COVID-19 has had – and continues to have – a major effect on all parts of society.

The insurance sector has been placed under the spotlight as providers and regulators grapple with finding a balance between stepping up and providing respite to policyholders through claims and the need to maintain prudential soundness.

This note outlines our key learnings on the impact of COVID-19 on insurance markets across sub-Saharan Africa (SSA) as it relates specifically to insurance regulators. We focused on the following pertinent questions:

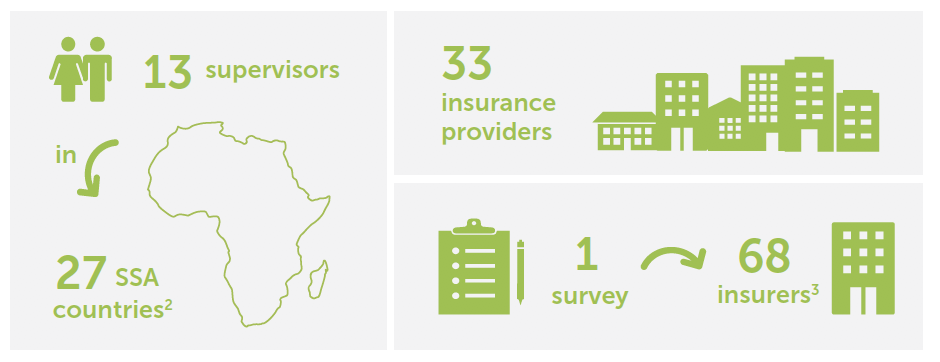

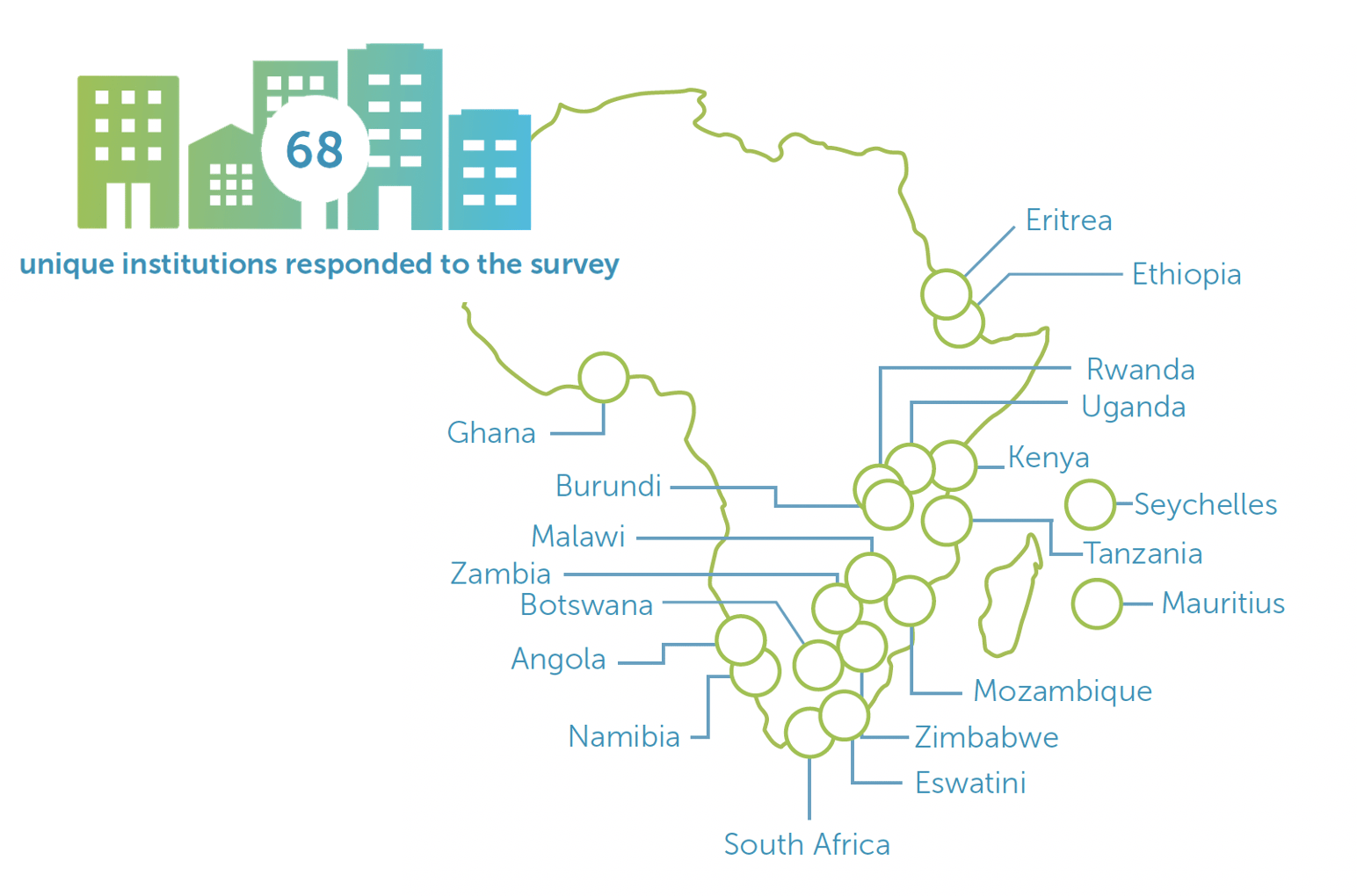

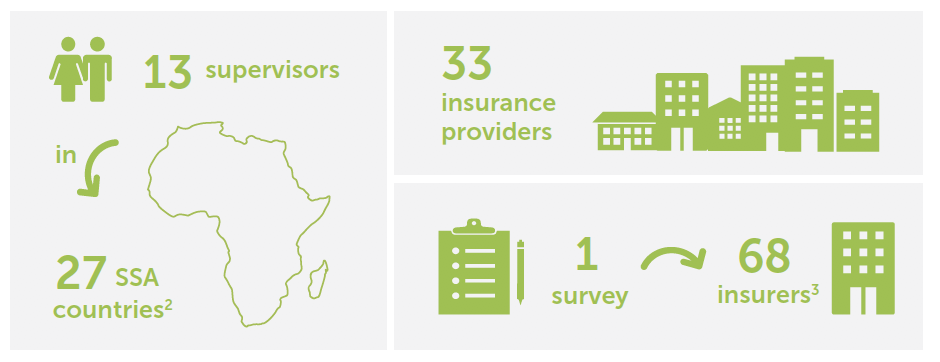

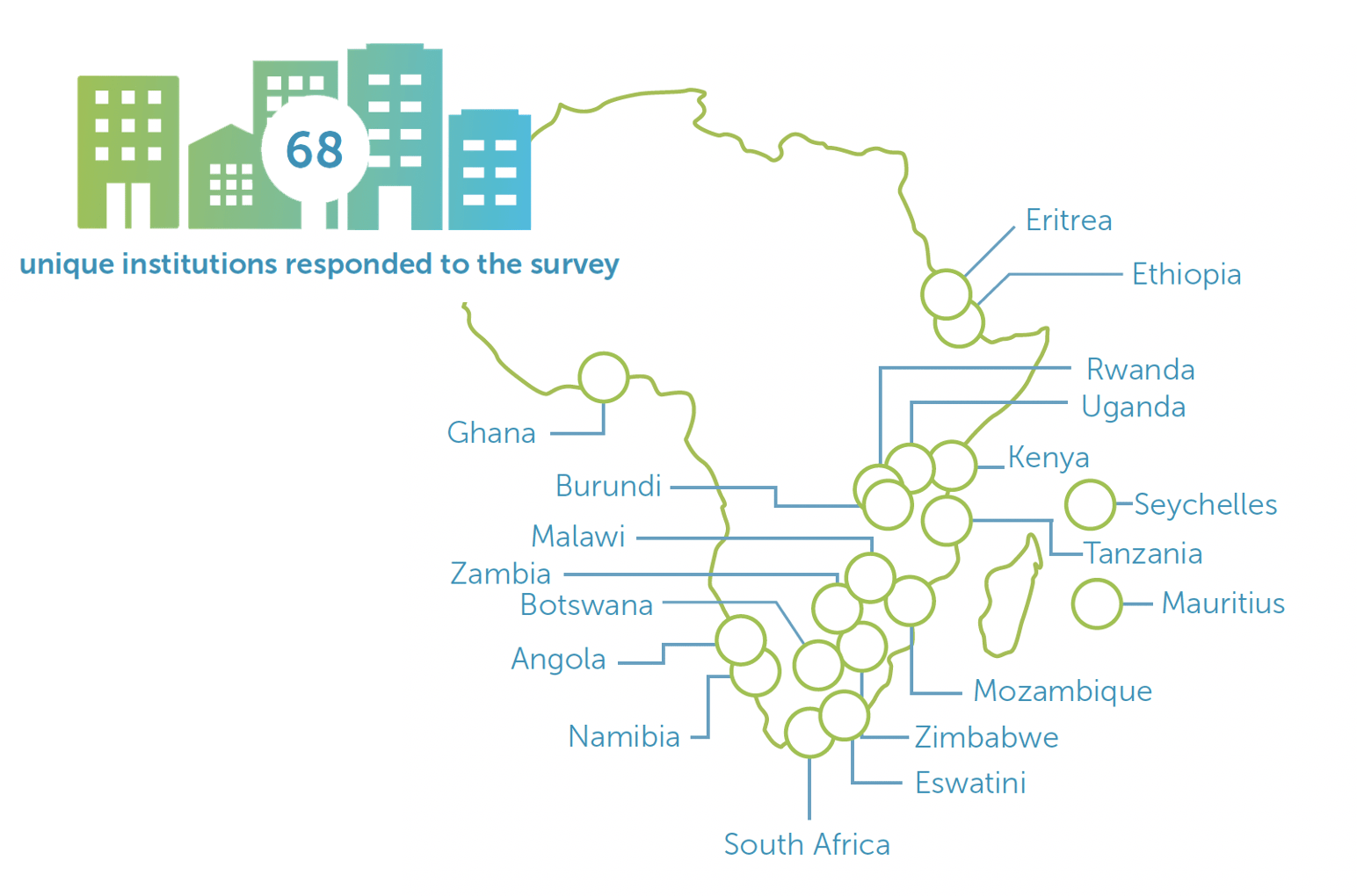

And engaged with:

COVID-19 containment and mitigation measures in sub-Saharan Africa (SSA) have restricted the movement of people, goods and services. This has affected insurers’ operations, which, to a large extent, have traditionally required physical engagement. It is also affecting insurers’ ability to launch new products, conclude new sales, collect premiums, service existing customers and process and pay claims.

Moreover, the economic crisis triggered by the pandemic is affecting premium and investment income, and balance sheets are put under strain. While the pandemic has exacerbated pre-existing weaknesses of the insurance sector in SSA, it also provides an opportunity for insurers and regulators to become better equipped to embrace and adopt innovation and develop their insurance markets.

This note takes stock of the impacts of the pandemic on insurers, based on interviews with 34 insurers, insurtechs, reinsurers and insurance and broker associations across 18 markets, looking at the impacts on operations, impacts across the insurance product cycle, balance sheet impacts and the regulatory engagements and responses. The report identifies key opportunities for insurance and regulators.

The pandemic and the accompanying safety measures have affected the way insurers operate, the insurance product cycle, the potential reputation of insurers due to COVID-19 exclusions, as well impacting balance sheets that will likely result in liquidity constraints. There has been varied engagement from regulators; with some being very proactive in their communication surrounding the pandemic while others have been slow to respond and have created feelings of uncertainty in the insurance sector.

While the pandemic has exacerbated pre-existing weaknesses of the insurance sector in SSA, the consultations for this study indicate that it also provides an opportunity for insurers and regulators to become better equipped to embrace and adopt innovation and develop their insurance markets. Some of the opportunities identified in the report are that the forced digitisation of insurers can help them enhance their efficiency as well adopt the remote on-boarding of customers, and COVID-19 has created an imperative for regulators to address the barriers to digitisation as well as proactively encouraging innovation in the sector.

To read about the other opportunities identified, please download the full report.

This summary infographics document visually presents and analyses the findings from a survey conducted by FSD Africa, the Organisation of Eastern and Southern Insurers (OESAI) and Cenfri in June 2020 to understand the impact of COVID-19 on the insurance sector in Eastern and Southern Africa.

As part of our work in credit markets, we aim to contribute to a greater understanding of factors that inhibit the growth of credit markets in sub-Saharan Africa. We partnered with Intellecap to undertake research on market innovations in retail credit markets.

The objective was to assess innovative models emerging in selected countries – South Africa, Nigeria, Kenya, Tanzania and Rwanda – and to identify the critical factors for success. The region continues to face a myriad of challenges across the spectrum of the lending value chain, which affect credit access. These include low-income levels, poor infrastructure, weak policy and a high cost of credit.

In the face of these challenges, innovative digital technologies and business models are emerging in an attempt to solve credit access challenges. The report identifies over 30 credit innovations that leverage technology, multiple data sources and partnerships to enhance access and delivery of financial services to underserved segments across the continent.

The insights generated through the research are intended to highlight market opportunities and challenges, and will be of value to policymakers, regulators, credit providers, financial sector analysts, as well as others interested in supporting credit market growth in the region.

The Access to Insurance Initiative (A2ii) celebrates its 10 year anniversary in 2019. On 2 and 3 September, the A2ii hosted its 10-Year Anniversary Conference High-Level Forum and Expert Symposium in Frankfurt and launched the “A2ii: 10 Years On” publication. This publication focuses on the evolution of inclusive insurance over the last decade, probing the impact of inclusive insurance regulations and the way forward to address the gaps that remain.

It includes detailed country case studies on Ghana and Mongolia that are based on a range of interviews with public and private insurance industry stakeholders. In its capacity as a specialist development agency, FSD Africa and DFID supported Cenfri in its collaboration with the A2ii to develop the publication.

You can download the publication from here.

Through our support, over the last five years, Women’s World Banking partnered with three large African banks — in Nigeria (Diamond Bank), Tanzania (NMB) and Malawi (NBS Bank) — on an array of projects to reach low-income women and girls with credit and savings projects, accompanied by financial education.

Major takeaways from this publication include: How to develop a successful digital savings product for women, how to create sustainable financial products for youth and their families, must haves for credit programs focused on women-owned businesses, and best practices for creating leadership programs to drive change.

This Compendium has been developed to address the challenge that FSD Network members face in the identification/design and application of indicators that measure financial market system changes and resultant FSD outcomes and impacts . As part of a broader effort to address the need for tools that support the practical application of impact oriented measurement (IOM) principles, the Compendium is aimed at serving as a resource with a bespoke set of quality indicators appropriate for FSDs to measure outcome and impact level results in a more harmonised manner.

This document sets out an approach and framework for assessing Value for Money (VfM), for FSD Africa (FSDA). It has been developed as a resource for the FSD network. The VfM framework is intended to be practical, user-friendly and to minimise the reporting burden for MRM staff. At the same time, there is a minimum level of effort required in VfM assessment to ensure credibility.

The framework also aims to support a consistent approach to VfM assessment and reporting, while retaining sufficient flexibility to accommodate differences in context and guard against making invalid comparisons.

This document sets out a step-by-step process and a series of templates to guide FSDs in designing and completing a Value for Money (VfM) assessment. This document should be used in conjunction with the VfM framework, which contains full details of the approach and methods.