5th December 2023

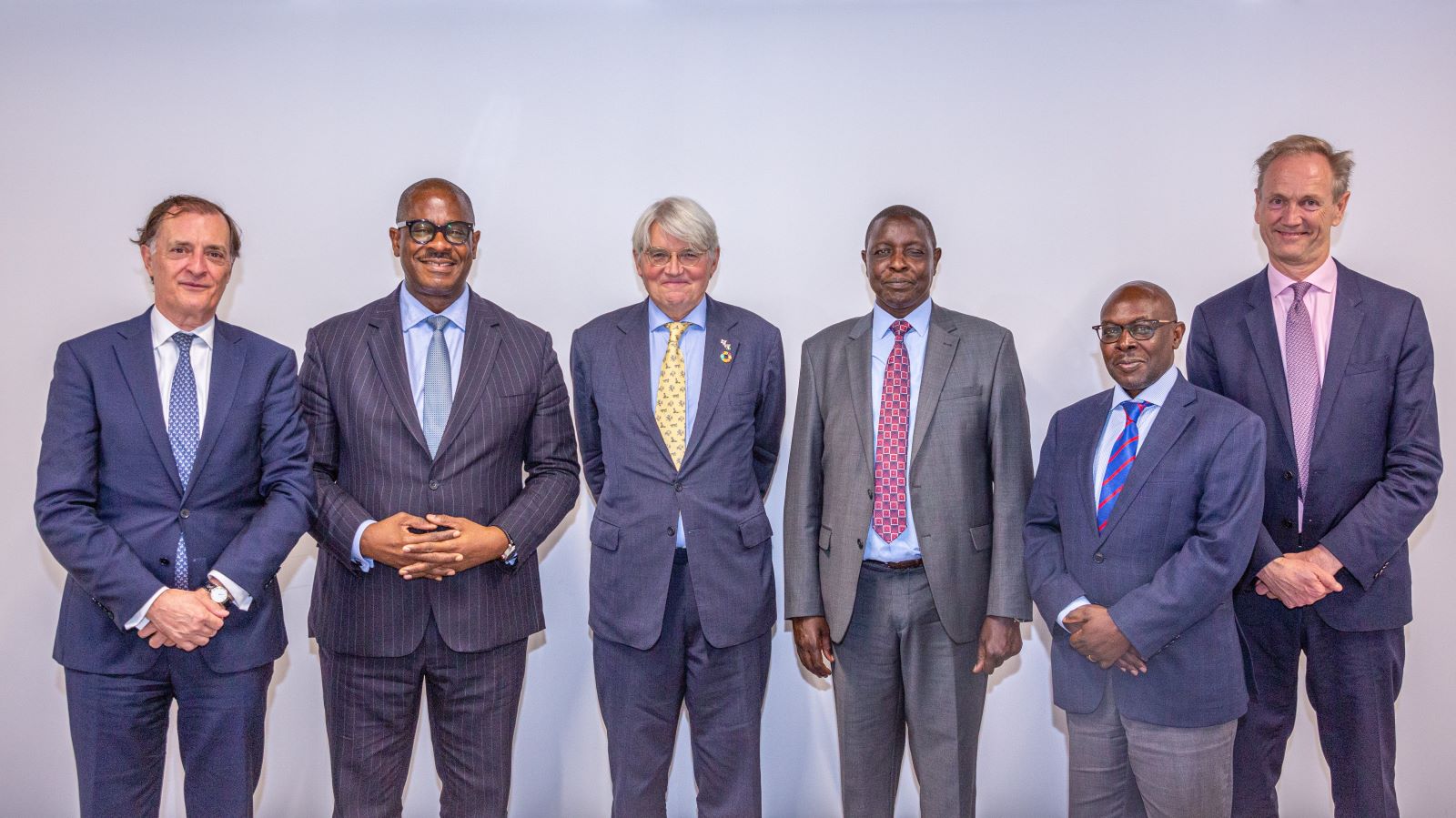

Dubai, United Arab Emirates: On the dedicated Finance Day of COP28, the Right Honourable Andrew Mitchell MP, Minister of State of the United Kingdom for Development and Africa, joined Kenyan government and stakeholder representatives in the UK Pavilion to celebrate progress on the newly incorporated Dhamana Guarantee Company Limited (Dhamana). The new guarantee company has been created to unlock local capital for sustainable infrastructure and projects that will advance climate change mitigation and adaptation efforts across East Africa.

Dhamana was established in Nairobi, Kenya, by InfraCo Africa, part of the Private Infrastructure Development Group (PIDG), and Cardano Development with support from FSD Africa. The company draws on the success of other PIDG-supported credit enhancement facilities, InfraCredit Nigeria and InfraZamin Pakistan, and recently received significant funding commitments from the African Development Bank (AfDB) and CPF Financial Services (CPF), who were represented alongside PIDG at the meeting with Mr Mitchell in Dubai.

Mr Mitchell said, “As our recent white paper set out, the UK is committed to supporting countries that want to draw on their own resources to tackle climate change. This investment will provide the guarantees needed to enable Kenyan pension funds to fund climate resilient infrastructure in Kenya. It is fantastic to see that PIDG, Cardano Development and FSD Africa are collaborating with the Africa Development Bank and a Kenyan pension fund to deliver this new approach and demonstrate how African resources can be used to fund African development.”

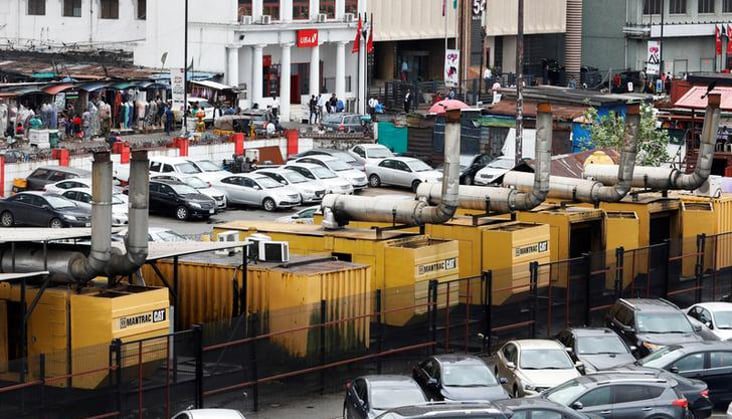

Dhamana’s initial focus of operations will be in Kenya, a country which holds significant wealth in pension,i life insurance and private wealth funds. However, in Kenya, as for much of East Africa, cash- flow based investments and infrastructure projects are largely reliant on US dollar denominated bank loans. Such loans seldom have sufficient tenor length to ensure project success, and can expose borrowers to currency exchange risk, challenges which Dhamana’s local currency guarantees will serve to mitigate.

Dhamana CEO, Christopher Olobo, said, “The focus of COP28 is around the need to unite, act and deliver for climate action. Dhamana epitomises this ethos by bringing partners together to facilitate a step-change in how we finance East Africa’s development, accelerate access to climate-resilient infrastructure and achieve the UN SDGs. With the backing of our shareholders, Dhamana will strengthen local capital markets, connecting bankable projects with untapped pools of domestic institutional capital and ensuring that investors have the comfort they need to use their funds for positive change.”

InfraCo Africa’s CEO, Gilles Vaes, said, “We are extremely proud of the work undertaken by all parties to establish Dhamana, and to attract significant funding commitments which will enable it to deliver on its vision.” Emphasising the significance of Dhamana for climate action, PIDG CEO, Philippe Valahu, said, “As part of the wider PIDG suite of credit enhancement facilities, Dhamana’s local currency guarantees will support the growth of local capital markets, unlocking domestic capital to underpin a thriving ecosystem for climate-resilient infrastructure and project development across East Africa.”

Joost Zuidberg, CEO Cardano Development enthusiastically stated, “The power of Dhamana lies in its ability to catalyse substantial investments from East Africa’s institutional capital, fortifying the bedrock for the sustained financing of the region’s burgeoning economic landscape. At the heart of Cardano Development lies our incubation and management of guarantee solutions for emerging and frontier markets, we are delighted to work alongside AfDB, County Pension Fund, InfraCo Africa, PIDG and FSDA on this innovation and together empower Dhamana with the essential support and capital required to realise this pivotal mission.”

Mark Napier, CEO FSD Africa said, “FSD Africa is committed to supporting local currency bond markets in Africa as well as local currency credit enhancement facilities as they play an important de-risking role. This role is pivotal in the mobilisation of climate finance from both local and international owners of capital to African economies that require different sources of capital to fund their green growth. FSD Africa is particularly pleased to provide seed funding for Dhamana Guarantee Company Limited’s Technical Assistance Facility which will provide project preparation and transaction support to potential issuers of innovative climate financing debt instruments, thereby increasing the pool of bankable climate-resilient projects in East Africa.”

Following the recent announcement of the African Development Bank’s Board approval for a US$10m equity investment into Dhamana, AfDB Vice President for Private Sector,

Solomon Quaynor, said, “Dhamana’s credit enhancement offering aligns well with several of AfDB’s strategic objectives, including our commitment to stimulating local currency debt markets as a route to unlocking new sources of green and sustainable finance for the real sector and infrastructure development across East Africa.”

Dr. Hosea Kili, CEO of CPF concluded, saying, “CPF Financial Services is excited to be part of the investors in Dhamana, a new guarantee company to serve the East African region. Dhamana is envisioned to unlock local currency debt from untapped pools of capital in Kenya and the East Africa region, providing guarantees for local currency bonds invested in by East African pension funds, insurers, and other financial institutions. This guarantee fund will enable infrastructure and other sectors to raise more money locally in KES, without the borrowers suffering from KES-to-USD devaluation.”

Dhamana Guarantee Company (Dhamana):

Dhamana is working to catalyse the development of domestic capital markets in East Africa. It does this by connecting significant untapped pools of domestic institutional capital with the real economy, such as new green infrastructure, and providers of credit to individuals and businesses. This increases access and the affordability of local capital, providing new low-risk opportunities for local investors. Dhamana will also serve to provide a portfolio of businesses with access to the local currency capital needed to deliver bankable projects, meeting the high demand for new affordable housing, transportation, water, and energy infrastructure, and promoting long term economic development. www.dhamana.com

The Private Infrastructure Development Group (PIDG)

PIDG is an innovative infrastructure project developer and investor which mobilises private investment in sustainable and inclusive infrastructure in sub-Saharan Africa and south and south-east Asia. PIDG investments promote socio-economic development within a just transition to net zero emissions, combat poverty and contribute to the Sustainable Development Goals (SDGs). PIDG delivers its ambition in line with its values of opportunity, accountability, safety, integrity, and impact. Since 2002, PIDG has supported 211 infrastructure projects to financial close which provided an estimated 222 million people with access to new or improved infrastructure. PIDG is funded by the governments of the United Kingdom, the Netherlands, Switzerland, Australia, Sweden, Germany and the IFC. www.pidg.org

InfraCo Africa:

InfraCo Africa is part of the Private Infrastructure Development Group (PIDG) and seeks to alleviate poverty by mobilising investment into sub-Saharan infrastructure projects. It does this by investing directly into early-stage projects and by providing project development leadership. Through its investments arm, InfraCo Africa can also provide equity to close a financing gap and start construction or fund innovative solutions that need support to scale-up, to pilot new products or enter new markets. InfraCo Africa is funded by the governments of the United Kingdom (through FCDO), the Netherlands (through DGIS) and Switzerland (through SECO). www.infracoafrica.com

Cardano Development:

Cardano Development (CD) is an incubator and fund manager, established in 2007. Through careful risk-management analysis in data poor settings, CD identifies scalable solutions that can help to make frontier financial markets more inclusive, investible, and sustainable to unlock lasting economic value. CD creates scalable solutions for currency, credit, and liquidity risks in these markets. With over USD 6 billion assets and USD 2.5 billion capital under management, CD supports eight scale-up funds: TCX, GuarantCo, Frontclear, BIX Capital, ILX Fund, IMFact, AGRI3 Fund and Nyala Venture. As well as six start-ups: NASASA CD, Octobre, Social Infra Ventures, The Development Guarantee Group, The Green Guarantee Company and new guarantee company with ongoing management services and corporate governance oversight. www.cardanodevelopment.com.

FSD Africa:

FSD Africa is a specialist development agency working to help make finance work for Africa’s future. Based in Nairobi, FSD Africa’s team of financial sector experts work alongside governments, business leaders, regulators, and policymakers to design and build ambitious programmes that make financial markets work better for everyone. Established in 2012, FSD Africa is incorporated as a non-profit company limited by guarantee in Kenya. It is funded by UK aid from the UK government. www.fsdafrica.org

African Development Bank (AfDB):

The AfDB Group is a regional multilateral development finance institution established to contribute to the economic development and social progress of African countries that are the institution’s Regional Member Countries (RMCs). The AfDB was founded following an agreement signed by member states on August 14, 1963, in Khartoum, Sudan, which became effective on September 10, 1964. The AfDB comprises three entities: the African Development Bank (ADB), the African Development Fund (ADF) and the Nigeria Trust Fund (NTF). As the premier development finance institution on the continent, the AfDB’s mission is to help reduce poverty, improve living conditions for Africans and mobilise resources for the continent’s economic and social development. www.afdb.org

CPF Financial Services (Kenya):

CPF is a leading financial institution with its core in Pensions Management, boasting a substantial fund value of USD 1.06 billion in Assets Under Management. The institution has a strategic footprint extending across East Africa, providing a wide range of services, including Fund Administration, Trust Fund Services, Digitization, Archival Services, Training and Management Consulting. The CPF Group has subsidiary companies across various sectors including Laser Infrastructure & Technology Solutions (LITES), Laser Property Services, Laser Insurance Brokers (LIB), CPF Asset Managers and Rukisha Advances Solutions (a cutting- edge payments platform). www.cpf.or.ke