NAIROBI, Kenya, Feb 19 – A new gender bonds toolkit has been introduced in Nairobi to centralize capital for women in the African capital markets.

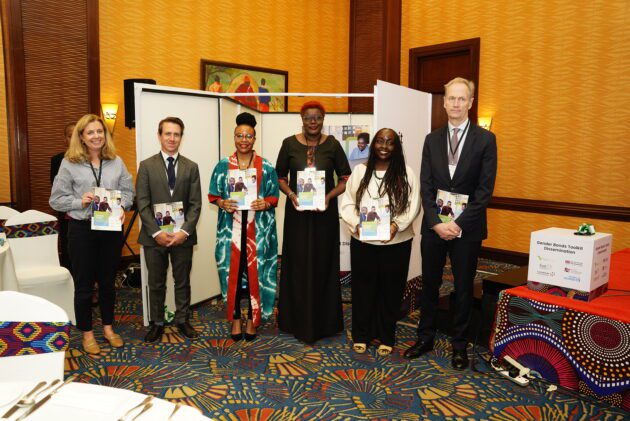

FSD Network’s gender collaborative program, British International Investment (BII), and the United Nations Entity for Gender Equality and the Empowerment of Women (UN Women) are the proponents of the program.

The toolkit seeks to equip stakeholders with the necessary insights and strategies to foster inclusive and impactful investments, bridging gender gaps in the investment landscape.

Generally, gender-focused bond issuances have been viewed as complex due to the lack of a ‘go to’ reference on the process and procedure.

However, the toolkit will champion the centralization of efforts to mobilize gender smart capital, strategically addressing technical capacity gaps on both the demand and supply sides.

“With the launch of the gender bonds toolkit, FSD Africa together with our partners are catalysing a seismic shift in African capital markets,” Mark Napier, Chief Executive Officer of FSD Africa, said during the launch.

“This initiative not only signifies our commitment to gender equality but serves as a powerful tool to mobilize capital, foster sustainable growth, and empower women across the continent,’’ Napier added.

According to a report by UN Women and UNDP in 2022, sustainable bonds aligned with SDG 5, achieving gender equality and empowering all women and girls, were still 1 percent of the $900 billion issued through green, social, sustainability, and sustainability-linked bonds.

The financing gap was even more evident when gender finance was considered as a proportion of total global assets under management (AUM), making up not even 0.01 percent.

However, as of June 2023, global Assets Under Management for Use of Proceeds bonds dedicated to gender equality and women’s empowerment reached $13.5 billion, underscoring the increasing significance of gender-focused investments.

“As a founding member of the 2X Challenge and a leader in providing gender finance, BII is committed to empowering women’s economic development,” Jo Fry, Investment Director, and Head of Intermediated Financial Services at BII, said.

“This means that we’re constantly looking for new ways in which we can mobilise more capital and better support women,” Fry stated.

“Our goal in producing this guide is to demonstrate and create better understanding of how effective gender impact bonds can be as an investment tool to advance gender equality in Africa.”

Parallelle Finance, an investment research and consulting firm, served as the author of the toolkit.

Read original article