Nearly a year ago, we joined the A2ii in Abidjan to sit down with a roomful of regulators to discuss the challenges and imperatives CIMA faces in regulating mobile insurance at the CIMA-A2ii Workshop on Mobile Insurance Regulation. In the CIMA context, as with most countries in Africa, mobile network operators (MNOs) and the technical service providers (TSPs) that support them are emerging as key players in extending the reach of insurance. The discussions at the workshop focused on how insurance regulators can broaden their focus to include these MNOs and TSPs, as well as how to cooperate across different regulatory authorities.

A year on, these considerations remain as valid as ever, but we have come to realise that there is more at stake than m-insurance. Digital technology is changing the insurance landscape as we know it by paving the way for new players and business models with the potential to rapidly expand coverage. This is causing a re-think of how insurance is traditionally delivered. In addition, while m-insurance remains important, looking beyond m-insurance to the broader insurtech field is important to truly understand the opportunities technology provides to change the game in inclusive insurance and the associated risks.

Thus far, the insurtech debate has largely focused on developed country opportunities. But the tide is turning. My colleagues and I recently scanned the use of insurtech in the developing world to see what the potential is for addressing challenges in inclusive insurance. We found more than 90 initiatives in Asia, Latin America and sub-Saharan Africa that fit the bill. What we saw is that the “insurtech effect” is happening in two ways.

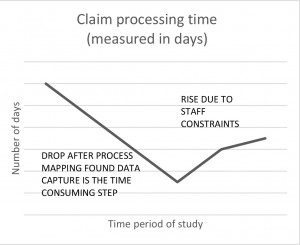

Firstly, digital technology is a tool to make insurance as we know it better: it is being used as a backbone to various elements of the insurance life cycle, in an effort to streamline processes, bring down costs and enable scale. Examples include new ways of data collection, communication and analytics (think big data, smart analytics, telematics, sensor-technology, artificial intelligence – the list goes on), as well as leveraging mobile and online platforms for front and back-end digital functionality (such as roboadvisors, online broker platforms, mobile phone or online claims lodging and processing, to name a few!).

It also allows for more tailored offerings: on-demand insurance initiatives are covering consumers for specific periods where they need that cover, for example for a bus ride, on vacation or when borrowing a friend’s car for one evening, while advances in sensor technology mean that insurers can adapt cover and pricing based on usage, for example allowing customers to only pay car insurance for the kilometres they actually drive every month.

In all of the above, digital technology, including the application of blockchain for smart contracting and claims, makes the process seamless.

Secondly, digital technology is a game changer. In many ways, it is changing the way insurers do business, design and roll out their products, and, importantly, who is involved in the value chain. Peer to peer platforms (P2P) are a much-discussed example of these next generation models. They are designed to match parties seeking insurance with those willing to cover these risks. The revolutionary element lies in the ability to cover risks that insurers usually shy away from due to the lack of data to adequately price the risks – all now enabled by digital technology. But these platforms are often positioned in regulatory grey areas: if all the platform does is match people to pool their own risks, does it then need a licensed insurer involved? And if advice is provided by a robot powered by an algorithm, who is ultimately accountable?

No wonder insurance supervisors are sitting up straight when you mention the word “tech”. As Luc Noubussi, microinsurance specialist at the CIMA secretariat, said at the 12th International Microinsurance Conference in Sri Lanka late last year: “Technology can have a major impact on microinsurance, but change is happening fast and regulators need to understand it”.

So, how do they remain on the front foot in light of all of this, what different functions, systems and players do they need to take into account and what are the risks arising? In short: how can they best facilitate innovation while protecting policyholders? Front of mind is how current regulatory and supervisory frameworks should accommodate new modalities, functions and roles – many of them outside the ambit of “traditional” insurance regulatory frameworks – and what cooperation is required between regulatory authorities to achieve that.

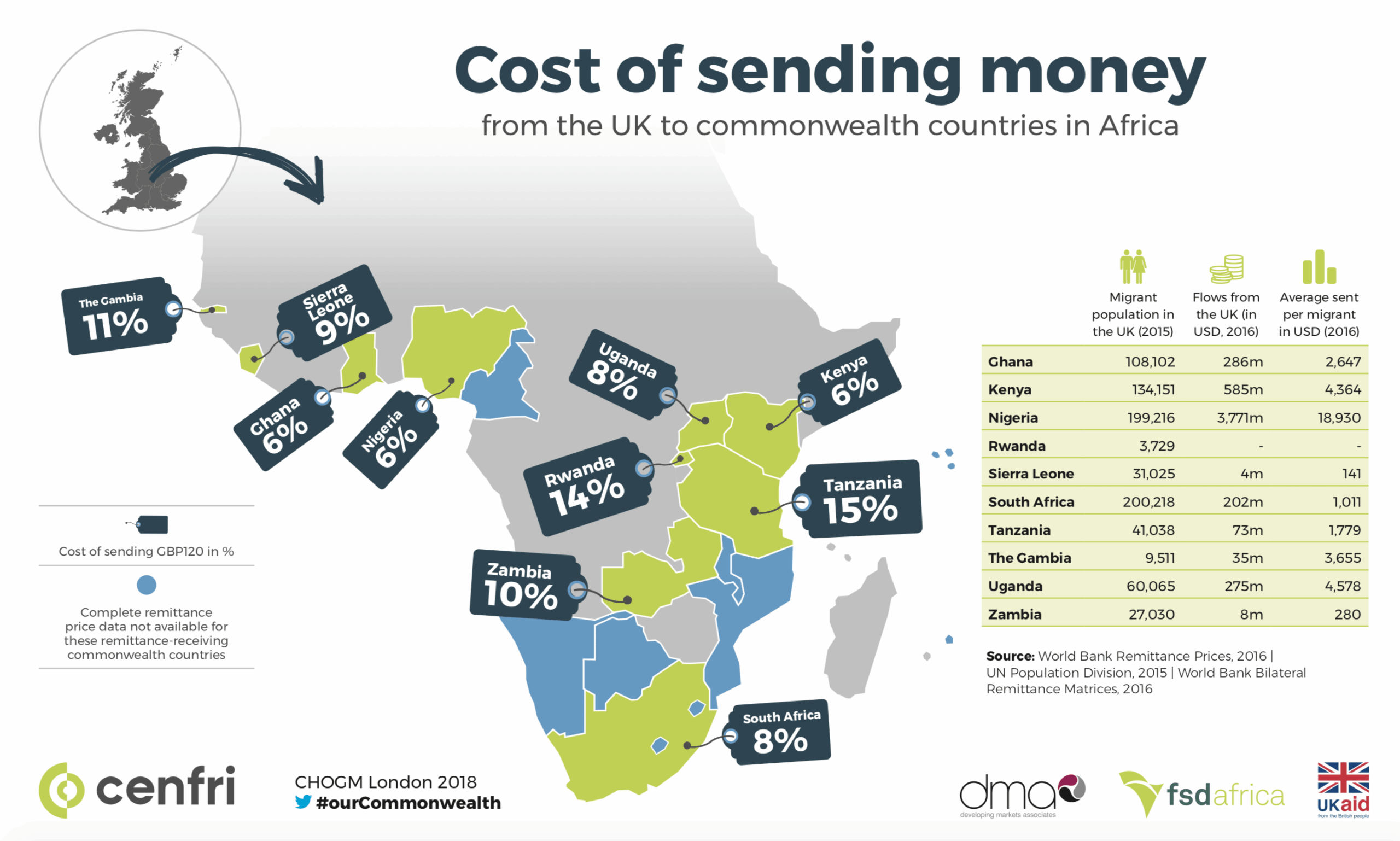

Two weeks from now we’ll again be sitting down with regulators from sub-Saharan Africa for the Mobile Insurance Regulationconference hosted in Douala, Cameroon, from 23 – 24 February 2017 by the A2ii, the IAIS and the 14 state West-African insurance regulator, CIMA, supported by UK aid, FSD Africa and the Munich Re Foundation. This conference will delve into the opportunities that mobile insurance present and the considerations for regulators and supervisors in designing and implementing regulations to accommodate it. The imperative to find an m-insurance regulatory solution remains, but it is clear that the horizon has broadened: at play is the way that insurance is done across the product life cycle, who the players are in the value chain and, at times, the very definition of insurance.

As we suggested in an earlier blog, this could be microinsurance’s Uber moment, but then regulators need to be on-board. We look forward to taking part in the discussions to see how supervisors plan to do just that.