Trash to Resilience: How BimaLab boosted Soso Care’s unique microinsurance intervention

AN INSURTECH ACCELERATOR FOR INNOVATORS WORKING TO CREATE THE FUTURE OF INSURANCE IN AFRICA

Insurance penetration in Africa has historically been exceptionally low, with insurance coverage in 2019 at a mere 2.78%, significantly below the global average of 7.23%. Providing insurance to lowerincome populations across Africa encounters multiple obstacles, including high premium costs, limited customer awareness, and a lack of innovative solutions. Although insurance penetration in Nigeria is still relatively low, there is a significant upsurge in innovative developments within the sector. FSD Africa, in partnership with insurance regulatory authorities and other stakeholders, is actively working to stimulate and capitalise on these innovations to foster inclusive growth within the sector.

In collaboration with the Swiss Re Foundation and Nigeria’s National Insurance Commission (NAICOM), FSD Africa initiated the BimaLab insurtech accelerator program. A specific objective in Nigeria has been to assist NAICOM in formulating policies and fostering a conducive environment to boost micro-insurance, capitalising on the growing prevalence of smartphones. Another objective has been supporting insurtech startups in establishing networks, promoting partnerships, and gaining access to business opportunities.

One of the successful beneficiaries is Soso Care, a leading health micro-insurance startup operating in four Nigerian cities. Leveraging on the training and newly established partnerships, the company can now effectively offer health micro-insurance to low-income earners in exchange for recyclable waste as premiums. Collaborations with global insurers like AXA and AIICO has enhanced Soso Care’s growth and driven financial inclusion, the partnership with Wema Bank has resulted in technical and financial assistance, and the partnership with Port Harcourt Municipal Government is expected to enrol over

5,000 members of the public in the healthcare insurance scheme by year-end. The latter was signed at a Conference on Waste to Health.

By training and partnering effectively, Soso Care has provided essential healthcare services to low-income earners and promoted sustainable waste management. This has led to healthier communities, improved healthcare access, and reduced environmental harm, offering a mutually beneficial solution for people and the planet.

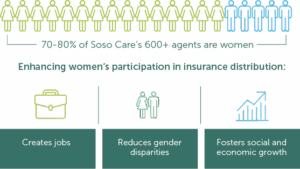

GENDER EQUALITY AND ECONOMIC RESILENCE

Soso Care also provides income-generating opportunities. In 2019, a pilot project involving 100 women collecting plastics generated funds to fuel Soso Care’s growth. Today, they serve 7,000 women, with gratitude for the support from BimaLab.

Providing financial support to insurtech startups is undeniably crucial, yet there are other drivers of their growth and success. Soso Care demonstrated that, even without substantial financial backing, they could benefit from the non-monetary support from BimaLab, significantly improving their operations.

Furthermore, the success of the BimaLab accelerator in Kenya and Ghana, yielding similar results and impact as in Nigeria, underscores the effectiveness of FSD Africa’s innovative resilience-building tools.