Raising Investment Capital for Greenfield Infrastructure Projects with InfraCredit

Nearly 8,000 rural households in Southern Nigeria are expected to access clean, affordable solar power following a collaborative initiative between FSD Africa and Infrastructure Credit Guarantee Company Limited (InfraCredit). So far, the initiative has facilitated 1.6 billion Naira in local funding for DarwayCoast, a solar power company. This funding has enabled DarwayCoast to scale up its solar power project, providing affordable electricity to households through mini-grids, contributing to climate change mitigation goals.

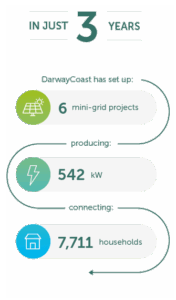

In three years, DarwayCoast has set up six mini-grid projects expected to produce 541.76 kW of solar energy and connect 7,711 households by September 2023. The project covers six sites: two in Lokpaukwu, Abia State, and four in Rivers State. Equipment procurement and powerhouse assembly are completed at all locations. Solar PV installation is finished at Lokpaukwu, and pole installation is 70% complete at the other sites. All remaining installations will be finalised by August 2023. Of the jobs created in the projects so far, 31 were taken up by females and 196 by males.

To impact capital markets and reduce poverty, InfraCredit employs an impact assessment framework to measure the effects of its guarantees at the project, end user, and market levels. The partnership with FSD Africa has allowed InfraCredit to engage in riskier, high-impact investments, facilitating inclusive finance and economic growth. Supporting DarwayCoast also promotes climate action financing and paves the way for other transitional energy projects. InfraCredit is actively seeking additional partners to join FSD Africa in expanding its capacity to accelerate funding for renewable energy and energy transition initiatives.

Many greenfield infrastructure projects face assessment challenges due to a lack of technical expertise. FSD Africa offers the necessary technical support, ensuring these projects meet InfraCredit’s rigorous due diligence criteria and maintain high-quality standards for presentation to potential lenders.

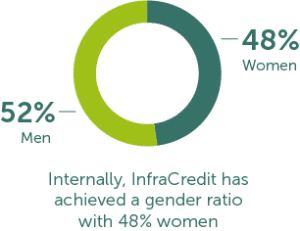

In view of Sustainable Development Goal 5, gender alignment is one of the indicators that InfraCredit assesses and strives to improve, aided by its gender action plan. Through technical assistance and incentives, it champions gender balance and inclusion in project design. Internally, InfraCredit has attained a gender ratio of 48% women.

InfraCredit’s partners are looking into replicating the credit guarantee model across Africa. Such an initiative is currently taking shape in East Africa, and as its way to give back, InfraCredit is providing technical assistance, sharing knowledge, experience and data.