27 Jan 2021

27 Jan 2021

We undertook a study with RisCura to identify, explain and address the root causes of “market failure” relating to Initial Public Offerings (“IPOs”) on African stock exchanges.

The study takes a robustly comparative approach, drawing out common challenges and recommended solutions from deep individual analysis of seven stock exchanges, ranging from West Africa to East and Southern Africa and some Francophone countries.

The study identified multiple causes for the ‘market failure’ witnessed to date, with responses differing according to geography as well as to the respondents’ role, or vantage point, within the ecosystem and wider economy.

These factors can be grouped into three broad categories:

The study uncovered positive and proactive recommendations for cross-cutting solutions which, taken together, have the potential to transform the performance of IPOs on African exchanges.

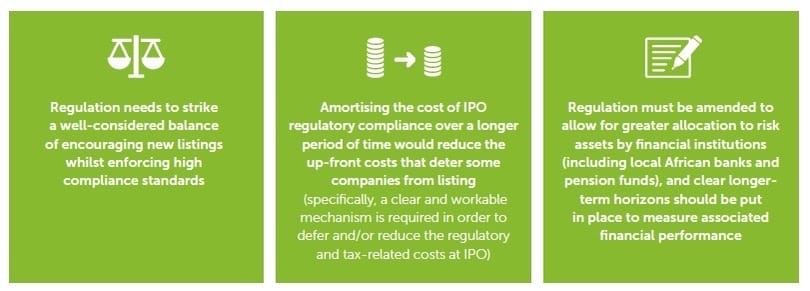

Three high-priority changes were identified as important and necessary:

Beyond these structural and ‘infrastructural’ solutions, there is also a clear need for ‘softer’ reforms and initiatives in the form of enhanced advocacy, awareness-raising and information-sharing.

Download the summary of this study to read more about ‘market building’ challenges and recommended actions for consideration.