Summary of discussion and outputs of the FSD Network Gender Learning Session.

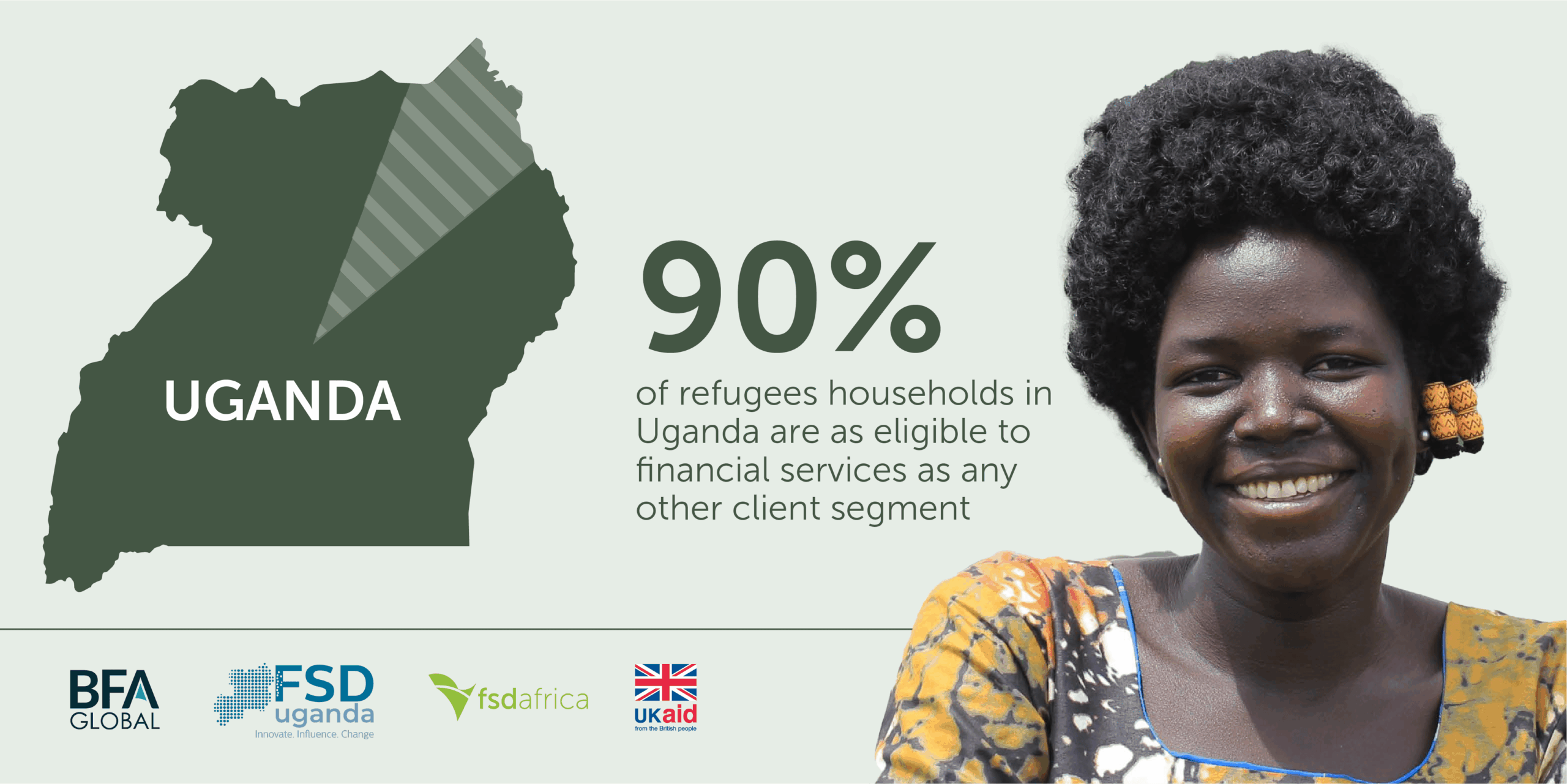

Country: Uganda

The objective of the report is to assess whether the appropriate application of ‘new’ technologies could be leveraged by donors and other development agencies to increase formal remittance flows into Africa and/or reduce the cost of sending money home.

Fragile and conflict-affected states (FCAS) are of particular interest given the importance of remittances to livelihoods and post-conflict development, as well as the exacerbated challenges that are often faced in these jurisdictions.

UK-KENYA PARTNERSHIP REACHES FURTHER MILESTONE FOR LONG-TERM CLIMATE FINACE SOLUTIONS IN KENYA

- Investors back Dhamana Guarantee Company’s work to transform East Africa’s financial landscape.

- Tackling climate change given another boost in Kenya as, for second time in a week, a UK-Government backed investor in green finance solutions puts pen to paper.

Monday 30 September 2024 – the Dhamana Guarantee Company Ltd (Dhamana) has reached a major milestone, marked at an event in Nairobi today.

Investors in the new company put pen to paper at a signing ceremony, which will allow the company to kick-start operations.

Dhamana aims to mobilise private sector finance to support the development of sustainable growth businesses. It will do so by issuing guarantees to commercially viable projects, businesses, and institutions that tackle the climate crisis and make progress towards the Sustainable Development Goals (SDGs).

The design and creation of the company was supported by the UK-Government backed investor the Private Infrastructure Development Group (PIDG) through InfraCo Africa. With its anchor investment, PIDG kick-started Dhamana, attracting further investment from the African Development Bank (AfDB) and County Pension Fund Financial Services (CPF), with support provided by Cardano Development and FSD Africa.

The project will target businesses that add value to people’s lives, improving the day-to-day life of Kenyans. The increase in affordable finance for Kenyan businesses will mean projects will require less capital to get off the ground, make money, and generate growth. Dhamana will also enable investors to diversify their portfolios, acting as a catalyst to transform East Africa’s financing landscape.

This is the second time in a week that an investor in climate solutions backed by the UK Government has achieved a milestone. Last week, MOBILIST signed a partnership with the Nairobi Securities Exchange, which aims to drive the listing of new investment products in the Kenyan market and increase the amount of private sector capital available for development and climate projects in Kenya and drive growth.

Dhamana CEO, Christopher Olobo, said, “With the support of our investors and supporters, the Private Infrastructure Development Group (PIDG), Cardano Development, FSD Africa, CPF Financial Services, and the African Development Bank (AfDB), we have worked to develop Dhamana as an important catalyst for long-term sustainable finance in the region. Dhamana’s local currency guarantees will connect pools of untapped capital with East Africa’s real economy, making a tangible difference to people’s lives and offering local investors the opportunity to invest in Paris-aligned initiatives.”

Speaking after the event, PIDG CEO, Philippe Valahu said, “Building on the success of other PIDG-supported credit enhancement facilities in Nigeria and Pakistan, Dhamana will demonstrate the value of such a facility in the East African market, opening up opportunities for investors and clients alike. Crucially, Dhamana will engage new partners and investors in our efforts to urgently address the climate crisis and accelerate delivery of the UN sustainable development goals.”

The acclaimed and innovative Bimalab Africa Insurtech accelerator program by FSD Africa is now set to expand to cover a total of fifteen countries across the African continent from the initial ten countries covered in the 2023 program, following a US$ 600,000 support by Swiss Re Foundation.

Launched in Kenya by FSD Africa in 2020 and supported by the Swiss Re Foundation since 2023, the BimaLab Africa Insurtech Accelerator Program offers hands-on venture-building support to high-impact insurtech start-ups that improve the resilience of underserved and climate-vulnerable communities.

In this extension of the Foundation’s support through 2025, BimaLab will expand its footprint to accelerate 55 insurtechs in a total of 15 African countries. It will build strong innovation ecosystem by activating investors, capacity-building networks, and corporate institutions to unlock capital, attract talent and share knowledge about insurance solutions tailored to those communities’ needs.

BimaLab Africa addresses problems faced by vulnerable communities and businesses, it gives priority to enterprises that address challenges on climate change, health and gender as well as obstacles faced by micro, small and medium enterprises. Africa’s protection gap, or uninsured losses, for natural catastrophes was around 80% of the total economic losses they caused in 2022, up from 58% one year earlier. These figures highlight the severity and volatility of the region’s natural disasters as well as its lack of financial protection against them. BimaLab Africa will create an insurtech innovation ecosystem that supports the growth of insurtechs; reach underserved markets, communities and households.

“Insurance provides a crucial safety net when people experience threats like natural disasters, ill health or economic disruption. We are proud to scale our partnership with BimaLab Africa, an initiative we strongly believe in. Bimalab Africa supports the growth of insurtechs, their reach to underserved markets, communities and households. It creates an insurtech innovation ecosystem in Africa. ” said Stefan Huber Fux, Director of the Swiss Re Foundation.

Bimalab Africa program is a unique programme bringing together insurance innovators, technology partners, insurance firms, investors, and regulators to work in concert in unlocking industry bottlenecks in modernising insurance services. Previously Bimalab Africa has had chapters supporting insurtechs in Egypt, Ethiopia, Ghana, Kenya, Morocco, Nigeria, Rwanda, South Africa, Uganda, and Zimbabwe. Among the new countries where the programme seeks to spread wings to are Tanzania, Tunisia, Senegal, Zambia, Malawi, and Somalia.

FSD Africa Principal Innovation and Resilience and Bimalab Africa Programme Lead Elias Omondi says the impact of the programme has been phenomenal over the last four years in expanding the reach of the program and playing a catalytic role in innovation by developing products for vulnerable customers and attracting investors to insurtech startups.

“BimaLab Africa enables startups enjoy access to a structured learning environment, mentorship, funding connections and a network of like-minded entrepreneurs, financiers, tech companies and regulators that can help them grow their businesses. We have supported 63 startups since 2020 and facilitated development of 3 regulatory sandboxes. Furthermore, investors have supported ten ventures providing over US$10 million in funding and over 40 products developed have reached more than 3 million new customers reached” said Elias Omondi, Principal from FSD Africa.

Insurance penetration in Africa has been lagging compared to other parts of the globe at only 3% compared to the world average of 7%. Innovation and technology are expected to play a key role in addressing the challenge.

Coordination problems are hard! Solving them represent potential for massive returns. The paradox of “insufficient demand” for already available capital pools, and the taunted “financing gap” on the other is perhaps a famous coordination problem in development finance circles.

If capital was a person, she would have to be ambitious – while avoiding hubris, readily embrace ambiguity showing a deep interest in, and a belief in a more prosperous future. She would have natural aptitude for building strong relations and for solving hard relational problems – while not being suicidal. She would be agile – showing great ability to renew herself for new emerging risks and opportunities. She would need to have training in management of trauma and disappointment, all while embodying a philosophy of optimism.

She would brush up on her Keynesian economics and contemplate its implications in the context of low productivity in Africa, ongoing debt distress, and weak institutions of political governance.

Africa needs capital that is fearless, brave, and courageous – intrepid. A form of capital that works on two sides of development, it will serve to accelerate capital flows on one hand, and work to unlock demand on the other. Her vision will draw from two themes – first, an ambition to deeply explore and design paths to solving Africa’s intractable development and second, an ambition that anticipates nasty surprises all the while building partnerships, institutions, and incentives to get things going. An ambition that fuses understanding with execution.

At FSDAi, we are working hard to solve these problems and provide risk-bearing, early-stage capital in innovative forms to support venture-building stage capital allocators who combine capital with other critical support to businesses at the start-up and early stages. We are also working to develop new asset classes – across private credit, guarantees, and alternatives among others. To do this well, we work from the ground up to ensure we understand the demand side of capital – interrogating market conditions, through partners, building a pipeline of investable opportunities, and addressing talent gaps. FSDAi works too on the capital formation side, providing catalytic capital that makes it easier to attract new forms of capital.

In markets, tailwinds can quickly become headwinds. As the global inflation has shown, capital flight is all too easy. The inflationary pressures were not always obvious, and most countries in Africa were focused on kickstarting their economies from the ravages of the Covid pandemic when the inflationary headwinds hit. Africa faces weak economies, high unemployment rates and low productivity and debt overhang – local and external. Backing enterprise is not equivalent to putting out your sail; and yet, optimism of the future of Africa should be fused well with certainty of turbulence in markets over time.

Africa will need capital that encourages entrepreneurs to emerge. That will mean finding capital that is patient and that can catalyze other capital to flow onto the continent. Capital that can persuade local pension funds to invest. The current equilibrium is unsatisfactory – there is not enough capital that accepts disproportionate risk, enables third-party investment that otherwise would not be possible, and is long term. Capital at start-up, early, venture-stage and SME growth capital is still severely in short supply.

Local capital is all too often preserved in money markets and government treasuries and only trickles into the real economy. Capital flows to address early-stage ventures is especially limited as most fund managers are too risk-averse and impatient. Even when they take risks, venture funds are pack hunters – signalling each other to back the same ventures.

To truly address the demand side – enterprises that have ambitions to build sustainable infrastructure, innovate to cut pollution, manage just transitions, and spur investment across a wide range of sectors will be essential.

FSDAi and FSD Africa are working on innovations to catalyze capital flows across the continent. These initiatives include supporting structures that facilitate risk transfer mechanisms including credit enhancement and mechanisms to manage foreign currency risks. In addition to backing fund managers to build capacity and accelerate investment in climate. Other initiatives have included investing in themed investment structures that can respond to specific priorities such as affordable housing, agriculture, or even investments towards green transition.

FSDAi has been supporting capital allocators by enabling blended structures. In these structures, FSDAi provides risk-bearing equity that shields private capital that is less courageous. Convertible instruments is another tool in FSDAi’s stable – allowing conversion to equity upon success

Unlocking capital through demonstration is also a tactic that we have deployed. This allows founders with credible business models to access capital early, test and raise further capital on the back of a tested business model.

FSDAi is working to provide mechanisms to test, accelerate and mobilise capital at scale to address these demand and supply side issues to deepen access to inclusive and functional financial markets. In return, ventures will emerge to address the climate challenge. When more appropriate capital is available, more of these ventures will thrive.

ABIDJAN, Côte d’ivoire, 21 November 2023 -/African Media Agency(AMA)/-The Board of Directors of the African Development Bank Group has approved a $10 million equity investment in Dhamana Guarantee Company Limited to support the use of capital markets as an alternative source of long-term funding for infrastructure and the real sector in East Africa.

Dhamana will be domiciled in Kenya as a limited liability company with a regional mandate to provide credit guarantees on debt capital market instruments. The Bank Group’s financing will enable Dhamana to issue guarantees for debt instruments. These local currency bonds are intended to boost the credit rating of the instruments to crowd in investment from pension funds, insurance companies and sovereign wealth funds to finance infrastructure and the real sector in East Africa.

The Bank, together with InfraCo Africa (part of the Private Infrastructure Development Group), Financial Sector Deepening Africa, and local institutional investors and other partners, will be supporting the operationalization of Dhamana.

Dhamana will support access to financing for key sectors including transport, water, renewable energy, and waste management, among others. Dhamana is committed to catalyze financing to assist the scale-up of green and sustainable financing into East Africa. Its credit guarantee activities should provide investors with the necessary comfort to support the allocation and intermediation of pools of private institutional investors’ funding into infrastructure.”

Nnenna Nwabufo, African Development Bank Director General for the East Africa region, said, “The African Development Bank is pleased to continue to support the operationalization of innovative solutions such as those provided by Dhamana to unlock and channel long-term local currency funding towards the real sector.

PIDG’s CEO, Philippe Valahu, said, “African Development Bank joining PIDG marks a significant milestone for the Dhamana Guarantee Company. This additional equity will allow Dhamana to further mobilise significant untapped pools of domestic institutional capital into East Africa’s real economy, such as new green infrastructure, and providers of credit to individuals and businesses. We are committed to catalysing the development of domestic capital markets in Africa, as we seek to unlock investment for bankable, climate-resilient projects to be delivered with the scale and urgency required to meet the challenges of climate change and welcome the support of African Development Bank in Africa to help achieve this goal.

Ahmed Attout, African Development Bank Acting Director for Financial Sector Development, said: “The Bank’s support for Dhamana shows the catalytic role and potential of guarantee companies in leveraging opportunities for real sector and infrastructure financing in local currency and local corporate debt capital markets deepening in the East Africa region. The investment in Dhamana follows the Bank’s priority to mobilize institutional financing for infrastructure investment in East Africa.”

The Bank’s partnership with Dhamana advances several strategic objectives including to help stimulate local currency debt market financing across diverse infrastructure sectors and enhancing economic diversification and competitiveness in the region. The intervention also aligns with the Bank’s priorities to promote regional integration including through improved infrastructure development, promotion of inclusive and sustainable industrialization, and fostering innovation.

The investment aligns with African Development Bank strategic efforts, in collaboration with development partners, including PIDG, to operationalize credit enhancement companies in selected Regional Member Countries.

Distributed by African Media Agency (AMA) on behalf of African Development Bank.

Read original article

Nairobi, Kenya, September 04, 2023

In a first for Africa today sees the launch of the Pan-African Fund Managers’ Association (PAFMA), a new trade association bringing together fund managers from across the continent with backing from some of the industry’s most powerful players.

The five founding members of PAFMA are the Pension Fund Operators Association of Nigeria (PENOP); the Fund Managers Association (FMA) in Kenya; the Botswana Investment Professionals Society (BIPS); the Ghana Securities Industry Association (GSIA) and the Investment Management Association of Uganda (IMAU). These national associations, which between them account for assets under management (AUM) of over US$70 billion, have established PAFMA in collaboration with FSD Africa, a specialist development agency working to build and strengthen financial markets across Sub-Saharan Africa

The launch of PAFMA, at an event in Nairobi on 4th September during the Africa Climate Summit 2023 where the founding members will sign an MoU, comes as the industry faces many challenges. These include historically low savings rates – which as of 2021 stood at just 24% of GDP in Sub-Saharan Africa – along with a scarcity of viable investment opportunities and the escalating environmental risks confronting the continent.

Recognising the prevalent dominance of government securities among the current investible assets managed by fund managers on the continent, PAFMA’s primary objective is to foster the adoption of alternative investments. This includes a particular focus on green finance, a pivotal driver for bolstering various sectors of the economy. By championing these alternative investment avenues, PAFMA seeks to not only stimulate job creation but also enhance income generation.

Among its activities, PAFMA aims to spearhead localised research efforts and initiatives to enhance knowledge sharing and capacity building enabling fund managers to evaluate and make investments in regions and countries where they did not previously have a presence. Serving as a proactive advocate, PAFMA will also offer policy insights and champion the interests of its members in both regional and international arenas as well as facilitating regular gatherings of fund managers from across Africa.

Commenting on the launch, Oguche Agudah, CEO, PENOP Nigeria, said:

“I’ve always believed that the solutions to Africa’s challenges lie within us. We need to come together, commit to collaborate, and speak with one voice. The managers of capital on the continent have a unique opportunity to individually and collectively determine to a large extent the trajectory of the continent. Working together, we can achieve so much more. The time is now.”

Patrick Kariuki, Chairman, FMA and Managing Director, Gen Africa Managers Ltd, said:

“The Fund Managers Association is very excited to partner with other like-minded Pan-African Fund Manager Associations. Our industry and its future growth depend on vibrant collaboration amongst fund managers across Africa. With PAFMA, fund managers will be able to evaluate and make investments in regions and countries where we did not have sufficient local context. The Fund Managers Association is honoured to be invited to this exciting and very important initiative.”

Mark Napier, CEO, FSD Africa, said:

“We are excited about the establishment of the Pan-African Fund Managers’ Association which comes at a timely juncture. This association will be integral for African Fund Management organisations to ensure that they share industry knowledge, manage risks with a continental and international view and drive needed investment in critical sectors such as climate mitigation and adaptation. This African-led initiative is a powerful demonstration of our shared vision to transform Africa’s financial and investments sector landscape.”

In the challenging circumstances that refugees face, there are stories of resilience, determination, and success that deserve to be celebrated. Meet Amani, a remarkable young man who has not only found hope but has thrived in a refugee settlement in Uganda. Amani’s journey is a testament to the power of financial inclusion and the opportunities it can bring to refugees.

A New Beginning in Uganda

Amani fled conflict and persecution in his home country in South Sudan, and found solace in Uganda’s Bidi Bidi refugee settlement. Amani’s life took a transformative turn courtesy of the Financial Inclusion for Refugees (FI4R) Project supported by FSD Africa and FSD Uganda in partnership with local financial service providers.

Amani fled conflict and persecution in his home country in South Sudan, and found solace in Uganda’s Bidi Bidi refugee settlement. Amani’s life took a transformative turn courtesy of the Financial Inclusion for Refugees (FI4R) Project supported by FSD Africa and FSD Uganda in partnership with local financial service providers.

Access to Financial Services

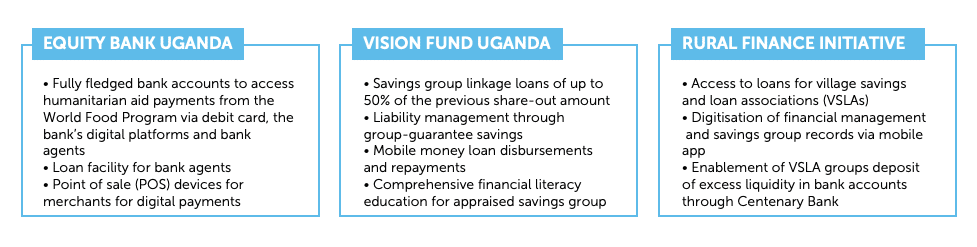

Upon arrival at the settlement, Amani was introduced to Equity Bank Uganda Limited, one of the financial service providers collaborating with FSD Africa and FSD Uganda. The other financial partners were VisionFund Uganda and Rural Finance Initiative (RUFI).

Amani opened a savings account with Equity Bank, which enabled him to save money and start planning for a better future securely. With access to credit and affordable loans, Amani seized the opportunity to start a small business, selling handmade crafts within the settlement.

Amani opened a savings account with Equity Bank, which enabled him to save money and start planning for a better future securely. With access to credit and affordable loans, Amani seized the opportunity to start a small business, selling handmade crafts within the settlement.

Building Livelihoods and Empowering Others

Through Amani’s dedication and hard work, his business flourished. Amani not only improved his own living conditions but also extended support to other refugees in the settlement with the income generated. Amani became an inspiration, encouraging fellow refugees to explore entrepreneurship as a means to financial independence.

Through Amani’s dedication and hard work, his business flourished. Amani not only improved his own living conditions but also extended support to other refugees in the settlement with the income generated. Amani became an inspiration, encouraging fellow refugees to explore entrepreneurship as a means to financial independence.

Financial Education and Community Support

Recognising the importance of financial literacy, Amani actively participated in financial education programs organised by project partners. Amani learned valuable skills such as budgeting, saving, and managing cash flow. Motivated by his own success, Amani began mentoring other refugees, sharing knowledge and empowering them to take control of their financial lives.

Recognising the importance of financial literacy, Amani actively participated in financial education programs organised by project partners. Amani learned valuable skills such as budgeting, saving, and managing cash flow. Motivated by his own success, Amani began mentoring other refugees, sharing knowledge and empowering them to take control of their financial lives.

Resilience and Overcoming Challenges

Amani’s journey was not without obstacles. Like many other refugees, he faced uncertainties, limited resources, and occasional setbacks especially during the COVID-19 pandemic. However, through perseverance and the support of the refugee community, Amani remained steadfast in his pursuit of a better future. Amani’s resilience and determination served as a beacon of hope for others facing similar challenges.

Amani’s journey was not without obstacles. Like many other refugees, he faced uncertainties, limited resources, and occasional setbacks especially during the COVID-19 pandemic. However, through perseverance and the support of the refugee community, Amani remained steadfast in his pursuit of a better future. Amani’s resilience and determination served as a beacon of hope for others facing similar challenges.

Amani’s Impact and Dreams for the Future

Today, Amani’s success story continues to inspire many. He has become a respected member of the refugee settlement, actively participating in community development initiatives.

Amani dreams of expanding his business beyond the settlement’s boundaries, creating opportunities for fellow refugees and contributing to the local economy. Amani’s journey exemplifies the transformative power of financial inclusion and the impact it can have on the lives of refugees.

Amani dreams of expanding his business beyond the settlement’s boundaries, creating opportunities for fellow refugees and contributing to the local economy. Amani’s journey exemplifies the transformative power of financial inclusion and the impact it can have on the lives of refugees.

Conclusion

Through access to financial services, coupled with resilience and community support, Amani has not only thrived but has become a source of inspiration for others. Amani’s story highlights the importance of creating an inclusive world where refugees are given a chance to rebuild their lives, contribute to their communities, and dreams of a brighter future.

Through access to financial services, coupled with resilience and community support, Amani has not only thrived but has become a source of inspiration for others. Amani’s story highlights the importance of creating an inclusive world where refugees are given a chance to rebuild their lives, contribute to their communities, and dreams of a brighter future.

Together, we can work towards realising the vision of hope and inclusion for all refugees.

The African continent presents a massive investment opportunity for investors to advance climate solutions in the coming decade, however, a set of barriers to finance have stifled requisite investment to date. In this new report, in collaboration with Climate Finance Innovation for Africa and Climate Policy Initiative, we provide a framework for how innovation in financing structures can leverage strategic deployment of public capital to ‘crowd-in’ private investment at levels not yet seen.

This paper focuses primarily on climate mitigation, which represents the largest investment opportunity for private investors. We refer audiences focused specifically on adaptation to the work done by the Global Center on Adaptation and Climate Policy Initiative on Financial Innovation for Climate Adaptation in Africa.

I often find it difficult for most people to relate to refugees. We seem to forget that we can be in the same situation depending on the circumstances around us. The happenings in Ukraine have shown just how delicate our stability status is, and that we can quickly be turned into forcibly displaced people overnight!

While conflict, war or persecution have been traditionally viewed as the main forces giving rise to refugees, natural disasters triggered by climate change among others are fast becoming a force to reckon with. The number of forcibly displaced people has now surpassed 100 million for the first time, fueled by the war in Ukraine and other ongoing conflicts around the globe.

This takes me back to a scenario in June 2018 when FSD Africa, FSD Uganda and BFA Global were conducting a design sprint with 6 Ugandan financial service providers (FSPs), to develop new ideas for financial products and services for refugees in the country. The 4-day event reached a phenomenal breakthrough when one of the participants posed: “What if something happened and we found ourselves in another country as refugees? What financial services would we need?” Those two questions opened the minds of the participants and ideas started flooding in. The design sprint was one of the 4 steps that FSD Africa has been following to develop financial inclusion for refugees (FI4R) projects. The other 3 are:

- Market assessments that capture the financial lives of refugees and show the potential of serving these populations.

- Innovation competitions where FSPs are invited to pitch ideas of how they would address refugee financial needs

- Financial support and technical assistance to FSPs to develop, pilot and roll-out financial solutions.

In Uganda, working with FSD Uganda, we identified Equity Bank Uganda Limited, VisionFund Uganda and Rural Finance Initiative to offer financial services in various refugee settlements from October 2019. While the project concluded in March 2022, these FSPs have continued operations as this turned out to be a viable business for them. The project engaged BFA Global as the learning and research partner. They undertook a baseline study in January 2020 and a series of 4 financial diaries (linked below) – capturing the financial needs and uses of refugee households.

The 4 financial diaries:

- Financial Inclusion for Refugees (FI4R) – Results of round 1 diaries

- Financial Inclusion for Refugees (FI4R) – Results of round 2 diaries

- Financial Inclusion for Refugees (FI4R) – Results of round 3 diaries

- Financial Inclusion for Refugees (FI4R) – Results of round 4 diaries

They then carried out an endline study in November 2021. The partners achieved the following results:

- Over 26,300 customers accessed loans, with 73% being female

- Cumulative loans amounted to £9 million ($2.7million)

- 262 bank agents were recruited across the settlements, 15% of which were women

- Over 93,300 households registered on Equity Bank Uganda’s digital platform

- 65,484 households receiving digital payments as of March 2022.

- The bank made payments worth UGX 10.8 Bn (£2.2m) during the first quarter of 2022

- 8 humanitarian agencies used the Equity Bank Uganda platform for disbursements

Below is a summary of some of the different financial services offered by the FSPs:

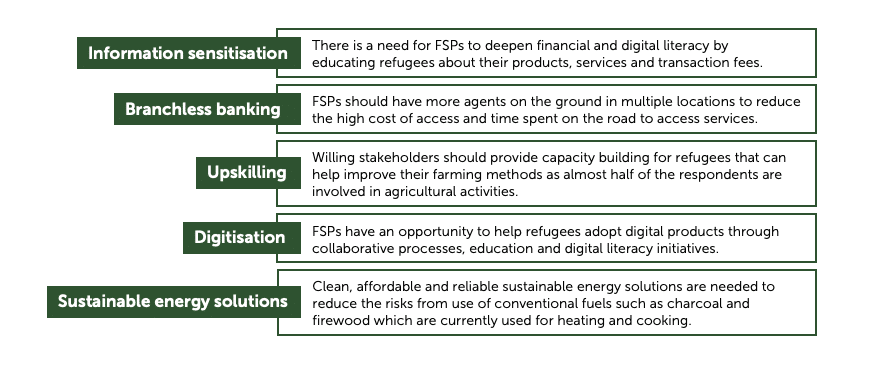

Based on the end-line study findings, there is still work to be done to improve financial services for refugees in the following areas: