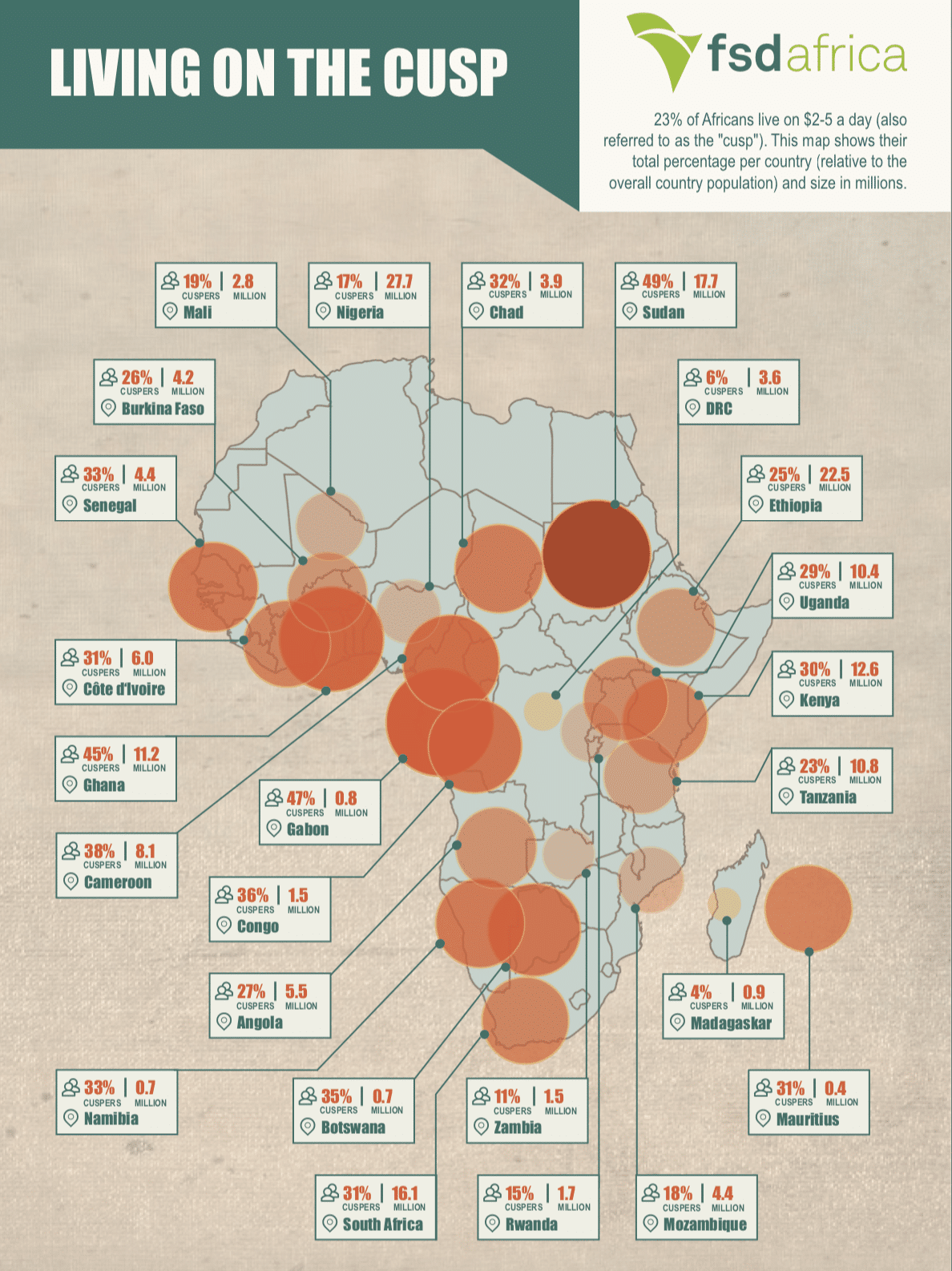

Insurance has a strong role in combatting poverty and advancing development, in at least three ways:

Improving individual and household resilience

Insurance makes households more resilient in the face of financial shocks. Insurance also enables households to access services such as credit, health and education that may otherwise not be attainable to them.

Improving business resilience & productivity

Effective risk transfer is a fundamental part of corporate sustainability.

It also facilitates exports and imports, enables foreign investment and helps to ensure access – at better terms – to business financing.

Developing the demand and supply of capital

Insurance mobilizes capital through premium collection, its role in enabling business development and its linkages with the pensions market.It also pools capital into larger pots of funds that are more efficient to manage and invest.

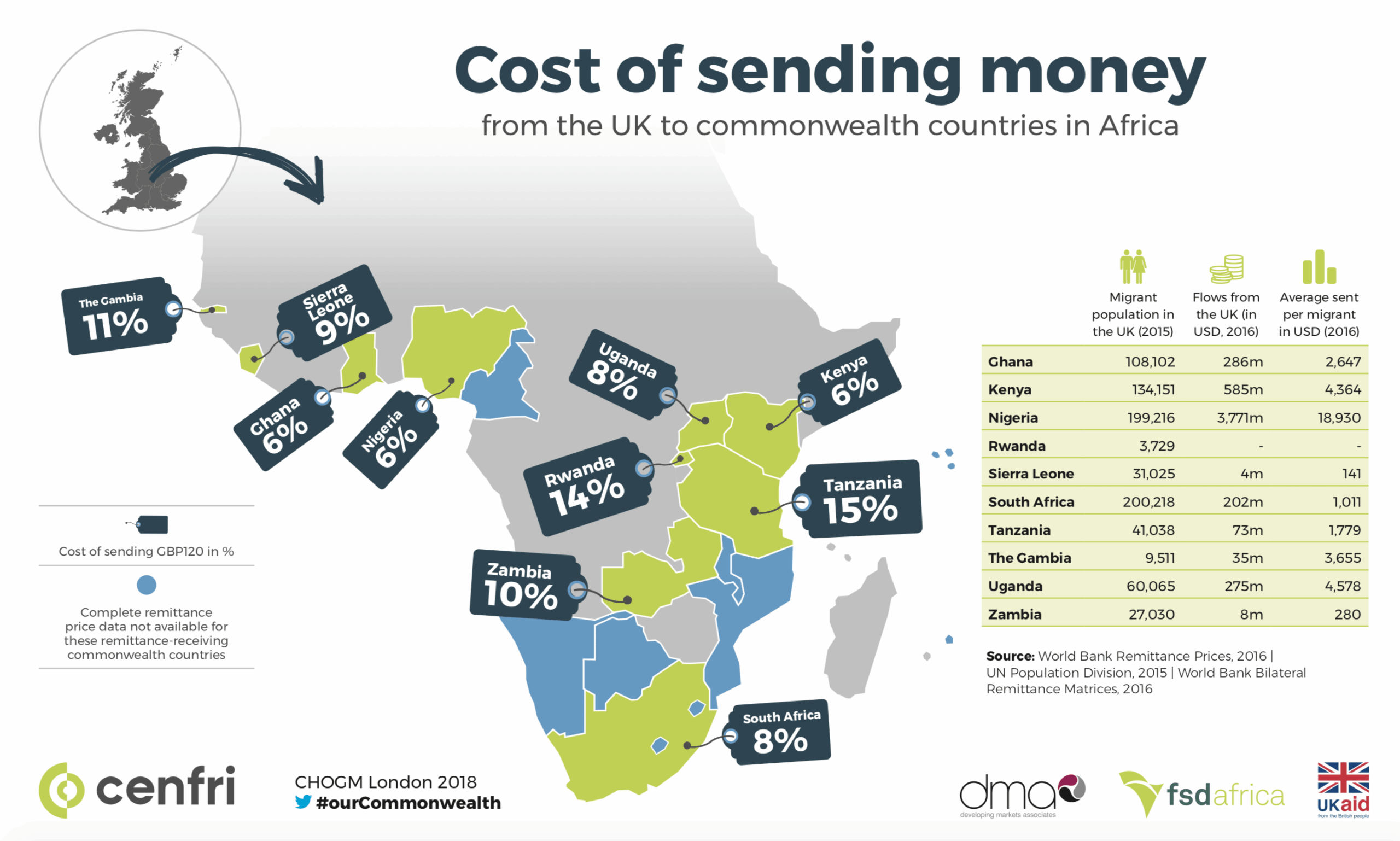

Recognising the role that insurance can play in supporting sustainable development and growth, the UK’s DFID partnered with the World Bank, FSD Africa and Cenfri to conduct a series of diagnostics that explore how these three roles manifest in four countries in SSA: Ghana, Kenya, Nigeria and Rwanda.

This paper synthesises cross-cutting themes from the study countries and beyond and draws conclusions and recommendations on how to further develop insurance markets.