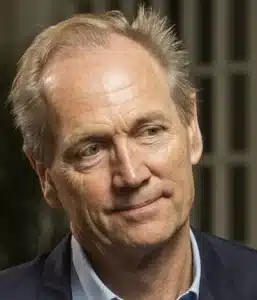

Central Bank Governor Dr Patrick Njoroge fielded some tough questions from the audience on 9th February 2017 at FSD Kenya’s annual financial inclusion lecture. British economist, Professor John Kay, had just delivered a provocative talk on the risks of financialization in the economy. He cautioned Kenyan bankers and policymakers to avoid the mistakes of the Anglo-American finance model and work towards building a financial sector with local solutions that deliver real value for real people.

The point was not lost on the Governor. In the question and answer session, he was grilled on the future of finance in Kenya and how the CBK would ensure access to services that delivered real value to consumers. In his response, the Governor singled out the financial needs of “cuspers,” getting by on about $2-5 per day.

This market segment, now includes about 12.6 million Kenyans. These are not the poor, on the brink of survival. But nor have they achieved firm footing in the middle class – they live “on the cusp”. The sheer size of this group means we must pay it attention. Cuspers affect the economic lie classes in innumerable ways. The future of this segment will be affected by changes in the financial sector more than any other.

Providing cuspers with helpful financial tools to smooth the volatility in their incomes and build enduring assets will be key to ensuring that Kenya develops a bigger and more inclusive middle class and benefits from the economic and social gains that such a transformation entails.

But such transformation is not automatic. In our own research on this market segment, we found that the vulnerabilities of the cusp group mean they could end up simply churning within this low-level income band without ever building real capital or income security. We find that cuspers are very much exposed to macro-level shocks and often lack the tools to manage micro-level ones without major financial setbacks.

We also find that credit can be an important tool for upward mobility, and Kenya’s digital credit revolution is opening up those possibilities more rapidly than anyone could have expecteven three years ago. The question today is whether the financial sector is being driven by short-term profits or taking the long term view of sustainable profits by prioritizing cusper client welfare. We have to ask ourselves – how useful is M-Shwari or Branch or Tala to the asset-building ambitions of the cusp group?

“Good credit” for the cusp group happens when borrowers are not overwhelmed with options, they have a plan for the use of capital, have practiced borrowing, understand their debt service obligations, and select from a diversity of credit offerings to fit the right borrowing need. Most importantly, good credit unlocks a pathway towards real assets like land, housing, businesses, and higher education.

I am pleased to hear that the Governor is thinking and talking about those living on the cusp. The question is, are bankers list