Embargoes until 22nd February 2024, afternoon.

Tanga

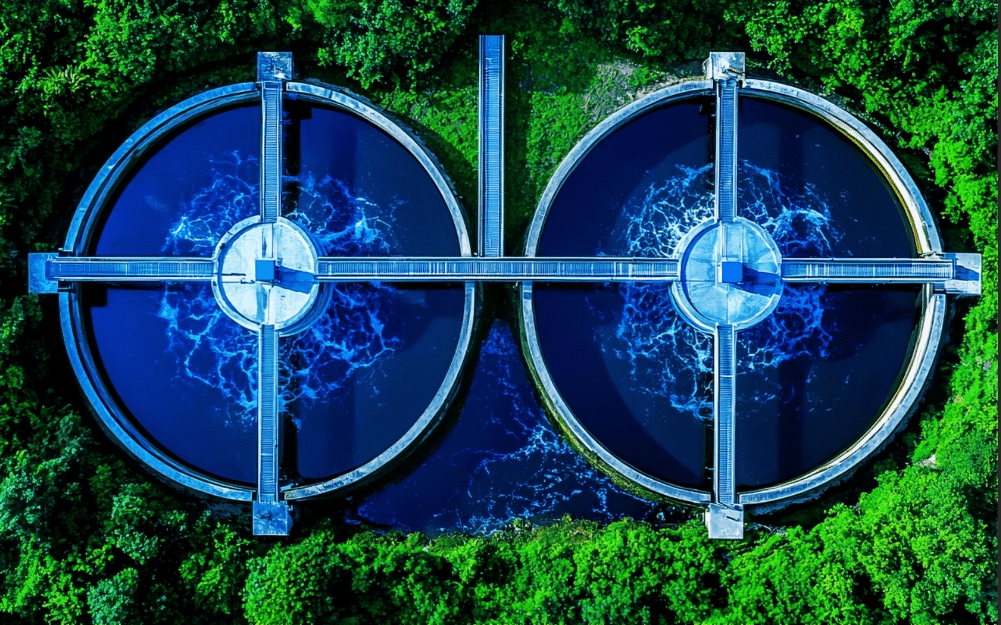

Today, the first ever Sub-national Water Infrastructure Green Bond in East Africa, worth TZS 53.12 billion has been issued by Tanga Urban Water Supply and Sanitation Authority (Tanga UWASA), an autonomous water utility. This landmark transaction would fund the expansion and improvement of sustainable water supply infrastructure and environmental conservation within Tanga city and nearby townships. The 10-yrs project revenue bond to be listed at Dar es Salaam Stock Exchange (DSE), offers an attractive interest rate of 13.5% per annum to be paid semiannually.

The government of Tanzania adopted the Alternative Project Financing (APF) strategy in 2021 because of the need to broaden its domestic revenue base to finance various national development initiatives including water, energy, heath care, agriculture, and other productive infrastructure projects. Tanga bond is the first significant transaction to demonstrate that the existing regulations and frameworks can be used by municipalities, cities, and sub-national entities to raise significant capital from domestic capital markets in local currency to finance development. Innovative financing such as this one can help to bridge the gap between what is available and what the government, need to reach national development plans and sustainable development goals”.

In his speech while gracing the launching ceremony, the guest of honor H.E. Philip Mpango, Vice president of United Republic of Tanzania said that financing of strategic revenue generating projects through a revenue bond such as the Tanga Bond will reduce pressure on government budget and provide an opportunity to focus on priority social initiatives that can’t be financed via commercial windows. On that front, he said , “Am directing the Treasury Registrar’s Office which supervises public institutions and the Minister of State, President Office, Regional Administration and Local Government (PORALG), to explore eligible public institutions, Local Governments, cities and municipalities to prepare to tap long term finance via revenue and municipal bond issuance.”

Speaking during the event, the Deputy Minister of Finance Hon. Hamad Chande highlighted that, the Government of Tanzania is committed to ensure that its Alternative Project Financing strategy is used by more public entities to finance local development instead of relying only on government grants, a leaf to be borrowed from the Private Sector and Corporates who operates in the same market.

On his side, Hon. Jumaa Aweso, the Minister for Water insisted that the direction of the 6th administration and the CCM Manifesto is to ensure access to water supply by 95% in urban areas and 85% in rural areas by December 2025. To date, water accessibility has reached 88% and 77% in urban and rural areas respectively. “In order to achieve these targets, it is crucial to deploy various innovative financing mechanisms similar to what Tanga UWASA has done. This project is expected to improve and increase water supply from 96% to 100% in Tanga City and reliability of water for 24 hours, by June 2025. Similarly, increase water supply network from 70% to more than 95% in the townships of Muheza and Pangani respectively by June 2025. Likewise, increase capacity to supply adequate water to Mkinga District through the ongoing project which is under construction”. He added.

On his key remarks, the Head of United Nations Capital Development Fund (UNCDF) in Tanzania Mr. Peter Malika congratulated the government for achieving this historic milestone. He said “UNCDF played an important role of partnering with the government and its key national institutions to influence policies and improve the enabling environment related to domestic capital markets development. Tanga Bond is a demonstration that capital markets are a viable option for financing national development needs without increasing the national debt limits”. UNCDF will continue to provide technical assistance and financial assistance to ensure more sub-national and municipal bond issuances take place to meet the growing demand to fund public services driven by growing populations, urbanization and climate change.

Mr. Nicodemus Mkama, Chief Executive of the Tanzania Capital Market and Securities Authority (CMSA) highlighted that “CMSA has been at the fore in steering development of innovative sustainable capital market products that have facilitated successful issuance of the first gender and multi-currency green bonds in Sub-Saharan Africa; as well as shariah compliant sukuk bonds. These results have positioned Tanzania on the map of global capital markets that offer innovative and sustainable products attracting both domestic and international investors. The Tanga UWASA bond, which is an innovative, sustainable blended capital market product with elements of subnational, water infrastructure, green, revenue bond is a milestone pathfinder transaction, expected to showcase other subnational institutions and municipalities in financing revenue generating projects, through capital markets.”

Other stakeholders involved in preparations of the Tanga water green bond includes NBC Bank (lead transaction advisor), FSD Africa (supported green framework), FIMCO and Global Sovereign Advisory (financial & investment advisory), ALN Tanzania (legal advisor), Innovex (reporting accountant), Vertex International Securities (stockbroker) and ISS Corporate Solutions (second-party opinion provider).

General public, investors, Institutions and individuals are welcome to visit any NBC Bank branches or any other authorized brokers to invest in the Tanga water green bond, within the offer period of 6 weeks.

END