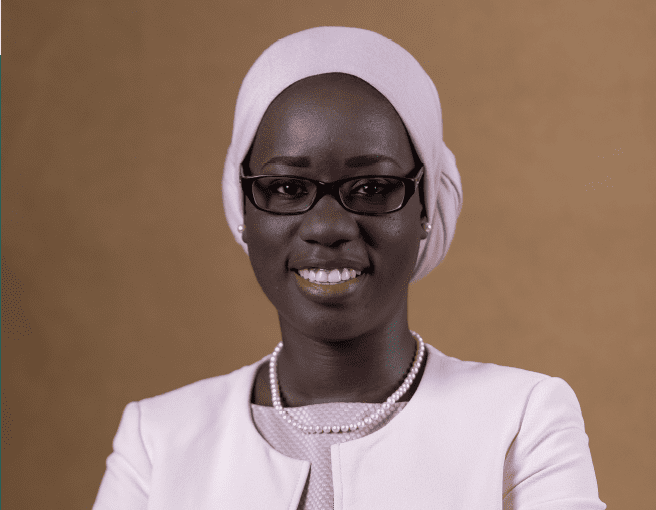

Amsterdam, 11 October 2022 Diago Dièye has today joined Nyala Venture as Managing Director. She combines robust finance and investment experience with a strong network in the SGB (small and growing businesses) and LCP (Local Capital Providers) ecosystem. Diago’s previous position was Chief Operating Officer and Program Director of an impact investment fund that finances SGBs. She most recently co-structured and deployed a USD 30 million Access to Finance Program, which led to the financing of more than 600 SGBs and 11,000 micro-entrepreneurs through 15 LCPs.

Diago is a seasoned professional with over 15 years of experience spent between the US, the UK and Senegal in the financial services industry. As a specialist in Corporate Finance, particularly for SGBs in frontier markets, she has been focusing on delivering capital to SGBs for the past 10 years.

FSDAi hopes to accelerate capital flows into SGBs especially those focused on closing the gender gap. We are excited to have Diago join Nyala Venture team to drive this important work and look forward to seeing this nascent asset class grow.

Anne-Marie Chidzero, Chief Investment Officer, FSD Africa Investments