Coordination problems are hard! Solving them represent potential for massive returns. The paradox of “insufficient demand” for already available capital pools, and the taunted “financing gap” on the other is perhaps a famous coordination problem in development finance circles.

If capital was a person, she would have to be ambitious – while avoiding hubris, readily embrace ambiguity showing a deep interest in, and a belief in a more prosperous future. She would have natural aptitude for building strong relations and for solving hard relational problems – while not being suicidal. She would be agile – showing great ability to renew herself for new emerging risks and opportunities. She would need to have training in management of trauma and disappointment, all while embodying a philosophy of optimism.

She would brush up on her Keynesian economics and contemplate its implications in the context of low productivity in Africa, ongoing debt distress, and weak institutions of political governance.

Africa needs capital that is fearless, brave, and courageous – intrepid. A form of capital that works on two sides of development, it will serve to accelerate capital flows on one hand, and work to unlock demand on the other. Her vision will draw from two themes – first, an ambition to deeply explore and design paths to solving Africa’s intractable development and second, an ambition that anticipates nasty surprises all the while building partnerships, institutions, and incentives to get things going. An ambition that fuses understanding with execution.

At FSDAi, we are working hard to solve these problems and provide risk-bearing, early-stage capital in innovative forms to support venture-building stage capital allocators who combine capital with other critical support to businesses at the start-up and early stages. We are also working to develop new asset classes – across private credit, guarantees, and alternatives among others. To do this well, we work from the ground up to ensure we understand the demand side of capital – interrogating market conditions, through partners, building a pipeline of investable opportunities, and addressing talent gaps. FSDAi works too on the capital formation side, providing catalytic capital that makes it easier to attract new forms of capital.

In markets, tailwinds can quickly become headwinds. As the global inflation has shown, capital flight is all too easy. The inflationary pressures were not always obvious, and most countries in Africa were focused on kickstarting their economies from the ravages of the Covid pandemic when the inflationary headwinds hit. Africa faces weak economies, high unemployment rates and low productivity and debt overhang – local and external. Backing enterprise is not equivalent to putting out your sail; and yet, optimism of the future of Africa should be fused well with certainty of turbulence in markets over time.

Africa will need capital that encourages entrepreneurs to emerge. That will mean finding capital that is patient and that can catalyze other capital to flow onto the continent. Capital that can persuade local pension funds to invest. The current equilibrium is unsatisfactory – there is not enough capital that accepts disproportionate risk, enables third-party investment that otherwise would not be possible, and is long term. Capital at start-up, early, venture-stage and SME growth capital is still severely in short supply.

Local capital is all too often preserved in money markets and government treasuries and only trickles into the real economy. Capital flows to address early-stage ventures is especially limited as most fund managers are too risk-averse and impatient. Even when they take risks, venture funds are pack hunters – signalling each other to back the same ventures.

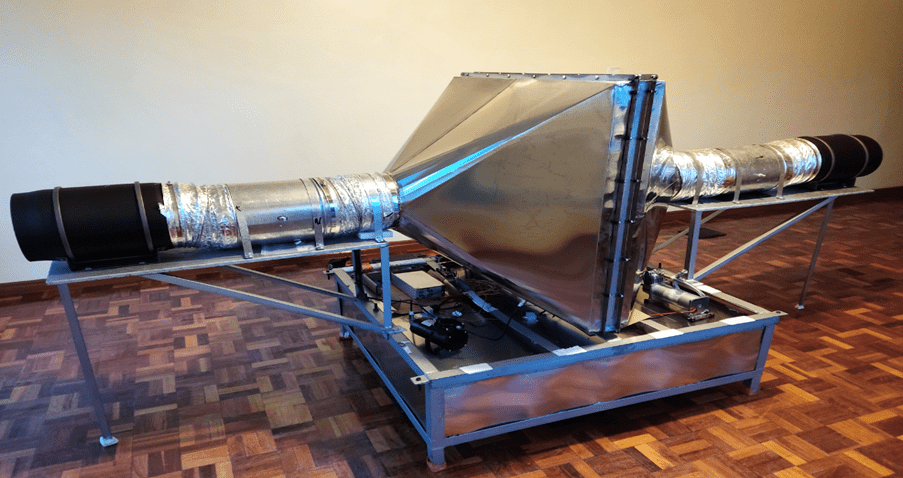

To truly address the demand side – enterprises that have ambitions to build sustainable infrastructure, innovate to cut pollution, manage just transitions, and spur investment across a wide range of sectors will be essential.

FSDAi and FSD Africa are working on innovations to catalyze capital flows across the continent. These initiatives include supporting structures that facilitate risk transfer mechanisms including credit enhancement and mechanisms to manage foreign currency risks. In addition to backing fund managers to build capacity and accelerate investment in climate. Other initiatives have included investing in themed investment structures that can respond to specific priorities such as affordable housing, agriculture, or even investments towards green transition.

FSDAi has been supporting capital allocators by enabling blended structures. In these structures, FSDAi provides risk-bearing equity that shields private capital that is less courageous. Convertible instruments is another tool in FSDAi’s stable – allowing conversion to equity upon success

Unlocking capital through demonstration is also a tactic that we have deployed. This allows founders with credible business models to access capital early, test and raise further capital on the back of a tested business model.

FSDAi is working to provide mechanisms to test, accelerate and mobilise capital at scale to address these demand and supply side issues to deepen access to inclusive and functional financial markets. In return, ventures will emerge to address the climate challenge. When more appropriate capital is available, more of these ventures will thrive.

Amani fled conflict and persecution in his home country in South Sudan, and found solace in Uganda’s Bidi Bidi refugee settlement. Amani’s life took a transformative turn courtesy of the

Amani fled conflict and persecution in his home country in South Sudan, and found solace in Uganda’s Bidi Bidi refugee settlement. Amani’s life took a transformative turn courtesy of the  Amani opened a savings account with Equity Bank, which enabled him to save money and start planning for a better future securely. With access to credit and affordable loans, Amani seized the opportunity to start a small business, selling handmade crafts within the settlement.

Amani opened a savings account with Equity Bank, which enabled him to save money and start planning for a better future securely. With access to credit and affordable loans, Amani seized the opportunity to start a small business, selling handmade crafts within the settlement. Through Amani’s dedication and hard work, his business flourished. Amani not only improved his own living conditions but also extended support to other refugees in the settlement with the income generated. Amani became an inspiration, encouraging fellow refugees to explore entrepreneurship as a means to financial independence.

Through Amani’s dedication and hard work, his business flourished. Amani not only improved his own living conditions but also extended support to other refugees in the settlement with the income generated. Amani became an inspiration, encouraging fellow refugees to explore entrepreneurship as a means to financial independence. Recognising the importance of financial literacy, Amani actively participated in financial education programs organised by project partners. Amani learned valuable skills such as budgeting, saving, and managing cash flow. Motivated by his own success, Amani began mentoring other refugees, sharing knowledge and empowering them to take control of their financial lives.

Recognising the importance of financial literacy, Amani actively participated in financial education programs organised by project partners. Amani learned valuable skills such as budgeting, saving, and managing cash flow. Motivated by his own success, Amani began mentoring other refugees, sharing knowledge and empowering them to take control of their financial lives. Amani’s journey was not without obstacles. Like many other refugees, he faced uncertainties, limited resources, and occasional setbacks especially during the COVID-19 pandemic. However, through perseverance and the support of the refugee community, Amani remained steadfast in his pursuit of a better future. Amani’s resilience and determination served as a beacon of hope for others facing similar challenges.

Amani’s journey was not without obstacles. Like many other refugees, he faced uncertainties, limited resources, and occasional setbacks especially during the COVID-19 pandemic. However, through perseverance and the support of the refugee community, Amani remained steadfast in his pursuit of a better future. Amani’s resilience and determination served as a beacon of hope for others facing similar challenges. Amani dreams of expanding his business beyond the settlement’s boundaries, creating opportunities for fellow refugees and contributing to the local economy. Amani’s journey exemplifies the transformative power of financial inclusion and the impact it can have on the lives of refugees.

Amani dreams of expanding his business beyond the settlement’s boundaries, creating opportunities for fellow refugees and contributing to the local economy. Amani’s journey exemplifies the transformative power of financial inclusion and the impact it can have on the lives of refugees. Through access to financial services, coupled with resilience and community support, Amani has not only thrived but has become a source of inspiration for others. Amani’s story highlights the importance of creating an inclusive world where refugees are given a chance to rebuild their lives, contribute to their communities, and dreams of a brighter future.

Through access to financial services, coupled with resilience and community support, Amani has not only thrived but has become a source of inspiration for others. Amani’s story highlights the importance of creating an inclusive world where refugees are given a chance to rebuild their lives, contribute to their communities, and dreams of a brighter future. Amani fled conflict and persecution in his home country in South Sudan, and found solace in Uganda’s Bidi Bidi refugee settlement. Amani’s life took a transformative turn courtesy of the

Amani fled conflict and persecution in his home country in South Sudan, and found solace in Uganda’s Bidi Bidi refugee settlement. Amani’s life took a transformative turn courtesy of the  Amani opened a savings account with Equity Bank, which enabled him to save money and start planning for a better future securely. With access to credit and affordable loans, Amani seized the opportunity to start a small business, selling handmade crafts within the settlement.

Amani opened a savings account with Equity Bank, which enabled him to save money and start planning for a better future securely. With access to credit and affordable loans, Amani seized the opportunity to start a small business, selling handmade crafts within the settlement. Through Amani’s dedication and hard work, his business flourished. Amani not only improved his own living conditions but also extended support to other refugees in the settlement with the income generated. Amani became an inspiration, encouraging fellow refugees to explore entrepreneurship as a means to financial independence.

Through Amani’s dedication and hard work, his business flourished. Amani not only improved his own living conditions but also extended support to other refugees in the settlement with the income generated. Amani became an inspiration, encouraging fellow refugees to explore entrepreneurship as a means to financial independence. Recognising the importance of financial literacy, Amani actively participated in financial education programs organised by project partners. Amani learned valuable skills such as budgeting, saving, and managing cash flow. Motivated by his own success, Amani began mentoring other refugees, sharing knowledge and empowering them to take control of their financial lives.

Recognising the importance of financial literacy, Amani actively participated in financial education programs organised by project partners. Amani learned valuable skills such as budgeting, saving, and managing cash flow. Motivated by his own success, Amani began mentoring other refugees, sharing knowledge and empowering them to take control of their financial lives. Amani’s journey was not without obstacles. Like many other refugees, he faced uncertainties, limited resources, and occasional setbacks especially during the COVID-19 pandemic. However, through perseverance and the support of the refugee community, Amani remained steadfast in his pursuit of a better future. Amani’s resilience and determination served as a beacon of hope for others facing similar challenges.

Amani’s journey was not without obstacles. Like many other refugees, he faced uncertainties, limited resources, and occasional setbacks especially during the COVID-19 pandemic. However, through perseverance and the support of the refugee community, Amani remained steadfast in his pursuit of a better future. Amani’s resilience and determination served as a beacon of hope for others facing similar challenges. Amani dreams of expanding his business beyond the settlement’s boundaries, creating opportunities for fellow refugees and contributing to the local economy. Amani’s journey exemplifies the transformative power of financial inclusion and the impact it can have on the lives of refugees.

Amani dreams of expanding his business beyond the settlement’s boundaries, creating opportunities for fellow refugees and contributing to the local economy. Amani’s journey exemplifies the transformative power of financial inclusion and the impact it can have on the lives of refugees. Through access to financial services, coupled with resilience and community support, Amani has not only thrived but has become a source of inspiration for others. Amani’s story highlights the importance of creating an inclusive world where refugees are given a chance to rebuild their lives, contribute to their communities, and dreams of a brighter future.

Through access to financial services, coupled with resilience and community support, Amani has not only thrived but has become a source of inspiration for others. Amani’s story highlights the importance of creating an inclusive world where refugees are given a chance to rebuild their lives, contribute to their communities, and dreams of a brighter future.