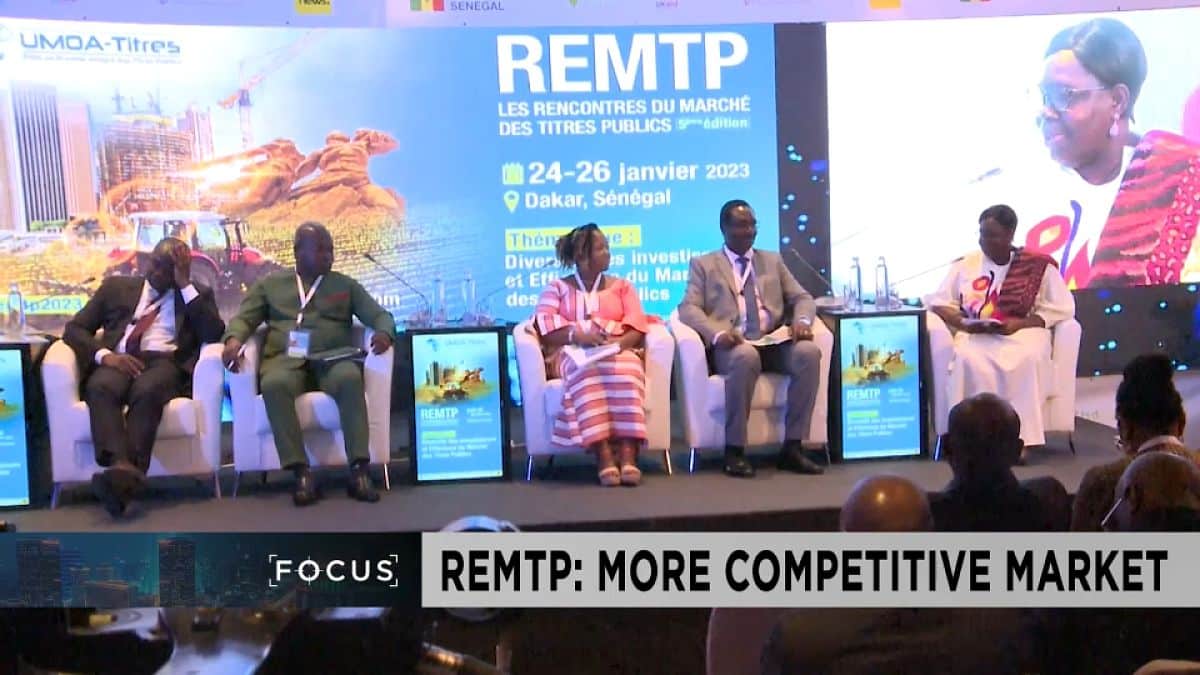

Dakar is a city in the throes of change. The capital hosted the second edition of the Public Securities Market Meeting held from Jan 24 – Jan 26.

The forum focused on the issues and challenges of the regional sovereign debt market with the aim to position the market as a real investment option.

To this end, WAMU-Securities and other financial market players are advocating for an expansion of public securities to new investors.

“We need to rely more on our market, especially since external markets are almost closed,” Banassi Ouattara, the acting deputy general director of Waemu started right off.

“The Eurobond markets are closed because of the policies of the central banks which are forced to implement; with inflation galloping around the world. So, there is this need to broaden the investor base and the broadening of the investor base also contributes to the efficiency of the market because it will result in the expression of different strategies. This means that the more investors we have, at the same time as some buy securities, others will want to sell, so there will be a lot of trading in the market.”

Facilitating the financing of local economies

The forum saw three days of exchanges on the theme “Investor Diversity and the Efficiency of the Public Securities Market.” Basically, on how to facilitate the financing of local economies, something major players say requires a paradigm shift particularly for financial inclusion.

“Unfortunately, even though the financial market was created in 1998, it has yet to be demystified and no longer frightens certain investors in the various segments of the population,” Harold Coffi, the general director of financial services company at Societé Générale Senegal analyzed.

“I think that everyone has a role to play: experts, SGI, SGO, etc. There are also the banking networks since we have access to a large population that can easily adhere to these products. But there is also, in terms of financial inclusion, the much lower income, unbanked population. That’s where OME, so the Telco’s can also help.”

“I think it’s the combination of all of that, strong partnerships that will allow us to have a broad base of collecting the savings that exist in Africa much more effectively,” Coffi concluded.

Financial markets do remain indispensable in this quest to boost economies. WAMU-Securities, for example, facilitates contacts between governments and investors.

Moreover, one of the highlights of the Public Securities Market Meetings is the Country Focus. This is a forum for sharing experiences but also for presenting progress made and development projects to attract investors. A great opportunity for countries like Burkina Fasoa according to Aminata Ouedraogo, the Burkinabe deputy director of the public treasury.

“For us, it is very significant because we started the year 2023 with a program of issues. It was an opportunity for us first to reassure investors to accompany us and also to share our issuance program. So, for us, this is a framework that we need to perpetuate. We will return to normal conditions very soon. We especially ask investors to be with us always.

WAEMU, a zone full of potential

Today, the WAEMU zone offers guarantees: enormous economic potential, reassuring growth prospects despite the global and internal crises. This is reassuring for investors like FSD Africa, an institutional partner of WAMU-Securities. Funded by the British government, this specialized development agency works to build and strengthen financial markets in Sub-Saharan Africa.

“Our presence here in Dakar will serve to increase our network. It will also increase the number of institutional partnerships that we can have. We have the opportunity to invest directly in companies. We also offer technical assistance to companies and governments on the continent. And I think that our presence will allow us to show all the financial instruments that we offer”.

Because of the crises that make access to international markets increasingly difficult, governments are forced to adapt. Financial market players have understood that economic sovereignty requires a broader investor base. For WAMU-Securities, domestic markets remain a more than credible alternative for making national and community economies more attractive.

Read original article