Harnessing the immense power of Africa’s innovative young talent is critical for a successful green transition on the continent. Triggering Exponential Climate Action (TECA) hinges on directing this talent intentionally toward our generation’s most pressing challenges – climate change and biodiversity loss. Last year’s inaugural “TECA wave”, implemented by BFA Global and funded by FSD Africa, saw 30 Fellows supported to launch seven new ventures solving for challenges in the blue economy (used here to mean sustainable use of natural water resources for economic growth, improved livelihoods, and jobs while preserving the health of the environment).

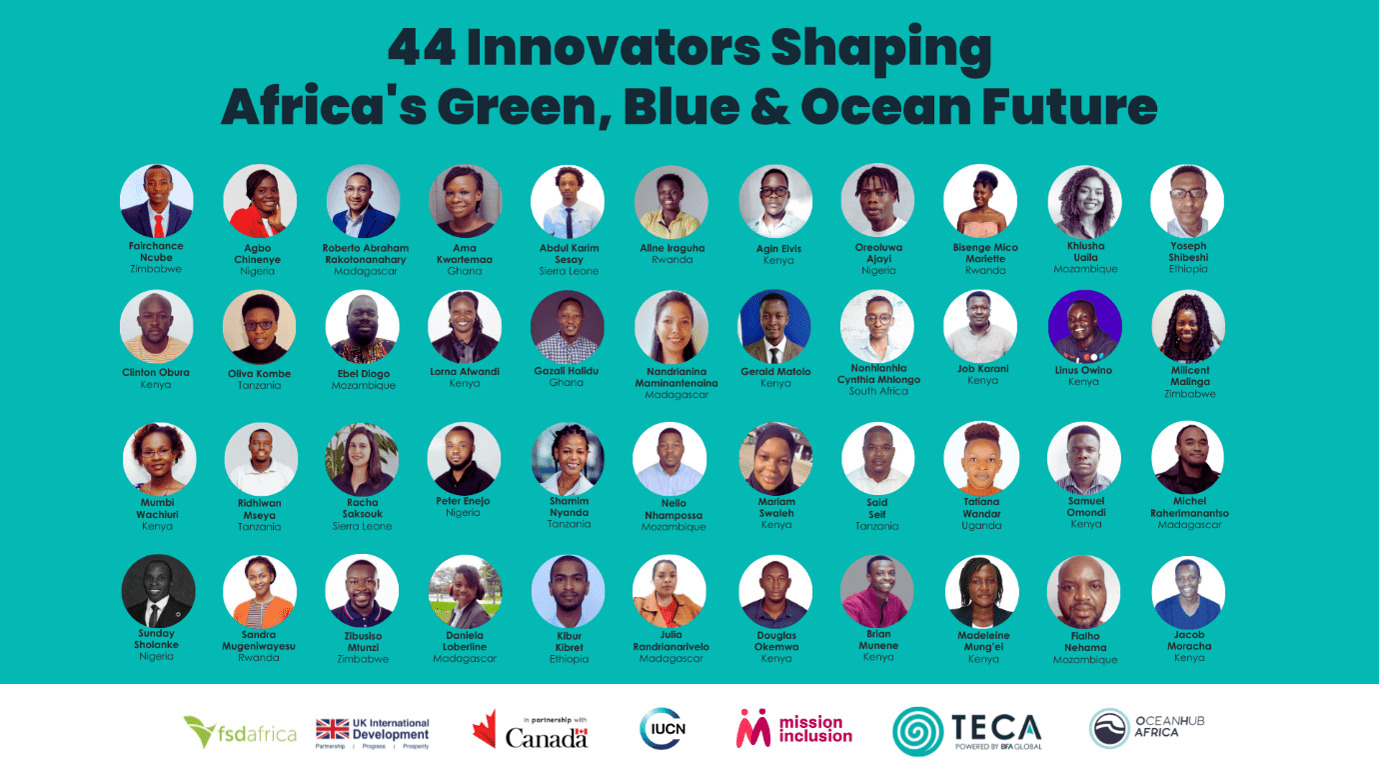

This year, we and BFA Global have been joined by a powerhouse team of organisations resulting in the new Africa Blue Wave Coalition. IUCN, through a partnership with the Canadian Government, is co-financing the Africa Blue Wave alongside us, and Ocean Hub Africa (OHA) has come on board as blue economy venture building experts. Through this collaboration, TECA has recruited 44 new talented and energetic Fellows from 12 different African countries to take on the challenge of building climate solutions.

As has become the tradition, the new wave kicked off with the “huddle”, a 4-day in-person convening of TECA Fellows and venture builders, that took place in Watamu, Kenya, in March 2024. I had the pleasure of joining the Fellows for this unique opportunity to immerse ourselves into blue and green economy challenges as well as engage with and learn from one another at the very start of the TECA journey. Green economy, in this case, refers to the sustainable use of terrestrial landscapes for economic growth, improved livelihoods, and jobs while preserving the health of the environment and boosting biodiversity.

Watamu, a small coastal town in Kilifi County, Kenya, not only boasts a stunning coastline, but it is also home to Mida creek, one of the most productive mangrove ecosystems in the world, supporting livelihoods, marine-life and an impressive diversity of bird and animal species. This served as a perfect location for the TECA Fellows to gain a deeper understanding of the challenges faced by fisher folk, farmers, conservationists, and others whose livelihoods depend on this protected ecosystem.

Through the support of Kenya Marine & Fisheries Research Institute (KMFRI), we had the pleasure of visiting both green and blue economy players in the region. These included an aquaculture and conservation self-help group (Umoja) practicing sustainable marine fish farming and mangrove nursery establishment and rehabilitation; and beach management units (BMU) at landing sites in Takaungu as well as Kuruwitu, where we met with BMU officials and groups undertaking fishing, extraction of coconut oil, mangrove restoration, plastic recycling, and coral restoration, among other activities.

The decision to focus this second TECA wave on both green and blue economy solutions was validated by the clear complementarity in the spectrum of opportunities for innovation identified by the fellows. This was further highlighted when we had the opportunity to visit a Fellow from the first TECA wave. Fardosa Mustafa launched Registree in 2023 with a goal to empower mangrove conservation communities in the coastal region through digital tracking of mangroves and carbon accounting. So passionate about this work, Fardosa moved from her home in Nairobi to Watamu after her time in the TECA programme to focus on better understanding the needs of the communities she was supporting. In doing so, she has gained a deeper understanding of their needs and pivoted her business model to supporting sustainable agricultural practices in the coast; an exciting shift from blue to green within the same region.

Despite having completed the TECA process, the team at BFA keep a close eye on Registree and others who have launched their start-ups through the programme, providing input and support where needed. Dr. Mathew Egessa, another TECA graduate, joined the team in Watamu to speak with the current cohort of fellows about his journey building Vua Solutions. He also had to opportunity to check in with venture builders and gain input into challenges he faced in the business highlighting the importance of ongoing relationships and expertise that the TECA process provides.

Fardosa and Mathew’s stories exemplified for me the importance of the kind of high touch support provided by the TECA team. To adequately support these entrepreneurs requires time, patience, adaptability, and inevitably capital investment. It requires for all players within the climate space – educators, entrepreneurs, regulators, venture builders, experts, and investors – to think differently about how we support innovation.

The huddle left me with the feeling that, although there is still a lot of work to be done in building solutions that address the needs of communities in Africa at the same time as mitigating the impact of climate change, there is hope. The 44 TECA Fellows I met in Watamu were passionate about building these solutions and incredibly energised about the opportunity to work with experts who were ready to provide the support needed.

As FSD Africa, we are excited to be joined on this journey by IUCN and OHA, recognising the importance of partnership and collaboration towards Africa’s green transition.