30 Apr 2020

30 Apr 2020

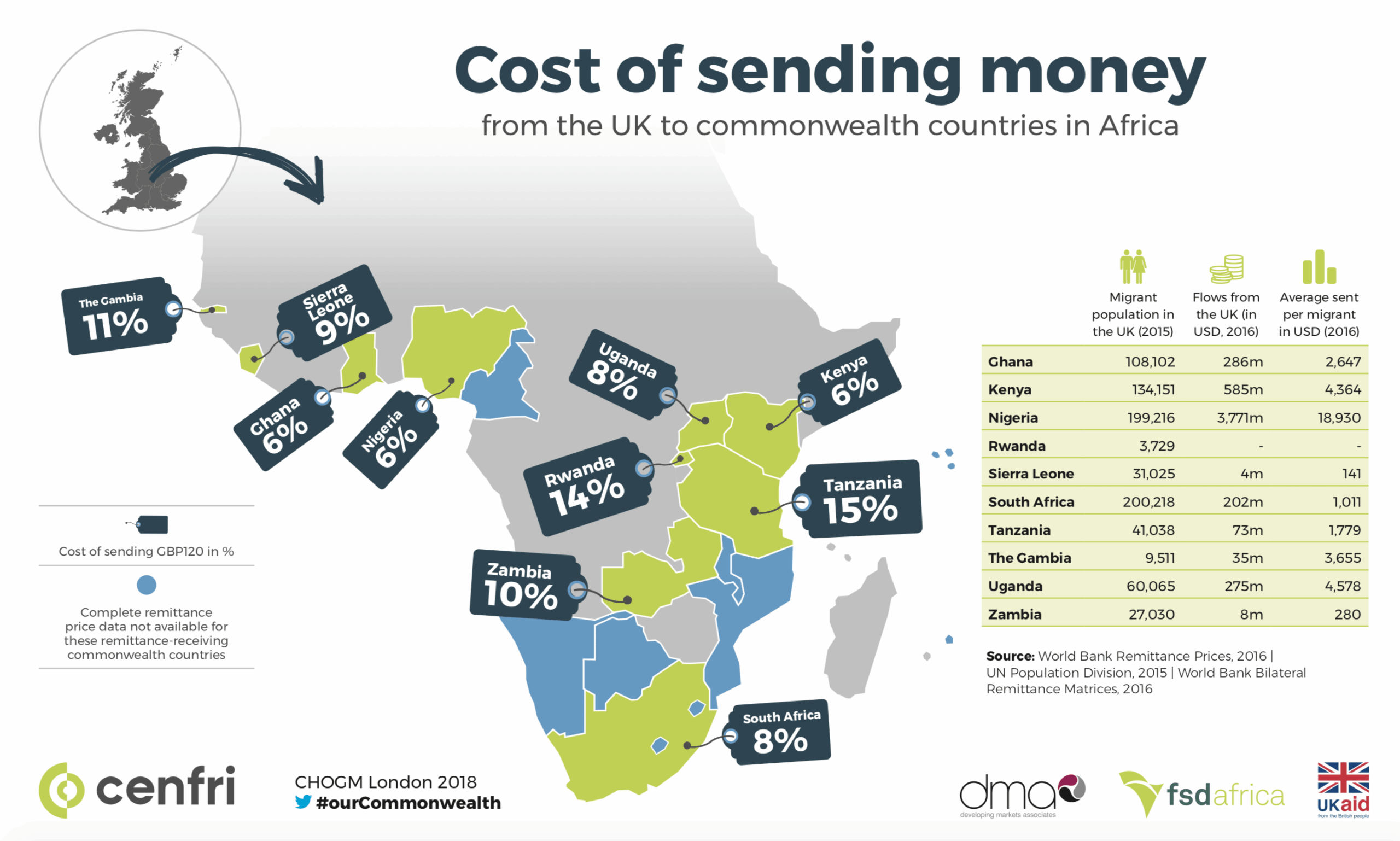

Remittance flows represent an increasingly important source of income for sub-Saharan Africa (SSA). Between 2012 and 2015, formal flows steadily grew at a higher growth rate than foreign direct investment (FDI) and official development assistance (ODA). As a result, the value of formal remittances sent into SSA today almost matches those of FDI and ODA. Formal flows between countries in SSA are greater than ever. However, since 2016, the value of formal remittances sent into the region is no longer growing. Much of which is migrating to informal channels as SSA still has the most expensive corridors in the world, both in terms of sending funds from outside as well as within the region.

Remittances act as key sources of financial support for households: they reduce the likelihood of impoverishment, contribute to improved health and education, and provide greater resilience to financial shocks. To maximise formal remittance impact in the region, the true cost of sending and receiving the funds needs to drop to incentivise higher formal flows. This does not only include a decline in the remittances prices but also improved access for senders and recipients at the first and last mile.

To offer a more detailed analysis of the barriers to formal remittances in SSA, a new report from Cenfri and FSDA outlines the complexities of achieving sustainable cost reductions and increased access for remittance senders and recipients.

Vol. 1 of a seven-part series marks the start by identifying the most prominent corridors within and into SSA in terms of volume, cost and importance for the economy. It also investigates the relationship between remittance flows and migration patterns, used as a proxy to identify pain points in specific corridors. This report is aimed at remittance stakeholders, policymakers and anyone who is interested in understanding the remittance market in SSA in more detail.

Vol. 2 investigates barriers based on deep dives in four different countries in SSA providing the overarching barriers to understand a highly complex value chain. Vol. 3 – 6 provides case studies of the four countries against the backdrop of their unique country context. Vol. 7 concludes with recommendations on necessary policy actions and multi-country approaches for remittance players.

Vol. 3 explores the state of the remittance sector in Uganda and unpacks the key challenges and best practices within the industry.

Vol. 4 explores the state of the remittance sector in Ethiopia.

Vol. 5 explores the state of the remittance sector in Côte d’Ivoire.

Vol. 6 explores the state of the remittance sector in Nigeria.

Vol. 7 aims to provide stakeholders that are active in remittance sectors with recommendations on how to systematically overcome the supply-side barriers to formal remittances in SSA.