In Africa, capital market regulators are tasked with a dual mandate – both developing and regulating the market. This raises the difficult question of how a regulator might play a dual role, including determining the right strategic focus, activities and capacity to do so effectively. This is particularly important in resource-constrained economies where the regulator operates with a limited team and budget. Its functions must be delivered with constrained financial resources and managed in a way that is proportional to the market context. The White Paper on Financial Sustainability and Regulatory Proportionality of Capital Market Regulators in Africa proposes an analytical framework to assess the state and stage of a country’s financial market, which guides how the capital market regulator should implement its mandate, focus areas and engage policymakers on appropriate funding models.

In addition, limited resources call for careful identification of regulatory gaps that need to be bridged by capital market regulators to enable them to achieve both their regulatory and developmental mandates. Gleaning from institutional capacity assessments that we have supported in eight regulators in Africa from 2015 to 2022, the Institutional Capacity Assessment Toolkit for Capital Markets Regulators in Africa is a reference guide to equip regulators in systematically identifying their capacity gaps and developing appropriate institutional strengthening programs to address them.

In 2020, we partnered with FCDO Ethiopia and KfW (on behalf of BMZ) to implement an emergency jobs protection facility for manufacturers in various industrial parks in Ethiopia. The main objective of this intervention was to ensure continuity of employment for workers and the post-Covid sustainability of Ethiopia’s textile and garment manufacturing sector.

Following the conclusion of the Facility, we also undertook a review of the programme’s performance in line with specific objectives on behalf of the funders. This learning brief summarises the findings of the report and highlights the challenges, lessons and impact of the programme.

Determining climate finance needs in developing economies is critical to identify financing gaps and opportunities to guide stakeholders to effectively access, allocate and mobilize climate finance. Such data supports international policy processes, like the determination and implementation of a new collective and quantified goal on climate finance and accelerates action. The process of estimating needs also helps in assessing the effectiveness of climate finance flows.

51 out of 53 African countries that submitted Nationally determined contributions have provided data on the costs of implementing their NDCs. Collectively, they represent more than 93% of Africa’s GDP. Based on this data, it will cost around USD 2.8 trillion between 2020 and 2030 to implement Africa’s NDCs.

African governments have committed USD 264 billion of domestic public resources, about 10% of the total cost. USD 2.5 trillion must come from international public sources and the domestic and international private sectors. This externalinancial support, required beyond domestic public sources, is defined as “climate finance need”. While almost all African regions have expressed high needs (Figure 1), these could be underestimated due to a lack of capacity and guidance to make accurate assessments and a lack of data from subnational governments and vulnerable communities. Countries may not be able to provide as much domestic public finance as initially estimated given high debt levels amid unanticipated budgetary pressures — for example, from the COVID 19 c

Africa is under pressure to develop its green finance market for two crucial reasons. The first is to significantly and sustainably respond to climate change, as the continent is vulnerable to the severe effects of climate change. Secondly, African private and public sectors lag behind other emerging markets in green (and sustainability) bond issuances. The SADC Green Bond Programme serves to address the aforementioned challenges in general, and in particular, the embryonic status of the green finance market in the SADC region.

Since its official launch in March 2021, the Programme has made commendable headway in implementing its core strategic objective of developing the green bond market in SADC – which is demonstrated by the publishing of this SADC Green Finance Demand Study. Considering that the development of the capital market ecosystem depends on timely empirical information, the importance of this study cannot be overstated. Not only does it bridge the existing knowledge gap regarding green investmt opportunities and barriers in the SADC region, but it is also underpinned by one of CoSSE’s mandates, which is to encourage the transfer of securities markets’ intellectual capital and technical expertise among member Exchanges of CoSSE.

We undertook a study with RisCura to identify, explain and address the root causes of “market failure” relating to Initial Public Offerings (“IPOs”) on African stock exchanges.

The study takes a robustly comparative approach, drawing out common challenges and recommended solutions from deep individual analysis of seven stock exchanges, ranging from West Africa to East and Southern Africa and some Francophone countries.

Challenges

The study identified multiple causes for the ‘market failure’ witnessed to date, with responses differing according to geography as well as to the respondents’ role, or vantage point, within the ecosystem and wider economy.

These factors can be grouped into three broad categories:

Solutions

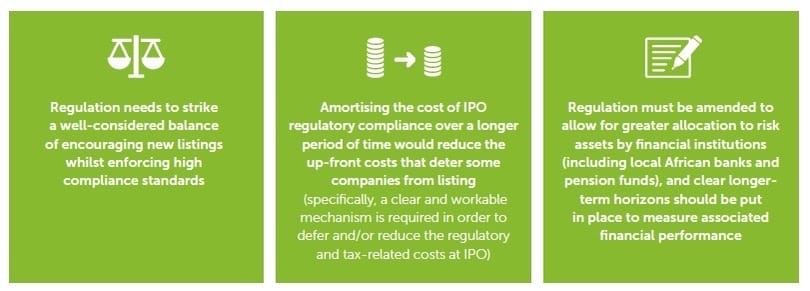

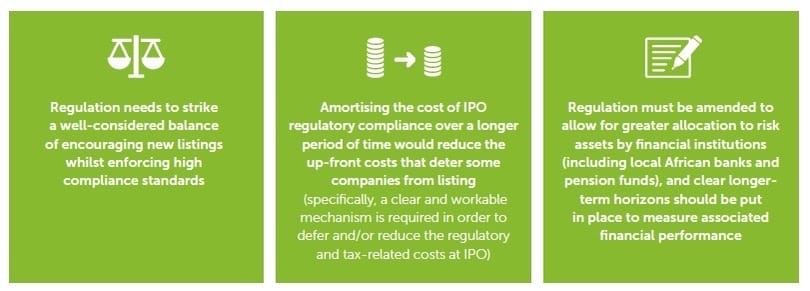

The study uncovered positive and proactive recommendations for cross-cutting solutions which, taken together, have the potential to transform the performance of IPOs on African exchanges.

Three high-priority changes were identified as important and necessary:

Beyond these structural and ‘infrastructural’ solutions, there is also a clear need for ‘softer’ reforms and initiatives in the form of enhanced advocacy, awareness-raising and information-sharing.

Download the summary of this study to read more about ‘market building’ challenges and recommended actions for consideration.

Following a webinar we held on 23 February 2021, where together with Lion’s Head Group Partners educated participants on Green Bonds and shared key insights from this scoping study on the feasibility of a Green Bond Market in Ghana.

In this study, we describe what a green bond is, the benefits they offer to issuers and borrowers and the barriers in issuing them. We review the current state of the Debt Capital Market in Ghana and the active issuances, both sovereign and corporate. We then assess the state of development of Green Finance in Ghana, the viability of using the DCM to support sustainable development and highlight how green bonds could be used to achieve the country’s Nationally Determined Contributions.

We also benchmarked Ghana against other Sub-Saharan African (SSA) countries with active green bond markets to identify key market development actions. In our analysis of the potential for green bonds in Ghana, we provide key stakeholder takeaways from interviews held as part of the stakeholder engagement, which formed the basis of our data for the report in addition to information gathered through desk research.

Finally, we provide an analysis of key takeaways – including key hurdles to be addressed, recommend actionable initiatives that could be implemented to drive the green bond market in Ghana – and a short and medium-term potential pipeline derived from conversations with local stakeholders.

Through this collaboration, we hope to build thought leadership for FSD Africa in Ghana.

Africa’s urban challenges are complex. Cities need tailored, endogenous solutions which work for their residents. It also means that the scale of projected investments to drive compact, connected and clean urban development is varied and depends on country-specific characteristics, as are the challenges of financing these investments.

This report addresses financing Africa’s green urban transition; highlights urban opportunities; makes the economic case for sustainable urban infrastructure investment; and outlines financing solutions for low-carbon urban development applicable to the whole region.

With case studies from three African countries, this report shows how investment in compact, clean and connected, urban development could accelerate growth across the continent and secure more resilient and prosperous lives for their residents.

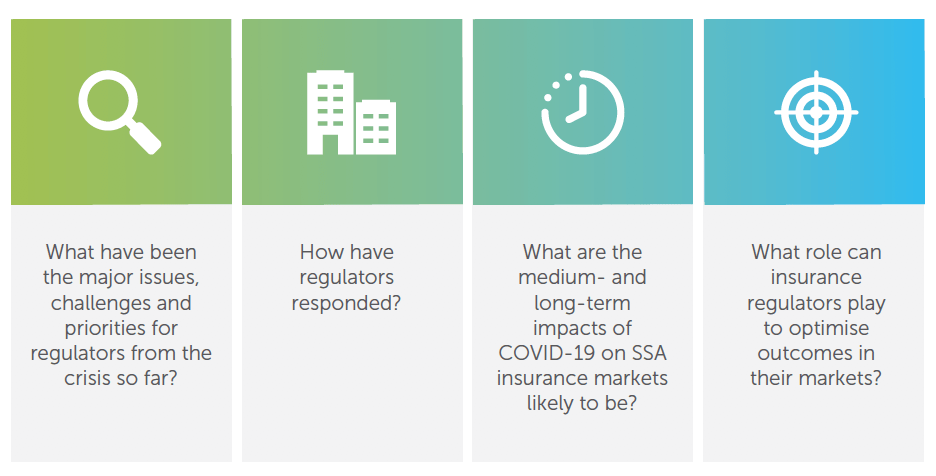

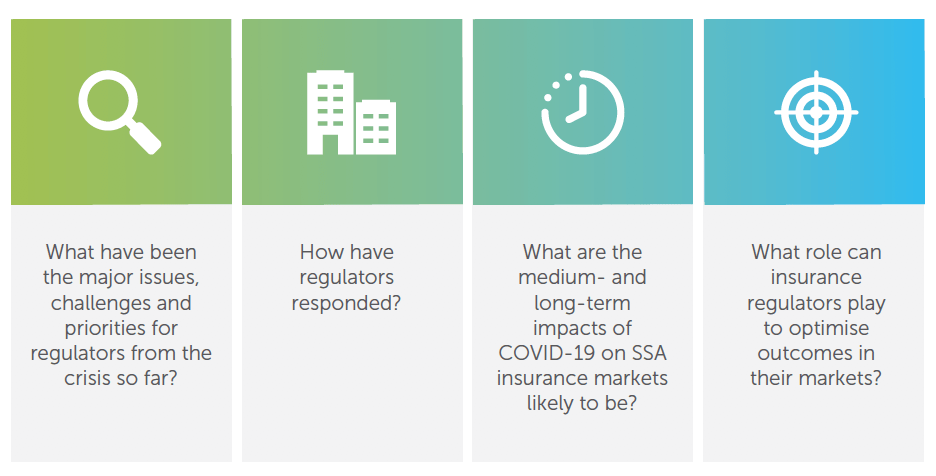

COVID-19 has had – and continues to have – a major effect on all parts of society.

The insurance sector has been placed under the spotlight as providers and regulators grapple with finding a balance between stepping up and providing respite to policyholders through claims and the need to maintain prudential soundness.

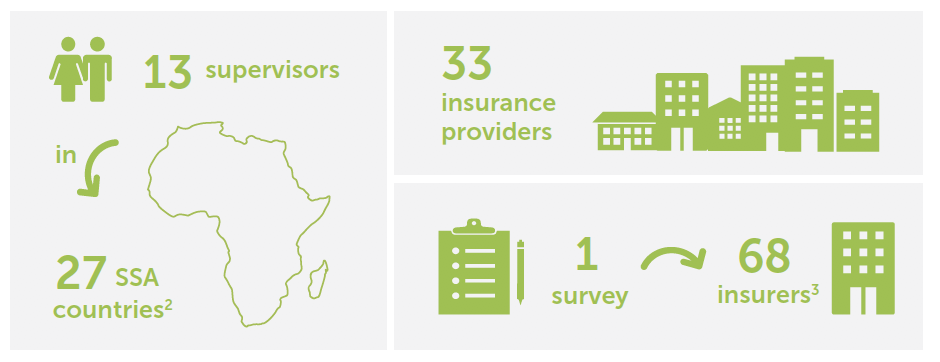

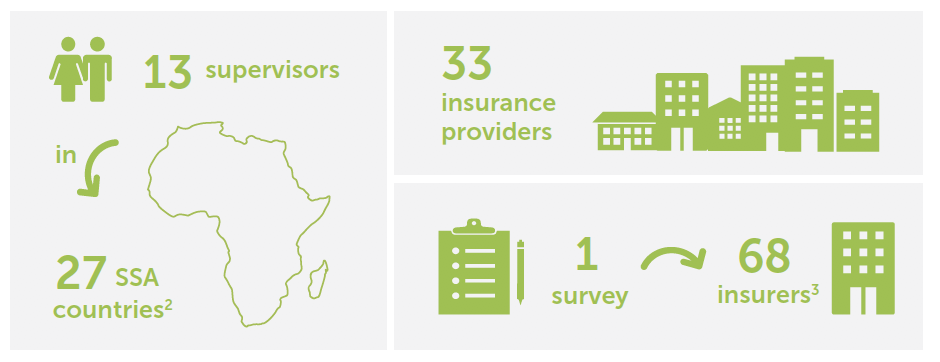

This note outlines our key learnings on the impact of COVID-19 on insurance markets across sub-Saharan Africa (SSA) as it relates specifically to insurance regulators. We focused on the following pertinent questions:

And engaged with:

As part of our work in credit markets, we aim to contribute to a greater understanding of factors that inhibit the growth of credit markets in sub-Saharan Africa. We partnered with Intellecap to undertake research on market innovations in retail credit markets.

The objective was to assess innovative models emerging in selected countries – South Africa, Nigeria, Kenya, Tanzania and Rwanda – and to identify the critical factors for success. The region continues to face a myriad of challenges across the spectrum of the lending value chain, which affect credit access. These include low-income levels, poor infrastructure, weak policy and a high cost of credit.

In the face of these challenges, innovative digital technologies and business models are emerging in an attempt to solve credit access challenges. The report identifies over 30 credit innovations that leverage technology, multiple data sources and partnerships to enhance access and delivery of financial services to underserved segments across the continent.

The insights generated through the research are intended to highlight market opportunities and challenges, and will be of value to policymakers, regulators, credit providers, financial sector analysts, as well as others interested in supporting credit market growth in the region.

The Africa Long-Term Finance (LTF) Initiative seeks to rebalance the focus toward this perspective by (a) assembling data and establishing an

“LTF Scoreboard,” on which individual countries are benchmarked against one another on the availability of LTF, and (b) undertaking country diagnostics in a number of African countries to identify specific hurdles faced in deepening markets for LTF and ways such hurdles could be overcome. This report is the first of these country-diagnostic reports.

This country report on Côte d’Ivoire focuses on infrastructure, housing, and enterprise finance. It applies a flexible definition of LTF that reflects the differing productive life of assets being financed, which may vary from 20 to 30 years in the infrastructure and housing sectors and 5 years or less for enterprises.

Given scarce fiscal resources and the underdeveloped status of domestic financial markets, the report identifies sizable long-term financing gaps in the infrastructure, housing, and enterprise sec