We engaged Lion’s Head Global Partners to conduct a study on Private Debt markets in Africa. While keeping a pan-African perspective, the study focussed on Nigeria, Kenya, Ghana, and Morocco as markets of strategic importance. South Africa was used as a reference market, given the development of the financial sector and the size and scale of the South African institutional investor base.

In addition to desk research and data analysis, the outputs, analysis, and recommendations were driven by stakeholder consultations, workshops, and interviews to both reflect individual positions, but also generate buy-in from stakeholders.

The insights from the study will support FSD Africa’s overarching strategic goal to mobilise long-term finance in local currency to support Africa’s development priorities and inform our transaction support, regulatory initiatives and knowledge and capacity-building engagements under its Africa Private Equity and Private Debt programme. The study will also benefit stakeholders including institutional investors, borrowers, regulators and policymakers, who seek to improve the enabling environment.

FSD Africa is a specialist development agency working to make finance work for Africa’s future. Set up in 2012, we work on policy and regulatory reform, capacity strengthening and improving financial infrastructure, and addressing systemic challenges in financial markets to spark large-scale and long-term change.

Additionally, we provide risk capital by investing in cutting-edge ideas that we believe have the potential for significant impact. We take on projects that are more complex and riskier than those taken on by typical development finance firms, to unlock additional funding for innovative sectors.

Over the past decade, we’ve seen that investing in financial markets drives economic growth, boosts the income of vulnerable groups and helps to reduce poverty. Through our market-building initiatives, we have directly and indirectly crowded in around £1.9 billion in long-term capital, availing finance for SMEs, affordable housing and sustainable energy projects.

Our work has also enabled development of innovative products, increasing access to financial services for close to 12 million people in Africa. This improved access has been particularly beneficial during the Covid-19 crisis. Between 2020 and 2021, we saw an 87% increase in the use of remittance services to cushion families from the economic effects of the pandemic.

Our programmes have also supported business growth, increasing access to jobs for vulnerable groups such as women. To date, we have created or sustained approximately 67,200 full-time equivalent (FTE) jobs, of which 12% were green jobs and 59% were occupied by women.

Results against five-year targets

The figure below shows our cumulative results against the five-year targets for each of our core indicators.

11 August 2022: The African continent presents a massive investment opportunity for investors to advance the deployment of climate solutions in the coming decade according to a new report Climate Finance Innovation for Africa. However, this will require innovation in financing structures and the strategic deployment of public capital to ‘crowd-in’ private investment at levels not yet seen.

Current levels of climate finance in Africa fall far short of needs. Africa’s USD 2.5 trillion of climate finance needed between 2020 and 2030 requires, on average, USD 250 billion each year. Total annual climate finance flows in Africa for 2020, domestic and international, were only USD 30 billion (CPI forthcoming), about 12% of the amount needed.

Barriers related to shallow financial market depth, governance, project-specific characteristics, and enabling skills and infrastructure have stifled private investment in African climate solutions to date.

To overcome these challenges will require innovation in financing structures. But there is no one-size fits all. Public and private investors must tailor their financial instruments and strategies depending on the acute or chronic nature of the barriers identified.

Recommended actions for increasing the deployment of innovative finance include: Identifying and understand barriers constraining finance by sector and geography, matching instruments with barriers, matching instruments with project and technology lifecycles, enhancing engagement and co-financing with local stakeholders, and supporting innovation by establishing conducive policy and regulatory frameworks.

This work provides a framework for how these instruments and strategies can be efficiently deployed to overcome barriers to finance and capitalise climate solutions in Africa.

Read full report here.

This is Africa’s first corporate clean mobility bond worth 1 billion dirhams ($95m) launched by the Office National des Chemin de Fer (ONCF) to facilitate the refinancing of the operations of an electrified railway line aiming to achieve low carbon transportation in Morocco.

Casablanca, 28 July 2022: Africa’s first corporate clean mobility bond has today been launched by Morocco’s national railway operator (ONCF). ONCF was supported by CDG Capital in the strategic advice, structuring, placement, centralization, and coordination of the green certification work with its partners FSD Africa and CBI.

With this issuance, ONCF is targeting to raise approximately 1 billion dirhams ($100m) to support the Al Boraq project, which has led to considerable gains for the community in terms of connectivity, travel time and frequency, while reducing greenhouse gas emissions.

This high-speed line (Ligne à Grande Vitesse – LGV) project is part of a master plan to connect Tangier to Marrakech by 2030, advancing economic development by providing faster inter-urban passenger and freight lines with reduced carbon emissions. Through the LGV Journey time between Tangier and Kenitra has been reduced by 2 hours and 25 minutes and will result in a reduction of over 2.9 million tonnes of carbon equivalent over a 30-year timeframe.

Climate Finance is an important focus area for FSD Africa. This project presents an opportunity for FSD Africa to support the issuance of Africa’s first corporate clean mobility bond.

Mark Napier, CEO – FSD Africa

Persistent raises $10 Million Equity Round led by Kyuden International and FSD Africa to grow climate venture building in Africa

New York, Nairobi, Tokyo: 12 July 2022 – Today, Persistent Energy Capital LLC announced that it has raised USD 10M in equity in its Series C round. The raise, which was achieved with the support of two lead institutional investors, Kyuden International Corporation and FSD Africa Investments, will enable Persistent to continue to grow its successful climate venture building business in Africa.

The equity raise took the form of Series C Preferred Units of ownership in Persistent, giving Series C investors a seat on the Board of Directors. The largest investor of this Series C round, Kyuden International Corporation (“Kyuden”), is the overseas business arm of the Japanese Kyushu Electric Power Group. Kyuden has energy investment activities and consulting services across the world and shares with Persistent a strong commitment to renewable energy and building sustainable communities. Investing in Persistent represents a strategic move for Kyuden to expand their overseas business with an established partner in Africa, where the demand for clean power and electric mobility is growing dramatically. Persistent will benefit from the expertise, know-how, and network accumulated from domestic and overseas energy businesses of Kyuden around the globe.

This successful fundraise was also achieved thanks to the catalytic patient capital provided by Financial Sector Deepening Africa Investments Ltd.

We are delighted to support Persistent as it expands its innovative climate venture building model. We look forward to working with the Persistent team to accelerate the investment needed by African entrepreneurs in the nascent and fast-growing climate sectors. The combination of Persistent’s capabilities and approach, together with FSDAi’s expertise, patient capital and focus on green finance represents a very strong proposition in areas where innovation and early-stage equity capital are highly needed.

Anne-Marie Chidzero, CIO – FSD Africa Investments

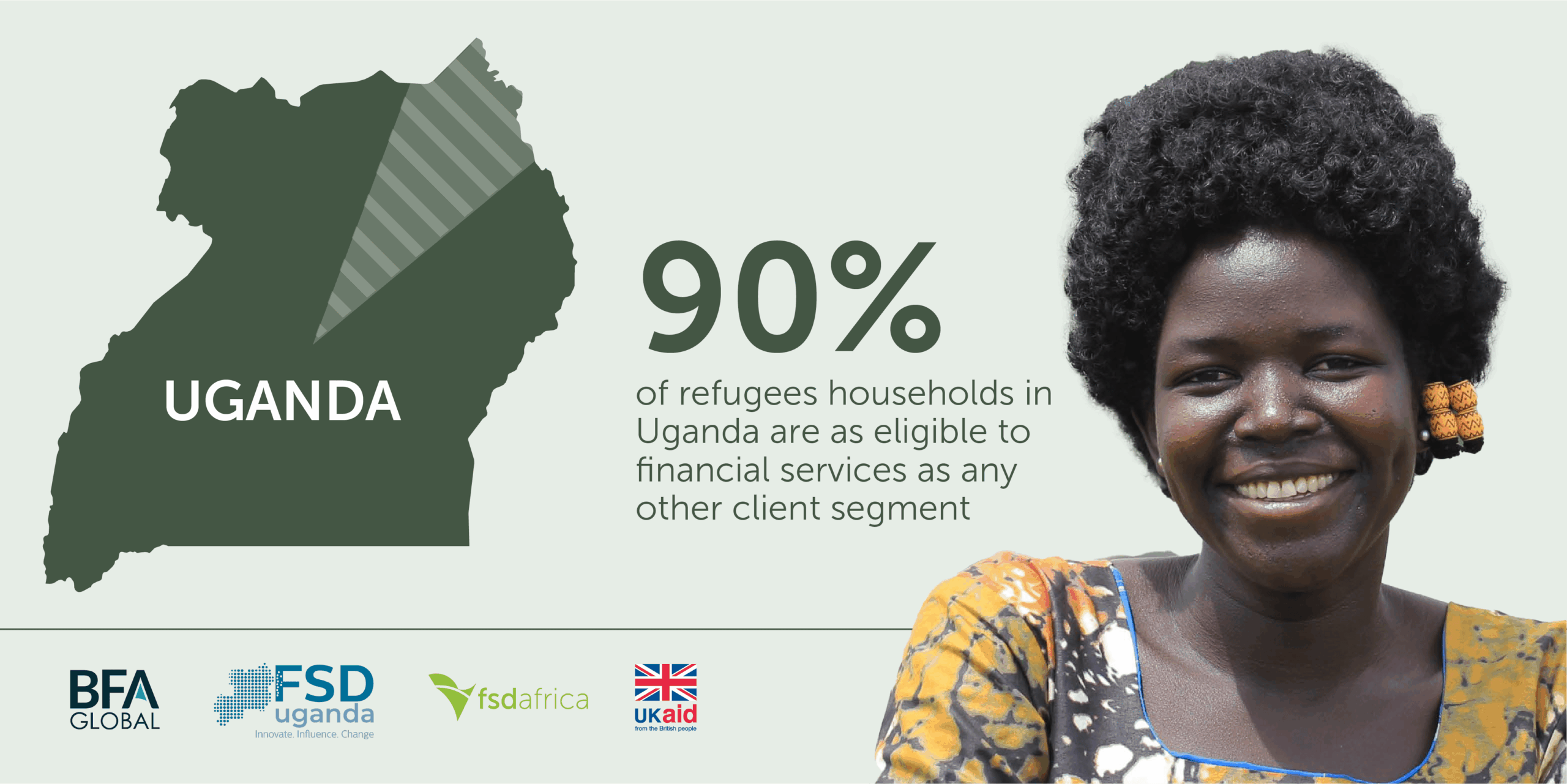

I often find it difficult for most people to relate to refugees. We seem to forget that we can be in the same situation depending on the circumstances around us. The happenings in Ukraine have shown just how delicate our stability status is, and that we can quickly be turned into forcibly displaced people overnight!

While conflict, war or persecution have been traditionally viewed as the main forces giving rise to refugees, natural disasters triggered by climate change among others are fast becoming a force to reckon with. The number of forcibly displaced people has now surpassed 100 million for the first time, fueled by the war in Ukraine and other ongoing conflicts around the globe.

This takes me back to a scenario in June 2018 when FSD Africa, FSD Uganda and BFA Global were conducting a design sprint with 6 Ugandan financial service providers (FSPs), to develop new ideas for financial products and services for refugees in the country. The 4-day event reached a phenomenal breakthrough when one of the participants posed: “What if something happened and we found ourselves in another country as refugees? What financial services would we need?” Those two questions opened the minds of the participants and ideas started flooding in. The design sprint was one of the 4 steps that FSD Africa has been following to develop financial inclusion for refugees (FI4R) projects. The other 3 are:

- Market assessments that capture the financial lives of refugees and show the potential of serving these populations.

- Innovation competitions where FSPs are invited to pitch ideas of how they would address refugee financial needs

- Financial support and technical assistance to FSPs to develop, pilot and roll-out financial solutions.

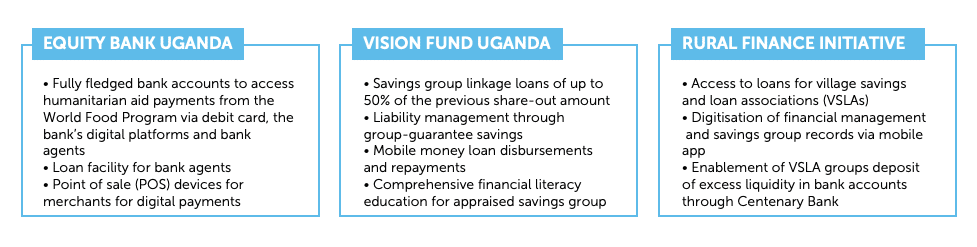

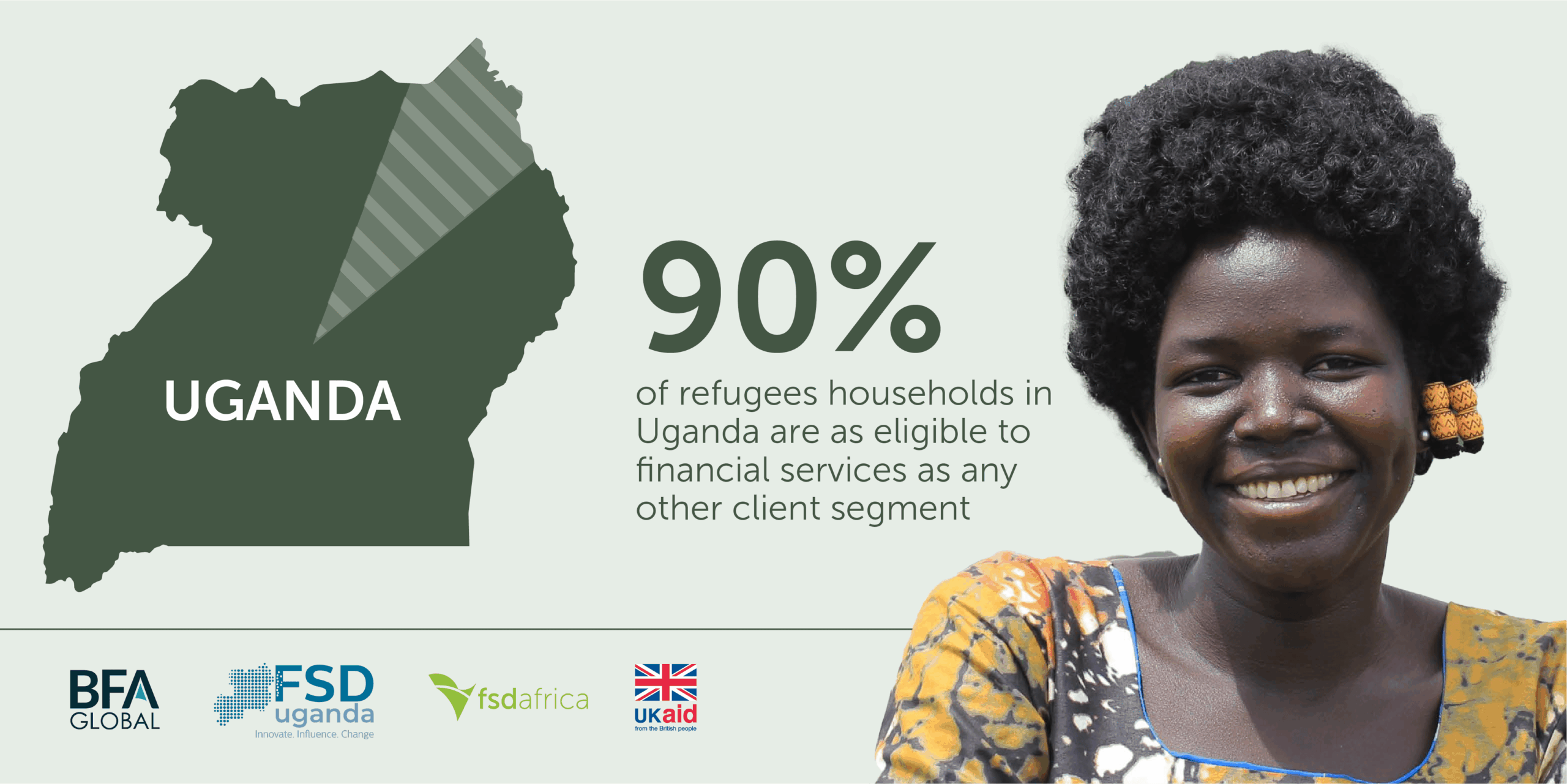

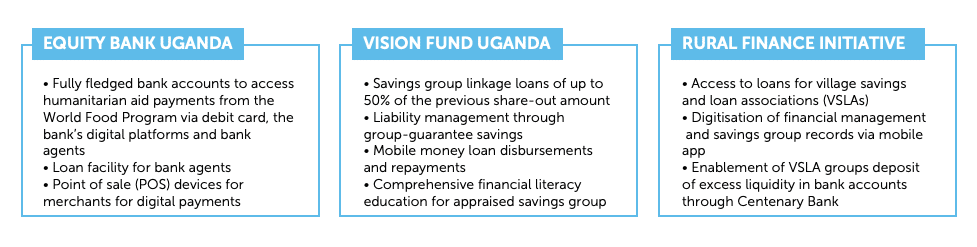

In Uganda, working with FSD Uganda, we identified Equity Bank Uganda Limited, VisionFund Uganda and Rural Finance Initiative to offer financial services in various refugee settlements from October 2019. While the project concluded in March 2022, these FSPs have continued operations as this turned out to be a viable business for them. The project engaged BFA Global as the learning and research partner. They undertook a baseline study in January 2020 and a series of 4 financial diaries (linked below) – capturing the financial needs and uses of refugee households.

The 4 financial diaries:

They then carried out an endline study in November 2021. The partners achieved the following results:

- Over 26,300 customers accessed loans, with 73% being female

- Cumulative loans amounted to £9 million ($2.7million)

- 262 bank agents were recruited across the settlements, 15% of which were women

- Over 93,300 households registered on Equity Bank Uganda’s digital platform

- 65,484 households receiving digital payments as of March 2022.

- The bank made payments worth UGX 10.8 Bn (£2.2m) during the first quarter of 2022

- 8 humanitarian agencies used the Equity Bank Uganda platform for disbursements

Below is a summary of some of the different financial services offered by the FSPs:

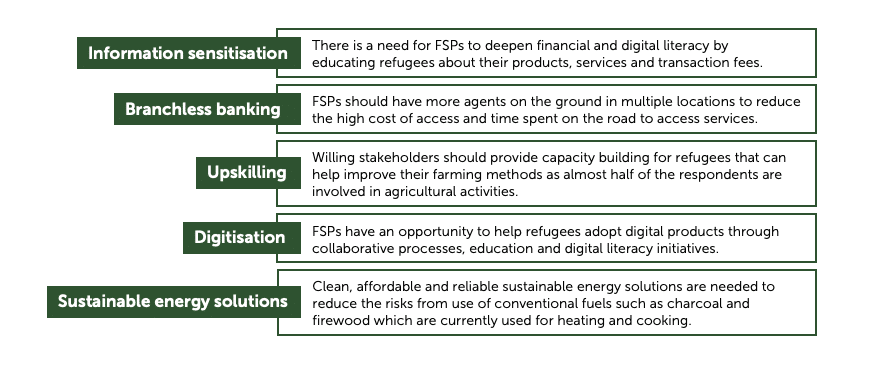

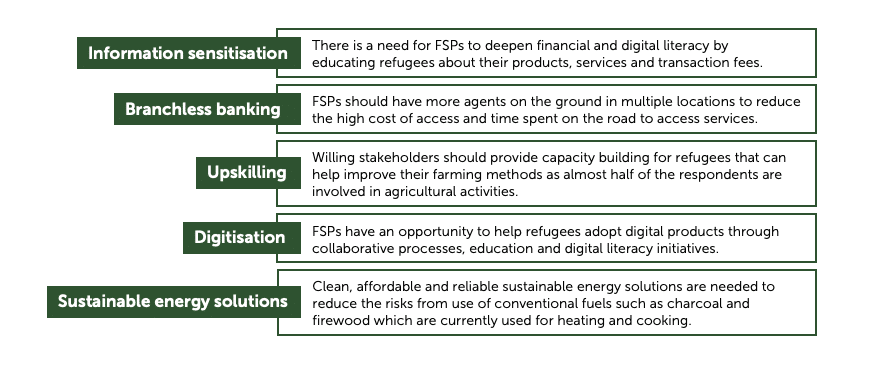

Based on the end-line study findings, there is still work to be done to improve financial services for refugees in the following areas: