Country: Ethiopia

11 August 2022: The African continent presents a massive investment opportunity for investors to advance the deployment of climate solutions in the coming decade according to a new report Climate Finance Innovation for Africa. However, this will require innovation in financing structures and the strategic deployment of public capital to ‘crowd-in’ private investment at levels not yet seen.

Current levels of climate finance in Africa fall far short of needs. Africa’s USD 2.5 trillion of climate finance needed between 2020 and 2030 requires, on average, USD 250 billion each year. Total annual climate finance flows in Africa for 2020, domestic and international, were only USD 30 billion (CPI forthcoming), about 12% of the amount needed.

Barriers related to shallow financial market depth, governance, project-specific characteristics, and enabling skills and infrastructure have stifled private investment in African climate solutions to date.

To overcome these challenges will require innovation in financing structures. But there is no one-size fits all. Public and private investors must tailor their financial instruments and strategies depending on the acute or chronic nature of the barriers identified.

Recommended actions for increasing the deployment of innovative finance include: Identifying and understand barriers constraining finance by sector and geography, matching instruments with barriers, matching instruments with project and technology lifecycles, enhancing engagement and co-financing with local stakeholders, and supporting innovation by establishing conducive policy and regulatory frameworks.

This work provides a framework for how these instruments and strategies can be efficiently deployed to overcome barriers to finance and capitalise climate solutions in Africa.

Read full report here.

Persistent raises $10 Million Equity Round led by Kyuden International and FSD Africa to grow climate venture building in Africa

New York, Nairobi, Tokyo: 12 July 2022 – Today, Persistent Energy Capital LLC announced that it has raised USD 10M in equity in its Series C round. The raise, which was achieved with the support of two lead institutional investors, Kyuden International Corporation and FSD Africa Investments, will enable Persistent to continue to grow its successful climate venture building business in Africa.

The equity raise took the form of Series C Preferred Units of ownership in Persistent, giving Series C investors a seat on the Board of Directors. The largest investor of this Series C round, Kyuden International Corporation (“Kyuden”), is the overseas business arm of the Japanese Kyushu Electric Power Group. Kyuden has energy investment activities and consulting services across the world and shares with Persistent a strong commitment to renewable energy and building sustainable communities. Investing in Persistent represents a strategic move for Kyuden to expand their overseas business with an established partner in Africa, where the demand for clean power and electric mobility is growing dramatically. Persistent will benefit from the expertise, know-how, and network accumulated from domestic and overseas energy businesses of Kyuden around the globe.

This successful fundraise was also achieved thanks to the catalytic patient capital provided by Financial Sector Deepening Africa Investments Ltd.

We are delighted to support Persistent as it expands its innovative climate venture building model. We look forward to working with the Persistent team to accelerate the investment needed by African entrepreneurs in the nascent and fast-growing climate sectors. The combination of Persistent’s capabilities and approach, together with FSDAi’s expertise, patient capital and focus on green finance represents a very strong proposition in areas where innovation and early-stage equity capital are highly needed.

Anne-Marie Chidzero, CIO – FSD Africa Investments

Membership to 2X Collaborative paves way for FSD Africa’s participation in the co-creation of the 2X Certification mechanism and enhances FSD Africa Investment’s co-investment, networking and partnership opportunities on gender lens investing

Nairobi: 5th July 2022: FSD Africa Investments (FSDAi), the investment arm of FSD Africa has today joined the 2X Collaborative. Launched at the UN Generation Equality Forum 2021 in partnership with GenderSmart and the Investor Leadership Network (ILN), the 2X Collaborative is a leading industry body for gender lens investing. Its mission is to convene and equip investors to increase the volume and impact of capital flowing towards women’s economic empowerment.

FSDAi’s membership to 2X Collaborative will provide access to peer learning networks, knowledge, co-investment platforms, partnership and training opportunities, and innovative investment tools. These benefits are useful for FSDAi in applying a gender lens investing framework through its investments such as Nyala Venture which provides a facility for local capital providers that are mostly women-led or apply a gender lens in their approach.

There is a huge opportunity to finance inclusive and accelerated green growth in Africa by tapping into the economic participation of women. We are therefore delighted to join the 2X Collaborative and shine a light on GLI investing to advance innovations that demonstrate the investment case for gender smart finance.

Anne-Marie Chidzero, CIO – FSD Africa Investments

I often find it difficult for most people to relate to refugees. We seem to forget that we can be in the same situation depending on the circumstances around us. The happenings in Ukraine have shown just how delicate our stability status is, and that we can quickly be turned into forcibly displaced people overnight!

While conflict, war or persecution have been traditionally viewed as the main forces giving rise to refugees, natural disasters triggered by climate change among others are fast becoming a force to reckon with. The number of forcibly displaced people has now surpassed 100 million for the first time, fueled by the war in Ukraine and other ongoing conflicts around the globe.

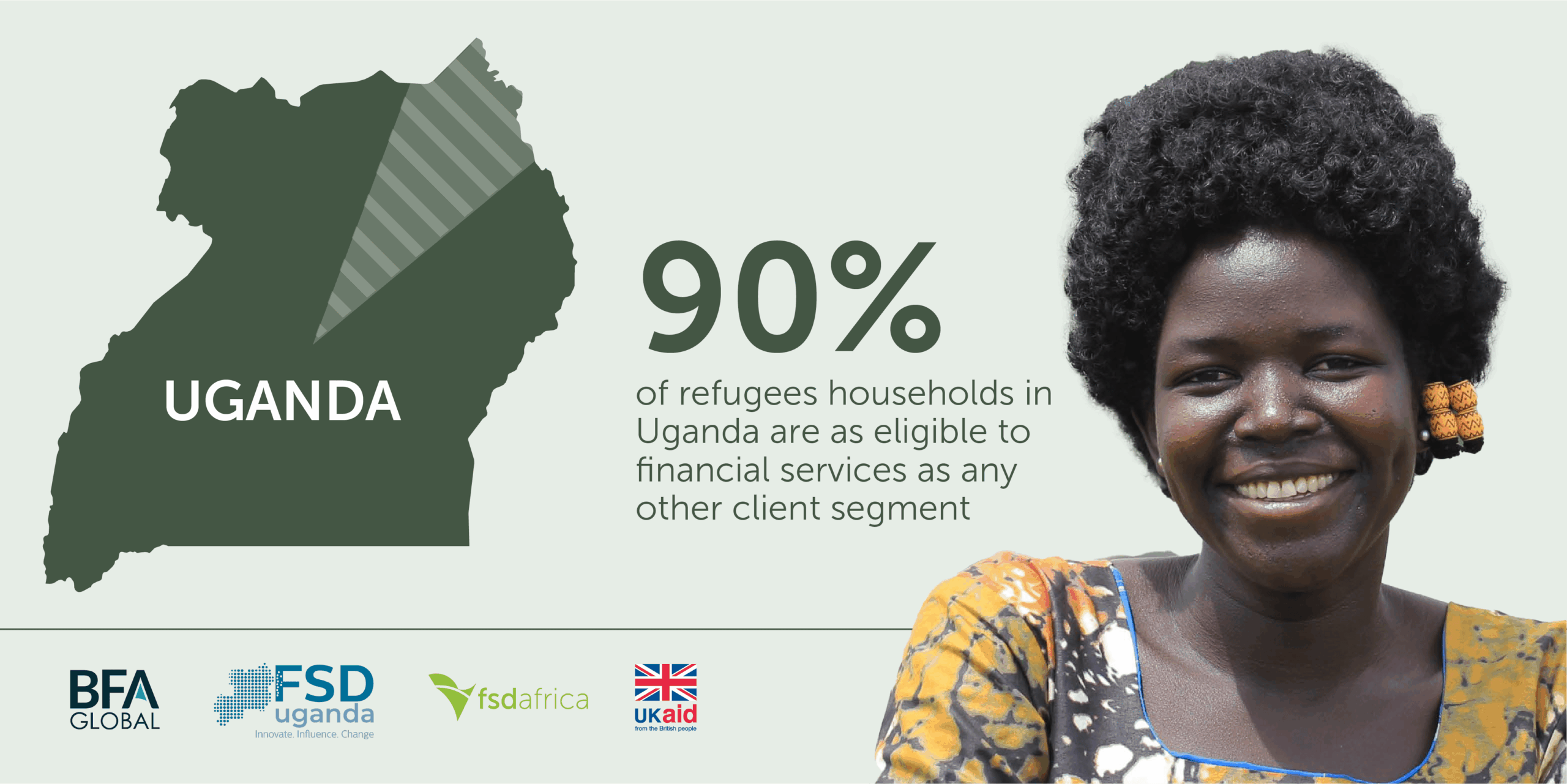

This takes me back to a scenario in June 2018 when FSD Africa, FSD Uganda and BFA Global were conducting a design sprint with 6 Ugandan financial service providers (FSPs), to develop new ideas for financial products and services for refugees in the country. The 4-day event reached a phenomenal breakthrough when one of the participants posed: “What if something happened and we found ourselves in another country as refugees? What financial services would we need?” Those two questions opened the minds of the participants and ideas started flooding in. The design sprint was one of the 4 steps that FSD Africa has been following to develop financial inclusion for refugees (FI4R) projects. The other 3 are:

- Market assessments that capture the financial lives of refugees and show the potential of serving these populations.

- Innovation competitions where FSPs are invited to pitch ideas of how they would address refugee financial needs

- Financial support and technical assistance to FSPs to develop, pilot and roll-out financial solutions.

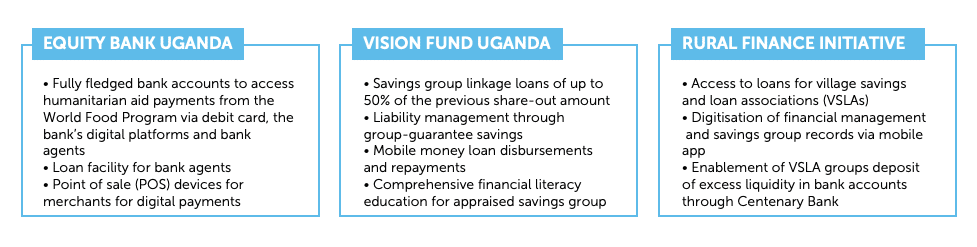

In Uganda, working with FSD Uganda, we identified Equity Bank Uganda Limited, VisionFund Uganda and Rural Finance Initiative to offer financial services in various refugee settlements from October 2019. While the project concluded in March 2022, these FSPs have continued operations as this turned out to be a viable business for them. The project engaged BFA Global as the learning and research partner. They undertook a baseline study in January 2020 and a series of 4 financial diaries (linked below) – capturing the financial needs and uses of refugee households.

The 4 financial diaries:

- Financial Inclusion for Refugees (FI4R) – Results of round 1 diaries

- Financial Inclusion for Refugees (FI4R) – Results of round 2 diaries

- Financial Inclusion for Refugees (FI4R) – Results of round 3 diaries

- Financial Inclusion for Refugees (FI4R) – Results of round 4 diaries

They then carried out an endline study in November 2021. The partners achieved the following results:

- Over 26,300 customers accessed loans, with 73% being female

- Cumulative loans amounted to £9 million ($2.7million)

- 262 bank agents were recruited across the settlements, 15% of which were women

- Over 93,300 households registered on Equity Bank Uganda’s digital platform

- 65,484 households receiving digital payments as of March 2022.

- The bank made payments worth UGX 10.8 Bn (£2.2m) during the first quarter of 2022

- 8 humanitarian agencies used the Equity Bank Uganda platform for disbursements

Below is a summary of some of the different financial services offered by the FSPs:

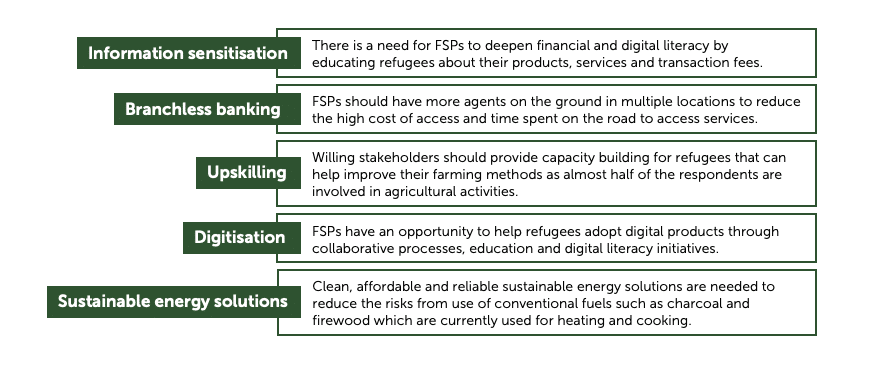

Based on the end-line study findings, there is still work to be done to improve financial services for refugees in the following areas:

Africa is highly exposed to risks associated with climate change and biodiversity loss.

In 2022, the IPCC reported with ‘high confidence’ that the continent is already experiencing significant changes from climate change and that future impact on the region will be ‘substantial’.

Effects include ongoing and accelerating changes in rainfall patterns, water availability and heatwaves with a sharp reduction in agricultural productivity – the mainstay of many African economies – and increased climate-related ill-health and mortality.

The economic consequences are likely to be severe. According to calculations by the African Climate Policy Centre are likely to be as much as a 12% contraction of Africa’s gross domestic product (GDP).

Furthermore, biodiversity loss of forests and coastal ecosystems threaten the environment and livelihoods in Africa and will contribute to an acceleration in global climate change.

Despite these risks, finance for the maintenance and enhancement of Africa’s natural capital is grossly insufficient. There is a financing gap in Africa of more than $100 billion annually. The biggest gap is in the sustainable management of landscapes and seascapes – a key area for Africa given the lower carbon intensity of its economies relative to developed countries.

Moreover, the limited finance that is available is from public sources. But domestic public budgets do not have the potential to increase sufficiently to close the financing gap by 2030.

Without a step-change in finance, we will witness an accelerated decline in biodiversity, the collapse of ecosystems and repeated climate disasters leading to the reversal of decades of poverty reduction and economic growth in the region as well as the acceleration of the global climate crisis.

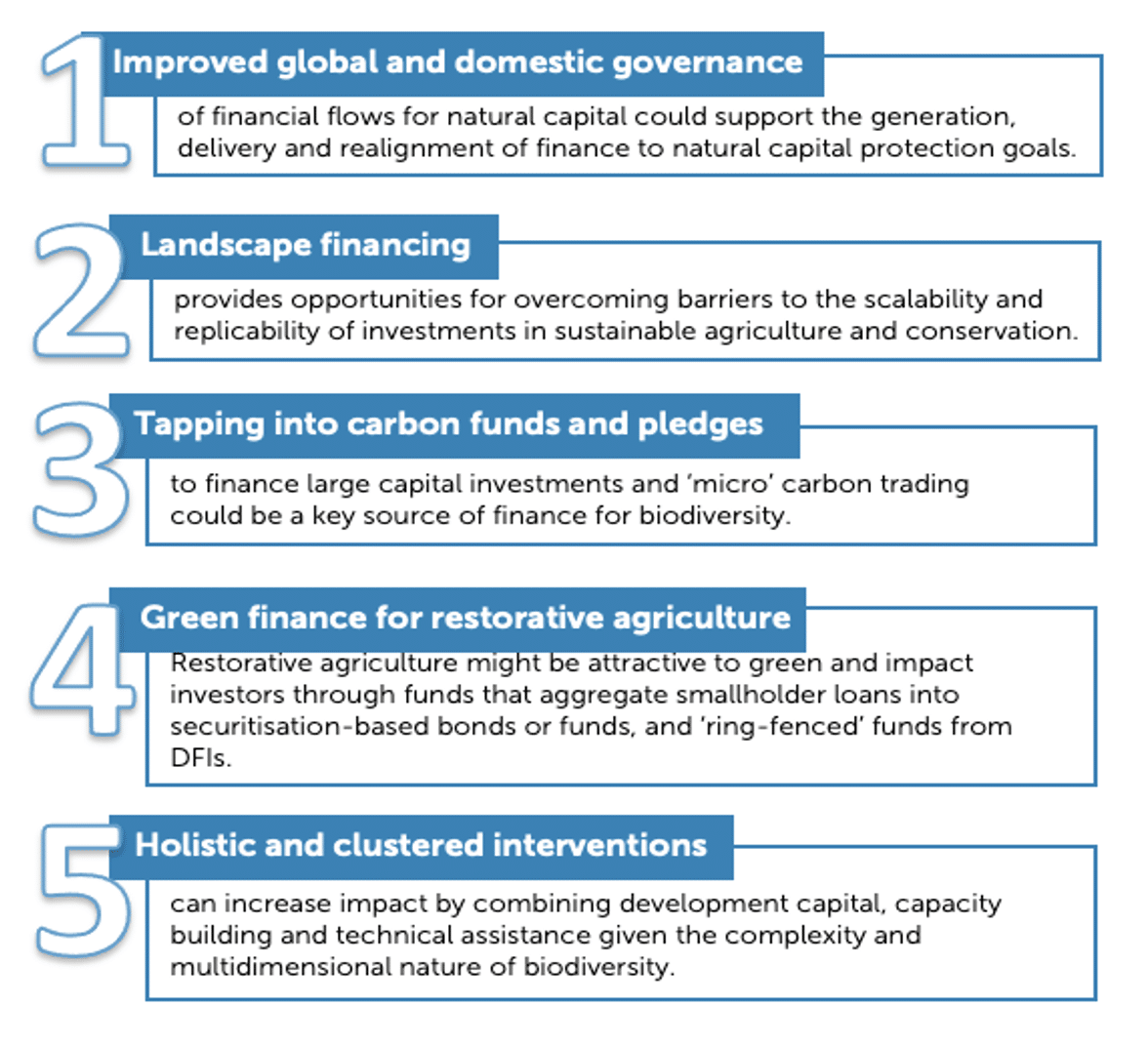

Given these challenges, this study, commissioned together with ODI, suggests five key approaches to greater mobilisation of finance for biodiversity in the region:

The launch of FSD Ethiopia and partnerships with Ethiopia Investments Holding will enhance efforts to deliver beneficial development and financial outcomes for a stronger more resilient national economy.

Ethiopia’s financial markets have been boosted by a series of announcements and commitments by Financial Sector Deepening (FSD) Africa, a specialist development agency working to strengthen financial markets across sub-Saharan Africa.

The announcements were made as part of a week-long visit led by senior leaders from the UK-Aid funded agency in collaboration with partners. These included the Ethiopia Ministry of Finance, Ethiopia Investments Holding, National Bank of Ethiopia, and the UN Environment Programme’s Principles for Sustainable Insurance Initiative (PSI).

From progress in establishing a securities exchange to launching FSD Ethiopia and solutions to help the country’s insurance industry respond to climate change, the initiatives will enhance the strength and health of Ethiopia’s f markets, building the foundations for a stronger more resilient national economy.

18th May – Establishment of the Ethiopia Securities Exchange: Ethiopia’s Ministry of Finance, the Ethiopian Investment Holdings and FSD Africa signed a cooperation agreement to establish the Ethiopian Securities Exchange (ESX). Once established, the ESX will become the 30th exchange on the continent. At least 50 companies, including banks and insurance companies, are expected to list at the launch of the exchange.

18th May – Investors RoundTable: Our investment arm, FSD Africa Investments held an investments roundtable in Addis introducing its work as a provider of early-stage, risk-bearing capital and as a catalytic investor, seeking to drive innovative models and products that can address gaps in Africa’s financial market.

19th May – Launch of FSD Ethiopia, which will work to enable the development of the country’s financial sector. With funding from UKAID and the Bill and Melinda Gates Foundation, FSD Ethiopia will build on FSD Africa’s initial efforts to enhance the country’s financial sector.

20th May – Ethiopian insurers endorse Nairobi Declaration on Sustainable Insurance: Insurance stakeholders in Ethiopia have thrown their support behind the Nairobi Declaration on Sustainable Insurance. The Nairobi Declaration on Sustainable Insurance is a continental commitment by African insurance industry leaders to support the achievement of the SDGs. The Nairobi Declaration brings together local and international insurance firms to promote the achievement of SDGs and make it easier for them to understand the commitment to support the achievement of the SDGs.

We are pleased to be collaborating with the Government of Ethiopia in this historic initiative that will accelerate the development of capital markets in Eth Our assistance for establishing the Ethiopian Securities Exchange will leverage FSD Africa’s vast expertise and experience in developing capital markets infrastructure across Africa.

Mark Napier, CEO

Addis Ababa, May 19, 2022: Newly established development agency Financial Sector Deepening Ethiopia (FSD Ethiopia) was officially launched at the Hyatt Regency Hotel, Addis Ababa, Ethiopia. With funding from UKAid and the Bill & Melinda Gates Foundation, FSD Ethiopia will build on FSD Africa’s initial efforts to strengthen the country’s financial sector. About 120 guests attended the launch of FSD Ethiopia, including representatives from the Bill & Melinda Gates Foundation, the UK government’s Foreign, Commonwealth & Development Office (FCDO), Ethiopian Investment Holdings (EIH), the National Bank of Ethiopia (NBE), financial service providers, development agencies and other partners.

We believe now is the right time to establish an FSD programme in Ethiopia. There are huge opportunities in Ethiopia’s financial sector reforms but also challenges ahead. Decisionmakers in both the public and private sectors will benefit from access to the neutral, technically informed advice and strong regional networks that FSD Ethiopia will be able to contribute

Mark Napier, CEO – FSD Africa.

Addis Ababa, May 18, 2022 – Ethiopia’s Ministry of Finance, the Ethiopian Investment Holdings and FSD Africa have today signed a cooperation agreement to establish the Ethiopian Securities Exchange (ESX).

Once established, the ESX will become the 30th exchange on the continent. At least fifty companies, including banks and insurance companies, are expected to list at the launch of the exchange. The exchange is designed to provide a fundraising platform for small and medium-size enterprises, which are the backbone of the Ethiopian economy. The exchange will also offer a platform for the privatisation of Ethiopia’s state-owned enterprises.

Ethiopia has enjoyed strong economic growth over the past two decades, averaging about 9-10%. With strong fundamentals, such as young and educated labour force and improved infrastructure, the economy has the potential to sustain such a high growth if structural challenges, such as limited access to finance, are addressed. In the past few years, the government has implemented several reforms to open the economy and the launch of a securities exchange will be a catalyst for attracting new investment from the private sector.

We are pleased to be collaborating with the Government of Ethiopia in this historic initiative that will accelerate the development of capital markets in Ethiopia. Our assistance for establishing the Ethiopian Securities Exchange will leverage FSD Africa’s vast expertise and experience in developing capital markets infrastructure across Africa. This support signals our long-term commitment to a thriving capital market that is deep, liquid, and efficient.

Mark Napier, CEO – FSD Africa.

Worldwide, women’s access to finance is disproportionately low. Despite substantial overall progress—in 2017, the World Bank reported, 1.2 billion more people had bank accounts than in 2011—there is still a 9% gap between women’s and men’s access. In sub-Saharan Africa, only 37% of women have a bank account, compared with 48% of men, a gap that has only widened over the past several years.

Africa’s gender gap in access to finance can have a dramatic impact on social and economic progress. Women today dominate African agriculture, the continent’s most important sector. When women farmers lack access to financial services, their ability to invest in modern technologies to raise their productivity is limited. They cannot diversify their farms. They cannot grow high-value crops and invest in assets such as livestock. And they cannot invest in better nutrition for their children.

Sub-Saharan Africa is the only region in the world where more women than men become entrepreneurs. But when it comes to tal, the situation looks less rosy. There is an estimated USD 42 billion financing gap for women in Africa today[1]. As a result, many female-owned businesses do not actualize their potential; and many investors miss profitable investment opportunities.

On average, women in Africa own fewer assets than men, often due to discriminations encoded in property laws, and so they lack the collateral necessary to secure larger loans. And women are sometimes required to present more significant collateral for the same size loan, further inhibiting their access to capital.

Inclusive Finance

Each year, the world comes together for International Women’s Day to renew the push for gender equality. At FSD Africa, we’re working to make equality a reality in Africa by breaking the economic bias against women, through the power of inclusive finance.

Two strategies are spearheading our mission: gender bonds and gender-lens investing. Both have the potential to make a real impact, by helping to fund women-led businesses and elevating the role of women in the economies of Africa.

Gender bonds

Gender bonds are an asset class with a specific purpose: to support gender equity and the empowerment of women.

They do this by creating proceeds that are used exclusively to finance women-owned and women-led businesses.

Although 89% of women in sub-Saharan Africa are in the informal sector, their businesses historically struggle to access finance. These businesses were severely impacted by the Covid pandemic.

Gender bonds are a way of addressing this inequality, and with our projects at the forefront, they’re breaking new ground in Africa.

Our projects in Morocco and Tanzania

FSD Africa began by working with UN Women to analyse the global market for gender bonds and assess how corporate gender bonds in sub-Saharan Africa could help to empower women.

Following this research, we partnered with Morocco’s capital market regulator to publish guidelines on issuing gender bonds – the first development of its kind in North Africa.

Later that year, we supported the issuance of North Africa’s first gender bond: the Banque Centrale Populaire Gender Bond in Morocco. Approximately USD 21 million was raised by way of private placement.

We also helped to develop the Jasiri Gender Bond Framework in Tanzania and provided support for the second party opinion. This led, in February 2022, to the issuance of NMB Bank’s Jasiri Bond: the first gender bond in East Africa. The offer closes on 21st March 2022 and NMB aims to raise approximately USD 17.2 Million.

<i”alignnone size-full wp-image-6055″ src=”https://fsdafrica.org/wp-content/uploads/2022/02/calin-stan-7a_PHX91su8-unsplash.jpg” alt=”” width=”640″ height=”402″ />

Gender-lens investing

Gender-lens investing is a term for investment strategies that are built around empowering women – while also aiming to generate return for investors.

Our investment arm, FSD Africa Investments, is focusing on gender-lens investing as a way of supporting our work towards equality.

They’re doing this in three ways: by applying a gender lens across their investments; by boosting gender diversity within FSD Africa Investments itself; and, by providing capital to existing investments that promote the role of women.

Bridging the financing gap

One route through which we aim to provide gender-lens capital is by directly investing in funds.

We will soon be announcing a partnership with a financing facility to support the growth of small, women-led businesses by providing funds and capacity-building to local capital providers. These providers, rooted in the local market, are best placed to serve the needs of small and growing businesses.

Creating real impact for women

We’re closely monitoring the impact of our gender bonds and gender-lens investing programmes as they progress. This will help us to grow and evolve our approach, to make sure we achieve real impact for women across Africa.

As we move forward, we’re more committed than ever to breaking the bias and making gender equality a reality.

To find out more about our work, get in touch: mary@fsdafrica.org

[1] AfDB