FSD Africa Investments (FSDAi), the UK-backed specialist development finance investor, is investing GBP 10 million into ARM-Harith’s Climate and Transition Infrastructure Fund (ACT Fund) to unlock local institutional capital for climate infrastructure. ARM-Harith Infrastructure Investment Limited is a leading African private equity firm committed to catalysing economic growth through sustainable infrastructure.

ARM-Harith and FSDAi’s investment introduces an innovative solution to allow Nigerian pension funds to address a longstanding challenge in infrastructure equity finance: the ability to invest while receiving early liquidity. By enabling predictable interim distributions during the early phases of investment, this innovative facility directly addresses a key barrier that has historically deterred domestic institutional capital from entering the asset class.

In addition, 75% of the FSDAi facility will be provided in local currency — a first-of-its-kind approach specifically designed to mitigate the impact of foreign exchange volatility for pension funds. This structure is expected to unlock an additional GBP 31 million in pension fund contributions — nearly five times the participation achieved in ARM-Harith’s first fund.

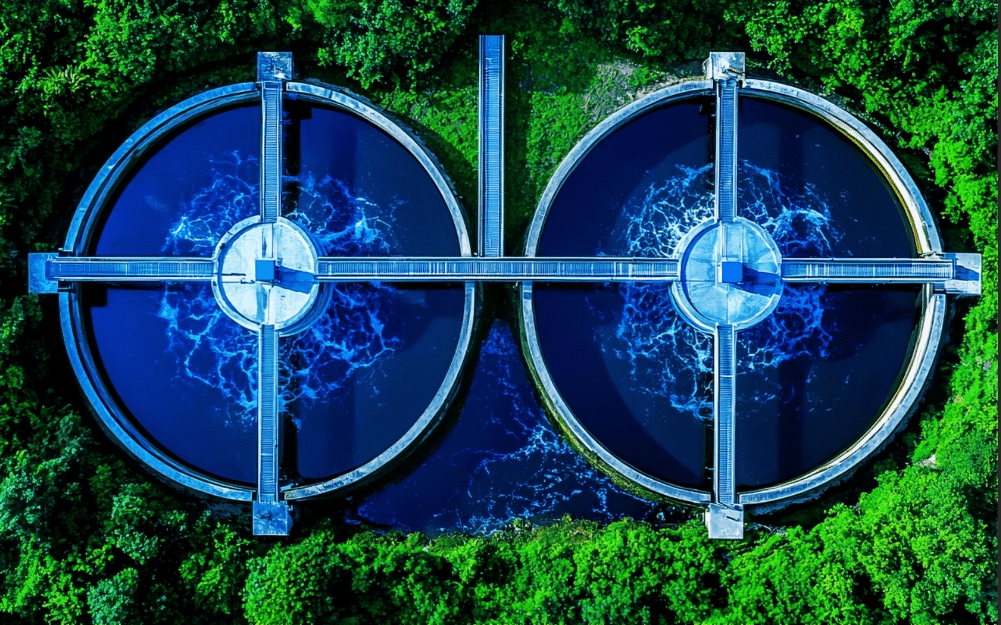

FSDAi’s investment aligns with its broader mission to deepen African financial markets towards accelerating the financing of Africa’s green economic transformation and will support the Fund’s investments in climate-resilient infrastructure including energy, transport, water, and digital connectivity. In alignment with at least four of the UN’s Sustainable Development Goals, the initiative is projected to create or support approximately 3,000 green jobs.

The British Deputy High Commissioner in Lagos, Mr. Jonny Baxter said,

“The UK government, through its bilateral and investment vehicles is committed to continue to support the country’s financial sector — developing domestic capital markets as a means of financing priority sectors and driving economic development. Local currency capital helps mitigate the impact of foreign exchange volatility, narrows the financing gap, supports diversification into new asset classes and into climate-related projects and social sectors – while providing long-term funds to growing businesses.”

Announcing FSDAi’s investment, FSDAi’s Chief Investment Officer, Anne-Marie Chidzero said:

“We are thrilled to collaborate with ARM-Harith to showcase how risk-bearing capital from a market-building investor like FSDAi can be strategically structured to unlock domestic institutional capital. This approach strengthens Africa’s financial markets and facilitates capital allocation towards sustainable, green economic growth across the continent.”

ARM-Harith CEO Rachel Moré-Oshodi emphasized the significance of this investment:

“For too long, domestic pension funds have remained on the sidelines of infrastructure equity due to liquidity constraints and heightened perception of risk. We are proud to have collaborated with FSDAi to design a pioneering solution that reduces risk for pension funds while delivering both early liquidity and long-term capital growth. This is a global first—a groundbreaking private sector-led solution that could fundamentally change how infrastructure equity is financed—not just in Nigeria, but across Africa.”