Although, industrialisation has brought huge development in job creation and world advancement, it has equally led to the degradation of the environment and encroachment of natural habitat that has led to climate change.

The drought, ocean surge, fire outbreak, among others, are the rotten fruit of industrialisation and urgent steps had to be taken to address this looming danger staring at us.

The Environmental, Social and Governance (ESG) Principles came into being, to address this challenge and several multinationals and local firms have incorporated ESG principles in their modus operandi to lower the effect of climate change.

ESG principles can lead to sustainable business by incorporating toolkits that guide the business in the context of the environment. This will ensure that insurance business is carried out responsibly.

Meanwhile, insurance industry globally is continuously undergoing profound changes, and the disruption faced are not just digital but also harsh market conditions, informed demanding customers, innovative/ new market entrants as well as regulations.

However, in insurance industry across Africa, the Nairobi Declaration on sustainable Insurance are expected to be given serious consideration by the Nigerian insurance industry.

Stakeholders’ Reactions

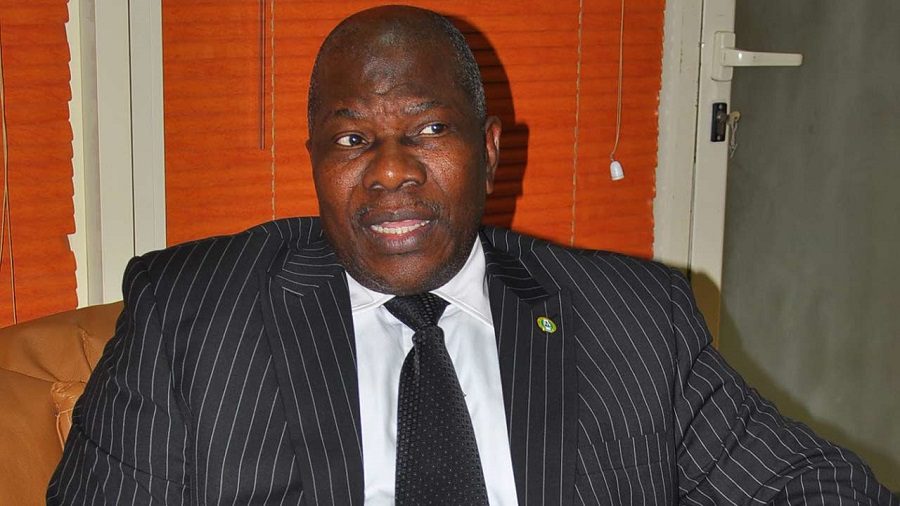

The commissioner for Insurance/CEO, the National Insurance Commission(NAICOM), Mr. Sunday Thomas, said, with the requisite knowledge of ESG, insurance companies would be able to enhance the value of their companies and avert the danger of paying little or no attention to the impact of ESG in corporate survival and sustainability.

“We must take cognisance of the fact that industrialisation and economic development have given rise to a wide spectrum of environmental externalities and social impacts bringing to the fore issues like board structure, shareholder rights, business ethics, risk management, incentives and executive compensation.

“Consequently, for businesses to continually develop, they must take into consideration the community in which they operate, ensure consistent value to customers, maintain the highest standards of governance and ethics, and mitigate its overall impact on the environment,” he pointed out.

Thomas maintained that, sustainable finance, which is the creation of economic value through the provision of financial services, now integrates ESG considerations for the lasting benefit of stakeholders and the society at large.

The objective, he noted, was to achieve a balance in the pursuit of economic prosperity with environmental protection and social development.

He advised that, in the financial services industry, there is an increasing realization that sustainable practices have a positive potential to save costs, increase revenues, reduce risks, develop human capital and improve access to finance thus, while ignoring sustainability issues increases legal and reputational risk.

“ESG (Environment, Social, and Governance) are the three broad categories within which corporate sustainability is measured. It is pertinent to point out here that sustainability reporting is becoming more and more prevalent and sought for not just by governments through regulations, but also by stakeholders such as investors, consumers, and employees. Increasingly, companies all over the globe are incorporating sustainability in long-term development strategies as well as their day to day operations.”

While admonishing insurance institutions to imbibe the principles of entrenching ESG issues in their decision-making process while they conduct insurance businesses, he added that, “working with other stakeholders to raise awareness on environmental, social and governance issues, manage risk and develop solutions in the conduct of insurance business in Nigeria is key.

“More so, working together with government at all levels, regulators and other key stakeholders to promote widespread action across society on environmental, social and governance issues in the insurance sector.

“We must demonstrate accountability and transparency by regularly disclosing publicly your progress in implementing these principles to relevant institutions responsible for; Monitoring and Evaluation of Compliance and Carrying out survey and research among stakeholders including (NAICOM, SEC, FRC),” he pointed out.

Thomas stressed that NAICOM also expects that insurance institutions take interest in pursuing: the developments of Green Products; improving operations geared towards energy efficiency; investment strategies; leveraging technologies; insuring people with disability; prioritise Corporate Social Responsibilities (CSR) and improving & complying with professional standards.

He reiterated NAICOM’s resolve to proactively respond to Climate changes like flood and disaster management; Monitoring Population Growth- Annuities Insurance Longevity; watch out for Green Technology- which includes Work on Electronic Submission of regulatory returns and renewal of licenses etc; investment and strategy support to Ethical Investment.

Other areas of top priority are: Green Products- Takaful & Microinsurance, implementation of Policies to encourage Insuring Crops and Weather Base Index, treating customers fairly- Prompt Claims payment as well as seeking synergy with development partners FSD Africa on BimaLab Project.

“Wherever there is a challenge, there is an opportunity. Thus, all the sources of disruptions can be harnessed to become a source of growth for insurers. While no one can predict exactly what insurance might look like in a decade, insurers can take several steps now to prepare for these changes.

“It is imperative that as an industry, we take precautionary measures by raising awareness within ourselves on the potential sustainability impacts of business transactions, and integrating these considerations into pre-emptive and holistic risk management processes.

“We encourage insurance companies to reduce their environmental footprint through their internal operations and business activities. As leaders of your respective companies, it is instructive that you take deliberate steps at reconciling long-term with short-term goals, global expansion with local objectives, workplace and community issues; all of which must be united, while not losing sight of the basic goals of profitable operations and increasing shareholder value.

“In other to facilitate economic prosperity, ensure environmental sustainability and social development, we must join forces with identified stakeholders to drive long term sustainable growth in the insurance sector for lasting benefits to all stakeholders.

“As an industry, we should draw on external knowledge and partnerships to keep pace with wider trends affecting not just the local but also the global insurance market. We must discover strategies to adapt and overcome further changes in the near future that may arise as a result of entrenching Economic, Social and Governance principles, as we forge ahead together in creating an enabling and sustainable environment through value creation,” he stressed.

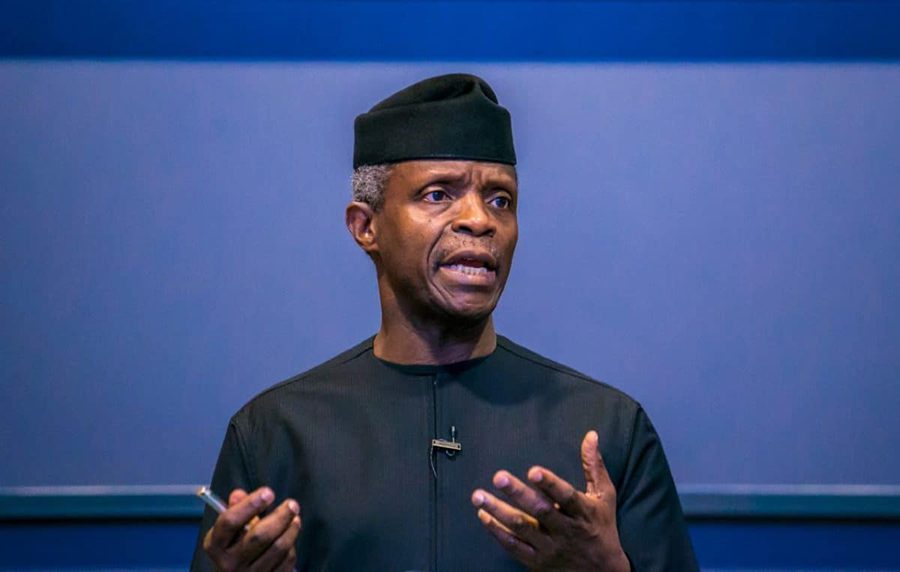

Similarly, ICEA LION Group has charged insurance regulators and operators in Africa to adopt Environmental-Social-Governance(ESG) to drive sustainable growth of the market on the continent.

Speaking at the recent 2022 Insurance Directors’ conference held at the College of Insurance and Financial Management (CIFM) in Lagos, Nigeria with the theme: ‘Transforming the Insurance Industry through ESG Principles: Directors’ Roles,’ the chief executive officer(CEO) of ICEA LION Holdings, Mr. Philip Lopokoiyit, said the key substance of the Nairobi Declaration on Sustainable Insurance was a declaration of commitment by African insurance industry leaders to support the achievement of the UN Sustainable Development Goals (SDGs).

He emphasised that the declaration is “an Africa-focused initiative designed to encourage and support African insurance market players.”

He further added that, “it is a convening tool that signals their willingness to develop ESG principles and solutions within their businesses as insurance players become change agents in light of the biggest challenge facing humanity.”

The declaration, according to him, is important because, while the UN Sustainable Development Goals (SDGs) are gaining momentum, progress to meet these SDGs from a financial services perspective was not yet at the speed or scale required.

Lopokoiyit added that, the ICEA LION Group went to COP 27 in Sharm El-Sheikh-Egypt 2022 as a founding signatory to the Nairobi Declaration on Sustainable Insurance (NDSI).

The group co-hosted a Climate Adaptation event together with UNFCCC, FSD Africa and Namib Re as representatives of the NDSI on 9th November 2022.

At this event, the signatories announced the launch of the Africa Climate Risk Facility.

According to the ICEA LION Holdings CEO, the signatories made a commitment to insure cumulatively more than 1.4 billion people by 2030 as well as provide $14 billion insurance capacity for flood, drought & cyclones in Africa.

He spoke on the $900 million multi-donor-trust fund facility, which when fully set up and resources mobilised, will be available for NDSI signatories.

The facility is expected to drive premium subsidies, product development and capacity building. According to the executive, other significant milestones for the continent at COP 27 included; the launch of the Africa Carbon Markets Initiative as well as the decision by developed countries to establish a loss and damage fund.

In terms of challenges of enthroning the ESG model in Africa, Philip identified six major roadblocks as heavy carbon-driven economies, few African voices on the issue, considerable lack of knowledge & awareness, uneven playing field for early-adopters of ESG, short-term planning models and lack of green finance instruments to quickly facilitate adoption of ESG principles.

It is imperative to emphasise that the ESG model suggested by the executive reflected prominently in the 16-point communique released by the event organisers, underlining the importance and strength of the Group’s participation at the event.

The ESG principles canvassed by the CEO of ICEA LION Holdings that got a buy-in in the final communique include: that insurance can serve as a veritable tool to solve sustainable challenges such as: Pollution, Poverty, Social Inequality, Biodiversity, Climate change, among others; that the Nairobi Declaration on sustainable Insurance should be given serious consideration by the Nigerian insurance industry and that the outcomes of COP 27 can facilitate Nigerian market expansion, among others.

Read original article