Executive Summary

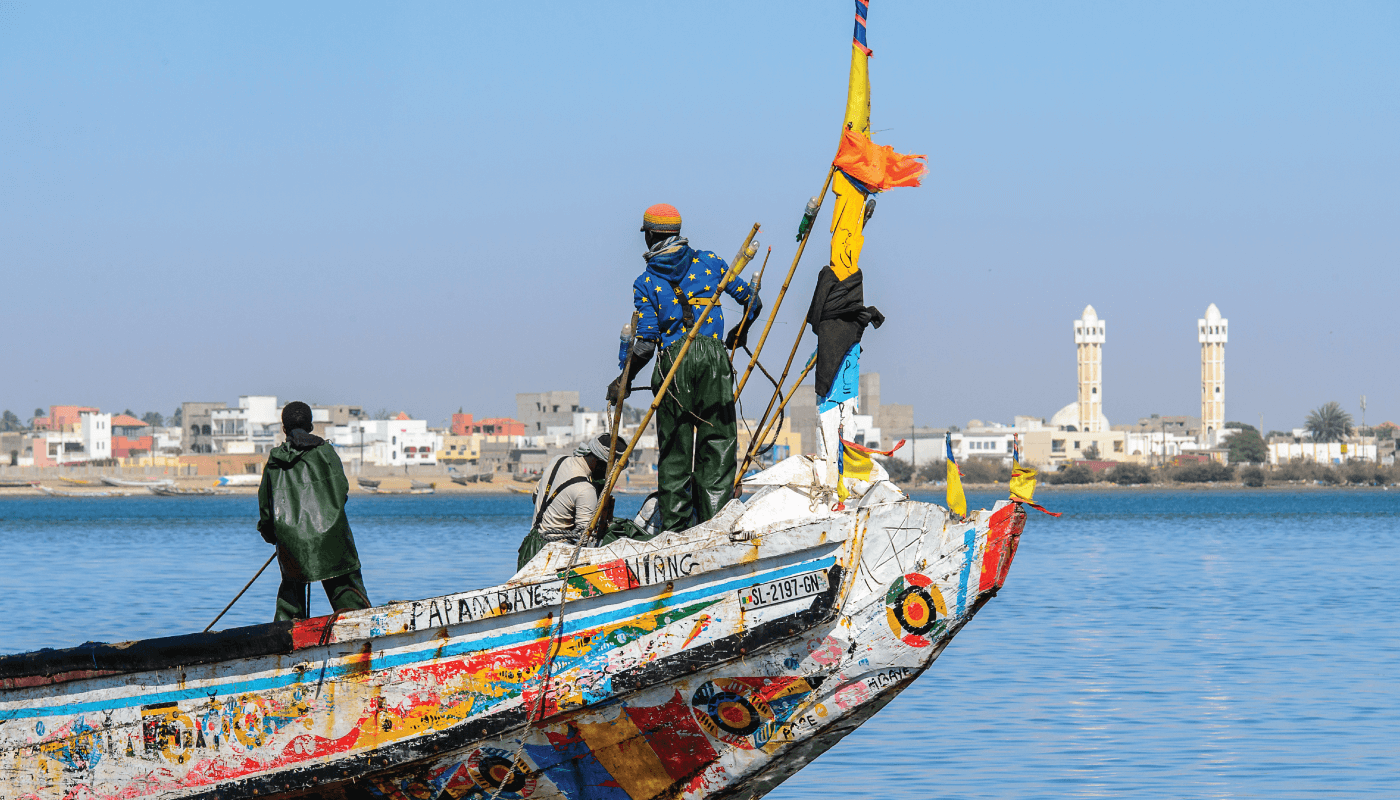

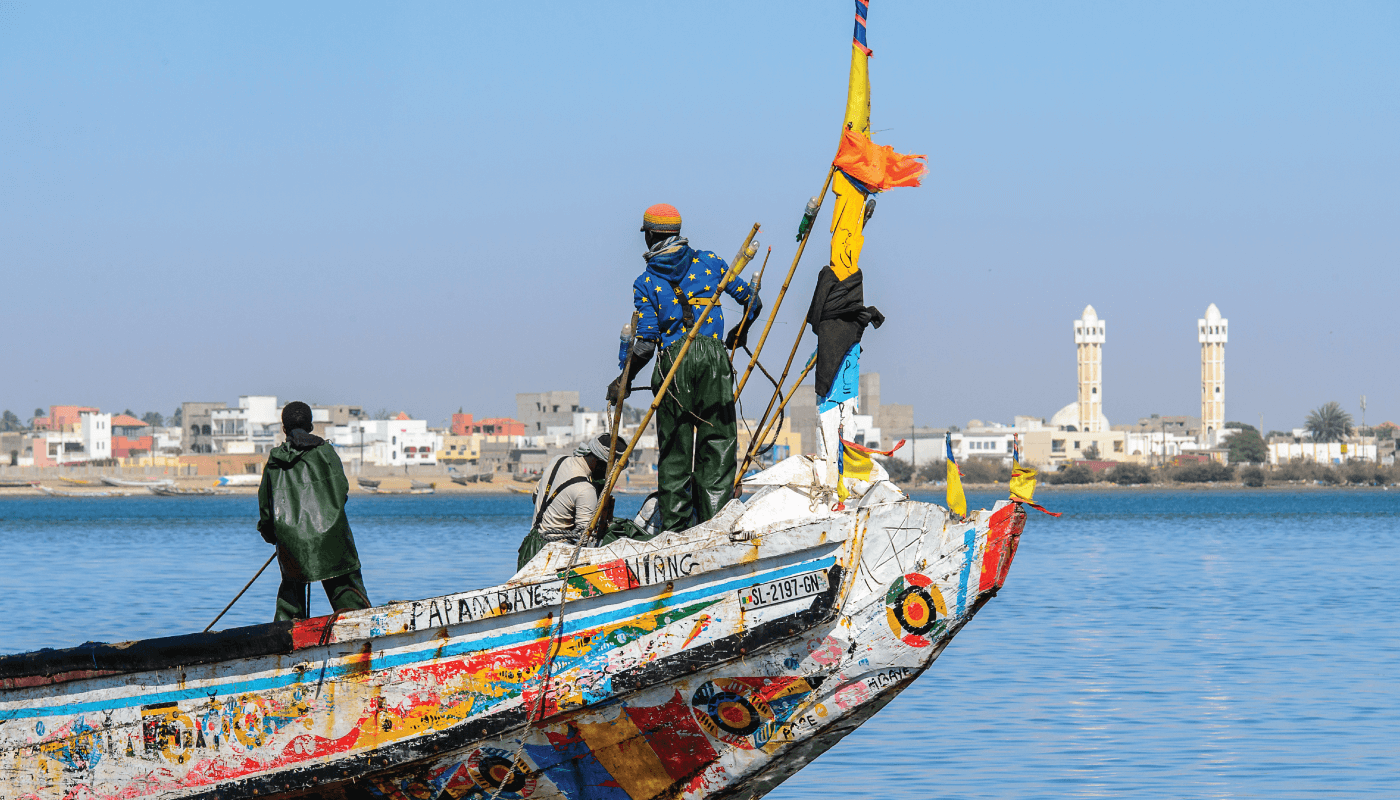

FSD Africa and UMOA-Titres (UT) commissioned Genesis Analytics as a consulting partner to develop a study that determines the feasibility of deploying a financial instrument to address climate change, environmental and/or waste management challenges in the city of Saint-Louis, Senegal.1 The study departs from a comprehensive assessment of the environmental challenges facing the city, and of its enabling environment through a SWOT analysis. A UNESCO World Heritage, where coastal erosion has become an existential threat, Saint-Louis main environmental challenges include exposure to climatic hazards (particularly severe coastal erosion and floods); land and ecosystem degradation; fishery decline and rarity of fish species; and poor waste management and other urban challenges.

After the initial diagnostic phase, the study maps the remedial initiatives that are best placed to tackle the identified challenges and lists the financial instruments that could be deployed to implement such solutions. An initial group of eighteen financial instruments were considered so long as they could be deployed to execute some of the potential remedies explored: The disaster risk finance toolkit; Nature-based Solutions (e.g., sustainable aquaculture, ecotourism, green roofs); Climate-Smart Agriculture (e.g., capture fisheries and aquaculture, energy Management); carbon markets (biodiversity protection); waste management initiatives and green urban initiatives. The instruments comprise typical funding tools (funds, bonds, securitization structures, etc), results-based finance mechanisms, and insurance.

The study concludes by pointing out that Saint-Louis Senegal, has the opportunity to capture a greater portion of the international climate finance flows available globally, through the deployment of Impact Bonds. This report provides an in-depth analysis explaining why this tool was chosen for the particular context of the city. Its flexibility in regards to scale and sector, its capacity to generate positive impact by fostering valuable partnerships, its great potential to be scalable and replicated once the first case is implemented, and its capacity to crowd in private capital, are some of the reasons that explain the choice.

The African continent presents a massive investment opportunity for investors to advance climate solutions in the coming decade according to a new report. However, a set of barriers to finance have stifled requisite investment to date. The report provides a framework for how innovation in financing structures can leverage strategic deployment of public capital to ‘crowd-in’ private investment at levels not yet seen.

With a dynamic entrepreneurial environment, the African continent presents a massive investment opportunity in the coming decade. However, climate finance in Africa falls short of what is required to implement regional Nationally Determined Contribution (NDCs), with climate finance needs eight times higher than amounts currently invested.

Barriers to finance related to financial market depth, local governance, project characteristics, and enabling skills and infrastructure have led the private sector to play a marginal role in African climate finance to date. Barriers can be acute or chronic and are highly context-dependent in the relevance and intensity, differing by geography, sector, and sub-sector.

Innovation in financing structures is required to overcome these barriers, but there is no one-size fits all approach. Investors must tailor strategies based on the geographic and sectoral context of a given investment, deploying combinations of financial instruments based on their effectiveness in addressing specific risks to overcome investment barriers.

The report provides a framework for how these instruments and strategies can be efficiently deployed to overcome barriers to finance and capitalize climate solutions in Africa. Some instruments can be deployed narrowly to address acute barriers to finance such as deploying guarantees to address early-stage construction risk.

The African continent presents a massive investment opportunity for investors to advance climate solutions in the coming decade, however, a set of barriers to finance have stifled requisite investment to date. In this new report, in collaboration with Climate Finance Innovation for Africa and Climate Policy Initiative, we provide a framework for how innovation in financing structures can leverage strategic deployment of public capital to ‘crowd-in’ private investment at levels not yet seen.

This paper focuses primarily on climate mitigation, which represents the largest investment opportunity for private investors. We refer audiences focused specifically on adaptation to the work done by the Global Center on Adaptation and Climate Policy Initiative on Financial Innovation for Climate Adaptation in Africa.

Being Africa’s sixth largest and fastest growing economy, Ethiopia has shown a strong commitment to being a middle-income country by 2025. Since the launch of the Climate Resilient and Green Economy (CRGE) strategy in 2011, it has established a rich policy landscape coupling economic growth with climate change action. Ethiopia’s ambitious climate targets are focused on ensuring low-carbon energy development, conservation of its vast forest reserves, and practicing climate smart agriculture, while mainstreaming adaptation and resilience as a key priority.

This report provides a deep dive analysis of the landscape of climate finance in Ethiopia in 2019/2020. Following an overview of climate relevant strategies and plans in the country to date along with financing needs (Section 1), it provides an in-depth analysis of climate finance flows in Ethiopia mapped across its value chain i.e. from sources, financial instruments, and their end uses and sectors (Section 2). The analysis is based on the methodology and database developed by CPI for the Landscape of Climate Finance in Africa (CPI, 2022). While data gaps, especially on the domestic budget expenditure and private investments limits a comprehensive assessment, the aim of the study is to inform and facilitate discussions among policymakers and public and private financiers, identifying gaps and opportunities for scaling climate finance in Ethiopia.