Climate change has severe consequences over the short to medium term across multiple sectors, such as agriculture, industry, energy, water, trade and tourism. If we don’t act now, it will impede Kenya’s vision to be a nation that has a clean, secure and sustainable environment by 2030 under the country’s long-term development blueprint, Vision 2030.

Under the Social Pillar (environmental management) of this plan, the country plans to achieve the vision by intensifying conservation of strategic natural resources, applying measures to guard against the adverse effects of increased pollution and waste, insulating development from natural hazards; and building institutional capacity in environmental planning and governance. The issuance of the Kenya Sovereign Green Bond is one of the mechanisms that have been conceptualised as a plan to secure alternative green and sustainable funding sources to finance this vision, and also fund the budget deficit as part of the Post Covid-19- Green and Resilient Recovery plan to build back Better.

The Kenya Sovereign Green Bond framework articulates the country’s governance on the funds raised from the issuance of the bond, including use of proceeds, the process for project selection and evaluation, management of proceeds, and reporting progress and impact requirements. The framework has been developed in a consultative process, receiving input from government agencies and other stakeholders.

Proceeds of the Kenyan Sovereign Green Bond will be used to finance in whole or in part eligible green assets/projects that will be identified from the approved National Budget by parliament.

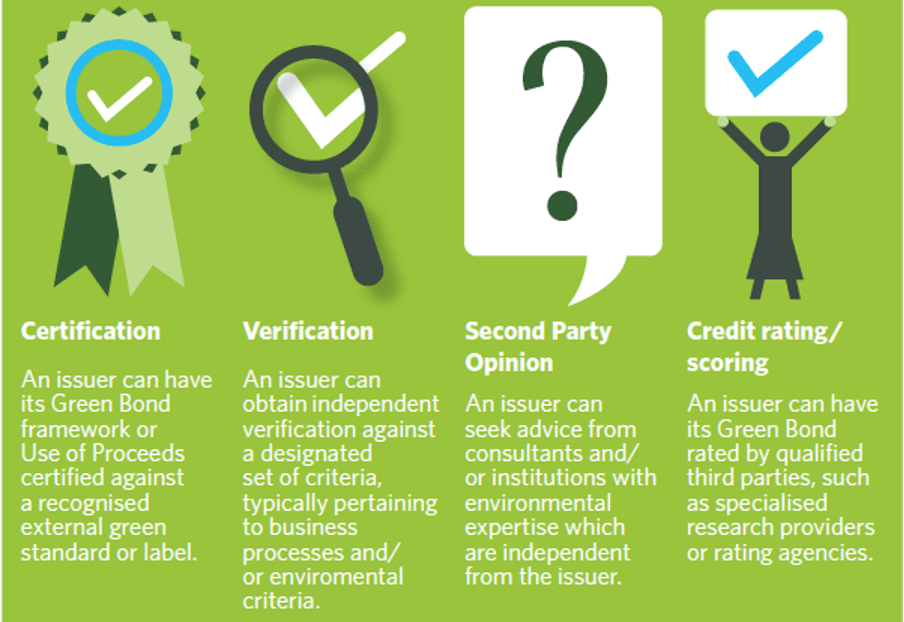

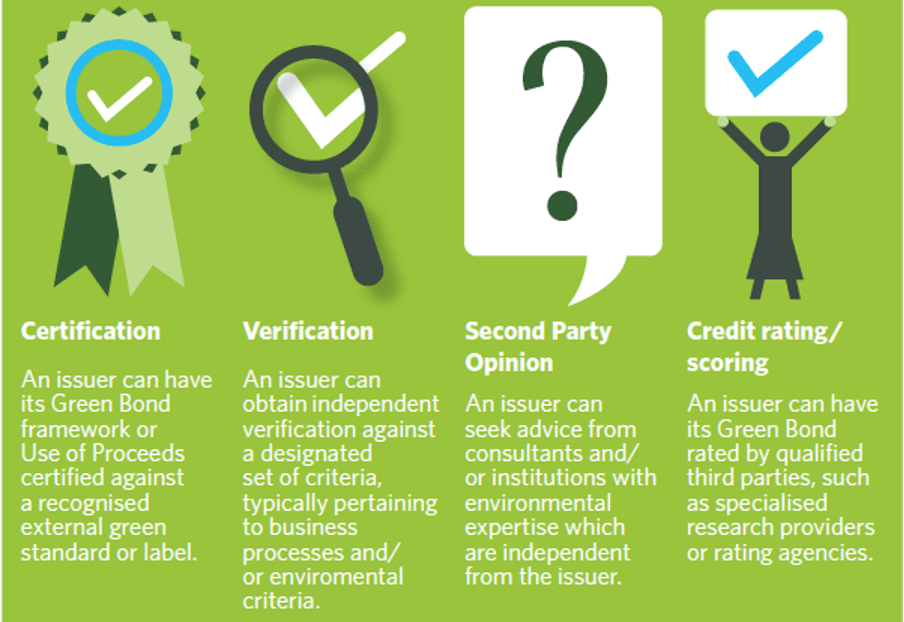

Transparency and disclosure on what is being financed by green bonds are important for investors. Credible, science-based, widely supported guidelines about what assets/projects qualify for green bonds helps investors make informed decisions about the green credentials of a bond. Evaluating the green features of underlying assets/projects may be referred to as verification or external review.

The phrase ‘external review’ refers to the independent assessment of the green credentials of a bond provided to the issuer by an external auditor (reviewer). Most external reviews can provide both a Second-Party Opinion (SPO) as well as a Verification (Assurance) Report against the Climate Bonds Standard.

External reviewers are generally engaged while or soon after the issuer has set up a Green Bond Framework and the review is normally made public before the roadshow. This is because the issuer can then use the independent review to promote the green credentials of the bond during the roadshow and it is now common practice for the review to accompany the bond’s information memorandum or prospectus when it is sent to potential investors.

Coding, tracking, monitoring and reporting of the utilisation of all climate finance and sovereign Green Bond proceeds during the fund allocation process until the completion of allocation of proceeds will be ongoing to ensure there is compliance with the Kenya Sovereign Green Bond Framework and any environmental and social risk assessments.

The National Treasury and Planning has obtained an independent second opinion from an appropriate provider to verify that the eligibility criteria, project selection, sovereign green bond proceeds allocation and management process, selected eligible green assets/projects are in line with international best practices on Green Bonds.

To guarantee that funds are properly attributed to the sovereign green bonds assets/projects as outlined in the framework, within the amounts set, the SPO will be published on the National Treasury and Planning website as well as all other websites globally. As per the green bond reporting guidelines, The National Treasury and Planning Ministry is expected to engage, annually, an independent third party to provide assurance on its annual use of proceeds and any impacts realised.