Over the last decade, insurance markets in sub-Saharan Africa (SSA) have grown from 4.5 million risks covered to more than 60 million risks covered today. However, according to this report, insurance penetration in SSA remains amongst the lowest in the world with life penetration at 0.3% and non-life at 0.5%, limiting its intermediation potential and contribution to inclusive economic growth and poverty reduction.

The report takes stock of the state of insurance markets across a sample of 15 countries in the region (Mauritius, South Africa, Botswana, Ghana, Kenya, Zimbabwe, Nigeria, Zambia, Senegal, Tanzania, Uganda, Rwanda, Mozambique, Angola, Ethiopia). It finds, although there is no universal development path of insurance sectors in SSA, they seem to be progressing, at varying speeds, through four different stages of market development: the establishment and corporate asset stage, the early growth and compulsory insurance stage, the retail expansion stage and the diversified retail stage.

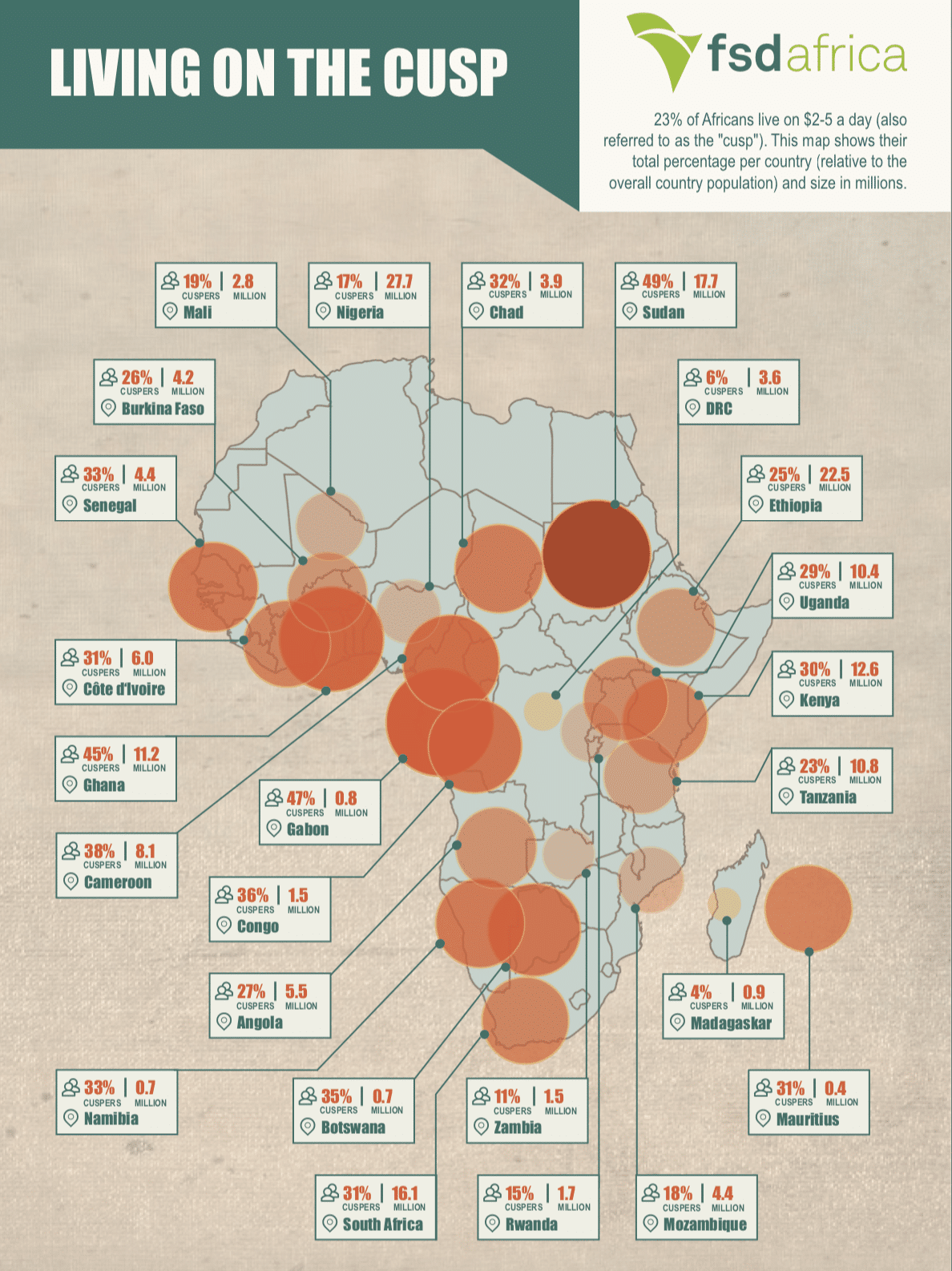

The report highlights that, most countries in the sample are locked into the early growth and compulsory insurance stage of insurance market development due to a number of exogenous and endogenous factors, which serve as barriers to the role of insurance in growth. Exogenous factors include barriers such as low income levels, informalisation of the economy and limited financial sector development, while endogenous barriers include small markets, a shortage of skills and data, and limited distribution infrastructure.

Commenting on the report, Doubell Chamberlain, the Managing Director of Cenfri says:

Insurance contributes to growth and poverty reduction in many ways. Over the last decade, the focus in development circles has been on how insurance, or microinsurance, can support resilience, and encourage productive risk taking behavior, amongst low-income individuals.

There has been less of a focus on how insurance markets can support livelihoods of low-income adults through mobilising and intermediating capital for growth. We hope that this report stimulates a new discussion on the role of insurance in supporting economic growth in SSA and invite those interested to follow up with us or FSD Africa.”