The document highlights the ongoing challenge of achieving gender equality, noting that if current trends persist, over 340 million women and girls will still be living in extreme poverty by 2030, particularly in sub-Saharan Africa. It argues for the need for innovative financing solutions to promote the economic empowerment of women and girls and to close gender gaps in various sectors. Gender bonds are presented as a promising tool for financing projects aimed at reducing gender inequalities and supporting women’s empowerment, similar to other sustainable bonds like Green or Social bonds. These bonds enable both corporate and sovereign issuers to focus capital on gender equality goals and improve transparency and accountability in spending, while attracting investors interested in gender-lens investing. The document notes that although the issuance of Gender bonds has been increasing globally, African markets have seen the lowest rates of issuance. However, there has been recent progress with Gender bonds being issued for the first time in countries like Morocco, Rwanda, South Africa, and Tanzania. Given the nascent state of Gender bonds and the growth of African capital markets, there is a need for clear guidance for issuers. The document introduces a Gender Bond Toolkit aimed at providing this guidance and encouraging more Gender bond issuances in Africa to mobilize capital for addressing gender inequities and promoting economic growth.

Pillar: Financial Markets

Capital markets are essential for economic development and like in many countries, the markets have the potential to make a significant contribution to Zambia’s economic development. This intervention is timely and shall be instrumental in catalysing Zambia’s economic recovery and transformation, especially at a time when the country’s macro-economic fundamentals have demonstrated resilience in the face of increasing global socio-economic uncertainty. The economy is estimated to have contracted by 2.7% in 2020 due to the covid-19 pandemic. However, the economy displayed its resilience and the GDP growth rate averaged 4.1% between 2021 and the first half of 2022. In addition, the inflation rate reduced from 21.5% at the beginning of 2021 to 9.7% in October 2022, while the Kwacha for a unit of a dollar appreciated by 26% relative to 2021.

Notwithstanding, the country’s debt position remains unsustainable. Positive strides have however been made in this regard, with the IMF approval of an External Credit Facility (ECF) of $1.3 billion to dismantle the debt arrears. In recognition of this, the plan aims to contribute towards the development of Zambia while remaining cognizant of the country’s current realities. As a recent report from the International Organisation of Securities Commissions (IOSCO) notes, “deep, liquid, and well-regulated capital markets are instrumental in financing the economy and are the foundation for a thriving private sector – a key driver of job creation and growth”. Hence, the plan has been developed in line with the aspirations of the 8th National Development Plan (8NDP) as well as successor plans and Vision 2030. These aspirations include, among others:

This plan sets out an integrated national financing framework and notes that “financing the 8NDP will require policies, partnerships and an enabling environment that effectively mobilises and uses public finance and promotes impactful private finance”.2 The objective of this Capital Markets Master Plan (CMMP) is to ensure that Zambia’s capital markets, alongside some similar sectors in the plan, make their contribution to help Zambia realise its potential

Download the report below

Background

Background. Since 2010, Morocco has been considering the green economy as a crucial complementary element to its sustainable development agenda with the potential to trigger development opportunities in various economic sectors. Morocco’s National Strategy for Sustainable Development (NSDS) and its initial and updated nationally determined contribution (NDC) set the country’s commitment to the green economy and put forward the various actions for mitigating greenhouse gas (GHG) emissions and adapting to climate change.

While the transition to a green economy concerns all actors in the economic fabric, particular attention should be paid to Morocco’s small and medium-sized enterprises (SMEs) as these businesses represent 93% of all companies in the country and employ over 46% of its workforce. However, these businesses generate only 40% of the nation’s gross domestic product (GDP) and 31% of its exports, demonstrating the growth potential of Morocco’s SMEs and the need for support with integrating into global value chains. To achieve this potential, these companies require diversified and accessible financial assistance that allows them to grow in line with Morocco’s green vision, in turn benefiting the national economy, bolstering the competitiveness of Moroccan SMEs in international markets and allowing the country to meet its climate and sustainability targets.

In order to effectively contribute to the development of green investment mechanisms for Moroccan SMEs, the Ministère de l’Economie et des Finance [Ministry of Economy and Finance] (MEF) of the Kingdom of Morocco, with support from the British Embassy in Morocco (part of the Foreign Commonwealth Development Office) and Financial Sector Deepening Africa (FSD Africa), has commissioned this scoping study. This study focuses on the provision of green finance to SMEs, helping them to both grow by offering green products and services and improve the sustainability of their own operations

Foreword

These guidelines were prepared by the Moroccan Capital Market Authority (AMMC), with the support of FSD Africa, in order to promote the development of financial instruments aimed at financing sustainable development and further expand opportunities for sustainable finance transactions.

As gender bonds are generally considered type of social bonds, the guidance provided in this document completes the previous guidelines published by AMMC. The present guidelines also introduce a new standard: the sustainability-linked bonds principles, that can be used to structure gender bond issuances as well as other types of sustainable bonds.

The present document provides useful information on mobilizing adequate financing for issuers interested in developing projects or activities aligned with gender equality and women’s empowerment. In addition, investors and other market participants can also rely on the guidelines for a better understanding of gender bonds and their relevance for sustainable finance approaches.

Executive Summary

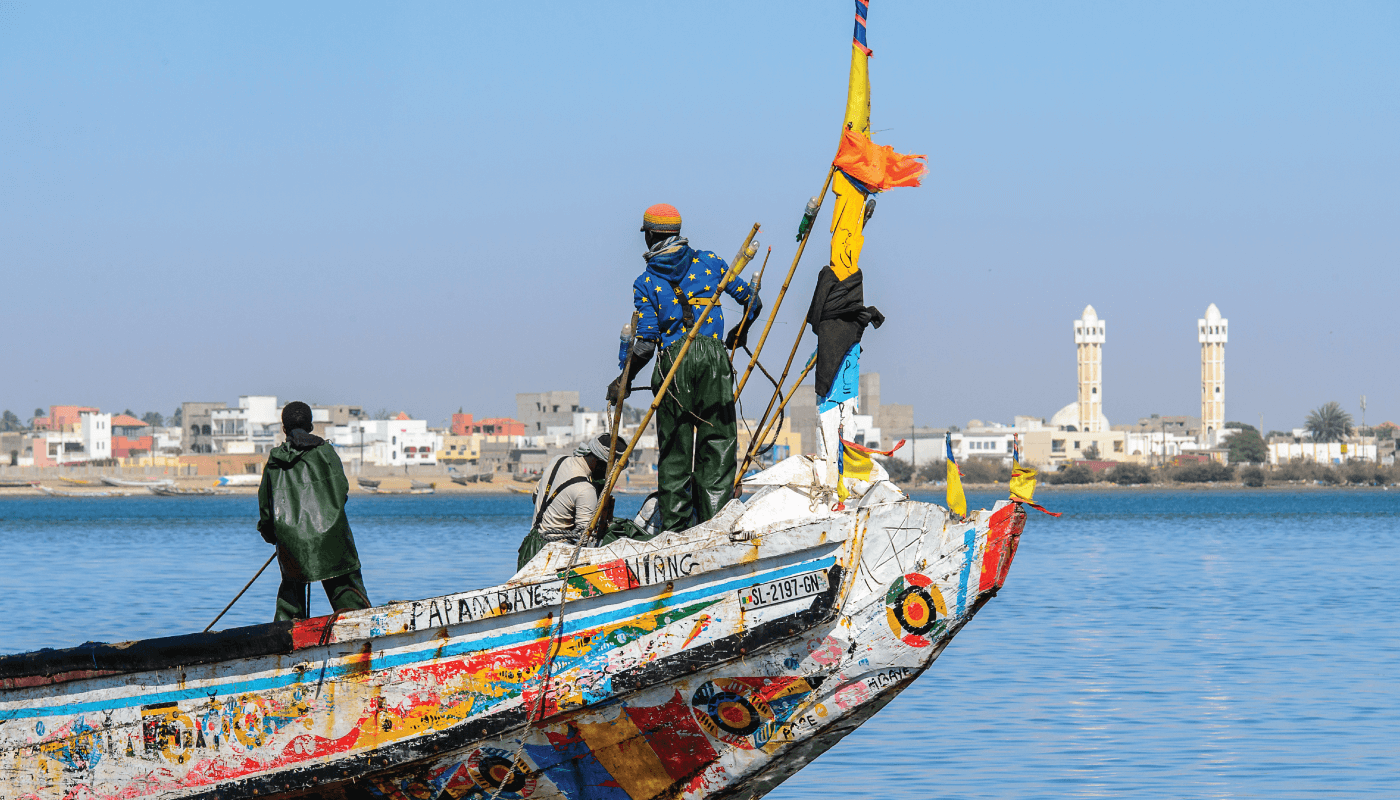

FSD Africa and UMOA-Titres (UT) commissioned Genesis Analytics as a consulting partner to develop a study that determines the feasibility of deploying a financial instrument to address climate change, environmental and/or waste management challenges in the city of Saint-Louis, Senegal.1 The study departs from a comprehensive assessment of the environmental challenges facing the city, and of its enabling environment through a SWOT analysis. A UNESCO World Heritage, where coastal erosion has become an existential threat, Saint-Louis main environmental challenges include exposure to climatic hazards (particularly severe coastal erosion and floods); land and ecosystem degradation; fishery decline and rarity of fish species; and poor waste management and other urban challenges.

After the initial diagnostic phase, the study maps the remedial initiatives that are best placed to tackle the identified challenges and lists the financial instruments that could be deployed to implement such solutions. An initial group of eighteen financial instruments were considered so long as they could be deployed to execute some of the potential remedies explored: The disaster risk finance toolkit; Nature-based Solutions (e.g., sustainable aquaculture, ecotourism, green roofs); Climate-Smart Agriculture (e.g., capture fisheries and aquaculture, energy Management); carbon markets (biodiversity protection); waste management initiatives and green urban initiatives. The instruments comprise typical funding tools (funds, bonds, securitization structures, etc), results-based finance mechanisms, and insurance.

The study concludes by pointing out that Saint-Louis Senegal, has the opportunity to capture a greater portion of the international climate finance flows available globally, through the deployment of Impact Bonds. This report provides an in-depth analysis explaining why this tool was chosen for the particular context of the city. Its flexibility in regards to scale and sector, its capacity to generate positive impact by fostering valuable partnerships, its great potential to be scalable and replicated once the first case is implemented, and its capacity to crowd in private capital, are some of the reasons that explain the choice.

The Member States of the West African Economic and Monetary Union (WAEMU) face the triple challenge of addressing the consequences of climate change, developing infrastructure in light of strong anticipated demographic growth, and rebounding from the impacts of recent global shocks such as the COVID-19 pandemic (hereafter “COVID”) and the war in Ukraine. These challenges need to be met in the context of sizable long-term financing gaps in several economic sectors, and within the fiscal constraints imposed by sovereign debt burdens which, for some Member States, are significant – especially in the context of tightening global credit markets and rising interest rates. Faced with these challenges, Member States need to ensure the development of their economy, while integrating the commitments developed within their Nationally Determined Contribution1 (NDC), which aim to combat climate change as part of broader national development plans. In this regard, private sector actors are required to contribute alongside public sector actors to the achievement of climate change mitigation and adaptation objectives, particularly in sectors whose expected contribution has been defined as relatively important.

“Green Bonds” are financial instruments whose proceeds are utilised to finance eligible projects and activities designed to foster sustainable, resilient and inclusive growth. In this sense, Green Bonds fit into the list of alternative financing mechanisms that can be used to solicit some of the capital needed for national objectives, potentially allowing access to a broader and more diverse investor base, some of whose investment mandates include positive environmental and social impact requirements.

This Study focuses on the feasibility of developing an active market for Green Bonds in the WAEMU region and aims to assess the potential for sovereign and corporate Green Bond issuance. The Study highlights multiple deficiencies that may impede the development of such a market, and provides recommendations to overcome them. Initiatives and interventions that should be taken to foster the emergence of such a market are also presented, as well as opportunities to develop a pipeline of green projects and activities eligible for Green Bond financing.

Given the regional, multi-country scope of the Study, a desktop review and stakeholder consultation was undertaken to identify common barriers, which are primarily related to three themes:

- The underdevelopment of the regional financial market relative to international standards.

- The lack of Green Bond and general climate initiatives from national governments, institutions and industries.

- The generally low level of familiarity among key market stakeholders with the international standards and requirements associated with Green Bonds, and consequent low capacity to meet such standards.

For each barrier identified, actionable recommendations are drawn from the lessons learned from more successful Green Bond programmes in other Sub-Saharan African countries, whilst giving due consideration to the specific nuances of the WAEMU region to assess their applicability. The findings from the desktop research were then supplemented and validated during additional interviews and in a stakeholder engagement workshop to ensure the recommendations are context appropriate.

The desktop review covers the following key determinants of market development potential:

- Regional debt capital market (structure, regulation, depth, liquidity, stakeholders, etc.)

- Historic context and current trends regarding sovereign and corporate bond issuance (issuance features, context and objectives, subscription rate, credit, etc.)

- Regional and national advances in climate integration and related initiatives.

- Stakeholders’ capabilities with regard to international standards and requirements for Green Bonds

- Investor appetite (investor awareness, investment trends, incentives, obstacles, etc.).

Africa stands at a crossroads: the continent has just exited a recession following the COVID-19 pandemic, but the recovery is fragile. Beyond the health dimensions of the COVID-19 crisis, the pandemic caused an estimated 6.1% fall in per capita incomes in 2020 – setting living standards back by a decade in a quarter of sub-Saharan Africa.

The IMF estimates that employment fell by about 8.5%, and more than 32 million people were thrown into extreme poverty in 2020, erasing at least five years of progress in poverty eradication.

Economic recovery will face headwinds primarily due to limited fiscal space for countercyclical support, a temporary collapse in private capital inflows from overseas, and the rumbling African government debt crisis, which continues to play out unevenly across much of the continent. In addition, there has been a significant shift in the pricing of African Eurobonds, with some countries effectively shut out from the international debt markets due to increased risk-aversion.

Meanwhile, on the heels of the pandemic, the unprovoked Russian invasion of Ukraine in February 2022 has brought turmoil to the global markets and increased inflationary pressures. As the manifold effects of the conflict reverberate globally, a key risk factor to monitor for African economies will be the impact of sharply rising global costs for food staples and critical agricultural inputs such as fertilizer. Ukraine is the world’s largest exporter of wheat and wheat prices have risen more than 80% in Q1 2022 compared to their 2017-21 average, creating acute challenges especially for those African countries running both food and balance of payments deficits. At the same time, the war in Ukraine brings into focus the strategic importance of African markets for global economic stability: to take just one example, new Liquid Natural Gas (LNG) export mega-projects under development across the continent – from Senegal and Mauritania to Mozambique and Tanzania – hold the potential to help reduce global energy dependency on Russia.

Looking beyond the near-term geopolitical uncertainty, many African countries are also faced with the twin challenge of climate change and biodiversity loss, which threaten to erode recent and future developmental gains across the continent. The sixth assessment report by the Intergovernmental Panel on Climate Change (IPCC) indicates that Africa is a natural capitalreliant continent and remains one of the most vulnerable to climate change. The IPCC report forecasts that extreme weather conditions will persist in Africa, increasing the risks of droughts and flooding, especially in coastal and low-lying areas.

Furthermore, Africa faces significant transition risks to a net zero carbon world. Unless they are proactively managed, the legal, policy and technological changes involved in the transition could leave an array of stranded assets on the continent whilst rendering whole sectors uncompetitive.

But the moment of crisis also presents an opportunity to build back better. By efficiently channelling growing pools of domestic and international savings towards critical parts of the real and social economy, capital markets are a key enabler to achieve the United Nations Sustainable Development Goals (SDGs). Capital markets also play an important role in green finance by funding climate smart investments that support mitigation, adaptation and resilience to climate change and bio-diversity loss. Furthermore, local currency capital markets can reduce currency and refinancing risks, improving the financial sector’s resilience to external shocks and supporting more efficient intermediation of scarce domestic savings. Finally, deeper capital markets have a key role to play in mobilising and directing the patient investment needed to build Compact, Connected, Clean and Resilient cities, thereby unlocking the significant ‘urbanisation dividend’ available in a continent that is the fastest urbanising world-wide.

At FSD Africa, we believe the role of Africa’s capital markets has never been more critical. The mobilisation of domestic resources through stronger financial intermediaries and capital markets is already a key African Union priority, encoded into its ‘Agenda 2063: The Africa We Want’ strategy – the continental blueprint for transforming Africa into a global powerhouse of the future. Since 2015, from our headquarters in Kenya, our dedicated team of Capital Markets development professionals at FSD Africa has been driving capital markets innovation and development. As you will read in this briefing note, the team operates across the continent, leading over 50 initiatives in more than 30 countries. We work in close partnership with private sector leaders and governments on a range of flagship programmes – from product development in areas such as gender, green and carbon-linked sustainability bonds to regulatory support, policy development, new market infrastructure, engagement with institutional investors and institutional strengthening.

As part of FSD Africa’s new strategic approach, our Capital Markets team will now focus on five priority countries: Ethiopia, Ghana, Kenya, Morocco and Nigeria. We will also double-down on early successes, building green bonds markets in Ghana, Kenya, Nigeria, Morocco, and the Southern African Development Community (SADC) region. We are proud of our results to date, and of the strong relationships we continue to build with a broad array of decision-makers, innovators, and opinion formers in Africa’s capital markets ecosystem. We offer our partners a fresh way of working – underpinned by our agility, deep knowledge of the continent, ability to deliver world class support and willingness to take risks. We are also based in Africa – close to the partners we work alongside and uniquely positioned as a neutral and trusted convener in a fast-evolving marketplace. We hope you enjoy reading about our work. We are always looking for new opportunities to deliver: so, if you would like to learn more, please be in touch. The final section of this note introduces you to our Capital Markets team, and it would be great to hear from you.

At FSD Africa, we believe the role of Africa’s capital markets has never been more critical.

Yours sincerely

EVANS OSANO

While chronic fiscal and current account imbalances that arose well before the Covid-19 pandemic placed limits on the ability of country authorities to respond to unexpected shocks, this did not prevent authorities in four of the focus countries

– Ethiopia, Ghana, Kenya, and South Africa – from adopting counter-cyclical fiscal measures that led to the accumulation of high levels of public debt.

This study shows that while all countries are exposed to liquidity and solvency risks, the most important risk to be monitored is the risk of an external debt distress. Ethiopia, Ghana, Kenya, and Nigeria face high levels of liquidity risk associated with their external indebtedness, and the risk of debt distress during the next decade in Ethiopia, Ghana, and Kenya is considered high. The availability of foreign exchange required to fund the current account deficit and external debt service is constrained by low public revenues (Ethiopia, Ghana, and Nigeria) and large trade deficits (Ethiopia, Kenya). At the same time, prospects for alleviating liquidity pressures in the short to medium term are limited, as they depend on structural changes aimed at reducing current account deficits. Indeed, it is anticipated that these pressures will become even more acute in 2022/2023 due to a combination of three factors – historically high levels of public debt, rising market interest rates and downward pressure on many emerging market currencies – which have caused the cost of external borrowing on commercial terms to become prohibitive.

Prior to the pandemic, given the limited depth of their financial systems, Ethiopia, Ghana, and Kenya had already accumulated unsustainable levels of public debt. Computational simulations

show that over the coming decade the level of public debt to GDP in Ghana, Kenya, Nigeria, and South Africa will stabilise, although in Ghana, Kenya, and South Africa this will happen at historically high levels, resulting in high debt service burdens and constraining fiscal space for new public investments. An important lesson highlighted by Covid-19 and the Ukraine war is the extent to which debt vulnerability derives from exposure to external creditors both in terms of the ability of sovereign borrowers to honor their external debt service obligations, and in terms of high debt service obligations which can lower economic growth prospects in the medium to longer term.

A comparative analysis shows that Nigeria and South Africa, Sub-Saharan Africa’s two largest economies, are in a less precarious situation than the other three countries. Nigeria entered the Covid-19 crisis with a lower level of public debt while South Africa’s deep domestic financial market makes it possible to absorb higher levels of public debt.

However, Nigeria and South Africa need to address specific risk exposures. Due to low fiscal revenue mobilisation, Nigeria’s total debt service absorbs a high share of government revenues, thus exposing the government to liquidity risk. Even with its more developed taxation system, South Africa is also exposed to liquidity risk because the ratio of total debt service to revenues is high. While foreign investors impose discipline on macroeconomic management, which should ultimately benefit the South African economy, reliance on foreign portfolio investment in domestic government debt exposes South Africa to risk, due to the ‘vagaries’ of foreign portfolio investors.

The African continent presents a massive investment opportunity for investors to advance climate solutions in the coming decade according to a new report. However, a set of barriers to finance have stifled requisite investment to date. The report provides a framework for how innovation in financing structures can leverage strategic deployment of public capital to ‘crowd-in’ private investment at levels not yet seen.

With a dynamic entrepreneurial environment, the African continent presents a massive investment opportunity in the coming decade. However, climate finance in Africa falls short of what is required to implement regional Nationally Determined Contribution (NDCs), with climate finance needs eight times higher than amounts currently invested.

Barriers to finance related to financial market depth, local governance, project characteristics, and enabling skills and infrastructure have led the private sector to play a marginal role in African climate finance to date. Barriers can be acute or chronic and are highly context-dependent in the relevance and intensity, differing by geography, sector, and sub-sector.

Innovation in financing structures is required to overcome these barriers, but there is no one-size fits all approach. Investors must tailor strategies based on the geographic and sectoral context of a given investment, deploying combinations of financial instruments based on their effectiveness in addressing specific risks to overcome investment barriers.

The report provides a framework for how these instruments and strategies can be efficiently deployed to overcome barriers to finance and capitalize climate solutions in Africa. Some instruments can be deployed narrowly to address acute barriers to finance such as deploying guarantees to address early-stage construction risk.

Nigeria is at a critical juncture in its development trajectory, faced with several overlapping and in some cases conflicting challenges: mitigating emissions; adapting to the immediate and inevitable effects of climate change; addressing widespread energy poverty; coping with high debt exposure, and adjusting to a rapidly expanding population fueling mass urbanization. All of this is set in the context of a country that derives 80% of its foreign exchange earnings from oil and gas. Which development path Nigeria can feasibly take – business-as-usual or sustainable development – will depend on the availability of climate finance moving forward.

Since designing its National Climate Change Policy and Response Strategy in 2012, Nigeria has established a rich policy landscape dedicated to planning for and responding to, climate change. With greenhouse gas emissions rising continually since 2009, Nigeria needs to ensure prospective growth follows a low-emissions development pathway, preventing carbon lock-in as the country undergoes further industrialisation and urbanisation. At the same time, Nigeria is already highly vulnerable to the impacts of climate change with key risks including but not limited to agriculture & food security, floods & droughts; water stress; and ecosystem stress. The key purpose of this case study is to inform and facilitate discussions among policymakers and public and private financiers, identifying gaps and opportunities for increasing both the quantity and quality of climate finance in Nigeria.