The Ethiopian Securities Exchange (ESX) announced today the successful closing of its capital-raising exercise, surpassing by more than two-fold the amount of funds it sought to start its operations. Initiated in November 2023, with intensive efforts by its management and advisors and roadshows in Addis Ababa, Nairobi, and London, the Exchange witnessed dramatic interest by domestic and foreign commercial investors, obtaining a whopping ETB 1.51 billion (US$ 26.6 million), representing subscription of 240% of its initial target capital raise of ETB 631 million (US$ 11.07 million), with participation by a total of 48 domestic and foreign institutional investors across financial and non-financial sectors.

ESX was established in October 2023 through a pioneering public-private partnership with the Government of Ethiopia through the Ethiopian Investment Holdings (EIH), its strategic investment arm, as the founding shareholder, with a mandated total public shareholding of up to 25%, with the remaining 75% to be private shareholding.

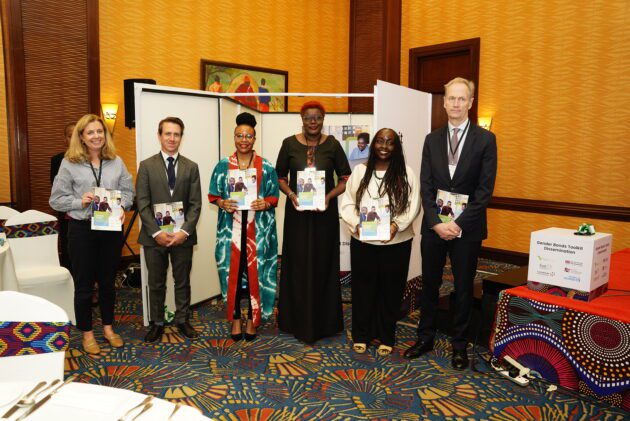

At present, the list of investors includes foreign strategic investors, including FSD Africa, the Trade and Development Bank Group (TDB), Nigerian Exchange Group (NGX), along with 16 domestic private commercial banks, 12 private insurance companies, as well as 17 other private domestic investors. Public sector interests, jointly representing 25% of shareholding, include EIH and its subsidiaries such as Ethiotelecom and the Commercial Bank of Ethiopia, among others.

The overwhelming interest as investors rallied around the Exchange, up to the close of the capital raise period, signals the enthusiasm and confidence that the ESX heralds a major milestone in the country’s journey towards financial sector development and economic transformation. By facilitating the mobilisation of capital, enhancing transparency, and promoting corporate governance standards, ESX aims to unlock new avenues for investment, spur entrepreneurship, and catalyse sustainable development across various sectors of the economy.

“We are thrilled to have exceeded all our expectations in terms of the capital raise and are excited by the overwhelming confidence shown by investors in the long-term prospects of both ESX and Ethiopia’s capital markets more broadly,” said Tilahun Esmael Kassahun (Ph.D), CEO of the ESX, adding that “strategic foreign investments by TDB, FSD Africa, and NGX Group are particularly important in allowing the transfer of technical knowhow and best practices as well as other areas of long-term strategic value that we will explore.”

ESX also announced today other progress, including the release of its draft Exchange Rulebook for public consultation, the completion of the technical evaluation for the selection of its technology provider, a major milestone to operationalising the Exchange’s trading, and issuer and investor education plans in the coming months leading up the launch of this exciting development for the Ethiopian economy.