The investment represents the first institutional backing for the venture builder, which aims to assemble a portfolio of businesses focused on climate action across Africa, boosting continental participation in global carbon markets.

22 May 2023, Nairobi – FSD Africa Investments (FSDAi) has invested £1 million in Africa Climate Ventures (ACV), a pioneering venture builder working to build a US$45 million portfolio. ACV will catalyse the carbon asset class in Africa by building innovative businesses focused on solving our generation’s greatest challenge and at the same time capturing a significant share of global carbon markets in Africa. The venture represents a series of “firsts” in Africa: from its entirely Africa-based founder team and its permanent capital structure based in Kigali, to its exclusive focus on carbon mitigation, capture and removal, the continent’s fastest evolving sector.

ACV represents a historic evolution in Africa’s carbon ecosystem and will contribute directly to capital mobilisation in climate action. Indeed, by 2030 ACV aims to eliminate one million tonnes of carbon every year while improving the lives of 50 million Africans and creating at least 5,000 jobs on the continent.

The venture builder features a peerless bench of experienced Africa-based founders with a record of pioneering innovation on the continent and championing disruptive enterprises. James Mwangi is a 2022 Climate Breakthrough Award Winner and the founder of the Climate Action Platform for Africa, a non-profit organization that aims to help Africa achieve broad-based economic growth through climate action leadership. James is best known as a co-founder of Dalberg Advisors, the firm’s first elected Global Managing Partner and then Dalberg Group’s Executive Director. Mohamed Cassim is a South African investor best known as an angel investor, the Chair of MFS Africa Board, and the Founder of Abacus Advisory. CJ Fonzi was also a Partner at Dalberg Advisors, with the firm for over a decade he served as the Group Director of Innovation and then founded Dalberg’s Rwanda business in 2017.

This team is working to build a portfolio of climate positive businesses across Africa, with the ultimate aim of launching and scaling 15 ventures in the next four years. ACV is seeking to build this portfolio by investing to: i) bring proven global climate technology to Africa, ii) accelerate and de-risk the continental expansion of technologies and business models that have gained traction in one or a few African market(s), and iii) add carbon revenue streams to existing African businesses with the potential to scale climate positive solutions.

ACV has adopted a structure more in-line with a global north venture studio in which the vehicle is structured as a permanent capital vehicle which sells equity rather than securing fund management mandates. This has allowed ACV to begin building ventures in parallel with fund raising, which the founders believe is paramount given the urgency of climate change, and the need for Africa to quickly establish itself as part of the solution. There are already two ventures in the portfolio: KOKO Networks Rwanda, a co-venture between ACV and KOKO Networks which already provides sustainable bioethanol cooking fuel to over 900,000 Kenyan families and aims to reach a million Rwandan families by 2027, and Great Carbon Valley, a Kenya based developer of direct-use clean energy applications currently focused on developing a direct air capture and permanent carbon storage site in Kenya.

ACV’s pipeline of further opportunities demonstrates the breadth and versatility of the venture builder. They range from biochar and enhanced rock weathering technologies, to biodigester and e-mobility businesses, to harvesting carbon revenue for green growth across the portfolio of a well-established continental private equity fund. These are businesses and technologies which have the capacity to transform African economies and make a meaningful difference in climate change but they require risk capital and hands on venture builders to scale, attract further investment, and reach their potential.

FSDAi’s investment in ACV takes the form of a convertible loan of £1 million to support the venture builder’s formalisation and build additional ventures as demonstrations to attract investment from larger funds. On top of this investment, FSD Africa will provide £75,000 in grant funding to support the development of premium carbon credits and the marketing of portfolio and pipeline companies. Moving forward, FSDAi has secured the right to invest up to £8 million in ACV’s planned 2024 close.

FSDAi is the investment arm of specialist financial development agency FSD Africa which receives funding from the UK government and provides tools and resources to drive large-scale change in financial markets and support sustainable economic development. ACV is the latest in a series of investments by FSDAi in innovative green investment vehicles including Persistent Energy, a leader and pioneer investor in the off-grid energy and e-mobility sectors in Sub-Saharan Africa, and Nithio, which invests in renewable off-grid energy.

FSDAi has committed to support ACV on the basis that its activities will actively contribute to Africa’s transition to net-zero, the promotion and acceleration of the continent’s green sector, and the creation of quality, skilled jobs (around 600 will be created via this initial £1 million investment) in a strategically vital sector. Ultimately, FSD Africa believes that ACV can help the continent’s businesses participate in global carbon markets and capitalise on the continent’s unrivalled capacity for profitable climate-smart businesses. Moreover, FSDAi’s investment aligns with the emerging priorities of African policymakers who will gather in Kenya in September at the Africa Climate Summit to co-ordinate a unified, collective pan-African approach to the discussions at the next COP in Dubai.

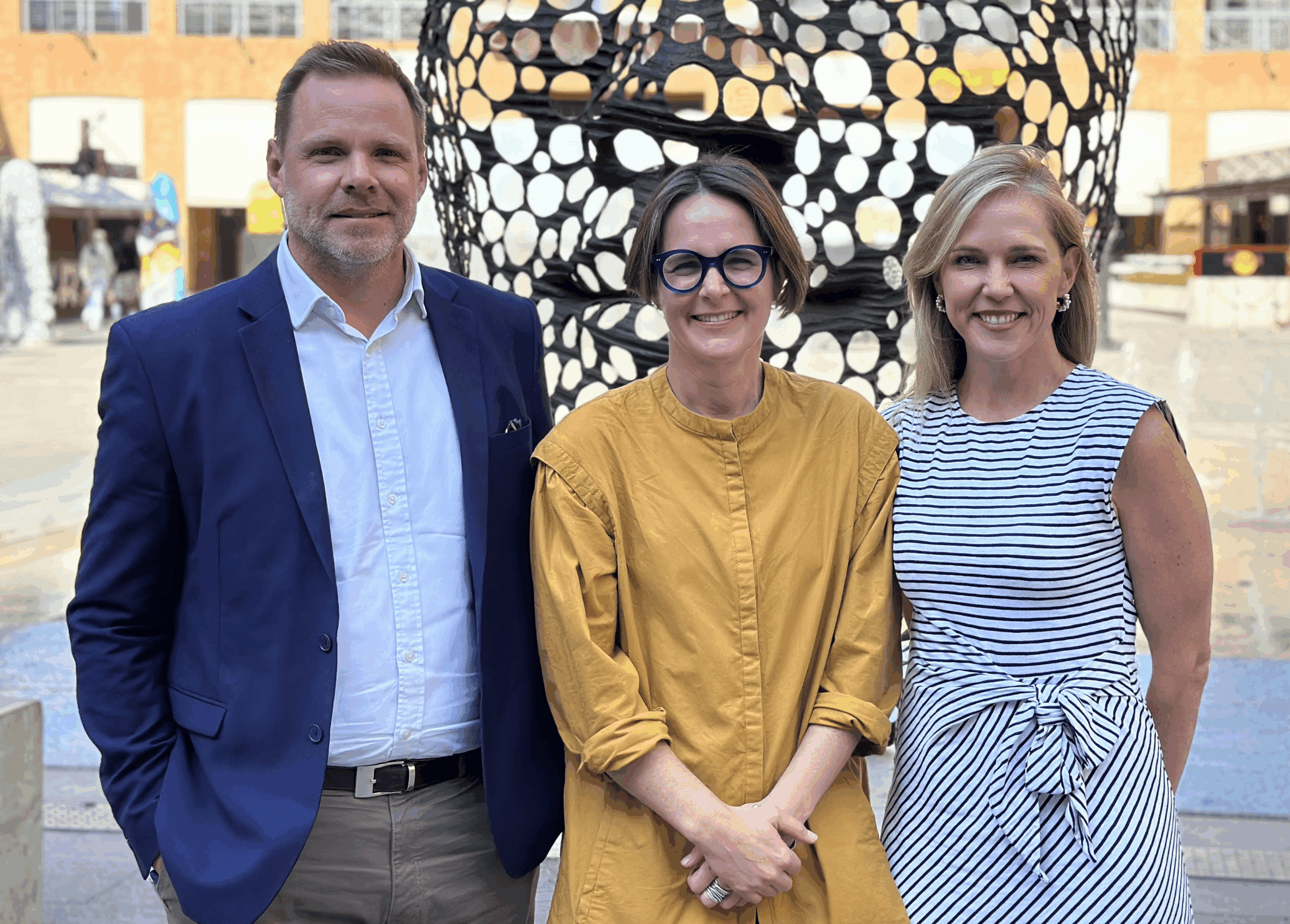

Anne-Marie Chidzero, CIO of FSD Africa Investments, said: “In backing the ACV partners, FSDAi sees a tremendous opportunity to galvanise global investment and finance to promote Africa’s status as the pre-eminent climate investment destination.’’

James Mwangi, CEO of Africa Climate Ventures, said: “We are thrilled that FSDAi has joined us in building ACV. The involvement of FSDAi has already been invaluable in refining the ACV model. As we work towards ambitious objectives, we believe FSDAi will be a key partner in ensuring our success.”

Rachel Turner, Director, International Finance, Foreign, Commonwealth & Development Office, said: “We are excited to be supporting this enterprising partnership between FSD Africa and ACV. The need to mobilise climate finance for Africa has never been greater, and this can’t happen without innovations that can build the pipeline of opportunities to absorb and deploy capital into productive, sustainable and inclusive uses. Tapping into the developing carbon market ecosystem represents a significant opportunity for Africa to raise capital at affordable terms whilst contributing directly to the climate challenge. This partnership with an impressive African team is pioneering in its approach.”