“Our economies are built on the back of women’s unpaid labour at home”

– Melinda Gates

Empowering women means, at its core, providing women with strength and confidence to control their lives, and knowledge of their own rights so that they can actively engage in their communities.

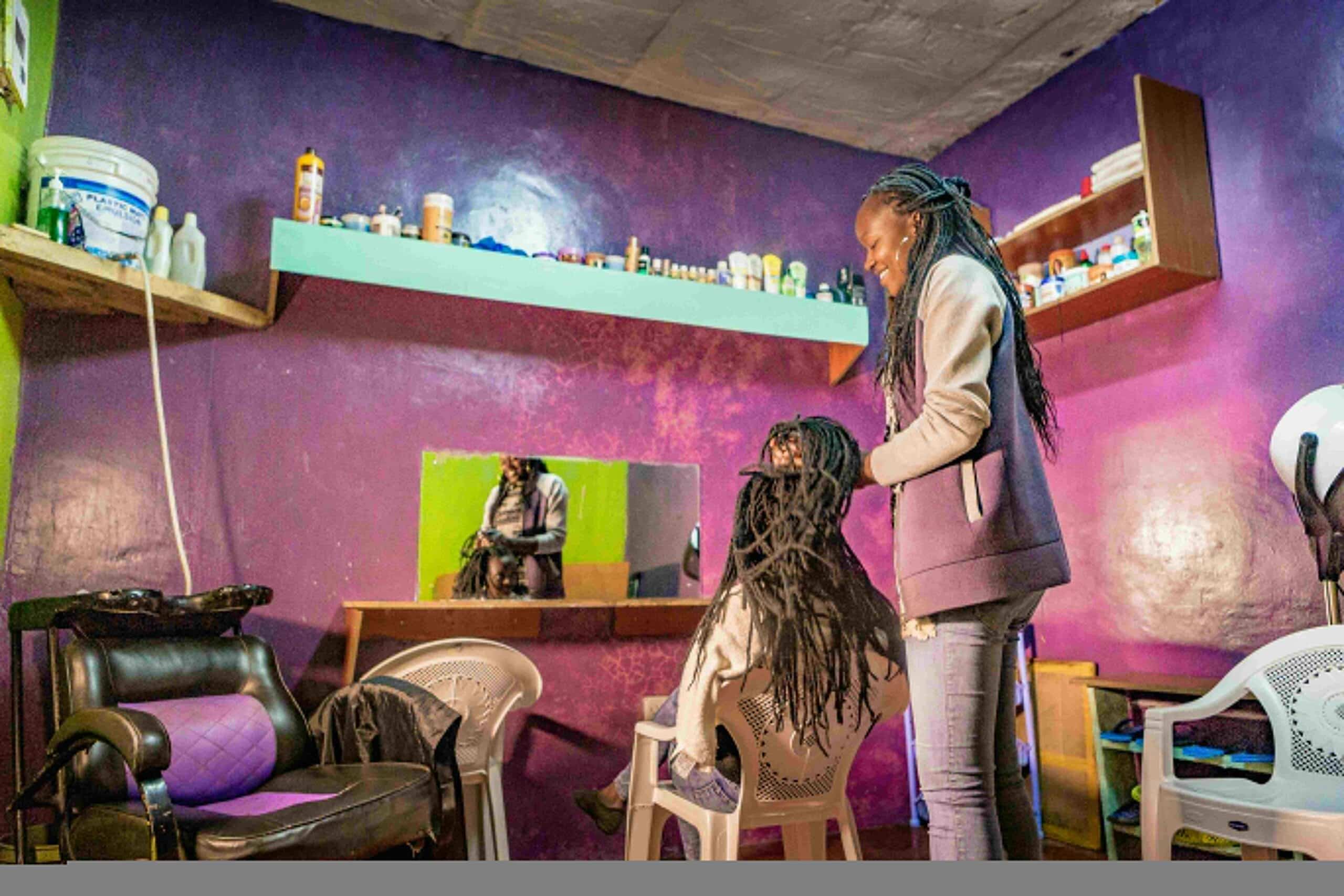

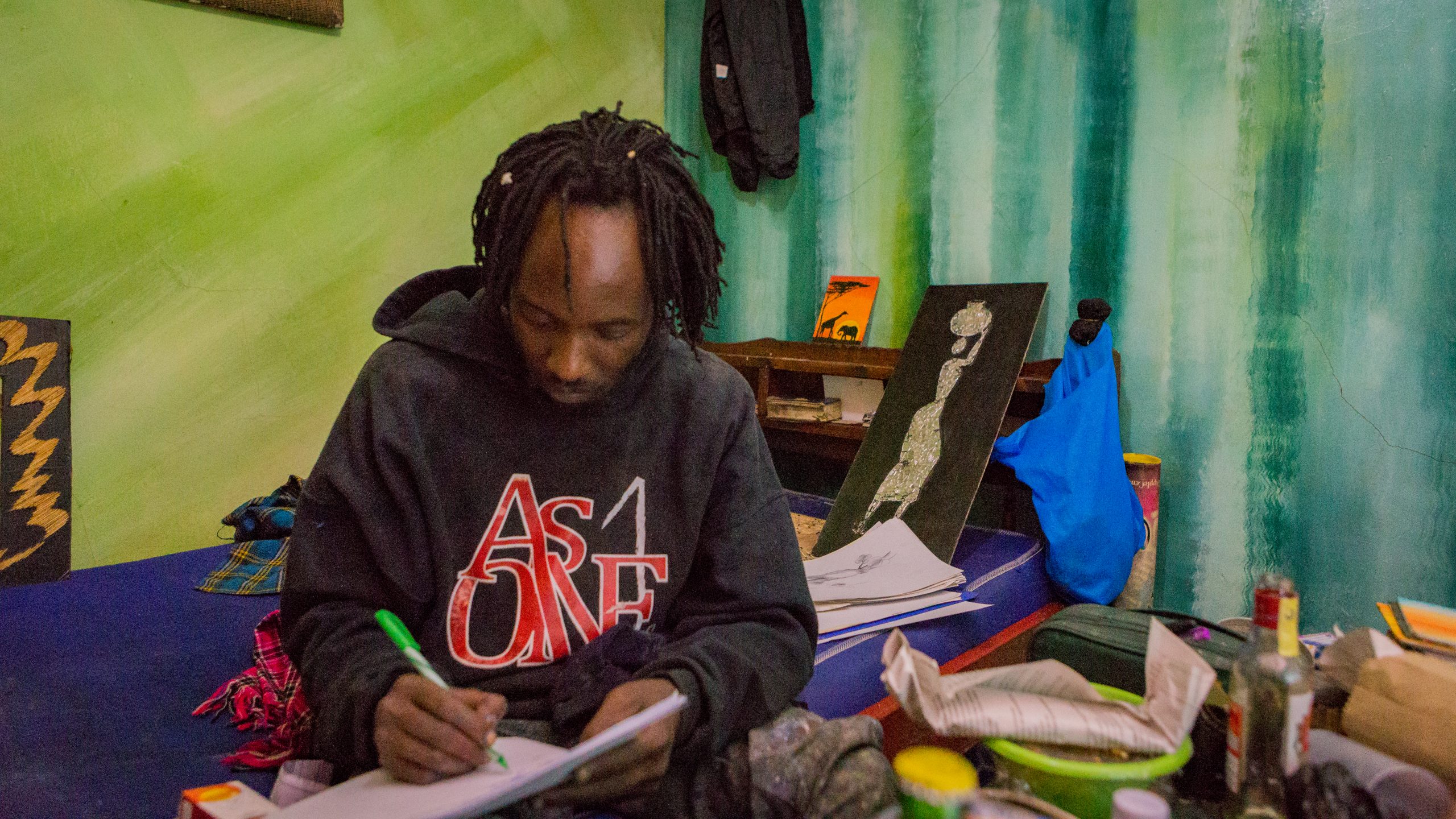

Increasing women’s access to financial services allows them to have better control over financial resources and improves independence and mobility. It also fosters greater investments in income-generating activities, and the ability to make decisions that serve the needs of women and their families. In short – financial inclusion empowers women.

But how do women, especially those living in rural areas, access financial services?

Savings groups (SGs) and access to finance

SGs are easily accessible groups of people who get together regularly to save money and borrow from the group savings, if needed, according to rules established by the group.

Programmes that promote SGs typically focus on women’s economic empowerment and measure change through quantitative indicators of economic well-being. This is mainly because SGs enable the accumulation of funds which can be used as capital for micro-enterprises and for such programmes, the quantification of results is easier. This approach, however, provides a limited understanding of the role of SGs in affecting various dimensions of women’s empowerment, such as social, political and reproductive empowerment.

The SEEP network, in partnership with FSD Africa and Nathan Associates, commissioned a savings group research across sub Saharan Africa. The aim of the research was to highlight good practices in the design and monitoring of Savings Group programmes for women’s empowerment outcomes. The research also led to the development of a monitoring tool for the measurement of the various dimensions of women’s empowerment within SGs.

Savings groups and women’s empowerment

The research built upon pre-existing frameworks and for the first time captured women’s empowerment in the specific context of SGs.

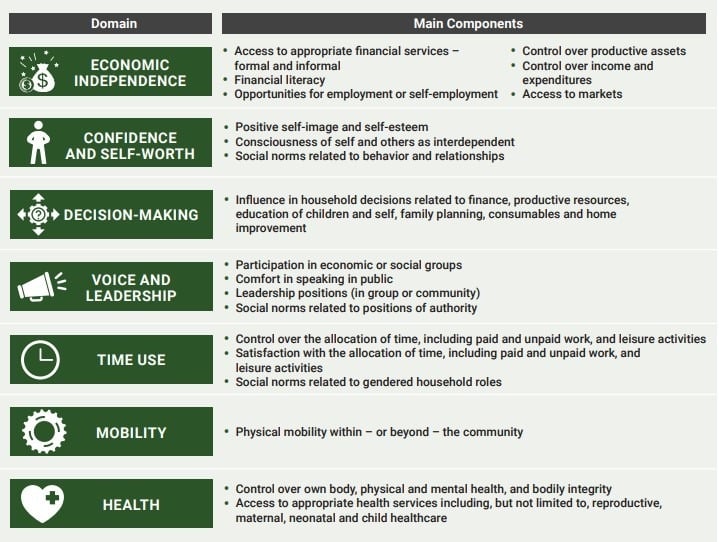

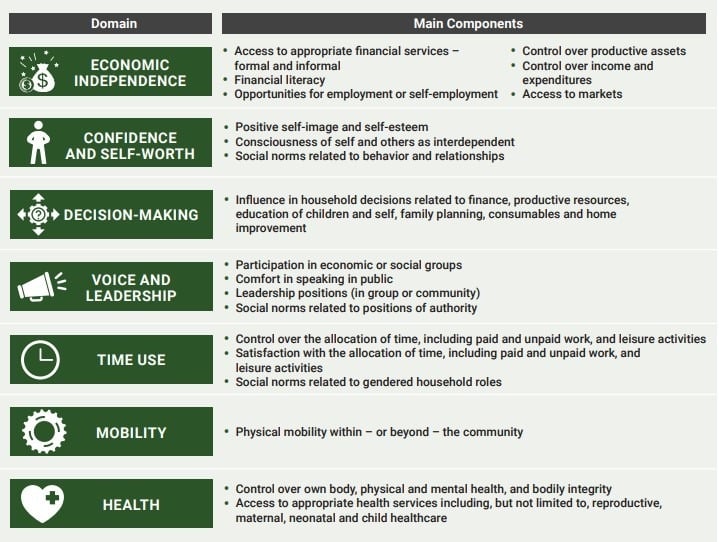

In particular, seven ‘domains’ or clusters of core areas within which empowerment can be measured have been identified. These are i) Economic independence; ii) Confidence and self-worth; iii) Decision-making; iv) Voice and leadership; v) Time use; vi) Mobility; vii) Health.

Through these domains, SGs market actors can design SGs interventions with sight of the empowerment impacts they aim to achieve. They can also observe the likelihood of empowerment outcomes and impacts across different SGs intervention types:

i) Savings Groups only interventions, for example, a development institution working on financial inclusion could adopt an SGs only approach to enable target groups to access appropriate financial services from formal financial institutions. For these kinds of interventions, empowerment impacts are strongly observed in 2 out of the 7 domains, economic independence and confidence and self-worth. Through this type of intervention, it was observed that participants gained access to appropriate financial services, enhanced financial management skills, expanded social and support networks. Fewer impacts on mobility, time-use and health were observed.

ii) Savings Groups in combination with other economic development activities, for example, a Savings Group initiative could be combined with financial education, technical or vocational training, or specific income generating activities. Strong empowerment impacts are observed for such interventions for 3 out of the 7 domains, that is, economic independence, confidence and self-worth and decision-making. Improved decision-making is observed through participants engaging in employment or self-employment and demonstrating abilities in influencing relevant decisions in their homes and communities.

iii) Savings Groups within other integrated programming i.e. programming that is aimed at weeding out harmful social norms & inequalities: for example, a Savings Group initiative could be integrated with gender programming that challenges harmful social norms such as domestic violence, female genital mutilation, negative attitudes to family planning/reproductive health, etc. The programming approach could combine SGs with education and capacity building for members accompanied by gender dialogue sessions, engaging members and their spouses, community and religious leaders.

For such interventions, impacts are strongly observed within 5 of the 7 domains: economic independence, confidence and self-worth, decision-making, voice and leadership and health. Empowerment demonstrated by leadership is observed through changes in gender norms, especially within women’s economic participation; empowerment in health through increased and improved investments in maternal, neonatal and child health or improved attitudes and norms with respect to reproductive and sexual rights. For empowerment demonstrated by time use, impacts are observed through more equitable allocation of unpaid household labour.

An example of an impactful SGs within an integrated programming intervention (i.e. intervention option iii), is the ‘Towards Economic and Sexual Reproductive Health Outcomes for Adolescent’ girls (TESFA) project under CARE International in Ethiopia. Girls within SGs provided with sexual and reproductive health (SRH) training demonstrated both economic and health related gains from programme participation. These were observed through, increased SRH knowledge, improved communication on SRH, decreased levels of gender-based violence, improved mental health, increased social support and gender attitudes.

A systematic approach to analyzing women’s empowerment

Saving Groups create economic independence for women but in order to analyze their contribution to other domains of empowerment, there is need for a systematic design of a monitoring and results measurement approach. Through this research, a toolkit that provides guidelines as to how to create an evidence-based theory of change was developed. Drawing from existing frameworks economic empowerment and existing data, the toolkit proposes a more holistic framework for SGs, based on the seven domains of empowerment discussed above. It also provides some standardized indicators to improve the comparability and aggregation of results across projects and organizations.

For more information and application of the WEE toolkit click here.