The importance of insurance has been amplified in the face of the Covid-19 pandemic

The Covid-19 pandemic constitutes one of the largest shocks to the African continent in recent times; in 2020, GDP contracted by 2.1% across Africa, costing the region at least $115 billion and pushing 30 million Africans into extreme poverty (AFDB, 2021; World Bank, 2020). Beyond this negative impact, the pandemic has also amplified the importance of the insurance sector’s role in the development of and support of the resilience of businesses and individuals. Insurance can help manage risks and transfer funds to individuals and businesses when unexpected crises like Covid-19 hit, and it can aid in economic recovery by enabling capital to flow into investments and lending practices.

Covid-19 disrupted and exacerbated weaknesses within the insurance sector

Despite being part of the solution, the insurance sector itself has also been affected by the pandemic. Research conducted by FSD Africa, Cenfri and the Oanisation of Eastern and Southern African Insurers (OESAI) in mid-2020 found that the pandemic affected insurers’ operations, negatively impacting their ability to launch new products, conclude new sales, collect premiums, service existing customers and process and pay claims.

The operations of insurance regulators were also significantly disrupted

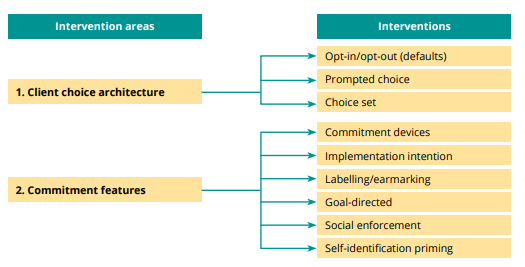

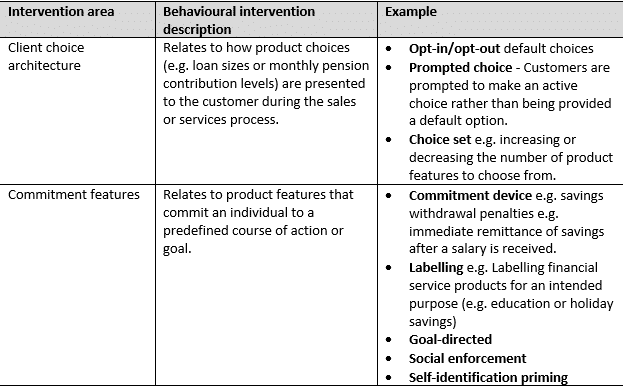

In seeking to fulfil their core mandates of market stability, consumer protection and (in some cases) insurance market development, insurance regulators across sub-Saharan Africa (SSA) have had to perform a balancing act between offering regulated entities regulatory relief during a challenging time and monitoring vulnerabilities in the market closely. Research conducted in 2020 by FSD Africa and Cenfri found that different regulators chose to prioritise different sides of this trade-off. Some insurance regulators eased up on their usual regulatory requirements in an attempt to enable regulated entities to enhance their capacity to respond to Covid-19. Oers placed greater emphasis on the set of issues arising from the pandemic, such as the potential for the face-to-face nature of insurance business in their markets to spread the virus. Despite these challenges, the research also found that opportunities emerged for regulators to enhance market efficiency and stability through digitalisation and careful market consolidation, as well as improve the efficiency of their reporting and supervision processes through new solutions, such as regulatory technology (regtech) and supervisory technology (suptech).

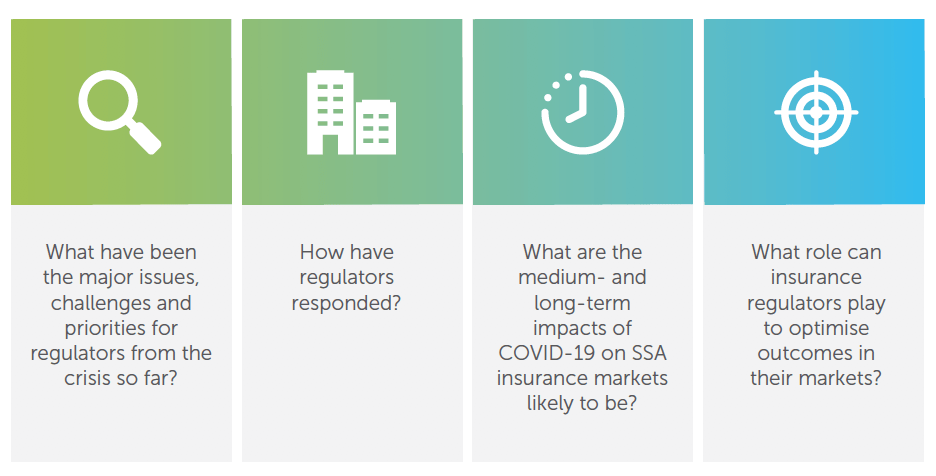

Assessment of long-term impacts to identify how to build back better

Covid-19 is far from over. A year on from when the previous study was conducted, our current research takes stock of the ongoing impacts through a future-looking perspective, to assess which regulatory responses have (or have not) been effective and to identify what the imperatives and opportunities for regulators are to support stable, sustainable and growing insurance markets. The aim of this research is to shed light on the actions needed to ensure the resilience and stability of African insurance markets in the medium- to long-term, while also encouraging market development, growth and inclusion. Furthermore, understanding which regulatory responses to the pandemic were most and least effective can provide important guidance for regulatory authorities on how to respond to the next systemic crisis – be it a pandemic, a significant cyber incident, a major natural disaster or widespread political protests or riots.