PREAMBLE

We, the African Heads of State and Government, gathered for the inaugural Africa Climate Summit (ACS) in Nairobi, Kenya, from 4th to 6th September 2023; in the presence of other Global Leaders, Intergovernmental Organizations, Regional Economic Communities, United Nations Agencies, Private Sector, Civil Society Organizations, Indigenous Peoples, Local Communities, Farmer Organizations, Children, Youth, Women and Academia:and Government in the presence of global leaders and high-level representatives on 6 September 2023 in Nairobi Kenya

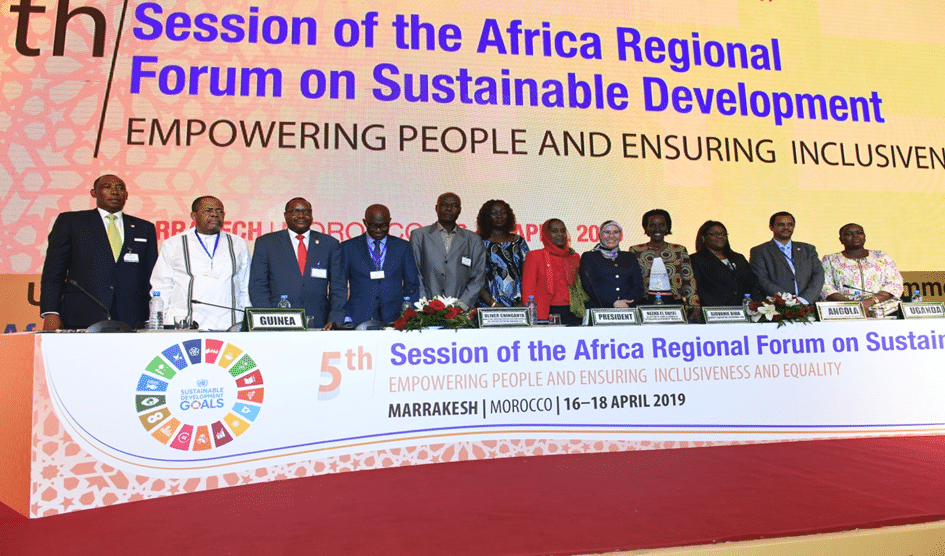

- Recall the Assembly Decisions (AU/Dec.723(XXXII), AU/Dec.764 (XXXIII) and AU/Dec.855(XXXVI)) requesting the African Union Commission to organize an African Climate Summit and endorsing the offer by the Republic of Kenya to host the Summit;

- Commend E Dr. William Samoei Ruto, President of the Republic of Kenya, and Chair of the Committee of African Heads of State and Government on Climate Change (CAHOSCC) for providing the political leadership of an African vision that simultaneously pursues climate change and development agenda;

- Commend also E Moussa Faki Mahamat, the Chairperson of the African Union Commission (AUC), for his dedication and commitment towards the convening of the Summit;

- Further Commend the Arab Republic of Egypt for the successful COP27 and its historic outcomes, particularly regarding loss and damage, just transition and energy, and call for the full implementation of all COP27 decisions;

- Acknowledge that climate change is the single greatest challenge facing humanity and the single biggest threat to all life on Earth, demanding urgent and concerted action from all nations to lower emissions and reduce the concentration of greenhouse gases in the atmosphere;

- Take Note of the 6th Assessment Report (AR6) of the Intergovernmental Panel on Climate Change (IPCC), stating that the world is not on track to keeping within reach the 1.5°C limit agreed in Paris and that global emissions must be cut by 43% in this decade;

- Underscore the IPCC confirmation that Africa is warming faster than the rest of the world and if unabated, climate change will continue to have adverse impacts on African economies and societies, and hamper economic growth and wellbeing;

- Recognise that Africa is not historically responsible for global warming, but bears the brunt of its effects, impacting lives, livelihoods, and economies;

- Reaffirm the principles set out in the United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement, namely equity, common but differentiated responsibilities and respective capabilities;

- Express concern that many African countries face disproportionate burdens and risks arising from climate change-related unpredictable weather events and patterns, including prolonged droughts, devastating floods, out-of-season storms, and wildfires, which cause massive humanitarian crisis with detrimental impacts on economies, health, education, peace and security, among other risks;

- Recall that only seven years remain to achieve the Sustainable Development Goals of the 2030 Agenda, and note with concern that 600 million people in Africa still lack access to electricity while about 970 million lack access to clean cooking;

- Further note that extreme weather events and changes in water cycle patterns are making it more difficult to access safe drinking water, resulting in about 400 million people in Africa having no access to clean drinking water and 700 million without good sanitation;

- Further recognise that African cities and urban centres are growing rapidly, and by 2050 would be home to over 1.0 billion people. Cognisant of the fact that rapid urbanization, poverty, and inequality limit planning capacities and other urban dynamics which increase people’s exposure and vulnerability to hazards and have thus turned cities into disaster hotspots across the continent;

- Concerned that despite Africa having an estimated 40 percent of the world’s renewable energy resources, only $60 billion or two percent of US$3 trillion renewable energy investments in the last decade have come to Africa;

- Reiterate Africa’s readiness to create an enabling environment, enact policies and facilitate investments necessary to unlock resources to meet our own climate commitments, and contribute meaningfully to decarbonisation of the global economy;

- Recognise that Africa’s vast forests, especially the Congo Basin rainforest are the largest carbon sinks globally, and the important ecosystem services provided by Africa’s vast savannahs, Miombo woodlands, peatlands, mangroves, and coral reefs, it is time that Africa’s natural capital wealth is properly measured by recognizing its contribution to reducing global carbon emissions;

- Further recognise the critical importance of the oceans in climate action and commitments made on ocean sustainability in multiple fora such as the Second UN Oceans Conference in 2022, and the Moroni Declaration for Ocean and Climate Action in Africa in 2023;

- Emphasise that Africa possesses both the potential and the ambition to be a vital component of the global solution to climate As home to the world’s youngest and fastest-growing workforce, coupled with massive untapped renewable energy potential, abundant natural assets and an entrepreneurial spirit, our continent has the fundamentals to spearhead a climate compatible pathway as a thriving, cost-competitive industrial hub with the capacity to support other regions in achieving their net zero ambitions;

Now hereby identify the following to be critical agendas for urgent collective action at the continental and global level:

- We call upon the global community to act with urgency in reducing emissions, fulfilling its obligations, honouring past promises, and supporting the continent in addressing climate change, specifically to:

-

- Accelerate all efforts to reduce emissions to align with goals of the Paris Agreement

- Honour the commitment to provide $100 billion in annual climate finance, as promised in 2009 at the UNFCCC COP15 in Copenhagen, Denmark

- Uphold commitments to a fair and accelerated process of phasing down unabated coal power and phase out of inefficient fossil fuel subsidies while providing targeted support to the poorest and most vulnerable in line with national circumstances and recognizing the need for support towards a just transition.

-

- We call for climate-positive investments that catalyse a growth trajectory anchored in the industries poised to transform our planet and enable African countries to achieve stable middle-income status by

- We urge global leaders to join us in seizing this unprecedented opportunity to accelerate global decarbonization, while pursuing equality and shared prosperity.

- We call for the operationalization of the Loss & Damage fund as agreed at COP27 and resolve for a measurable Global Goal on Adaptation (GGA) with indicators and targets to enable assessment of progress against negative impacts of climate change.

In recognition of the scale, urgency and importance of these collective actions, we commit to:

- Develop and implement policies, regulations and incentives aimed at attracting local, regional and global investment in green growth, inclusive of green and circular economies;

- Propel Africa’s economic growth and job creation in a manner that reflects our commitments to the Paris Agreement and also aids global decarbonization efforts, by leapfrogging the traditional progression of industrial development and fostering green production and supply chains on a global scale;

- Focus our economic development plans on climate-positive growth, including expansion of just energy transitions and renewable energy generation for industrial activity, climate smart and restorative agricultural practices, and essential protection and enhancement of nature and biodiversity;

- Promote clean cooking technologies and initiatives as a just energy transition and gender equality for African rural women, youth, and children;

- Strengthen actions to halt and reverse biodiversity loss, deforestation, and desertification, as well as restore degraded lands to achieve land degradation neutrality; and implement the Abidjan declaration on achieving gender equality for successful land restoration;

- Strengthen continental collaboration, which is essential to enabling and advancing green growth, including but not limited to regional and continental grid interconnectivity, and further accelerating the operationalization of the Africa Continental Free Trade Area (AfCFTA) Agreement;

- Advance green industrialization across the continent by prioritizing energy-intense industries to trigger a virtuous cycle of renewable energy deployment and economic activity, with a special emphasis on adding value to Africa’s natural endowments;

- Promote investments in reskilling to unlock the human capital that will power for Africa’s inclusive green transition;

- Redouble our efforts to boost agricultural yields through sustainable agricultural practices, to enhance food security while minimizing negative environmental impacts;

- Contribute to the development of global standards, metrics, and market mechanisms to accurately value and compensate for the protection of nature, biodiversity, socio-economic co-benefits, and the provision of climate services;

- Finalise and implement the African Union Biodiversity Strategy and Action Plan, with the view to realizing the 2050 vision of living in harmony with nature;

- Provide all the necessary reforms and support required to raise the share of renewable energy financing to at least 20 percent by 2030;

- Promote the production of green hydrogen and hydrogen derivatives such as green fertilizer and synthetic fuels;

- Integrate climate, biodiversity and ocean agendas into national development plans and processes to increase resilience of local communities and national economies;

- Promote regenerative blue economy and support implementation of the Moroni Declaration for Ocean and Climate Action in Africa, and the Great Blue Wall Initiative, whilst recognising the circumstances of Africa’s Island States;

- Support smallholder farmers, indigenous peoples, and local communities in the green economic transition, given their key role in ecosystems stewardship;

- Identify, prioritize, and mainstream adaptation into development policy-making and planning, including in the context of Nationally Determined Contributions (NDCs);

- Build effective partnerships between Africa and other regions, to meet the needs for financial, technical and technological support, and knowledge sharing for climate change adaptation;

- Promote investments in urban infrastructure including through upgrading informal settlements and slum areas to build climate resilient cities and urban centres;

- Strengthen early warning systems and climate information services, as well as taking early action to protect lives, livelihoods and assets and inform long-term decision-making related to climate change risks. We emphasise the importance of embracing indigenous knowledge and citizen science in both adaptation strategies and early warning systems;

- Support implementation of the Africa Water Investment Programme (AIP), which aims to close the Africa water investment gap by mobilising US$30 billion by 2030;

- Enhance drought resilience systems to shift from crisis management to proactive drought preparedness and adaptation, to significantly reduce drought vulnerability of people, economic activities, and ecosystems;

- Further enhance our inclusive approach including through engagement and coordination with the children, youth, women, persons living with disabilities, indigenous people, and communities in climate vulnerable situations;

- Accelerate implementation of the African Union Climate Change and Resilient Development Strategy and Action Plan (2022-2032)

CALL TO ACTION:

- We call upon world leaders to recognise that decarbonizing the global economy is an opportunity to contribute to equality and shared

- We invite Development Partners from the global north and south to align technical and financial support to Africa for sustainable utilization of Africa’s natural assets for low carbon development that contributes to global decarbonization.

- To accomplish this vision of economic transformation in harmony with our climate needs, we further call upon the international community to contribute to the following:

- Increase Africa’s renewable generation capacity from 56 Giga Watts (GW) in 2022 to at least 300 GW by 2030, both to address energy poverty and to bolster the global supply of cost-effective clean energy for industry.

- Shift exports of energy intensive primary processing of Africa’s raw material back to the continent, to serve as an anchor demand for our renewable energy and a means of rapidly reducing global

- Access to, and transfer of environmentally sound technologies, including technologies to support Africa’s green industrialisation and transition.

- Design global and regional trade mechanisms in a manner that enables products from Africa to compete on fair and equitable

- Request that trade-related environmental tariffs and non-tariff barriers must be subject to multilateral discussions and agreements and not be unilateral, arbitrary or discriminatory measures.

- Accelerate efforts to decarbonize the transport, industrial and electricity sectors through the use of smart, digital and highly efficient technologies such as green hydrogen, synthetic fuels and battery storage.

- Design industry policies that incentivize global investment to locations that offer the most and substantial climate benefits, while ensuring benefits for local communities.

- Implement a mix of measures that elevate Africa’s share of carbon markets.

- Reiterate the decision 1/COP27 that states that global transformation to a low-carbon economy is expected to require investment of at least USD 4 – 6 trillion per year and delivering such funding in turn requires a transformation of the financial system and its structures and processes, engaging governments, central banks, commercial banks, institutional investors and other financial actors.

- We call for collective global action to mobilise the necessary capital for both development and climate action, echoing the statement of the Paris Pact for People and the Planet, that no country should ever have to choose between development aspirations and climate action.

- Call for concrete, time-bound action on the proposals to reform the multilateral financial system currently under discussion specifically to:

- Build resilience to climate shocks, including better deployment of the Special Drawing Rights (SDRs) liquidity mechanism and disaster suspension clauses.

- Re-channeling of at least $100billion of SDRs to Africa, including through institutions such as the African Development Bank which will be able to leverage the SDRs by three to four times. We also call for the formation of a group of SDR donors to expedite this re- channeling ahead of COP28.

- Propose for consideration a new SDR issue for climate crisis response of at least the same magnitude as the Covid19 issue (US$650 billion).

- Better leverage of the balance sheets of MDBs to scale up concessional finance to at least $500b per year.

- Improve debt management, including:

- the inclusion of ‘debt pause clauses’, and

- the proposed expert review of the Common Framework and the Debt Sustainability Analysis.

-

- Provide interventions and instruments for new debt relief to pre-empt debt default to:

- extend sovereign debt tenor, and

- include a 10-year grace

- Provide interventions and instruments for new debt relief to pre-empt debt default to:

-

- Decisively act on the promotion of inclusive and effective international tax cooperation at the United Nations with the aim to reduce Africa’s loss of US$ 27 billion annual corporate tax revenue through profit shifting, by at least 50% by 2030 and 75% by 2050.

- Put additional measures to crowd in and de-risk private capital, such as blended finance instruments, purchase commitments, partial foreign exchange (FX) guarantee and industrial policy collaboration, which should be informed by the risks that drive lack of private capital deployment at

- Redesign MDB governance, to ensure a “fit for purpose” system with appropriate representation, voice, and agency of all countries.

- Decisively act on the promotion of inclusive and effective international tax cooperation at the United Nations with the aim to reduce Africa’s loss of US$ 27 billion annual corporate tax revenue through profit shifting, by at least 50% by 2030 and 75% by 2050.

- Note that multilateral finance reform is necessary but not sufficient to provide the scale of climate financing the world needs to achieve 43 percent emission reduction by 2030 required to meet the Paris Agreement goals, without which keeping global warming to 1.5 degrees celsius will be in serious jeopardy.

- Further note that the scale of financing required to unlock Africa’s climate-positive growth is beyond the borrowing capacity of national balance sheets, or at the risk premium that Africa is currently paying for private capital.

- Draw attention to the finding that inordinate borrowing costs, typically 5 to 8 times what wealthy countries pay (the “great financial divide”), are a root cause of recurring debt crises in developing countries and an impediment to investment in development and climate action.

- We call for adoption of principles of responsible sovereign lending and accountability encompassing credit rating, risk analysis and debt sustainability assessment frameworks and urge the financial markets to commit to eliminate this disparity by 2025.

- Urge world leaders to consider the proposal for a global carbon taxation regime including a carbon tax on fossil fuel trade, maritime transport and aviation, that may also be augmented by a global financial transaction tax (FTT) to provide dedicated, affordable, and accessible finance for climate-positive investments at scale, and establish a balanced, fair and representative global governance structure for its management, with an assessment of the financial implications on socio- economic impacts on Africa.

- Propose to establish a new financing architecture that is responsive to Africa’s needs including debt restructuring and relief, and the development of a new Global Climate Finance Charter through UNGA and COP processes by 2025.

- We call for revaluation of the Gross Domestic Product of Africa through the proper valuation of its abundant natural capital and ecosystem services including but not limited to its vast forests that sequester carbon to unlock new sources of wealth for Africa. This will entail the use of natural resource accounting and development of national accounting standards.

- Note that the first Global Stocktake which will conclude at COP28 offers a pivotal opportunity to correct course by including a comprehensive outcome, both backward and forward looking.

- Resolve to establish the Africa Climate Summit as a biennial event convened by African Union and hosted by AU Member States, to set the continent’s new vision, taking into consideration emerging global climate and development issues.

- Resolve also that this Declaration will serve as a strong contribution from the African continent to the global climate change process including COP 28 and beyond.

- Welcome the pledges and commitments made at the Summit to a tune of USD 26 billion from Development Partners including the European Union, the United Arab Emirates (UAE) as COP28 President- Designate, the Government of the United States, MDBs, Philanthropic Foundations, and Private Sector, to support Africa especially in the areas of renewable energy and adaptation.

- Appreciate the efforts of the United Arab Emirates as the COP28 President-Designate in the preparation of COP28 and affirm Africa’s full support for a successful and ambitious outcome of COP28.

- Request African Union Commission to develop an implementation framework for this Declaration and to make Climate Change an AU theme for the Year 2025 or 2026.

- Thank the Government and People of the Kenya for successfully hosting the inaugural Africa Climate Summit, and the warm hospitality accorded to all delegations to the Summit.

In witness of which we the African Heads of State and Government assembled in the (venue) of the Kenyatta International Convention Centre in Nairobi now make this declaration in the presence of global leaders and high-level representatives on this 6th day September 2023, in Nairobi, Kenya