Building healthy credit markets in Africa by 2026

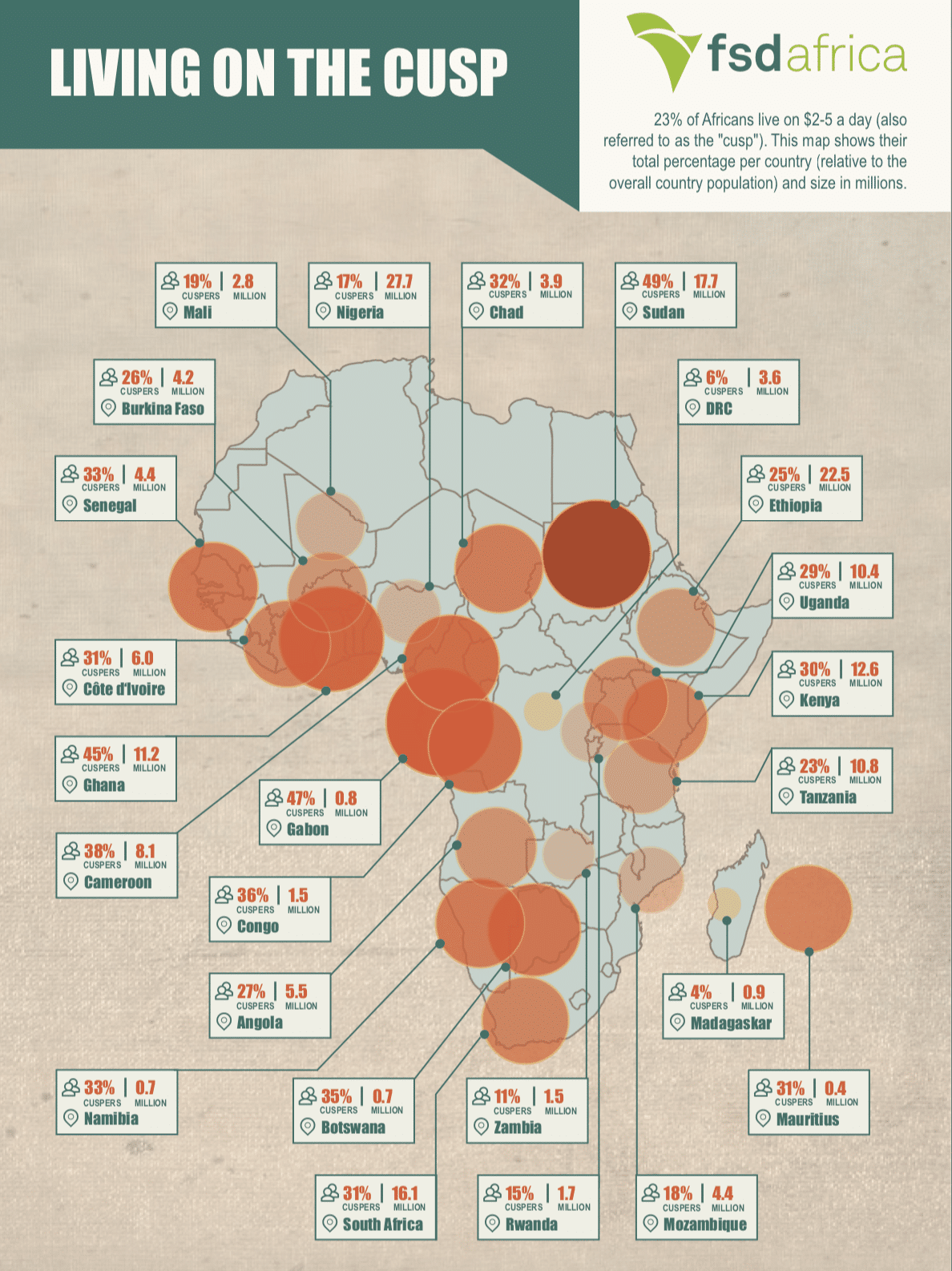

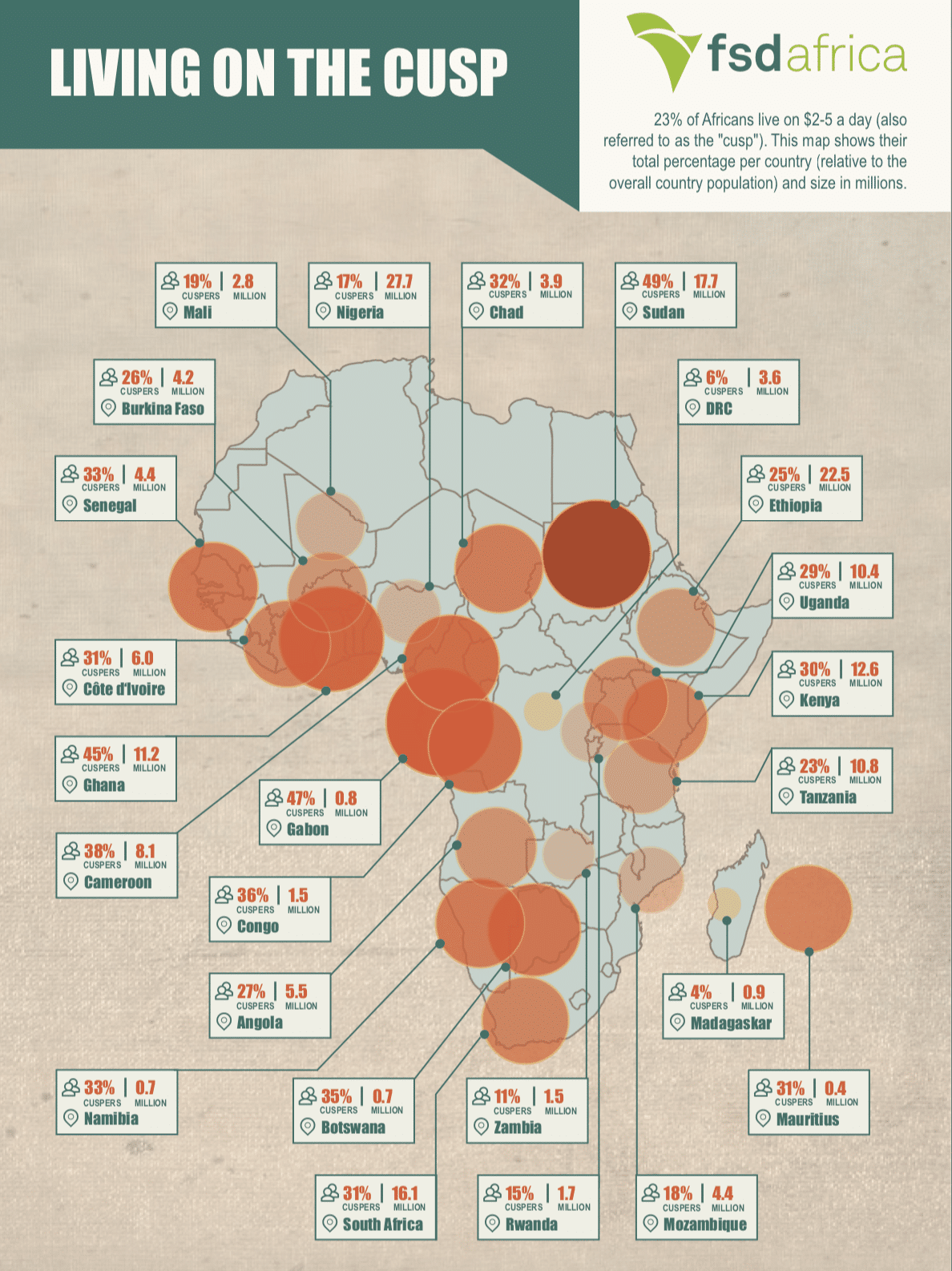

African economies are currently undergoing dramatic changes, including a changing consumer base. Absolute poverty is reducing as a new class of consumer—the cusp group—emerges. This group (we call “cuspers”), which now accounts for 23% of sub-Saharan Africa’s population, covers a segment of active earners getting by on $2-$5 per day and straddling the formal and informal worlds. For this group, healthy credit markets could expand opportunity and enable upward mobility, helping to build a true middle class. But, for this to happen, credit needs to expand and to do so in healthy ways.

In the Credit on the Cusp project, we look at the experience of cusp group borrowers and the lenders who serve them in three distinctive markets—South Africa, Ghana, and Kenya—to better understand what healthy credit market development would mean for this group. We explore some ways donors and policymakers can help build credit markets thaard mobility for Africa’s cuspers.

Refugees have a strong need for comprehensive financial services to support their livelihoods. Refugees, like other relatively low-income segments, need: savings or transaction accounts to safely store their income and minimise the risk of theft; loan products to support business ventures and meet other personal needs; insurance to minimise the financial impact of unpredictable events; and convenient access to financial services channels to receive remittances. The refugees’ need for financial services has become even more apparent as the World Food Programme continues to shift its humanitarian support from food assistance to cash-based transfers.

Rwanda has been hosting refugees for over 20 years. In this context of long-term displacement, governments, humanitarian agencies, the development sector and other stakeholders must provide long-term solutions for refugees, such as financial services, which can support market-based livelihoods. FSDA, UNHCR and AFR partnered on this study to assess both the demand for financial services in refugee populations and the business case for Rwandan financial institutions to provide these services.

The study had two objectives: first, to provide market intelligence to build a sound business case for financial institutions to profitably serve the forcibly displaced persons (FDPs) population; and second, to better understand the financial needs of the FDP population in Rwanda to enable financial service providers (FSPs) to effectively target the segment.

This report is the result of a triangulation of four different research activities: segmenting and sizing refugees as a market for financial services; translating the segments into business cases to assess potential for serving this market; creating profiles of segments based on field research in refugee camps; and assessing the regulatory environment to provide financial services for refugees.

Some of the key findings from the report are:

- At the moment, six of the seven camps in Rwanda have cash and the last camp Mahama is likely to

become cash before the end of the year.

- Contrary to expectations, refugees in Rwanda have enough income to be strong potential customers for FSPs.

- The report estimates that extending financial services to the refugee population of Rwanda would expand the market for financial services by approximately 44,000 individuals.

- Many refugees have used financial services before and want to use them again, perhaps even more urgently than Rwandan nationals.

- BFA’s dynamic business case model suggests the refugee population has as much potential to generate profit for FSPs as the traditional Rwandan population.

- One of the biggest challenges refugees face in accessing financial services relates to satisfying the ID requirement for ‘know your customer’ (KYC) purposes.

FSD Africa commissioned BFA to undertake an in-dept post-issuance survey of the first government bond sold exclusively via mobile based which provided key insights and recommendations.

This National Treasury led market development initiative to distribute government securities through mobile phones is one of the most innovative globally. Although the first pilot and launch did not achieve the desired outcome, the survey aims to enhance and guide the subsequent issuances of M-Akiba.

FSD Africa identified M-AKIBA as an opportunity to learn about an innovative tool which could enable the broadening and deepening of inclusive financial markets. The study identified successes and challenges that M-Akiba experienced.

This innovative bond aims to broaden the sources of borrowing beyond banks and other financial institutions to retail investors. The minimum subscription is less than $30 with an interest rate of 10% disbursed every six months over mobile money, at a three-year tenor.

The survey highlights the possibility for replication of this pilot issuance and explores other possible approaches for the mass distribution of securities.

The product was developed by the government in collaboration with Nairobi Securities Exchange (NSE), the Central Depository Settlement Corporation (CDSC), Mobile Network Operators (MNO), and the Kenya Association of Stockbrokers & Investment Banks (KASIB).

FSDA appointed BFA to create a pilot profile of the current and planned capacity of five National Payments System Departments (NPSDs, or their equivalents) at African central banks that will enable them to peer benchmark their own structure and capacity; and to plan better how to grow that capacity over time. This exercise will enable an understanding of possible gaps in knowledge and skills with regard to payments, potential for capacity building as well as possible requirements with respect to staff capability in key areas and potential structures.