Million

Reduction of 100 million tonnes annually by 2030, at least 30% capture.

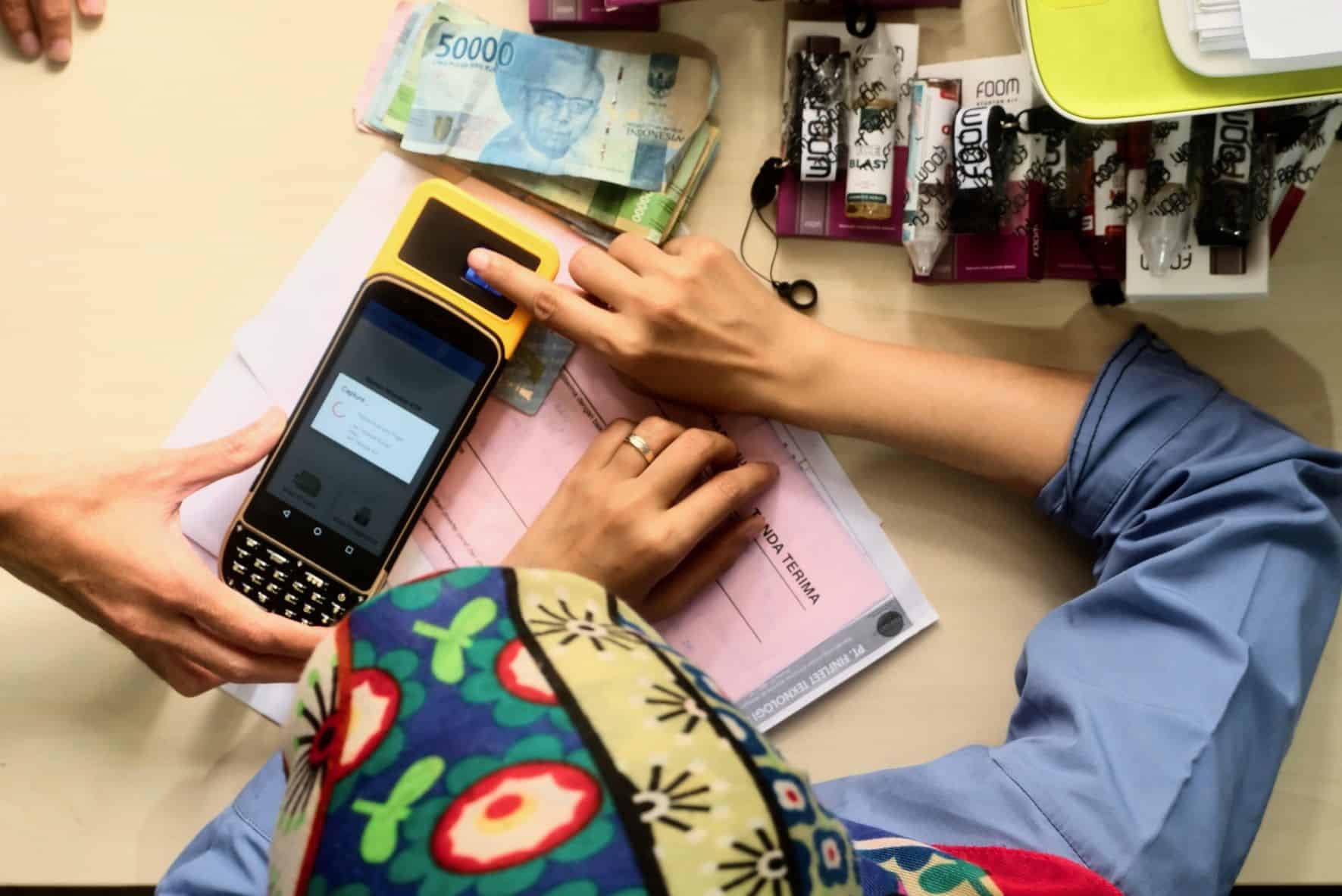

Through this partnership, FSD Africa is supporting Equity BCDC to increase access to unbanked populations in rural and peri-urban areas of DRC by scaling up its agency banking model, providing savings and loan products and building capacity of farmers, MSMEs, women and youth. FSD Africa’s support includes building of institutional capacity at the bank and the establishment of agents. Through Equity Bank BCDC’s market leadership in DRC it seeks to demonstrate the business case for serving unserved and underserved customers.

ACV’s impact measurement approach will evolve as we learn more about building businesses in the climate space and partner with new impact investors and actors.