bonds lead to such positive outcomes that they could become the norm for all bonds.

Interestingly, the Economist this week is also calling for companies to be obliged to assess and disclose their climate vulnerabilities by making mandatory the https://www.fsb.org/2017/06/recommendations-of-the-task-force-on-climate-related-financial-disclosures-2/ voluntary guidelines issued in 2017 by the private sector Task Force on Climate-related Financial Disclosures set up by the Financial Stability Board.

This trend towards transparency is good for market-building. It’s good for investors, companies and for employees of those companies. And Green Bonds are playing an important catalytic role in this.