Nearly one in four households in Africa are headed by women, reaching 41% in Zimbabwe, 36% in Kenya and 35% in Liberia according to the World Bank. Female-headed households have been increasing across all countries, globally. So, as well as considering the broader challenges and opportunities affordable housing creates for everyone, we should also ask: what’s the significance of housing specifically for women?

The consequences of good housing are far-reaching: the quality of housing impacts on its residents’ health and safety, their ability to function as productive members of society, and their sense of well-being in their community. Good housing contributes to good health outcomes, provides protection from the elements and supports a family’s needs throughout its life cycle. These factors have a particular impact on women. In many low-income households across Africa, whether in rural areas or in the cities, the home is still the woman’s domain. The quality of the living environment impacts partn her day-to-day experiences and capacities to meet the needs of all who depend upon her. It is for this reason that we know that women are especially keen on home improvements and often the drivers of such initiatives within their households.

Increasingly, and especially in high-unemployment contexts, the income-earning potential of housing is also being recognised. Many women identify entrepreneurial opportunities through their housing, using their homes as their business premises, running a shop on site, or working remotely. Some are renting out one or two rooms, or a structure in the backyard (see our video interviews with two female clients of Sofala’s i-build home loans project) contributing to household income. Recent research finds that poverty falls faster, and living standards rise faster, in female-headed households.

A home and its surroundings also affect a woman’s identity and self-respect. This social dimension, while less tangible, is nevertheless hugely significant. A home offers long- and short-term security for women as household members, especially those that are unmarried. Secure housing provides safe shelter and protection from homelessness after divorce, widowhood, job loss or other challenging circumstances. A key development worth noting has been that all government subsidised homes in South Africa are now registered in the names of both spouses. In short, a secure home enables more choices and more individual freedom. Having “a place to call my own” makes it possible for a woman to run her own household, that is, to become the head of the household, providing a degree of security to ride out and rebound from life’s uncertainties, such as temporary unemployment or illness.

Another impspect of home ownership is access to collateral, which enables women to access financial services and accelerate their earning potential. A savings account in a woman’s name offers a form of security and independence: a safe place to store and protect earnings. Women make better borrowers because they know that their ability to improve the home in the future depends on the reputation they develop in managing a particular loan. Women are therefore a very important part of the housing solution, and should be understood as such, by policy makers, project implementers, and service providers. In cases where women do not have title deeds for their home, banks are revolutionising the way they lend for home construction. For example, in Kenya – a country with a population of 50 million, but less than 30,000 mortgages – the Kenya Women Microfinance Bank (KWFT) has created a new loan product called “Nyumba Smart” (“smart home”). Using flexible collateral, the loans provide female customers with up to $10,000, repayable over three years, for the construction of all or part of a house.

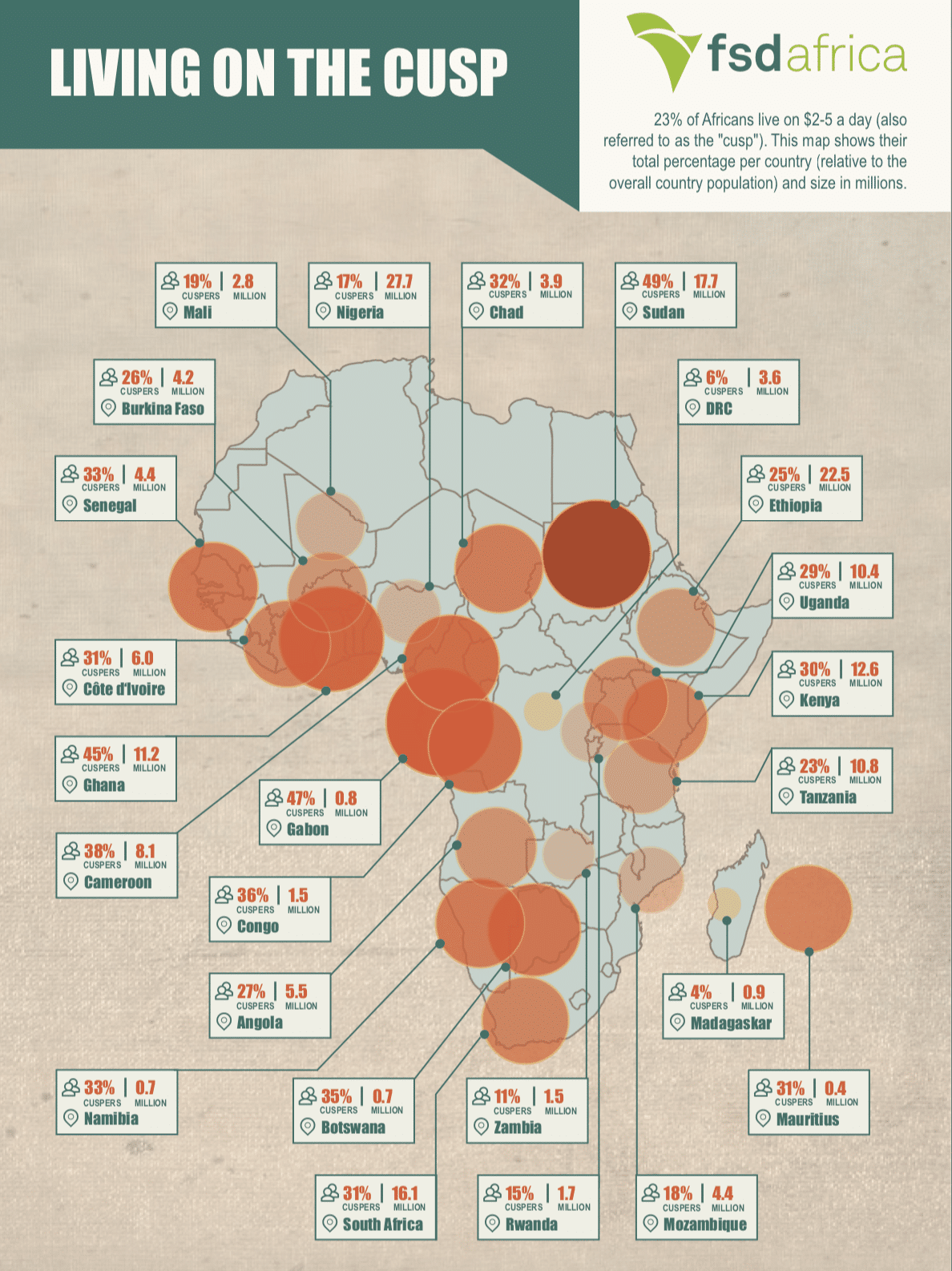

Despite this progress, over 300 million women live in African countries where cultural norms prevent equal property rights, even when there are formal, equitable property laws ouragingly, innovative technology-based tools are helping to overcome this barrier. For example, the social enterprise, Map Kibera is working on an open-source mapping platform for Nairobi’s largest slum. The objective is to give inhabitants an informal claim to their land, to lobby for services and to act as “evidence” in negotiations with municipal governments, which may otherwise bulldoze settlements with no legal title without warning.

At FSD Africa, we believe housing plays a crucial role in economic development and poverty reduction, not least for women. That is why we have partnered with the “http://housingfinanceafrica.org/”>Centre for Affordable Housing Finance in Africa (CAHF) to promote investment in affordable housing and housing finance across Africa; we have also invested in Sofala Capital, which includes Zambian Home Loans Limited and iBuild Home Loans Pty Limited as part of its group of companies. By strengthening Sofala’s balance sheet, we are enabling these companies to achieve scale with their innovative housing finance product offerin