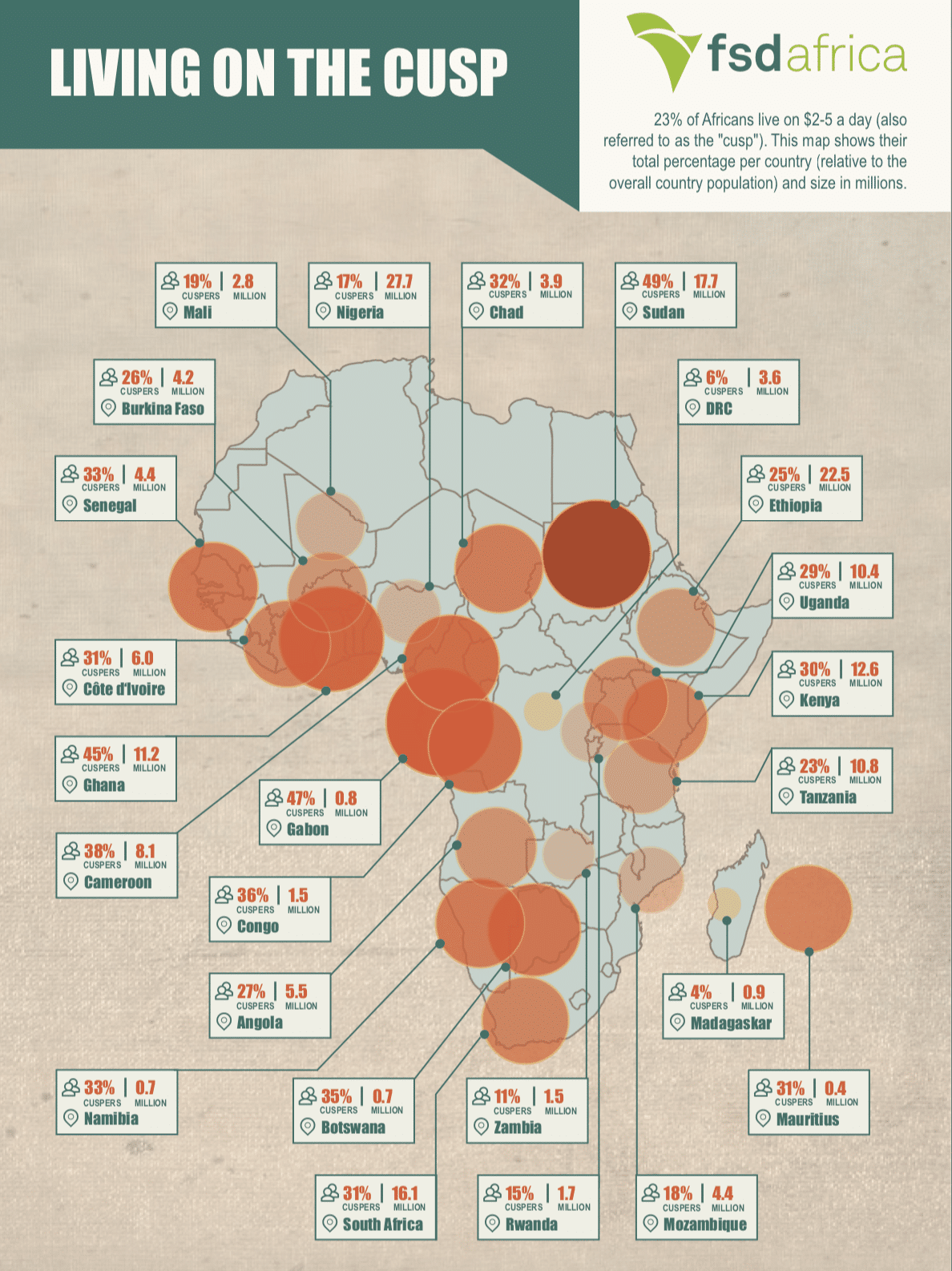

In sub-Saharan Africa (SSA), insurance markets are yet to fully develop. Despite a population of over 1 billion people, there are only an estimated 60 million risks covered and total premiums for life and non-life insurance accounted for only 1.4% of the global insurance market in 2015. The contribution of the insurance sector to the economy in sub-Saharan Africa, in terms of premiums to GDP, is amongst the lowest in the world at 2.9%. If South Africa is excluded, it drops below 1%.

The lack of market development within the region undermines the contribution of insurance to a range of poverty alleviation and economic growth outcomes. As a risk transfer tool, insurance not only assists economic actors to protect the economic and social assets they accumulate, but also unlock new opportunities for economic activity. As a mechanism for intermediation, it directly supports economic growth, and indirectly aids the development of capital markets.

However, developing a well-functioning insurance market is not a quick and easy process. Several financial sector development programmes (FSDs) across SSA have been making substantive gains over the last decade. Nevertheless, gaps still exist in recognising the potential of insurance market development to contribute fully to poverty alleviation and economic growth.

FSD Africa, in partnership with Cenfri, is working with the network of FSDs across SSA to derive key learnings, as well as identify and suppo new opportunities and approaches to insurance market development. This new collaboration kick-offed at the first FSD Insurance Market Development Workshop which was held in Nairobi, Kenya on March 27th and 28th. In attendance was FSD Kenya, FSD Mozambique, FSD Tanzania, FSD Uganda, FSD Zambia and Access to Finance Rwanda.

There were two key objectives for the workshop. The first was to share strategies, approaches, challenges and successes in insurance market development. The second was to identify opportunities for cross-country learnings and future collaboration.

The workshop was structured around the insurance market development curve and the four stages of insurance market development it introduces. The discussions revealed that while insurance market development is a key focus for many FSDs, many of their approaches differ. The stages provide the FSDs with a tool to inform their approach and there was interest in how their interventions could be shaped per the stages of market development.

The workshop emphasised the need to learn from common successes and challenges. Challenges identified by the FSDs included:

- Limited awareness and use of insurance;

- Limited incentives for business to serve low-income people;

- Questionable sustainability of certain agriculture and health products;

- Lengthy regulatory change processes; and

- Limited skills, capacity and data available on the benefit and impact of insurance for poverty alleviation and growth.

Successes highlighted focused on:

- Creation of local working groups t promote and support inclusive insurance and microinsurance;

- Innovations in product design such as index insurance and mobile microinsurance; and

- Capacity Building for regulators and providers.

The FSDs also identified the importance of on-going and sustained engagement with regulators and the private sector. They noted that this engagement has led to increased provider and stakeholder interest; and support for inclusive insurance and microinsurance, as well as positive regulatory relationships and influence.

Going forward, FSD Africa, Cenfri and the FSD network have agreed to collaborate on insurance market development to address these challenges and amplify successes through a Community of Practice to be established for this purpose.