The Nigeria’s insurance industry has recorded moderate growth in business expansion but still has low penetration when compared with other African countries, NIKE POPOOLA reports

As of the end of June 2023, the insurance industry’s total assets rose by 10.7 per cent to N2.7tn from 2.4tn reported in the corresponding period of 2022, according to the National Insurance Commission.

NAICOM’ statistics department revealed in its Bulletin for Q2, 2023, that the insurance industry’s balance sheet showed assets of non-life business was N1.63tn, while assets of life business stood at about N1.07tn.

The industry generate N551.4bn gross premium written in the first six months of 2023; It had generated N726.2bn gross premium written in the whole of 2022 financial period.

However, despite improvement in the industry’s businesses, the penetration was still below one per cent, according to industry figures.

On contribution to the larger economy, figures obtained from the Nigerian Bureau of Statistics reveal that the finance and insurance sector consists of the two subsectors, financial institutions, and insurance; the former accounted for 90.78 per cent and the latter, 9.22 per cent of the sector respectively in real terms in Q2, 2023.

As a whole, the sector grew at 28 per cent in nominal terms (year-on-year), with the growth rate of financial institutions at 30.41 per cent and 8.29 per cent growth rate recorded for insurance.

The sector’s contribution to the nominal GDP was 4.01 per cent in Q2, 2023, higher than the 3.63 per cent it represented a year previous, and lower than the contribution of 4.11 per cent it made in the preceding quarter.

The contribution of finance and insurance to real Gross Domestic Product totalled 5.26 per cent, higher than the contribution of 4.25 per cent recorded in the second quarter of 2022 by 1.01 per cent points, and lower than 5.35 per cent recorded in Q1, 2023 by 0.08 per cent points.

Perception

According to Mrs Augustina Steve of NAICOM, lack of trust and confidence in Nigerian insurance industry resulting from non-settlement of claims, constitute one of the biggest challenges of the industry.

“Non-settlement of claims has negatively impacted confidence in the industry,” she says.

In Nigeria, she notes, the problem of insurance industry is bad image.

This, according to her, for decades, perception stood as bane of the industry’s growth.

Steve says, “The bad image problem of the industry dates back to early 19th century when Nigerians took over insurance business from the early British managers.

“The way the then Nigerian managers carried out insurance business transactions especially in the area of claims payment made the public to see insurance as a scam.”

Ability to pay claims is the real test of a solvent insurance company, she notes.

She says that the quality of claims administration can make or mar an insurance company.

The NAICOM staff says, “Ideally, insurance business is all about claims payment, since claim is the main reason a policyholder takes up an insurance policy.

“Without claims being paid by insurance companies, people are not likely to take up insurance policies, and insurance company will not maximise profits, thus claims payment in insurance contract serves as spice that attracts potential policyholders to insurance patronage.”

She observers that experience has shown that some policyholders are dissatisfied with how they are treated by the insurers when loss occurs.

Some of the complaints by claimants about insurance claims management, she notes, are insurance companies’ request for too much evidence and documentations to prove a loss; some claims are not settled because the insurer refuses to admit liability; when claims are settled, they are not paid in full.

Other complaints, she says include that some claims are rejected on purely technical grounds; claims are generally unduly delayed; the insurer argues that the claims are fraudulent, among others.

Challenges

According to the President/ Chairman Of Council, Lagos Chamber Of Commerce & Industry, Dr. Michael Olawale-Cole, the insurance industry has experienced minimal growth in real terms over the years due to various challenges faced by stakeholders.

“These challenges include limited awareness among the general population regarding the significance of insurance, low purchasing power, disruption from technology, unfavourable economic conditions, apathy toward filing claims for damages, and diverse religious and cultural sentiments, among other factors,” he says.

The Nigerian insurance industry, despite its enormous potential, he observes, is still at the infant stage and far behind its African peers judging by key indicators.

According to the global insurance market report, he says, the insurance penetration rate for Nigeria and South Africa is 0.5 and 12.2, respectively. While other leading emerging economies, kenya (2.9) and ghana (1.2) have low insurance penetration rates, Nigeria has the lowest figure comparatively, despite being the largest economy in Africa, he says.

Undoubtedly, the LCCI boss says, the insurance sector has potential for development due to various alterations in the regulatory framework, necessitating future modifications in the operational practices.

He says, “It has the potential to achieve enhanced success in the aftermath of the pandemic via the adoption of novel strategic approaches by its stakeholders aimed at growing the sector.

“The future of the insurance business hinges on the extent and speed of digital transformation since it has the potential to enable industry participants to secure a significant market share. Digitalisation will provide a streamlined and efficient experience for clients entering the insurance sector.”

Awareness

The President, Chartered Insurance Institute of Nigeria, Mr Edwin Igbiti, says insurance plays a pivotal role in safeguarding the financial well-being of individuals, businesses, and even governments.

It serves as a safety net in times of unexpected circumstances or unforeseen events, he says.

Igbiti says, “Our aim as insurance practitioners is to educate and provide peace of mind to our clients, ensuring that they are adequately covered and prepared for any risk that may arise.

“We face certain challenges that hinder the growth and effectiveness of the insurance industry in our community. Lack of awareness about the benefits of insurance and its role in economic development is prevalent among our people.”

The CIIN boss seeks the support of the government and other organisations in creating awareness campaigns to educate the public and promote a culture of insurance, emphasising its importance in mitigating risk and protecting their assets.

“We request assistance in advocating for policies and regulations that promote transparency, fairness, and sustainability within the insurance sector,” he says

Service delivery

Head SERVICOM, Adeyemi Abubakar, attributes poor insurance penetration in Nigeria to the peculiar market environment, limited public awareness and negative public perception by those who are aware of insurance.

“But in the reality, inadequate service delivery is a major challenge to why insurance acceptance has been very low,” he says.

According to him, building confidence and promoting public understanding on the insurance mechanism, effective consumer protection and education will build consumer trust and confidence, consumer trust builds the insurance market through insurance premium volume.

He says that insurance market growth generates savings, investment and employment.

Insuretech

Mr Ibrahim Ngaski of Information Technology Department, NAICOM, says digital technology has taken the world by storm affecting, changing and improving the way things are done.

The insurance industry, he notes, is currently lagging behind and needs to reassess its business model, re-evaluate its strategy and make the digital agenda a high priority.

It is time for insurers to evolve and respond to these changes in order to meet up with customers’ expectations; and that requires a different set of skills, culture and operating model, he notes.

He explains that, “The term ‘Insurtech’ is coined from the combination of two words ‘Insurance’ and ‘technology’.

“Insurtech is the use of technological innovations designed to make the current insurance model more efficient. People in modern society want to be able to buy travel insurance, life insurance, health insurance, property insurance, and other products with the tap of a finger on their devices, rather than having to sift through stacks of forms.

“Insurtech start-ups are aware of this and have developed a method, for people to obtain easily accessible and ultra-customised insurance policies.”

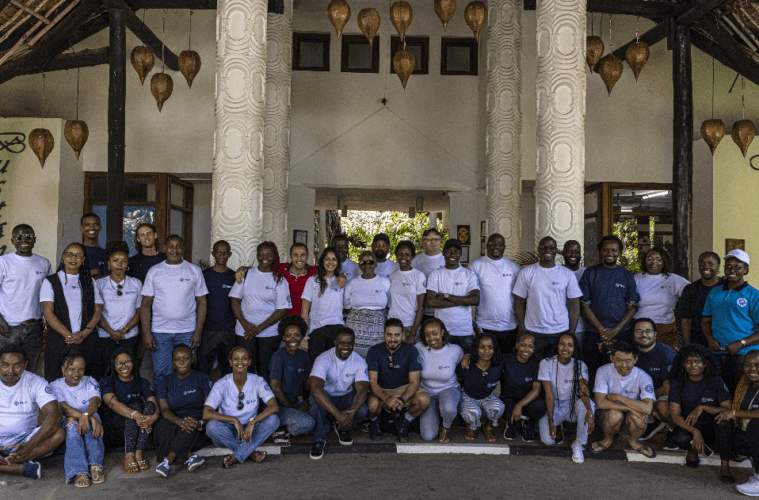

NAICOM, he says, recently partnered with FSD Africa 2022 to launch the BimaLab Insurtech initiative in Nigeria, which will enable the implementation of ideas for improving insurance in the country.

He says, “BimaLab Nigeria aims to close insurance market gaps by educating, nurturing, and promoting innovations and Insurtech start-ups.

“The innovators were selected to participate in the 10-week programme that provide them with the expertise, resources and support to develop and scale market-ready solutions that bring social and or commercial value to Nigeria’s Insurance sector by bringing creative ideas to the table.”

According to him, insurance companies can maintain a competitive edge by automating, improving and optimising their business processes without compromising efficiency, quality, and response time.

This will enhance employee productivity, speed-up processes, raise customer service levels, improve customer experiences, reduce operational expenses and increase operational efficiency, he says.

He adds that there is an urgent need for the insurance industry to adopt technologies to provide digital solutions.

When this is done, he says, it will improve access to insurance by providing digital channels of distribution, enhancing easier access to insurance products and coverage, speedy issuance of coverage and claims payment and provides Innovative products to their customers.

Growth initiatives

The Commissioner for Insurance, NAICOM, Sunday Thomas, says, the commission has shown a positive attitude to market development by the release of the Soundbox guidelines which is an instrument to test ingenuities in the market.

He says the commission seeks to facilitate and promote innovative insurance solutions that will address the gaps in current insurance offerings.

He adds that, “there is the urge to intensify the ongoing drive to facilitate platforms that address the demand-supply gap; encourage specialised products that addresses the needs of the oil and gas industry; Address all potential regulatory impediments; support the development of human capacity and ensure technical capacities of insurance suppliers; ensure adequate risk pricing and comprehensive coverages and risk management

“As the regulator, we are committed to creating an enabling environment that will consistently enhance increased capacity of the Insurance Institutions both financially and technically.”

Read original article