FSDAi Nyala Facility invests US$ 1 million in First Circle Capital Africa Fund I FSDAi Nyala Facility BV, a facility set up by FSD Africa Investments to invest in emerging local capital providers is injecting US$1 million into Africa-based specialist VC fund First Circle Capital. Run by former entrepreneurs and fintech executives Selma Ribica and Agnes Aistleitner Kisuule, First Circle invests in the continent’s most promising early-stage financial technology companies, leveraging the partners’ industry network and expertise with an angel investment track record at 33x MOIC.

First Circle focuses on insurtechs, financial infrastructure and climate fintechs. Other areas the fund

invests in is fintech Software as a Service (SAAS), Reg Tech and Alternative Lending Model firms. The team has built a portfolio of 13 investments so far in these areas, across 7 African markets.

Announcing FSDAi Nyala Facility’s investment, FSDAi’s Chief Investment Officer, Anne-Marie Chidzero said: “We are thrilled to back this promising GP team of remarkable female investors. First Circle stands out in the market as a thesis-led specialized fund with great depth of expertise and strategy in the fintech sector. We believe that FSDAi Nyala Facility’s backing will catalyse more institutional LPs into First Circle Capital Africa Fund I”.

According to BCG and the recent QED report, Africa is the fastest growing fintech region in the world, expected to grow its revenues by a staggering 13x by 2030. In Africa, fintech is well posed to resolve financial services access issues for the continent’s excluded and underserved population and SMEs, and to address its young population’s needs. Most Africans’ first interaction with the financial services sector may be through their smartphones, and BCG projects a fintech revenue CAGR of 32% until 2030, with South Africa, Nigeria, Egypt, and Kenya being the key markets.

Selma Ribica and Agnes Kisuule, Co-Founding partners of First Circle Capital commented:

“Expanding access, availability and stability of financial services for African consumers as well as SMEs is critical for economic development and social resilience. The majority of fintech funding to date has gone into payments, hence investing in the next layer of financial services poses a significant opportunity. We are investing in Africa’s most innovative entrepreneurs building the next layer of financial products, that enable and expand access to financial services for individuals and SMEs across Africa. We are excited to have FSDAi Nyala Facility as our first institutional partner, especially given FSD Africa’s track record in deepening access to financial services on the continent.”

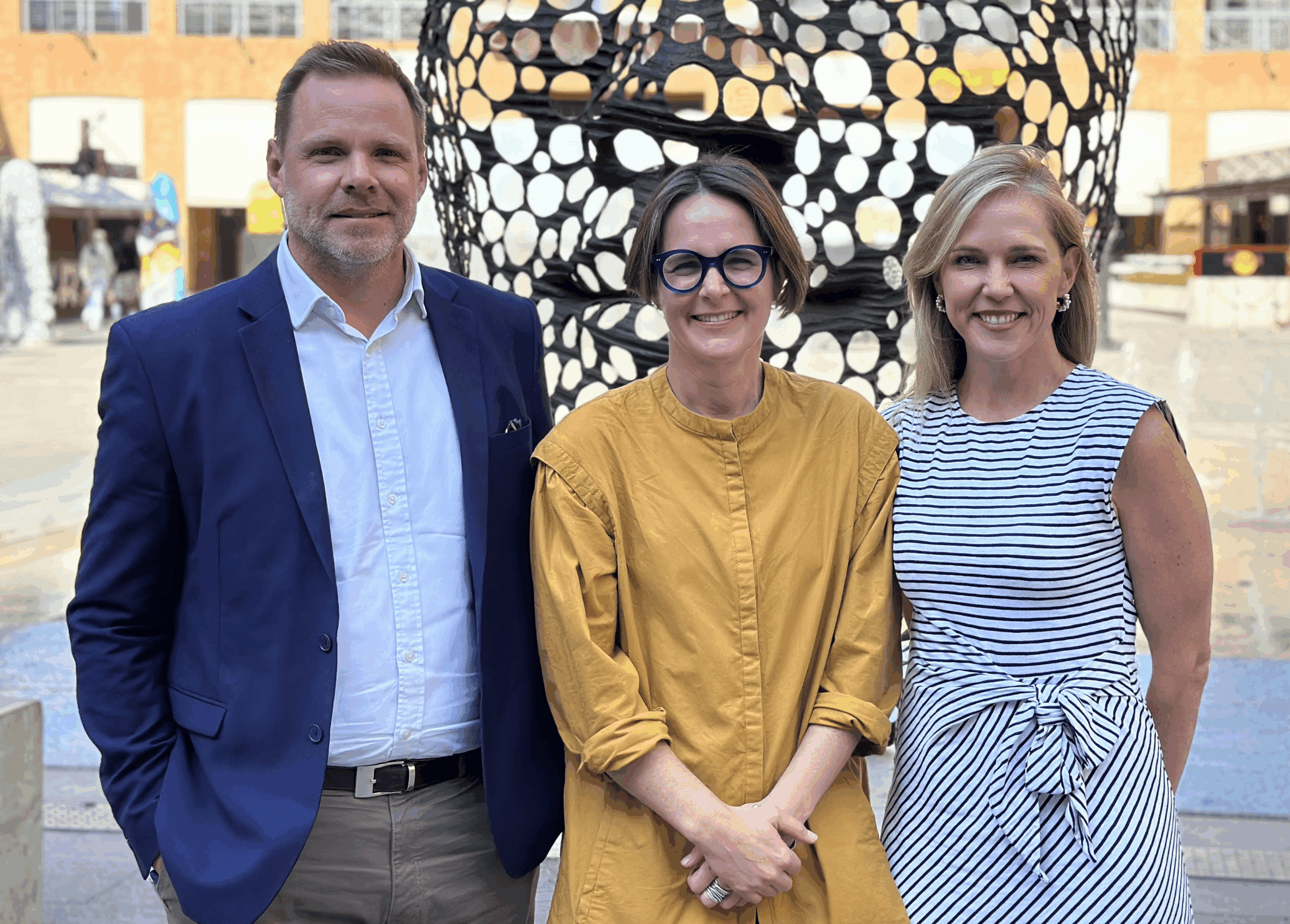

Co-founders and managing partners are former M-Pesa executive and FinTech investor Selma Ribica based in Morocco and former emerging markets entrepreneur Agnes Aistleitner Kisuule based in Kampala. Selma’s angel portfolio is at 33x MOIC in early stage fintech and includes companies such as Qonto, Tabeo, Expensya and Agnes has previously built businesses in Jordan, Ukraine and Uganda.

The fund has offices in Kampala and Casablanca. With their team, the managers are leveraging their operational know-how as successful operators, previous track record, and strong network across Africa and internationally to support portfolio companies with fundraising and growth.

First Circle Africa Fund I is backed by FSDAi Nyala Facility, Axian Group, and several serial entrepreneurs and investors.