Refugees are not an obvious customer segment for financial service providers (FSPs). It is not hard to see why: in a world where refugees are too often portrayed as very poor, vulnerable, with few tangible assets and little stability, where are the incentives to enter such a challenging market?

While FDPs often are vulnerable, poor, and burdened with instability, through a different lens they can present an intriguing opportunity. In places like Rwanda, large refugee camps can exist for decades and are home to vibrant micro-economies. Moreover, many FDPs fit the basic profile to access formal financial services; they have regular income, formal identification, and a need for financial products.

A study conducted by BFA Global in partnership with FSD Africa, Access to Finance Rwanda[1] (AFR), and UNHCR last year suggests that there are good reasons to believe that forcibly displaced persons (FDPs) can be a profitable customer group for FSPs.

Demand: Refugees Need Financial Services

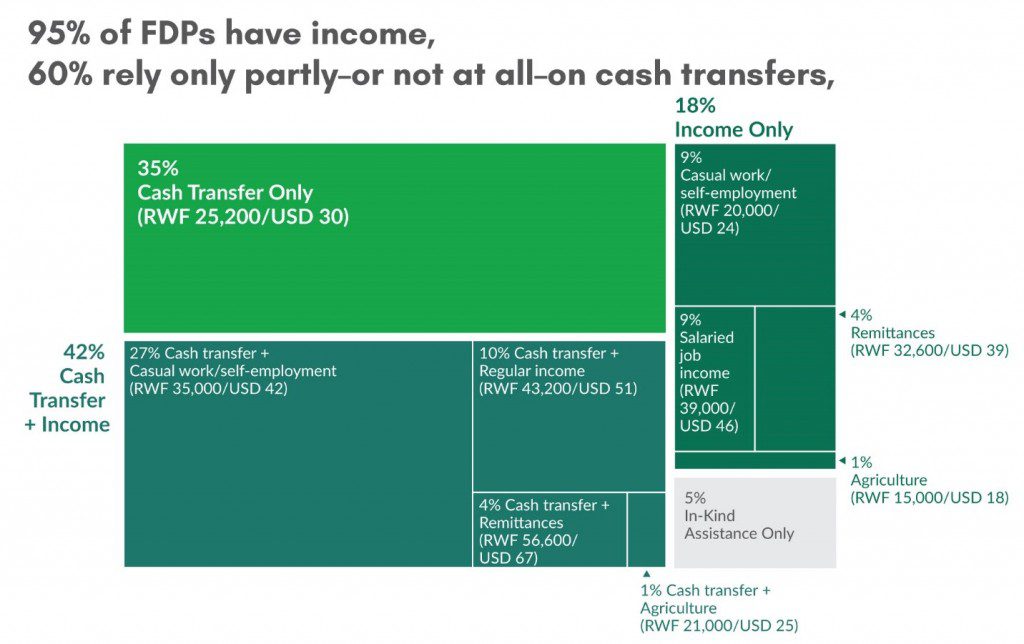

Many refugees not only receive aid, they also earn income, thereby creating sufficient cash flow to drive demand for financial services.

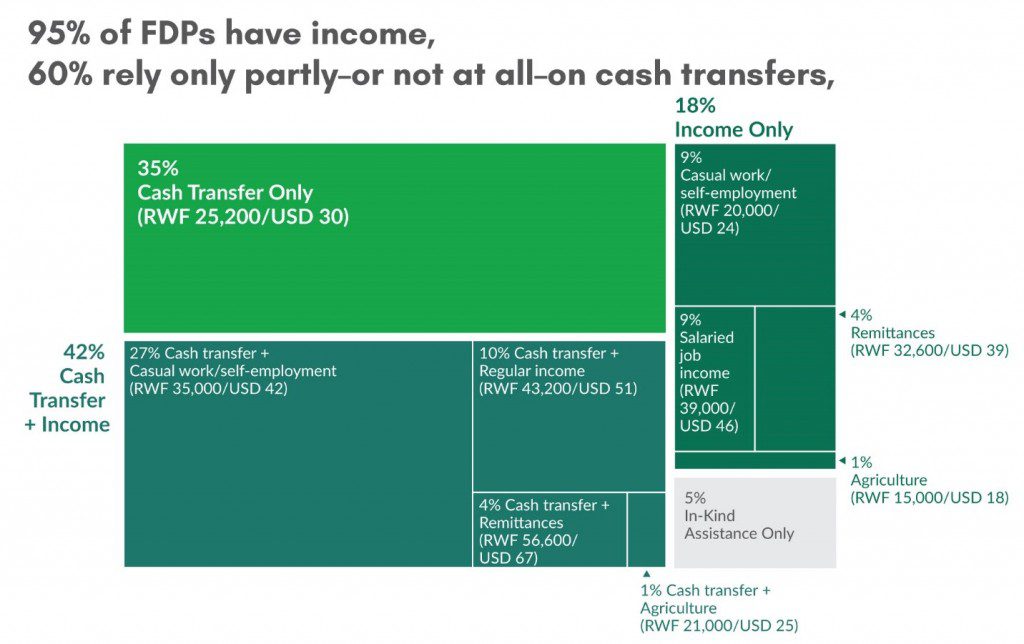

Although they are plagued by instability and insecurity, many refugees start businesses and some also have jobs. About a third, or 27% of refugees, are self-employed, providing services such as dressmaking and barbering largely within the camp. An additional 10% of refugees earn a monthly salary from employment. Finally, 4% receive remittances.

In addition to the income earned from work, 95% of refugees receive humanitarian aid in the form of monthly cash transfers. The World Food Programme (WFP) and the UNHCR are shifting from providing refugee households with in-kind humanitarian support to giving them cash. At the time of our study, refugee households in four out of the six camps in Rwanda were receiving monthly cash transfers. The other two camps were soon to migrate from in-kind to cash transfers.

With these regular inflows of cash, refugees need a place to receive and store their money, creating a clear demand for secure financial services.

Supply: Refugees can be a profitable segment

Not only is there substantial demand for financial services, our analysis suggests refugees are a viable customer segment. Of the 160,000 men, women and children who are displaced in Rwanda, we estimate that about 44,000 adults have sufficient monthly cash flow to make them viable customers for FSPs, with additional opportunities for cross selling.

To start, the basic transaction accounts that banks offer other low-income Rwandans would likely be even more successful with refugees who have regular, stable cash flows. Moreover, accounts that refugees open to receive their monthly cash transfers are notlikely to become dormant or inactive, as is generally the case with many low balance accounts, making refugees a more attractive proposition for banks.

In addition, there are opportunities for cost savings using mobile money. Although low-income households tend to use informal mechanisms such as savings groupto manage their finances, 90% of the refugees we interviewed use mobile money regularly and 95% already have experience using a bank account, thereby decreasing upfront training and client education costs.

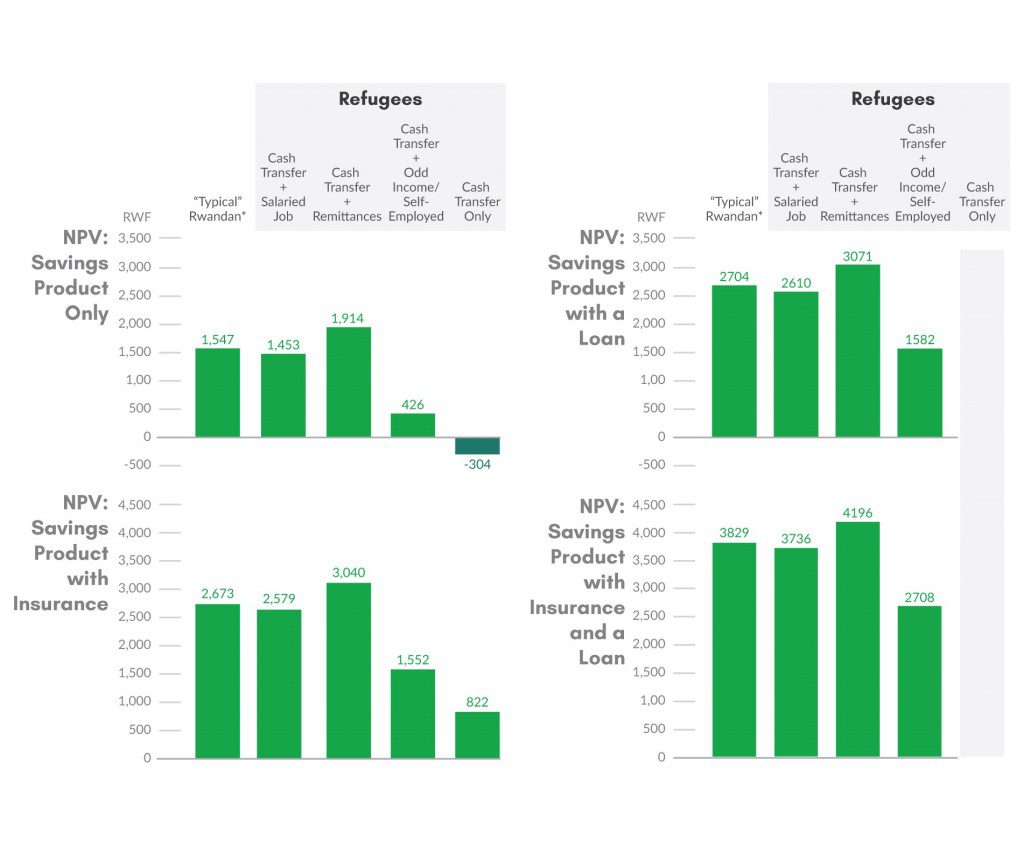

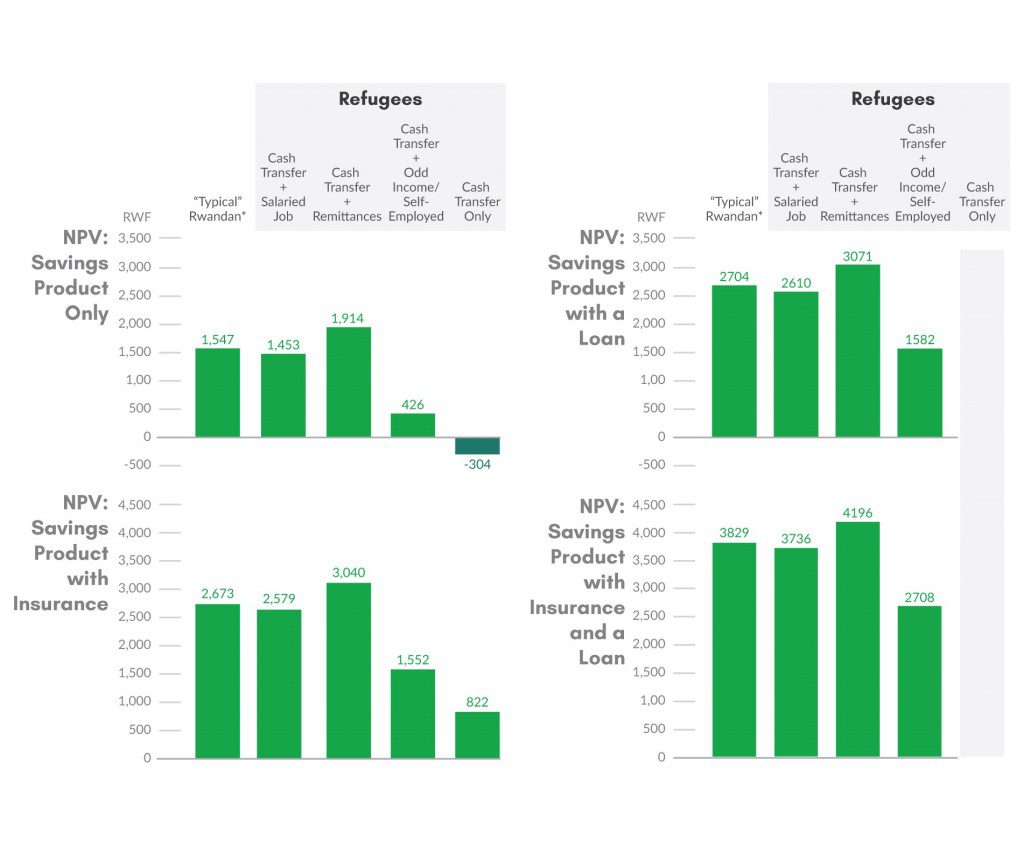

Finally, there are opportunities to cross sell other products although many segments are profitable with just a savings product. Our dynamic net present value model estimates FSPs can profitably serve refugees with salaried jobs, those who are self-employed, and those who receive regular remittances with only a savings proposition! In fact, we believe that these three segments, who together make up 41% of the adult refugee population, can be just as profitable to FSPs as typical low-income account holders in Rwanda.

That said, FSPs that offer only a savings product to refugees who depend solely on cash transfers are not likely to have a profitable proposition. Targeted cross-selling of other financial products, such as a loan or micro-insurance, will be needed to improve the FSP’s profitability for this segment.

Regulatory Environment: Refugees Qualify for Financial Services

Given the significant forces for demand and supply, the regulatory environment is the last piece of the puzzle. Fortunately, we found that refugees meet the formal requirements for opening a bank account in Rwanda.

Although most refugees do not have a government-issued ID card (which FSPs typically use for KYC purposes), all refugees have a proof of registration document issued by the Ministry of Disaster Management and Refugee Affairs. FSPs that want to serve refugees can request regulatory approval to use the proof of registration document to open accounts; the National Bank of Rwanda has approved such requests in the past.

Ultimately, our research suggests that FSPs shouldn’t be guided by the stereotypical narratives about refugees. We found that while refugees face difficult circumstances, they are also viable customers for FSPs that take an innovative approach to product design and customer acquisition.

As added incentive, in December 2017, FSD Africa launched an innovation competition to provide FSPs with ideas about how to bring financial access to refugees with grant funding of up to £160,000. The competition has received 21 concept notes to date.

[1]Rwanda is a signatory to the 1951 Convention relating to the Status of Refugees[1], which guarantees refugees the freedom of movement, right to work and other liberties and has been hosting refugees for over 20 years.

[1] BFA’s calculations based on the Maastricht Graduate School of Governance (2016) data set from a research conducted in May 20