-

Human activity is destroying biodiversity faster than ever before.

-

Almost 80% of threatened species are impacted by economic activity.

-

The COP15 summit has started work towards a new global pact on nature protection.

-

5 key transformations can save the natural world and boost GDP by trillions of dollars.

Whether you live in a city, a rural area or by the ocean, it’s likely you have noticed a decline in biodiversity. Maybe fewer birds visit your urban feeders, larger mammals are less common in the fields and forests around you, or your catches on those fishing trips are getting smaller.

What we’re all witnessing is a potentially catastrophic loss of biodiversity on which entire ecosystems depend.

Global efforts to protect nature

In an ongoing effort to slow the destruction of nature, delegates at the 2022 United Nations Biodiversity Conference in Montreal, Canada, focused on reversing the rapid decline of animals, plants and insects. The conference, also known as COP15, worked towards a new global agreement to protect biodiversity.

In a strongly worded opening address, UN Secretary-General António Guterres told delegates that “humanity has become a weapon of mass extinction”. Guterres piled further pressure on attendees by describing the conference as “our chance to stop this orgy of destruction”.

The destruction to which Gueterres refers spans the globe and is happening on a massive scale. According to a UN Global Land Outlook assessment, more than 1 million species are now threatened with extinction, vanishing at a rate not seen in 10 million years. As much as 40% of Earth’s land surfaces are considered degraded.

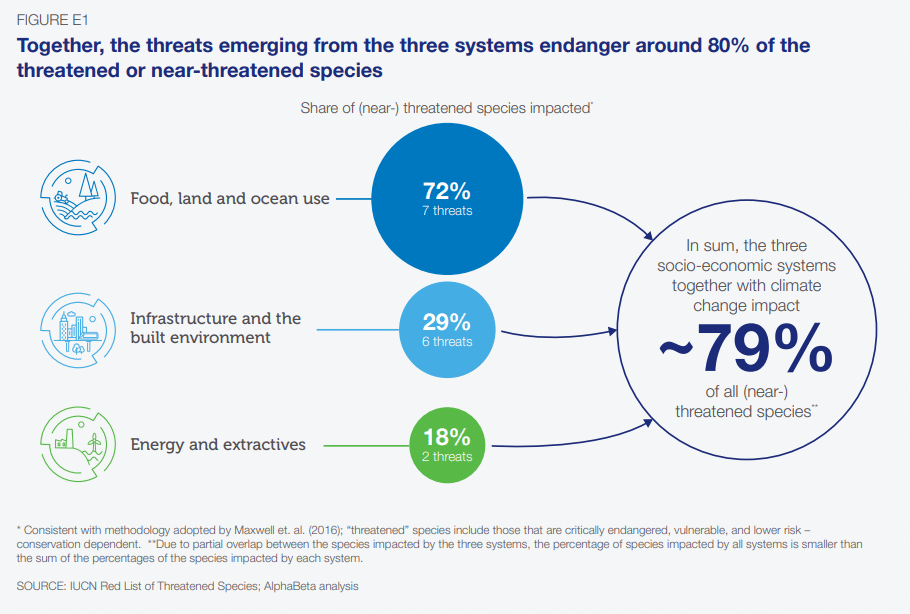

Research by the International Union for the Conservation of Nature found that human activity for food production, infrastructure, energy and mining accounts for 79% of the impact on threatened species.

Human systems for food, infrastructure and energy are destroying biodiversity. Image: WEF/IUCN

Creating a nature-positive economy

Only by fundamentally transforming these systems can we shift from destructive human activity to a nature-positive economy. The World Economic Forum’s New Nature Economy Report II sets out a range of transitions that will reverse nature loss and pull us back from the brink. Without these changes, the world will suffer irreversible destruction of biodiversity that will have far-reaching impacts on the economy and all life on Earth.

The report delivers a stark warning about the risks we are creating by destroying nature, stating that “$44 trillion of economic value generation – over half the world’s total GDP – is potentially at risk as a result of the dependence of business on nature and its services”.

Biodiversity loss was ranked as the third most severe threat humanity will face in the next 10 years in the World Economic Forum’s Global Risks Report 2022.

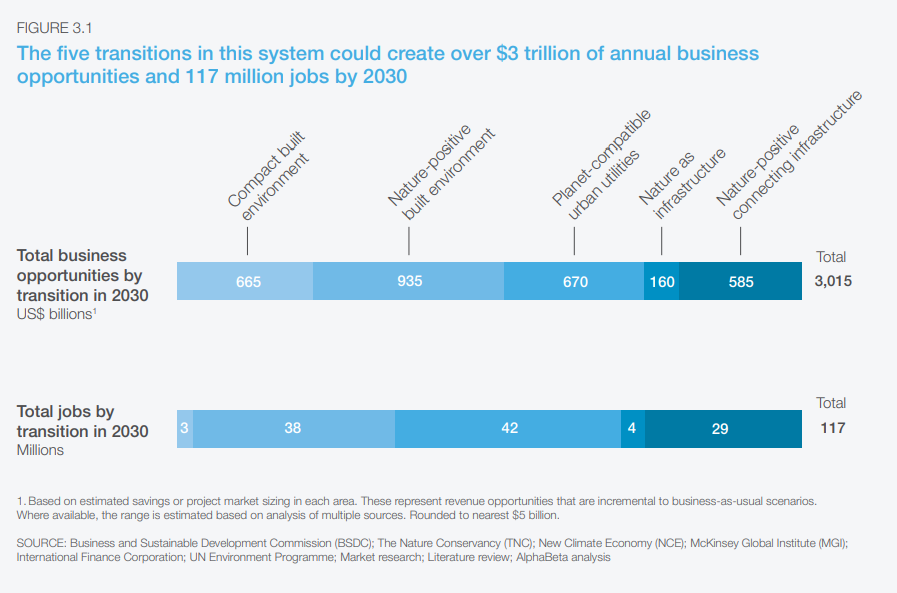

Five key transitions in the global economy could have a dramatic impact in slowing the loss of biodiversity, while bringing trillions of dollars of new economic opportunities and creating more than 100 million jobs.

Five key transitions in the global economy could have a dramatic impact in slowing the loss of biodiversity. Image: WEF New Nature Economy Report II

These transitions are:

1. Compact built environment

Higher-density urban development will free up land for agriculture and nature. It can also reduce urban sprawl, which destroys wildlife habitats and flora and fauna. Existing cities and settlements should be considered for strategic densification. Conservation-management projects should be established to protect biodiversity in areas that have been spared from development. This transition creates a $665 billion opportunity, with 3 million jobs created by 2030.

2. Nature-positive built environment

These built environments share space with nature. They are less human-centric, instead placing biodiversity at the core of project design. Infrastructure is located to avoid or minimize the destruction of nature, and all buildings are energy and resource efficient. Developments must include nature-friendly spaces and eco-bridges to connect habitats for urban wildlife. There’s a $935 billion opportunity in these built environments, and the possibility to create 38 million jobs by 2030.

3. Planet-compatible urban utilities

To stall biodiversity loss, we need utilities that effectively manage air, water and solid waste pollution in urban environments. In addition to benefiting nature, this will provide universal human access to clean air and water. Smart sensors and other Fourth Industrial Revolution technologies can transform urban utilities and make them planet-compatible. Creating them could deliver a $670 billion business opportunity and create 42 million jobs by 2030.

4. Nature as infrastructure

This transformation involves incorporating natural ecosystems into built-up areas. Instead of developments destroying floodplains, wetlands and forests, they would form an essential part of new built environments. This approach to development can also help deliver clean air, natural water purification and reduce the risk from extreme climate events. The business opportunity by using nature as infrastructure could hit $160 billion and create 4 million jobs by 2030.

5. Nature-positive connecting infrastructure

“Connecting infrastructure” includes roads, railways, pipelines and ports. Transitions in this area mean a change in the approach to planning to reduce biodiversity impacts, with a willingness to accept compromises when it comes to travel time and distance between departure point and destination. Building in wildlife corridors and switching to renewable energy in transport are key elements of nature-positive connecting infrastructure. The business opportunity here could peak at $585 billion, with the opportunity to create 29 million new jobs by 2030.

Time to make peace with nature

The outcomes of the COP15 biodiversity summit will shape the direction of humankind’s relationship with the natural world.

Costa Rica, once home to rampant logging, has now almost doubled the size of its rainforest. They turned it all around within a generation. It can be done.

Protect people and the planet. #COP15 #ActOnClimate #biodiversity #deforestation #rewilding #solutions pic.twitter.com/zKtBd1NlTs

— Mike Hudema (@MikeHudema) December 19, 2022

António Guterres urged delegates to overcome their differences and reach agreement on protecting nature, telling the conference: “it’s time for the world to adopt a far-reaching biodiversity framework – a true peace pact with nature – and deliver a green, healthy future for all.”

Read original article